Black Individuals’ homeownership is dramatically decrease than it’s for Whites, and one purpose is discrimination. This additionally appears to be the case for the LGBTQ+ neighborhood, a brand new examine signifies.

About half of LGBTQ+ adults mentioned in a survey that they’re householders. Practically three out of 4 who will not be LGBTQ+ are householders.

Why does this matter? As staff construct wealth to organize for his or her eventual retirement, the fairness of their houses is often their largest retailer of wealth – and value greater than their retirement accounts. Decrease homeownership places the LGBTQ+ neighborhood at a definite drawback.

The examine, by the Federal Reserve Financial institution of St. Louis, discovered that the homeownership hole was important even when the researchers accounted for main elements that may have an effect on it, equivalent to revenue and race and whether or not the particular person is married. On this apples-to-apples comparability, they mentioned, the persistence of a niche “suggests the potential for discrimination taking part in a task in these teams’ decrease homeownership charges.”

The info evaluation strains up with what people have instructed the Federal Reserve in surveys about their experiences within the housing market usually. Transgender and non-binary adults and individuals who determine their intercourse as “different” had been 5 occasions extra prone to say they skilled discrimination when making an attempt to lease or purchase a home.

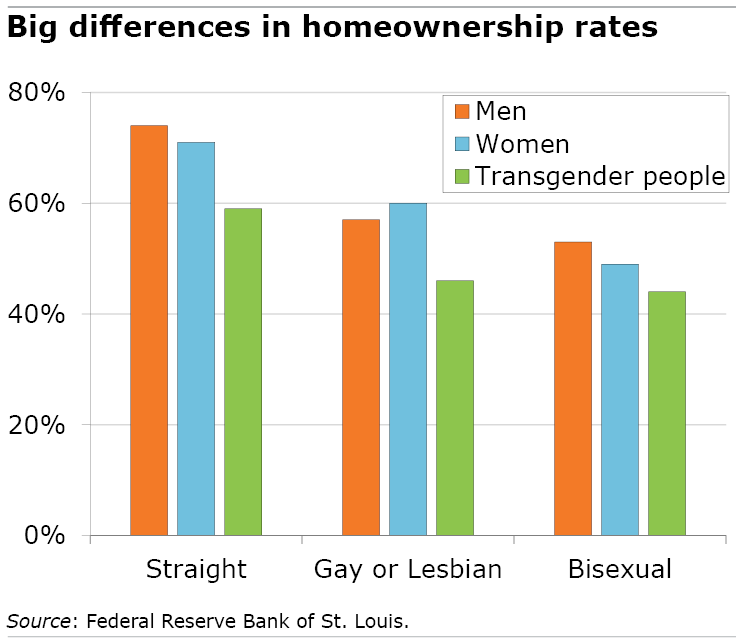

The examine broke down the homeownership charges by each gender id and sexual orientation. The gaps between LGBTQ+ and non-LGBTQ+ Individuals is putting. Straight women and men have the best homeownership charges, exceeding 70 %. The charges for homosexual males and lesbian girls are nearer to 60 %, although lesbians are barely extra prone to be householders.

Transgender people in any case – straight, homosexual or lesbian – have decrease homeownership charges. Bisexuals’ homeownership is even decrease.

When individuals are discriminated towards, ”they aren’t collaborating on this wealth-building channel to the identical extent,” the examine concluded.

Squared Away author Kim Blanton invitations you to comply with us @SquaredAwayBC on X, previously often known as Twitter. To remain present on our weblog, be part of our free electronic mail record. You’ll obtain only one electronic mail every week – with hyperlinks to the 2 new posts for that week – while you enroll right here. This weblog is supported by the Heart for Retirement Analysis at Boston School.