Can I Retire But? has partnered with CardRatings for our protection of bank card merchandise. Can I Retire But? and CardRatings might obtain a fee from card issuers. Opinions, evaluations, analyses & suggestions are the creator’s alone, and haven’t been reviewed, endorsed or authorized by any of those entities.

A standard theme on this weblog is an emphasis on monetary simplicity. Get the most important issues proper. Automate these choices and actions. Then go dwell your life.

Each rule has exceptions. One huge exception in my private life is the usage of bank card journey rewards. There are a number of causes for this.

Personally, I discover studying about and implementing methods to build up bank card journey rewards to be profitable and enjoyable. It allows me to do extra of what I really like, journey. Concurrently, I spend much less of my hard-earned {dollars} doing it.

Quite a few private finance methods that get a number of consideration sound too good to be true. That’s as a result of they typically are. Most of those methods contain appreciable danger, value, uncertainty, and complexity.

Conversely, utilizing journey bank card rewards correctly is predictable, repeatable, and saves you cash. For those who deal with reaching the most important wins with the least effort, additionally it is comparatively easy.

Easiest Credit score Card Technique – Money Again

The simplest means you can begin to get some advantages from bank cards is to make use of a money again card. Spend as you usually would utilizing a bank card somewhat than money or a debit card. You then get a portion of your spending refunded to you within the type of money again or reward factors.

That is what Kim and I did for years earlier than studying about journey bank card rewards. We typically earned about $500 per 12 months with this straightforward technique whereas growing good habits of all the time paying the cardboard on time to keep away from any charges. This concurrently helped enhance our credit score rating.

As a normal rule, one of the best playing cards will present roughly 1.5% money again on each buy. Most of those playing cards haven’t any annual charge.

You possibly can optimize this technique, selecting a number of money again playing cards that supply extra rewards in choose classes like grocery shops, gasoline, eating places, and so forth. Then use the optimum card for every objective.

This technique looks like a number of effort to trace and implement for a comparatively small reward to me, however I’ve heard from a lot of readers for whom this strategy is widespread.

One model of this technique that may very well be profitable is for renters to pay their lease on a bank card. card_name is designed for this. It affords as much as one level per greenback spent on lease funds with out the transaction charge. There isn’t a annual charge for customers. This might assist renters to build up rewards rapidly.

Yow will discover a listing of the present finest affords for money again credit score playing cards right here.

The 80/20 Evaluation of Journey Rewards

As soon as we established the behavior of spending on a card and paying it off on time, we have been able to see how a lot we may earn in journey rewards with the least quantity of effort.

Concentrating on Signal-Up Bonuses

The only greatest factor you are able to do to optimize bank card rewards is to focus on the beneficiant join bonuses that include new playing cards. Join a card. Put all spending on that one card. Earn bonus. Repeat if desired.

We preserve a spreadsheet monitoring when the annual charge is due and what perks the bank card supplies. If the continued worth of the cardboard exceeds the annual charge, we preserve it. If the worth doesn’t justify the charge, we shut it earlier than the charge is due.

Normally, to obtain the bonus you’ll have to meet an outlined minimal spend (typically $2,000-$6,000 for private playing cards) in a set period of time (typically 3-6 months). To make it well worth the effort of doing so, I goal playing cards the place I’ll get a minimum of $750-$1,000 of worth from the join bonus alone.

You possibly can earn upwards of 20% on {dollars} spent in the direction of the bonus, as in comparison with the 1.5% common for money again playing cards. You possibly can then repeat this course of with a number of playing cards per 12 months.

Sustainable Technique?

Chase, Capital One, American Specific and Citi every have a number of playing cards with beneficiant bonuses. As a pair, we’re every in a position to individually apply for every card, offering an primarily by no means ending supply of journey rewards.

We typically assume we are going to join one card per quarter and earn the bonus with our regular spending. We might goal further bonuses by way of the 12 months if we anticipate further spending that might allow us to hit minimal spends.

An instance is present join bonuses in anticipation of shopping for our annual ski passes. One other current instance was signing up for a enterprise card initially of the 12 months to pay medical insurance premiums as a lump sum on the cardboard to be able to get a bonus vs. paying premiums month-to-month.

Don’t Get Overzealous

As you watch your journey rewards accumulate after gathering your first few bonuses, it’s straightforward to go overboard signing up for brand new playing cards. Don’t get overzealous when getting began.

