Welcome again to Root of Good, of us! We landed in Poland a month in the past and now we have been having fun with this new-to-us nation fairly a bit. We began our journey in Krakow and made our method south to the Tatra mountains and Zakopane close to the border of Slovakia.

As I write this, we’re within the southwestern a part of Poland within the Klodzko Valley very near the Czech Republic. Over the subsequent few weeks we’ll head north towards Gdansk with a number of stops alongside the way in which.

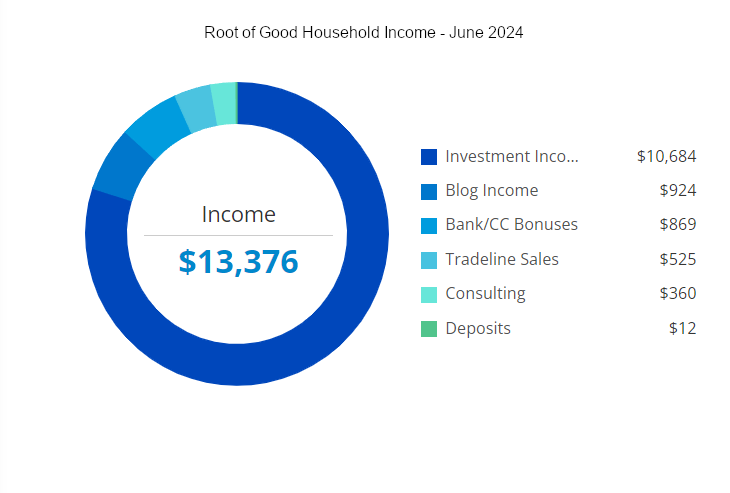

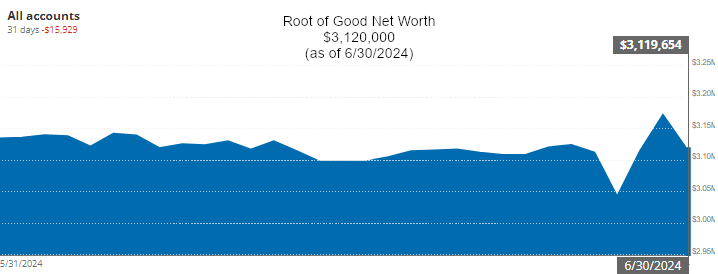

On to our monetary progress. June was a great month total for our funds. Our internet price dipped barely by $16,000 to finish the month at $3,120,000. Our revenue of $13,376 exceeded our spending of $5,889 for the month of June by a large margin.

Let’s bounce into the main points from final month.

Earnings

Funding revenue totaled $10,684 in June. Our fairness index funds and ETFs pay dividends quarterly on the finish of March, June, September, and December. In consequence, we had a bigger than regular quantity of funding revenue final month. Right here’s extra on our dividend investments.

Weblog revenue totaled $924 for the month. This represents a barely above common month of weblog revenue.

My early retirement life-style consulting revenue (“consulting”) was $360 final month. That represents two hours of consulting work throughout the month.

Tradeline gross sales revenue totaled $525 in June. That could be a nice month for my tradeline gross sales. I count on the subsequent month or two to be equally excessive. I ramped up my tradeline gross sales a number of years in the past and mentioned it in a bit extra element in my October 2020 month-to-month publish and in my July 2021 month-to-month publish. Most years I make round $4,000 to $6,000 in change for lending out my stellar credit score historical past from half a dozen bank cards.

For final month, my “deposit revenue” was $12. The deposit revenue got here from money again and incentive bonuses from the Rakuten.com and Mrrebates.com on-line procuring portals (a few of which was earned from you readers signing up via these hyperlinks).

In case you join Rakuten via this hyperlink and make a qualifying $25 buy via Rakuten, you’ll get a $10 join bonus (or extra!).

My “Financial institution/Bank card bonus” revenue was $869 final month. I not too long ago signed up for a number of US Financial institution Enterprise Leverage playing cards and the $750 bonus from the primary one posted throughout June, together with about $119 further money again from the spending that I placed on the cardboard.

Youtube revenue was $0 final month. Youtube solely pays out whenever you hit $100 in collected income. Lately, my Youtube earnings have been slightly below $50 per thirty days on common, so I solely receives a commission each three months.

