Practically the entire nation’s massive banks slashed their marketed mounted mortgage charges this week, in some circumstances by as a lot as 70 foundation factors (or 0.70%).

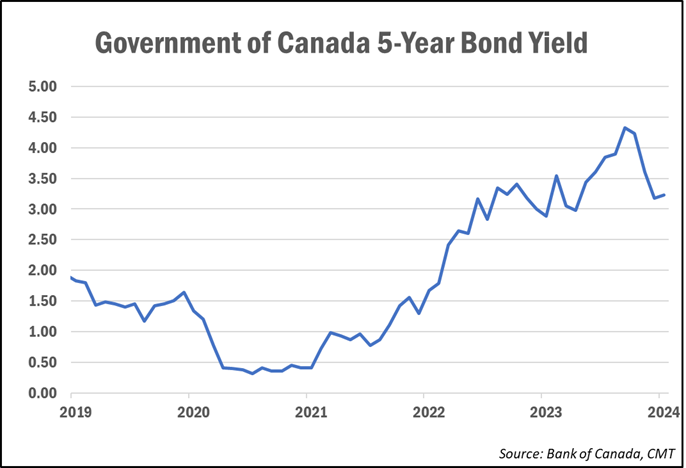

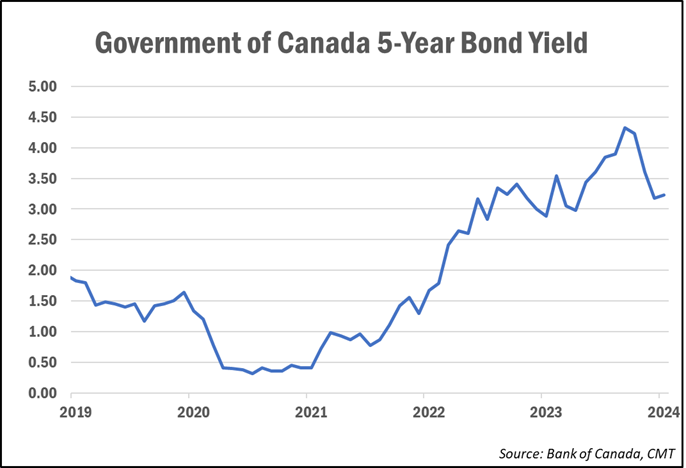

As we reported final month, numerous lenders have been dropping mounted mortgage charges to convey them according to funding prices following a pointy decline in bond yields, which lead mounted mortgage charge pricing.

This week, most massive banks, in addition to HSBC, lowered charges throughout all mortgage phrases, together with marketed 5-year charges, with insured (these with a down fee of lower than 20%) averaging 5.24% and uninsured at round 5.65%.

Nevertheless, we hear that well-qualified purchasers at choose banks are being supplied high-ratio 5-year charges as little as 4.99% if they’re closing within the subsequent 30 days.

Different mortgage lenders have additionally been busy dropping charges, together with some on-line deep-discount brokers. As of Friday, Butler Mortgage was providing the bottom insured 5-year mounted charge of 4.69%, though that’s not obtainable in all provinces.

Ron Butler instructed CMT that the speed entails no restrictions or hidden penalties. For these wanting a shorter time period, Butler additionally at the moment has the bottom high-ratio 3-year mounted, now priced at 4.99%.

Charges have been falling steadily since October, mirroring the decline in Authorities of Canada bond yields, which have fallen over a full share level since peaking in early October.

Observers say the newest charge transfer by the entire massive banks this week is solely to convey their pricing according to the present stage of bond yields.

“Price cuts are all because of the unfold being so excessive for therefore lengthy I believe,” Ryan Sims, a TMG The Mortgage Group dealer and former funding banker, instructed CMT. “They had been raking it in, and bond yields had stayed down for therefore lengthy, they wanted to regulate.”

Nevertheless, ought to yields begin to development again up, Sims stated debtors shouldn’t rule out the likelihood that charges development increased once more.

Variable charges anticipated to fall later this yr

Whereas mounted charges might proceed to fall additional, no less than one charge knowledgeable famous that bond yields—upon which mounted mortgage charges are priced—are foward-looking and have fallen in anticipation of financial coverage loosening later this yr. Consequently, additional fixed-rate cuts going ahead may very well be restricted.

“Our present mounted mortgage charges have already priced in substantial charge cuts by the U.S. Federal Reserve and the BoC in 2024,” Dave Larock of Built-in Mortgage Planners wrote in a latest weblog publish. “That reduces the potential for additional decreases.”

Variable mortgage charges, that are at the moment priced anyplace from 100 to 150 foundation factors above comparable mounted charges, are anticipated to fall all year long because the Financial institution of Canada delivers anticipated charge cuts.

“Anybody selecting a variable charge immediately should consider that their charge will fall under immediately’s obtainable mounted charges, and with sufficient time left on their time period to recoup the upper preliminary price plus some further saving,” Larock famous.

“Which means charges must begin falling considerably, and comparatively quickly,” he added. “I anticipate each issues to occur.”

Bond markets are at the moment pricing in a 74% likelihood of quarter-point charge reduce on the Financial institution’s March assembly, and a 30% likelihood of a further 50 bps in June. By September, markets see a 64% likelihood of 100-bps price of cuts to the present benchmark charge of 5.00%.

“If you happen to’re out there for a mortgage immediately, variable charges are price contemplating in case you can tolerate fee threat and are ready to be affected person,” Larock wrote.

For these not keen to tackle the chance of a variable-rate simply but, Butler says a 1-year mounted charge is “optimum” proper now because it buys debtors time to reassess the speed atmosphere in 12 months.

“For these renewing and who could have fee considerations, take a 3-year mounted to get a greater charge,” he prompt.