In our family, both Kim or I’ll join a card. We don’t add the opposite individual as a licensed consumer. This permits each of us to earn the bonus individually. It additionally retains our funds easy as we put every little thing on this one card as we spend towards the bonus.

Making use of for too many playing cards too rapidly may end up in lacking out on invaluable welcome bonuses, might stop you from getting playing cards you need sooner or later, and extreme credit score inquiries can harm your credit score rating.

Chase has essentially the most invaluable playing cards for my journey wants. Additionally they have a coverage that limits the variety of playing cards you’ll be able to get hold of from any issuer to five in a 24 month interval. That is one motive that I like to recommend beginning with Chase playing cards and being intentional with signing up for brand new playing cards.

Finest Playing cards to Begin With Journey Credit score Card Rewards

When somebody who has by no means utilized journey bank card rewards asks me the place to begin, I’ve two go to suggestions: The Chase Sapphire Most well-liked® and the Capital One Enterprise card. Every of those playing cards have a $95 annual charge.

Every affords a profitable join bonus and is straightforward to make use of. I barely want the Chase Sapphire Most well-liked® as a result of with a little bit of effort, you will get extra worth out of those rewards.

For those who assume you’ll join a number of playing cards, this additionally prevents lacking out on this invaluable card. Keep in mind, Chase restricts the variety of playing cards you’ll be able to apply for in a 24 month interval as famous above. You possibly can all the time come again and get the Capital One Enterprise card later.

Chase Sapphire Most well-liked® Card

The usual bonus on the card_name is 60,000 Final Rewards factors earned by spending a minimum of $4,000 within the first three months after opening the cardboard. The bonus factors have a price of a minimum of $750 when used to e book journey by way of the Chase journey portal.

To earn the factors, you would need to spend a minimum of $4,000 on the cardboard which might offer you a minimal of 4,000 further factors. This brings the worth of your rewards to a minimal of $800 in the direction of journey for spending $4,000 within the first 3 months after opening the cardboard.

Whereas these advantages are good, the explanation I really like the card_name is that it’s one among a number of playing cards that supply Chase Final Rewards factors. These factors may be transferred in 1,000 level increments 1:1 to journey associate’s reward packages, the place they might present outsized worth.

You will get properly over $1,000 in journey rewards by strategically transferring the Final Rewards factors to a journey associate. This occurs immediately with the clicking of a button. Yow will discover a full checklist of journey companions right here. Two of my favorites are Southwest Airways and Hyatt Resorts as a consequence of their ease of use and unbelievable worth.

The Chase Sapphire Most well-liked® Card, like many journey playing cards, additionally affords vital journey insurance coverage protections at no further cost.

Capital One Enterprise

The card_name supplies a equally beneficiant join bonus and is straightforward to make use of.

After you spend a minimum of $4,000 on the card_name inside three months of opening it, you’ll earn 75,000 miles. Once more, additionally, you will earn miles for every greenback you spend in your option to the bonus, so you should have a minimum of 79,000 miles, price $790 if you obtain your bonus.

Additionally they have their very own set of journey companions, which I personally discover much less engaging. I like this card as a result of this can be very straightforward to redeem these miles for all kinds of journey bills.

Like Chase, Capital One has a journey portal by way of which you’ll e book journey. You could discover higher charges than you may by yourself and pay immediately with miles.

For final simplicity, you’ll be able to e book journey and pay for it with the cardboard. Then merely apply the miles at a fee of 100 miles to $1 to offset the price for any expense coded by the seller within the journey class. Along with lodges and flights, these miles can be utilized to offset rental automobile, Airbnb, and rideshare bills.

The card_name has some further perks. It supplies journey insurance coverage advantages. As well as, it supplies a $100 annual credit score for World Entry or TSA PreCheck®.

Enterprise Credit score Playing cards

I’ve historically targeted my consideration on private bank cards. Small enterprise homeowners can apply the identical methods of focusing on bank card join bonuses when making enterprise purchases.

This lets you accumulate much more journey rewards. Most private playing cards have the same enterprise model. The draw back of enterprise playing cards is they have a tendency to have greater spending limits to attain the bonus (although the bonuses additionally are usually greater).

For instance, card_name affords new cardmembers a 100,000 Final Rewards level bonus after spending a minimum of $8,000 in purchases within the first 3 months of opening the cardboard. This card can be the primary enterprise card I’d personally join if I may meet the minimal spend to attain the join bonus, for a similar causes I just like the Chase Sapphire Most well-liked® for private use.