Right here is the Youtube channel for the curious. It’s random journey movies, birds, youngsters, and a few DIY movies. There are just a few primary movies that usher in many of the site visitors (and income!).

In case you’re concerned with monitoring your revenue and bills like I do, then try Empower Private Dashboard, previously generally known as Private Capital (it’s free!). All of our financial savings and spending accounts (together with checking, cash market, and greater than half a dozen bank cards) are all linked and up to date in actual time via Empower Private Dashboard. Now we have accounts all over, and Empower Private Dashboard makes it very easy to test on all the pieces at one time.

Empower Private Dashboard can be a strong software for funding administration. Preserving observe of our complete funding portfolio takes two clicks. In case you haven’t signed up for the free Empower Private Dashboard service, test it out right this moment (evaluation right here).

Monitoring spending was one of many crucial steps I took that allowed me to retire at 33. And it’s now simpler than ever with Empower Private Dashboard.

Bills

Now let’s check out June bills:

In complete, we spent $5,889 throughout the month of June which is about $2,500 greater than our recurrently budgeted $3,333 per thirty days (or $40,000 per 12 months). Insurance coverage and journey had been the best two spending classes final month.

Detailed breakdown of spending:

Insurance coverage – $2,635:

Our annual householders insurance coverage invoice of $1,335 got here due in June. Because of inflation, the premiums have skyrocketed by virtually 100% in contrast to a couple years in the past.

Our six month auto premium has additionally gone up fairly a bit. I imagine many of the enhance is because of including our two teen drivers. The six month premium was $1,300 at this renewal.

As our teenagers acquire further years of driving expertise, the insurance coverage re-rates them to a decrease threat class. So the present premiums ought to be the best they are going to ever be since our oldest child will quickly have two years of driving expertise and get a fee discount consequently.

Journey – $1,813:

Our journey spending of $1,813 represents all the pieces we’ve spent in Poland for the 23 days of June that we spent right here.

I didn’t break down the journey spending in fantastic element, however I’ve a tough estimate of the place that $1,813 journey spending went:

- $413 – rental automobile and gasoline

- $50 – parking

- $100 – Ubers whereas in Krakow

- $400 – eating places

- $500 – groceries

- $350 – tickets to sights, nationwide parks, museums, and castles

We’re spending extra freely than we normally do. If one thing appears mildly fascinating we’ll pay to go see or do it. Not an excessive amount of disappointment to this point with this method. We’ve taken an identical method with eating places. Eating out and takeout are low-cost sufficient that we will take pleasure in restaurant meals with out breaking the funds.

Get free journey like us

If you’re concerned with getting free journey out of your bank card like I do, contemplate the Chase Ink Limitless or Chase Ink Money enterprise playing cards (my referral hyperlink). Proper now, the Chase Ink enterprise playing cards provide an above common $750 to $1000 price of Chase Final Rewards factors that may be redeemed immediately for $750 in money. I simply signed up for one more new Ink card to snag certainly one of these nice bonus gives.

Chase is fairly liberal in terms of “what’s a enterprise”. In case you promote stuff on eBay or Craigslist or do some odd jobs often then you may have a enterprise and will get a bank card as a “sole proprietor”.

I take advantage of the 75,000 Chase Final Rewards factors by transferring them to my Chase Sapphire Reserve card (additionally providing a 60,000 level join bonus proper now). With the Sapphire Reserve card, I can get 1.5x the factors worth by reserving cruises, flights, resorts, or rental vehicles via their journey portal. Or 1.25x worth by reimbursing myself for groceries. That turns the 75,000 factors into $1,125 of free journey or $937.50 of free groceries. For instance, I used 165,000 Chase Final Reward factors to pay for the $2,475 in taxes, charges, and gratuities on two of my fall cruises. Or I can switch these Final rewards factors to over a dozen journey companions’ airline/resort applications like United, Southwest, or Hyatt.

Capital One VentureX card

One other favourite journey card in my pockets is the Capital One Enterprise X card. The Enterprise X card is a “keeper” for me. First off, it comes with a $750 join bonus after spending $4,000 within the first three months. The bonus is paid within the type of 75,000 bonus factors which you could redeem towards any journey purchases from wherever. Then you definitely earn a strong 2 factors per greenback spent perpetually! The opposite massive perk is airport lounge entry. You will get your self plus limitless friends into Precedence Move lounges. And also you plus two friends can get into Plaza Premium community lounges and Capital One Lounges.

