Below time strain to save lots of taxes, you acquire a conventional life insurance coverage plan within the final week of March with an annual premium of Rs 1 lac. After a few months, once you bought time to evaluate the product, you didn’t prefer it any bit.

You needed to do away with the plan, however the free-look interval was already over.

And once you checked with the insurance coverage firm concerning the give up prices, you have been politely advised that you simply wouldn’t get something again since you’ve gotten paid only one premium. Your woes didn’t finish there. Even should you had the persistence and cash to pay a number of extra premium installments, you don’t get a lot aid. Within the preliminary years, should you give up, you received’t get greater than 30-40% of the whole premiums paid again.

Don’t know whether or not to name this good or dangerous. Many buyers follow such plans (regardless of not liking them) merely due to the give up prices. The great half is that such heavy give up expenses assist buyers follow the funding self-discipline and develop their financial savings.

The dangerous half is that such exorbitant exit penalties take the freedom away from the buyers.

What should you later notice that the product just isn’t good for attaining your targets? Or that the product gives extraordinarily low returns?

What should you later notice that you simply signed up for too excessive a premium?

You’re simply caught. Can’t do something. And that’s by no means good from clients’ perspective.

However why are the give up prices so excessive?

The first motive is the front-loaded nature of commissions within the sale of conventional insurance coverage merchandise. “Entrance-loaded” means the majority of the compensation for the sale is paid within the preliminary years. As an illustration, within the sale of conventional life insurance coverage merchandise, the first-year fee might be as excessive as 40% of the annual premium.

Now, should you have been to give up the plan inside a few years and the commissions can’t be clawed again, who will bear the price of refunding you the premiums? Therefore, you’re penalized closely should you give up the plan.

The front-loaded nature of commissions additionally encourages mis-selling on the a part of insurance coverage brokers and intermediaries. I’ve thought of so many instances of blatant mis-selling by insurance coverage intermediaries, particularly the banks, on this weblog.

I’m NOT saying that every one insurance coverage brokers and intermediaries are dangerous. Am positive there are various who’re doing a beautiful job. However I need to say that the gross sales incentives and the buyers’ pursuits are misaligned.

What’s the IRDA saying about give up prices?

IRDA realizes that the whole lot just isn’t proper with conventional life insurance coverage gross sales. Give up prices being one in all them. The exit prices are simply too excessive and can’t be justified.

Why does the investor should lose all or say 3/4th of the cash if he/she doesn’t just like the product?

Therefore, IRDA has proposed a change. Only a proposal. Has invited feedback. Nothing is closing.

- There can be threshold premium on which give up expenses will apply.

- Any extra premium above that threshold is not going to be topic to give up expenses.

Allow us to perceive with the assistance of an illustration. And I take the instance from the IRDA proposal itself.

Allow us to say the annual premium is Rs 1 lac.

And the edge is Rs 25,000.

You could have paid premiums for 3 years. Rs 1 lac X 3 = Rs 3 lacs complete premium paid.

Therefore, give up expenses will apply solely on 25,000 X 3 = Rs 75,000.

Let’s say you will get solely 35% of such premium again should you give up after 3 years.

So, of this Rs 75,000, solely 35% can be returned. You get again Rs 26,250.

The remaining (1 lac – Rs 25,000) X 3 = Rs 2.25 lacs received’t be topic to give up expenses.

Therefore, the web quantity returned to you = Rs 2.25 lacs + 26,250 = Rs 2,51,250. This worth is known as Adjusted Assured Give up Worth and shall be the minimal give up worth.

The Give up Worth shall be larger of (Adjusted Assured Give up Worth, Particular Give up Worth).

Unsure how the Particular Give up worth is calculated. So, let’s simply give attention to the Adjusted Assured Give up Worth.

It is a huge enchancment over what you’d get should you have been to give up an present coverage now.

Whereas I’ve been fairly important of IRDA up to now, I need to say that is an especially buyer pleasant proposal from IRDA.

What would be the Threshold Premium?

It isn’t but clear how this “Threshold” could be calculated or arrived at.

It might be an absolute quantity or a proportion of annual premium. Or a combined method.

The decrease the edge, the higher for buyers.

As I perceive, the insurers can have the discretion to resolve the edge quantity.

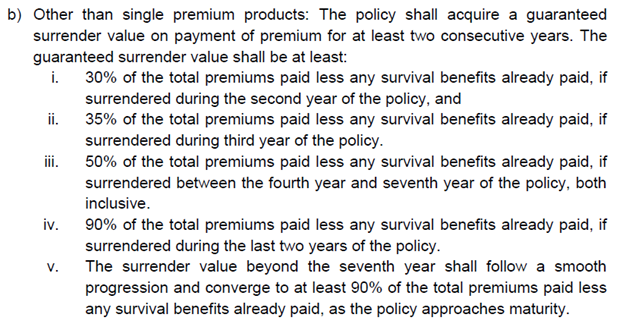

The IRDAI has set broad guidelines for minimal give up worth. Copying an excerpt from the proposal.

Frankly, tells nothing about how the edge could be arrived at.

I’m additionally undecided whether or not IRDA is referring to “Complete Premiums paid” or the “Complete Relevant Threshold Premium” when it mentions “Complete Premiums”. Whether it is “Complete premiums paid”, then this proposal could not account for a lot. Insurers can merely maintain the “Threshold Premium” fairly excessive.

We must wait and see.

Not everybody will like this

As talked about, IRDA has simply floated a proposal and invited feedback.

The insurance coverage firms is not going to like this. The insurance coverage brokers/intermediaries is not going to like this both.

Therefore, count on a pushback from the insurance coverage business.

However why?

If the give up expenses are certainly decreased (as proposed), it might be tough to maintain the front-loaded nature of commissions in conventional plans. Or the insurance coverage firm must introduce claw again provisions within the conventional plans. Both approach, their distribution companions (insurance coverage brokers) received’t like this. And incentives change the whole lot. Will the insurance coverage brokers be as inclined to promote conventional plans if the preliminary commissions aren’t so excessive?

We must see if this proposal sees the sunshine of the day. There can be pushback from the business. We must see if IRDA can maintain in opposition to all of the strain with out diluting the provisions of the proposal. As I discussed within the earlier part, a small play on definition/interpretation of “Threshold premium” can render the change ineffective.

Bear in mind LIC can be affected, and it sells loads of conventional life insurance policy.

We’ll quickly discover out.

By the way in which, would this transformation (if accepted) make conventional plans extra engaging to speculate?

No, it doesn’t.

This particular change solely pertains to give up of insurance policies. Nothing adjustments should you plan to carry till maturity. Therefore, should you should put money into such product, make investments on advantage.

Extra Learn/Hyperlinks

Publicity Draft-Product Laws 2023 dated December 12, 2023

Disclaimer: Registration granted by SEBI, membership of BASL, and certification from NISM under no circumstances assure efficiency of the middleman or present any assurance of returns to buyers. Funding in securities market is topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing.

This publish is for training function alone and is NOT funding recommendation. This isn’t a suggestion to speculate or NOT put money into any product. The securities, devices, or indices quoted are for illustration solely and aren’t recommendatory. My views could also be biased, and I’ll select to not give attention to features that you simply contemplate essential. Your monetary targets could also be totally different. You might have a special threat profile. You might be in a special life stage than I’m in. Therefore, you have to NOT base your funding selections primarily based on my writings. There isn’t any one-size-fits-all resolution in investments. What could also be an excellent funding for sure buyers could NOT be good for others. And vice versa. Subsequently, learn and perceive the product phrases and circumstances and contemplate your threat profile, necessities, and suitability earlier than investing in any funding product or following an funding method.