Nonetheless, I don’t have sufficient enterprise bills to attain the bonus. After I do have anticipated upcoming enterprise bills I scan the accessible small enterprise playing cards to see if there are any with low sufficient spending limits that I may obtain. I’ve signed up for 2 enterprise playing cards prior to now couple of years that had achievable spending necessities to attain invaluable bonuses. I’ll spotlight them beneath.

American Specific Membership Rewards

So far, I’ve highlighted Chase Playing cards that supply Chase’s Final Rewards Factors and Capital One Playing cards providing Capital One Miles.

The card_name is the same providing from American Specific. It has a proposal of 60,000 Membership Rewards® factors which you’ll earn by spending $6,000 on the cardboard within the first 6 months after opening the account. The cardboard has a $250 annual charge.

I personally wouldn’t begin with this card as a consequence of offering much less factors and having a better annual charge. Nonetheless, many individuals are drawn to the Membership Rewards® Journey Companions. Airline companions embody Delta domestically and a wide selection of worldwide airways. Resort companions embody Hilton and Marriott.

One other profitable supply of journey rewards are co-branded bank cards with particular airways and lodge chains. Nearly each airline and lodge chain has its personal loyalty program and related bank cards with the chance to earn factors or miles. I’ll spotlight just a few of my favorites.

Airline Particular Playing cards

Most airline reward packages are pretty related. You possibly can switch rewards from journey companions (Am Ex, Capital One, or Chase) to build up factors or miles. Alternatively you’ll be able to seek for playing cards affiliated particularly together with your favourite airline. For instance, we first began focusing on playing cards that supply Delta SkyMiles® since our closest airport, SLC, is a Delta Hub.

My first airline particular card was a card_name. It presently has a join bonus of 70,000 factors after spending a minimum of $4,000 on the cardboard within the first 3 months after account opening. The annual charge is waived the primary 12 months, earlier than leaping to $150/12 months. Cardholders can also verify one bag free of charge on each Delta flight booked on the cardboard.

All airline rewards typically work properly for many who journey alone or with a associate and have some flexibility on timing and magnificence of journey (i.e., many early retirees!). You may also get outsize worth for enterprise class flights.

Those that have extra inflexible schedules, journey final minute, or with household might discover it more durable to redeem reward factors with many airways. For our household of three that tends to journey round our daughter’s faculty schedule, one airline’s program stands head and shoulders above the remainder.

Southwest Fast Rewards

I really like Southwest Fast Rewards factors for a lot of causes, together with:

- Capacity to build up a number of factors,

- Ease of use,

- Worth, and

- The Companion Move

Simple to Get hold of

There are 3 ways to build up Southwest Fast Rewards factors:

- Flying Southwest (paying money),

- Incomes Chase Final Rewards factors and transferring them to Southwest,

- Incomes rewards immediately with a Chase/Southwest co-branded bank card.

The primary is an extended, sluggish option to accumulate these invaluable reward factors. You possibly can accumulate factors way more rapidly through the use of bank card rewards.

Southwest/Chase supply three totally different private bank cards. Additionally they have two totally different enterprise bank cards.

Having this number of playing cards mixed with the power to switch Chase Final Rewards to Southwest makes it straightforward to rack up an almost by no means ending provide of Southwest Fast Rewards factors.

Simple to Use

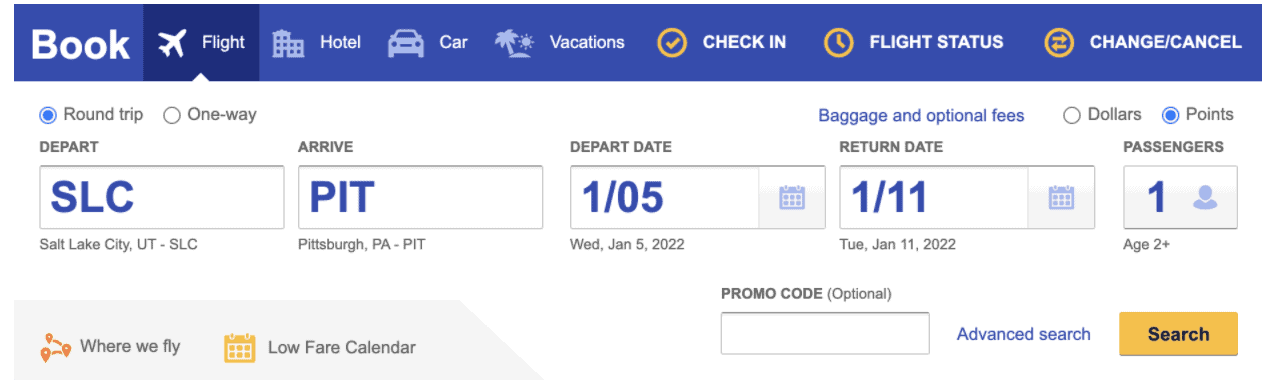

When you accumulate the Southwest reward factors, they’re straightforward to make use of. Merely go to the Southwest web site and choose the place and if you wish to go.