The Capital One Enterprise X card does have one catch – a $395 annual price. However they reward you yearly with a simple to make use of $300 journey low cost plus $100 price of factors. Collectively, that makes $400 they provide you yearly which utterly offsets the annual price. One other profit price mentioning: you’ll be able to add as much as 4 approved customers at no cost, and so they additionally get all the advantages of the Enterprise X card together with the precious airport lounge entry. We used this perk to “present” a pair of Enterprise X playing cards with airport lounge entry to my brother in legislation and his spouse to make use of on their household journey again house to Cambodia final April with their two younger youngsters.

Because the annual price is offset in full by journey credit annually, I personally plan on holding the Enterprise X card perpetually because the card advantages are so nice.

Electronics – $520:

We had a really unlucky exhausting drive failure throughout Might. 4 years of pictures had been worn out with no full backup of most of them. So we despatched the exhausting drive off for information restoration. I paid $520 for information restoration providers and the corporate managed to get better 100% of our information. Over two terabytes of pictures and movies.

We now have at the very least 2 full copies of all of our pictures and different priceless information. And we intend to keep up this degree of safety going ahead to stop future information losses.

Utilities – $304:

We spent $147 on our water/sewer/trash invoice final month.

The pure gasoline invoice was $25. All through the summer time, our pure gasoline invoice ought to be very low because it’s just for heating water. Moreover, utilization might be decrease since there’ll solely be one or two folks residing in our Raleigh home throughout many of the summer time.

The electrical energy invoice was $133 in June. The summer time cooling season is nicely underway and our electrical invoice displays that. I think about it will likely be over $200 for a month or two throughout the summer time given the a lot greater value of electrical energy now resulting from inflation.

Taxes – $300:

Our $300 quarterly North Carolina estimated tax invoice got here due in June.

Groceries – $242:

The grocery spending of $242 largely displays our spending the primary week of June whereas we had been nonetheless in Raleigh. Our oldest daughter stayed in Raleigh this summer time and we cowl her grocery payments, so there’s a small quantity of spending for her within the June grocery complete.

I embrace our abroad grocery spending within the “Journey” class of bills. We aren’t as cautious about searching for gross sales and getting offers whereas we’re shopping for groceries abroad. And we attempt a number of new issues. So I lump the groceries whereas touring into our total journey funds.

Healthcare/Medical/Dental – $37:

Our present 2024 medical insurance is free, due to very beneficiant Reasonably priced Care Act subsidies that we obtain resulting from our low ~$48,000 per 12 months Adjusted Gross Earnings.

Our 2024 dental insurance coverage plan prices $37 in premiums per thirty days. We picked a plan from Truassure via the healthcare.gov change. The dental insurance coverage does a great job of protecting routine cleanings, exams, and x-rays plus most of the price of primary procedures like fillings.

Dwelling Enchancment – $29:

Some insect repellent for our timber and shrubs. Bought shortly earlier than we left Raleigh for the summer time.

Cable/Satellite tv for pc/Web – $11:

We typically pay $25 per thirty days for a neighborhood diminished fee bundle resulting from having a decrease revenue and having youngsters. 50 mbit/s obtain, 10 mbit/s add. For the final a number of years, the price of the web service was briefly diminished to $0 because of the “Reasonably priced Connectivity Program”.

Now that the funding for the Reasonably priced Connectivity Program has ended, we lastly obtained a invoice for our web service. It was solely $11 for June because the ACP funding coated a portion of the invoice. Going ahead, we can pay the total $25 month-to-month web invoice.

Fuel – $0:

No regular gasoline spending for the month of June. I did purchase a half tank for our rental automobile in Poland. Nonetheless I included that within the “journey” funds class.

Spending for 2024 – Yr to Date

We spent $16,580 for the primary six months of 2024. This annual spending is about $3,500 lower than the budgeted $20,000 for six months per our $40,000 annual early retirement funds. I haven’t elevated our annual funds for inflation in a decade, so in some unspecified time in the future I must revisit the funds numbers. Thus far, so good! No want to offer ourselves a increase if we’re managing simply fantastic throughout the present funds.

As I discussed in April, our children’ school prices are utterly paid for by their monetary assist to this point. So school spending ought to stay fairly modest all through the remainder of 2024 into 2025. And it seems that each of our older youngsters are on observe to complete their bachelors levels in 2025.

