If Andrew Biggs and I can agree, the shift ought to have bipartisan help.

Andrew Biggs, a conservative economist with the American Enterprise Institute, and I are normally opponents. Our disagreements return a long time – privatizing Social Safety, adequacy of retirement revenue, compensation of state and native authorities workers – and only a few weeks in the past I assumed he was actually off base arguing that employees don’t pay for his or her Social Safety advantages.

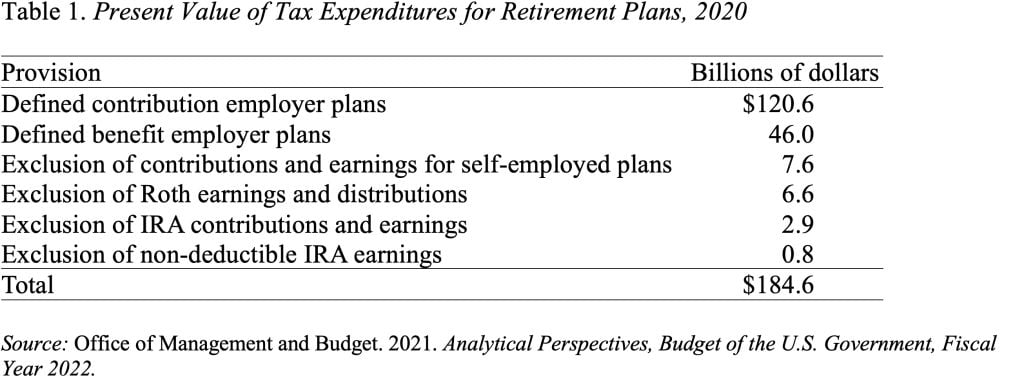

Typically, nonetheless, we see issues the identical manner. We each have concluded that: 1) the subsidies for personal sector retirement plans do little to extend non-public saving; and a pair of) the revenues raised from repealing these “tax expenditures” could possibly be higher used to handle Social Safety’s funding hole. The tax expenditures, below the non-public revenue tax, come up as a result of workers can defer taxes on compensation that they obtain within the type of retirement financial savings. This tax remedy considerably reduces the lifetime taxes of collaborating workers, relative to saving via an bizarre funding account. It additionally price the federal government $185 billion in 2020, equal to about 0.9 p.c of GDP.

Who will get the tax expenditure? Research present that 59 p.c of the present tax expenditures for retirement saving flows to the highest quintile of the revenue distribution. This sample isn’t a surprise, on condition that upper-income taxpayers usually tend to have entry to employer-sponsored retirement plans, usually tend to take part of their employer’s plan, and contribute extra once they do take part.

And up to date adjustments will enhance the share going to the highest quintile. Expanded “catch-up” contributions profit solely these constrained by the present limits – roughly 16 p.c of contributors. And rising the age to 75 for taking required minimal distributions permits contributors to make the most of 4½ extra years of tax-free progress. Typically, solely the wealthiest will have the ability to profit from this provision.

What do the tax expenditures purchase us? Provided that the tax expenditures go overwhelmingly to upper-income households, who face virtually no threat of poverty in previous age, it is very important ask whether or not these expenditures accomplish some broader social aim, akin to rising nationwide saving.

Concept doesn’t present a robust foundation for assuming that the federal tax preferences enhance whole saving. Sure, tax preferences make retirement saving extra enticing and big quantities have been amassed in retirement plans. However the economists’ lifecycle mannequin suggests that individuals could merely shift financial savings from bizarre taxable funding accounts to tax-favored retirement accounts.

Certainly, the proof helps the predictions of the lifecycle mannequin. The definitive 2014 examine, utilizing Danish tax information, checked out responses to a discount within the subsidy for retirement contributions for these within the prime tax bracket. The outcomes present that, for some, pension contributions declined. However the decline was practically completely offset by a rise in different sorts of saving. The tax subsidy, in different phrases, had primarily induced people to shift their saving from taxable to tax-advantaged retirement accounts, to not enhance general family saving.

Provided that the tax expenditure for retirement plans is a nasty deal for taxpayers, it is sensible to curtail these tax breaks and reallocate the proceeds. Over the following 75 years, Social Safety faces an actuarial deficit of 1.3 p.c of GDP, so making use of the revenues from eliminating the tax expenditure would remedy 70 p.c of the issue. And the positive aspects could be increased than this estimate for 2 causes: 1) the federal government would proceed to gather revenue taxes on previous tax-preferred contributions; and a pair of) payroll tax revenues could be increased as effectively as a result of they’re additionally affected by the tax preferences.

Briefly, let’s transfer authorities assets from retirement plans the place the motivation does just about nothing for retirement safety to a program that indisputably does – Social Safety.