You possibly can show airfare in {dollars} or factors. Click on factors and seek for flights.

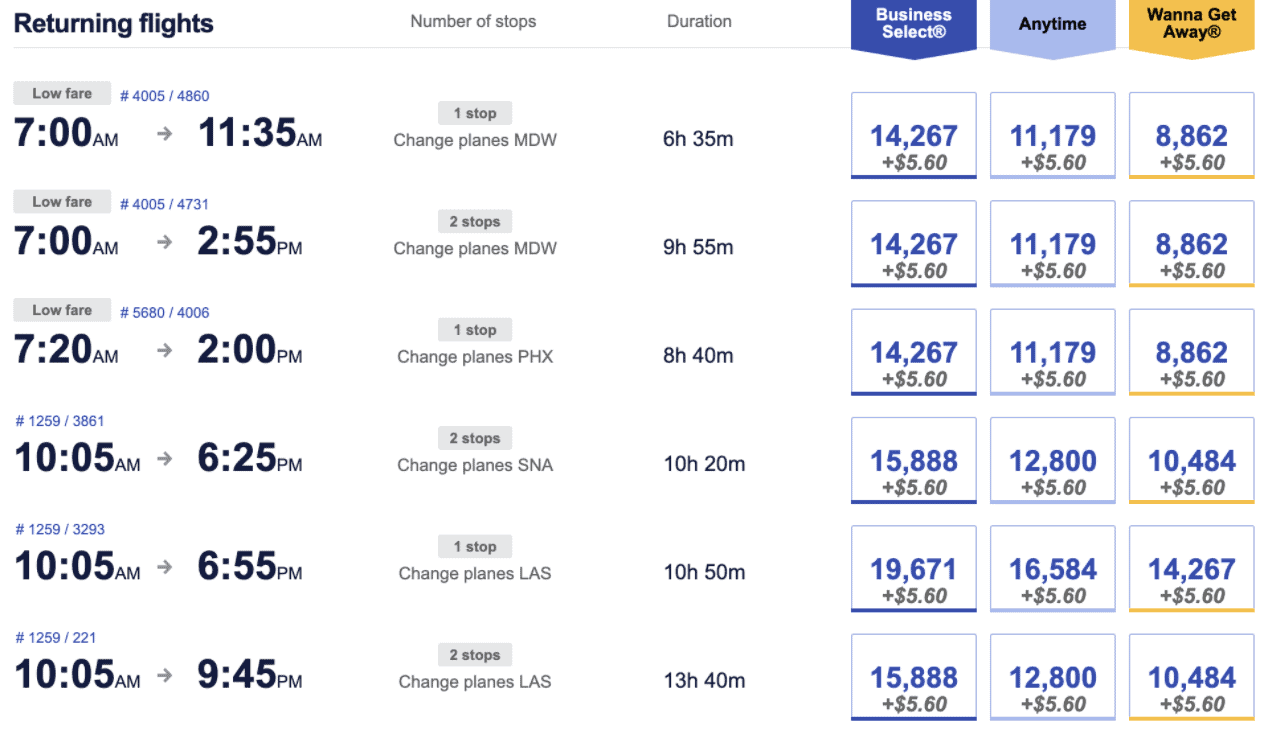

Flights then show with airfare represented in factors (plus $5.60, the U.S. 9/11 safety charge, which it’s important to pay for each one-way home flight). Click on the flight you need, e book your flight, and factors are deducted out of your account.

Southwest doesn’t black out dates for rewards factors. Additionally they don’t restrict the variety of seats that may be booked on factors, which is nice for households. For instance, our household of three recurrently flies again to Pennsylvania over the Christmas holidays and we just lately flew to Hawaii on factors over Thanksgiving break.