The wildcard spending for 2024 might be some upcoming dental work for Mrs. Root of Good. We nonetheless don’t know what it will appear like however we’ll discover out extra within the fall as soon as we return house from our summer time journey. No less than we’re operating $3,500 beneath our funds, so any giant dental bills gained’t make our complete annual spending utterly out of line for the 12 months.

Month-to-month Expense Abstract for 2024:

Abstract of annual spending from greater than a decade of my early retirement:

- 2014 – $34,352

- 2015 – $23,802

- 2016 – $38,991

- 2017 – $31,708

- 2018 – $29,058

- 2019 – $25,630

- 2020 – $28,466

- 2021 – $31,740

- 2022 – $29,449

- 2023 – $37,865

- 2024 – $16,580 (via 6/30/2024)

Web Price: $3,120,000 (-$16,000)

Our internet price dropped $16,000 to finish the month at $3,120,000. That’s a reasonably modest drop of a couple of half of a p.c of our total internet price. We’re nonetheless above the psychologically essential $3 million greenback mark.

For the curious, our internet price reported above consists of our house worth (which is totally paid off). I worth the home at $300,000, which might be what we’d internet after gross sales bills. Nonetheless, please be aware that I don’t contemplate my house worth as a part of my portfolio for “4% rule” calculation functions. I understand of us ask me about that each month so I simply wished to state that right here for readability.

Life replace

As this publish goes reside, we might be coming into the second month of our summer time adventures in Poland. Thus far it’s going nicely and never a number of disagreeable surprises. After the primary week and a half within the metropolis of Krakow, now we have spent the final three weeks within the countryside in smaller, quieter villages.

Having a rental automobile makes the journey a lot extra enjoyable and simpler logistically. No planes, trains, or buses to catch. On the mornings that we go away one airbnb or resort and go to the subsequent one, we leisurely get up at 8 or 9 am, take pleasure in a cup of espresso, and pack our gear into the tiny trunk of our Toyota Yaris. We’re out the door by 11 am and normally have one to a few hours of driving to get to our subsequent place.

Often we’ll discover someplace neat to cease for the day or seize lunch alongside the way in which. Principally simply take it straightforward and benefit from the surroundings all through the drive. I might name this a luxurious however we solely paid $17 per day for this very nice (however small!) rental automobile with computerized transmission.

On our longest drive from simply outdoors of Auschwitz to our citadel resort in Otmuchow, I checked the field on my Google Maps to set the path to “keep away from highways”. This turned what would have been roughly two hours of freeway driving into a 3 hour journey via the rolling countryside at a a lot slower tempo.

Fewer vehicles zipping by us. As a substitute, extra quaint villages, cows, wildflowers, and farm fields outdoors our automobile home windows. This was an incredible selection in hindsight and one we hope to proceed if our schedule permits us throughout our future drives via Poland.

Generally you simply should go your personal method and select “the highway much less taken” (to borrow an idea from Robert Frost).

Nicely that’s it for this month’s replace. I hope you loved the pics from our journey. See you subsequent month!

How is you summer time going? I heard it’s fairly sizzling in a number of the US proper now!

Need to get the newest posts from Root of Good? Ensure to subscribe on Fb, Twitter, or by electronic mail (within the field on the high of the web page) or RSS feed reader.

Associated

Root of Good Recommends:

- Private Capital* – It is the very best FREE technique to observe your spending, revenue, and whole funding portfolio multi function place. Did I point out it is FREE?

- Interactive Brokers $1,000 bonus* – Get a $1,000 bonus whenever you switch $100,000 to Interactive Brokers zero price brokerage account. For transfers underneath $100,000 get 1% bonus on no matter you switch

- $750+ bonus with a brand new enterprise bank card from Chase* – We rating $10,000 price of free journey yearly from bank card join bonuses. Get your free journey, too.

- Use a procuring portal like Ebates* and save extra on all the pieces you purchase on-line. Get a $10 bonus* whenever you join now.

- Google Fi* – Use the hyperlink and save $20 on limitless calls and texts for US cell service plus 200+ nations of free worldwide protection. Solely $20 per thirty days plus $10 per GB information.

* Affiliate hyperlinks. In case you click on on a hyperlink and do enterprise with these corporations, we could earn a small fee.