For those who cancel or change journey plans, your factors are absolutely credited again to your account with no change charges so long as you achieve this ten minutes previous to your scheduled departure time.

Worth

Southwest factors supply appreciable worth. They correspond to the worth of the flight. So if in case you have a versatile schedule, you will get nice offers.

Not like many airways, Southwest doesn’t nickel and dime you with hidden charges. You possibly can verify two luggage free of charge. This consists of outsized gadgets together with golf golf equipment and skis.

Past saving on airfare and baggage charges, reserving with rewards factors eliminates all taxes. The lone exception is the $5.60 U.S. 9/11 Safety Price which is defined above.

We pay a complete of $33.60 to fly our household of three cross-country and again utilizing factors. That’s far lower than the worth to Uber thirty minutes from our dwelling to the airport!

The Companion Move

Better of all, Southwest affords among the best offers on this planet of journey rewards: The Companion Move. You must accumulate 135,000 qualifying factors in a calendar 12 months to earn the cross. When you earn the cross, each time you fly your designated companion can fly with you free of charge for the rest of that 12 months and the whole following 12 months.

The factors wanted to qualify for the Companion Move may be earned by way of join bonuses with Southwest co-branded bank cards. (Word: Chase Final Rewards factors may be transferred to Southwest. Thus they are often twice as invaluable upon getting the Companion Move, however they DO NOT assist you to earn the Companion Move.)

Early in 2022, Kim took benefit of a bank card sign-up promotion that enabled her to earn a Companion Move. We took benefit of it to redeem ten free round-trip flights in 2022 and 2023.

Her companion cross expired final December 31. Realizing this, in mid-December I signed up for a Southwest® Fast Rewards private card and a Southwest® Fast Rewards® Premier Enterprise Credit score Card. The factors earned in January between spending on the playing cards and the 2 bonuses allowed me to earn practically 150,000 factors and one other Companion Move which will likely be good by way of the tip of 2025!

Present Southwest Provides

Southwest bonuses change incessantly. The affords on the non-public playing cards I took benefit of in December are not accessible.

Nonetheless, there’s presently a unique supply that permits you to earn a Companion Move(R), good by way of 2/28/25 plus 30,000 factors after you spend $4,000 on purchases within the first 3 months from account opening.

This supply is obtainable with any of three Southwest Private Playing cards:

The 2 Southwest enterprise playing cards are providing the usual sign-up supply.

card_name affords a 60,000 level bonus after spending a minimum of $3,000 within the first three months your account is open. It has an annual charge of $99.

card_name affords a 80,000 level bonus after spending a minimum of $5,000 within the first three months your account is open. It has an annual charge of $199.

These rewards would go twice as far when paired with a companion cross.

Resort Particular Playing cards

The key lodge chains additionally all supply co-branded bank cards. At one level, we’ve had playing cards with Hilton, Hyatt, IHG and Marriott. All may be invaluable. I prefer to have a financial institution of rewards with totally different chains so I all the time have choices when reserving journey.

I’ll briefly spotlight two lodge rewards packages that we’ve gotten large worth from by using totally different methods.

Hyatt

World of Hyatt factors typically present one of the best redemption worth for the least quantity of factors. We attempt to accumulate as many of those factors as attainable.

Examples of locations we’ve stayed in Hyatt properties on factors embody Occasions Sq. in NYC and Park Metropolis, UT. Comparable lodges with different chains with related money costs would have required 2-3 occasions extra factors.

The problem is acquiring Hyatt factors. For instance, the world of Hyatt Credit score Card, which has a $95 annual charge, presently has a join bonus of 65,000 factors. Nonetheless, reaching the complete bonus requires spending $18,000 on the cardboard over the primary six months of account opening.

That is the place having somewhat understanding of journey companions is useful. Chase Final Rewards factors may be transferred 1:1 to journey companions, together with Hyatt. This makes it a lot simpler to build up these invaluable factors.

IHG

IHG lodges reward program is one other Chase Final Rewards associate the opposite finish of the spectrum. Their factors don’t go practically as far.

For instance, we spent just a few nights on the Vacation Inn Specific Kailua-Kona in Hawaii just lately. The fee was 40,000 factors/evening for a room that might have been about $350/evening if we paid money. Transferring Chase Final Rewards to IHG to pay for the room would have been a suboptimal use of those invaluable factors.

Nonetheless, we’ve got an abundance of IHG factors as a result of they’re really easy to acquire on IHG co-branded bank cards. Over the previous few years, each Kim and I’ve every individually signed up for an card_name.

This card normally allows you to earn 140,000 factors after spending $3,000 on it within the three months after account opening. They’re presently providing a restricted time supply sign-up bonus of 165,000 factors! It additionally supplies a free evening every year on the anniversary of card opening amongst different perks. The cardboard has an annual charge of $99.

The card_name requires spending solely $3,000 (low for a enterprise card) within the first 3 months after account opening to attain a sign-up bonus of 140,000 Bonus Factors. This has been my enterprise card for the previous few years, enabling me to build up further factors whereas simply monitoring my enterprise bills.

Utilizing these three playing cards, we’ve obtained tons of of 1000’s of IHG factors in addition to free anniversary nights for the enterprise card that I preserve open. We’ve redeemed these rewards for lodge stays all around the nation, whereas nonetheless having a well being steadiness of factors in our account.

Premium Credit score Playing cards

For years I’ve learn private finance and journey bloggers write in regards to the card_name ($695 annual charge) and the card_name ($550 annual charge). I by no means noticed the worth, so I merely averted this class of bank cards.

Final 12 months, we determined to strive Capital One’s premium card once they launched the card_name. We flew rather a lot final 12 months and the factor that drew us to this card was entry to airport lounges.

The card_name supplies limitless complimentary entry for you and two company to 1,300+ lounges, together with Capital One Lounges and Precedence Move lounge companions which added a number of consolation whereas saving us appreciable cash when flying. Of specific curiosity to us was the model new Capital One Lounge in Denver the place we incessantly lay over since there are not any direct flights between our present dwelling in SLC, UT and our household close to Pittsburgh, PA.

Except for the airport lounge profit, this card features similar to the card_name card which as famous above has lengthy been one among my favorites. You earn 75,000 bonus miles if you spend $4,000 on purchases within the first 3 months from account opening, equal to $750 in journey.

The Capital One Enterprise X has a $395 annual charge. Nonetheless, that’s simply recouped since you obtain a $300 annual credit score for journey booked by way of Capital One Journey. This can be utilized to e book something from flights, to lodges, to rental automobiles.

As well as the cardboard supplies a $100 credit score for World Entry or TSA PreCheck® . You additionally get 10,000 bonus miles (equal to $100 in the direction of journey) yearly, beginning in your first anniversary.

So if you’re keen to use somewhat little bit of effort to e book journey by way of the Capital One Journey portal and you’ll reap the benefits of the airport lounges, it is a nice card that justifies the charge.

In Credit score Card Journey Rewards?

For readers who share my curiosity in journey bank card rewards, I’ve established an affiliate relationship with CardRatings. This creates an outlet to earn cash to help the weblog whereas writing about this technique that I personally love and use.

It additionally motivates me to remain abreast of the latest developments and finest affords for my very own profit and to share them with you. This may assist us all to journey extra whereas spending much less.

If you wish to help the weblog if you join new bank cards, we are going to earn a fee should you click on on the hyperlinks on this put up to take action. I’ll be maintaining this web page updated as a reference, with updates to any new affords as they develop into accessible.

It received’t value you something extra and also you’ll be getting one of the best present supply on the web by way of CardRatings. Thanks on your help and completely happy touring.

* * *

Helpful Assets

- The Finest Retirement Calculators can assist you carry out detailed retirement simulations together with modeling withdrawal methods, federal and state earnings taxes, healthcare bills, and extra. Can I Retire But? companions with two of one of the best.

- Free Journey or Money Again with bank card rewards and join bonuses.

- Monitor Your Funding Portfolio

- Join a free Empower account to realize entry to trace your asset allocation, funding efficiency, particular person account balances, web price, money circulation, and funding bills.

- Our Books

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire But? has partnered with CardRatings for our protection of bank card merchandise. Can I Retire But? and CardRatings might obtain a fee from card issuers. Different hyperlinks on this web site, just like the Amazon, NewRetirement, Pralana, and Private Capital hyperlinks are additionally affiliate hyperlinks. As an affiliate we earn from qualifying purchases. For those who click on on one among these hyperlinks and purchase from the affiliated firm, then we obtain some compensation. The earnings helps to maintain this weblog going. Affiliate hyperlinks don’t improve your value, and we solely use them for services or products that we’re conversant in and that we really feel might ship worth to you. Against this, we’ve got restricted management over many of the show adverts on this web site. Although we do try to dam objectionable content material. Purchaser beware.