Roofstock is an funding platform that permits you to put money into single-family rental properties.

Savvy inventory market traders know that transaction charges can kill market beneficial properties.

Fortunately, expertise has introduced transaction prices near zero for many inventory market traders. Sadly, actual property traders haven’t had the identical luck.

Over the course of 5 years, I’ve bought three rental properties (and bought one). My common promoting value for every of those was $4,000. Plus, as a purchaser I paid tons of for inspection charges and due diligence charges.

So far as I do know, the one firm efficiently decreasing costs for rental actual property traders is Roofstock.com. Roofstock is an internet market for tenant-occupied actual property. Seeking to grow to be an actual property investor? This is why you would possibly need to contemplate searching for properties on Roofstock.

|

Direct Possession and REITs |

|

What Is Roofstock?

Roofstock is an internet market that options a number of hundred tenant-occupied homes. All properties on the positioning are single household properties. The listings embrace full inspections, 3D Fashions, photographs and extra.

Along with the Roofstock Market, the corporate additionally provide REIT investments to accredited traders by its Roofstock One platform. Since launching in 2015, Roofstock has surpassed $4 billion in transaction quantity.

What Does It Supply?

This is a better take a look at a few of Roofstock’s key options and companies.

Low Prices

How a lot does it value to begin these properties? Nothing. If you happen to discover a property you want, you may learn the total inspection report, speak with an advisor, and mull it over.

While you’re prepared, you should purchase the home by paying the 0.5% charge utilizing your bank card (that’s proper, your bank card). When you full your financing (otherwise you wire the money), the home turns into yours. Sellers get an ideal deal too, paying only a 3% itemizing charge.

It’s laborious to emphasise simply how revolutionary this value chopping is. Firms like Fundrise and CrowdStreet have made it low-cost to realize actual property publicity, however to not straight personal particular person actual belongings. Roofstock really reduce the most important barrier to entry for actual property traders.

Begin Amassing Rents Proper Away

When you shut on the house, you begin accumulating lease immediately. It’s because you assume the contract from the earlier proprietor. The toughest a part of proudly owning actual property is discovering nice tenants.

If you should purchase a spot that already has tenants with a track-record of paying in place, it’s like shopping for a gold mine. Roofstock makes that occur.

Roofstock’s “Lease Up Assure” offers safety for vacant dwelling purchases as nicely. With this assure, Roofstock pledges to cowl your lease for as much as a 12 months if a lease hasn’t been signed in your “rent-ready” dwelling inside 45 days. Make sure you try the particulars of the assure right here to get the specifics of what “rent-ready” means.

Thorough Inspections

One more reason to think about Roofstock is its thorough inspections. The inspections cowl the precise high quality of the home, the estimated restore prices, and the monetary figures you want. It’s really attainable to purchase a home website unseen by Roofstock.

After all, you may fly out and consider the homes your self too. I feel most individuals will need to begin their roofstock investments in a comparatively native market.

Driving a number of hours to go to a number of homes is smart to me. However some individuals purchase the homes website unseen. The thorough inspections make {that a} affordable (if dangerous) possibility.

Simpler Financing

One of many hardest half about shopping for single-family rental properties is usually discovering the financing. However Roofstock has an built-in financing resolution for individuals with qualifying credit score and not less than 20% down.

If you happen to’re a severe purchaser, examine Roofstock’s mortgage provide to a proposal from LendingTree.com to see if you may get a greater deal. In keeping with Roofstock, its in-house financing resolution permits patrons to shut in as little as 30 days. It may not be the very best rate of interest, nevertheless it’s amazingly quick.

Use As A lot Or As Little Of The Platform As You Need

Among the best issues about Roofstock is how open the platform is. You should purchase tenant-occupied actual property, with Roofstock companion financing, and use Roofstock’s property supervisor.

Then again, yow will discover a purchaser’s agent, pay on your personal inspection, discover your personal financing, and handle the property your self.

That is an extremely necessary level to think about. If you happen to’ve obtained a property administration system in place, you don’t need to pay for a Roofstock property supervisor. If you happen to’re a brand new investor, it’s possible you’ll recognize the hand-holding.

Before you purchase, make an impartial analysis if actual property funding is for you. Whether it is, is only one instrument. You also needs to search for homes in your native market, and examine sources at websites like earlier than making the plunge.

Roofstock One

Roofstock One is totally totally different from Roofstock Market. Initially, it is solely open to accredited traders. Second of all, it enable traders to put money into portfolios of single-family properties. That is much like different actual property crowdfunding websites.

Getting began with Roofstock One requires a minimal funding of $5,000. Roofstock handles every part from there, together with the administration of all of the properties which are included in its Roofstock One portfolios. This implies it could possibly be an ideal possibility for traders who need a extra hands-off actual property investing strategy or who would love publicity to a broader diversification of properties.

However it’s necessary to notice that Roofstock One investments are extremely illiquid. Traders are required to have an funding horizon of not less than 5 years and there’s presently no secondary marketplace for promoting Roofstock One shares.

Roofstock Academy

Roofstock not too long ago launched their Roofstock Academy, the place you may learn to grasp flip key rental properties. This course goes nicely with really utilizing their platform for buying property.

The Roofstock Academy combines on-line studying with one-on-one teaching session and entry to a non-public community of different actual property traders.

Are There Any Charges?

Sure, there are prices for utilizing the Roofstock Market in addition to Roofstock One. This is how they break down.

Roofstock Market

Consumers pay a market charge of 0.5% or $500 (whichever is bigger) and sellers pay a 3% itemizing charge or $2,500 (which is bigger). Which means the whole fee is far decrease than the typical fee of actual property brokers of round 5%-6%. If you happen to determine to make use of one among Roofstock’s vetted property managers, their charges will differ by area, however the common is about 10% of the month-to-month lease.

Roofstock One

Roofstock is being curiously quiet in regards to the prices of Roofstock One. In actual fact, it would not point out charges wherever on the Roofstock One homepage or within the FAQs. From what we have been capable of finding on-line, it seems that Roofstock One traders are charged an asset administration charge that begins at 0.50% of the house worth however will alter on the similar fee because the gross lease modifications.

How Does Roofstock Evaluate?

There are few corporations on the market that may match what Roofstock affords. Sure, there are many actual property crowdfunding websites like Fundrise that may help you put money into non-traded REITs, however most do not provide particular person property investments.

Doorvest’s enterprise mannequin is much like Roofstock in that it permits you to purchase single-families properties outright. However the largest distinction is that the properties which are out there on Doorvest will not sometimes have renters dwelling there and may have renovations.

As soon as you’ve got chosen your excellent property on the Doorvest platform and made your refundable deposit, Doorvest will purchase the house in your behalf, renovate it, and discover a tenant. Then in any case of these steps have been accomplished, you will shut on the house on the Truthful Market Worth and start incomes passive earnings. Doorvest doesn’t provide any REIT investments.

Realty Mogul is much like Roofstock in that it permits traders to put money into each particular person properties and REITs. However whereas Roofstock’s platform focuses on single-family properties, all of Realty Mogul’s choices are business properties. This is a better take a look at how Roofstock compares:

|

Header |

|

|

|

|---|---|---|---|

|

Particular person single-family properties REITs of single-family properties |

REITs that embrace a mix of residential and business properties |

Particular person business properties REITs of economic properties |

|

|

$5,000 |

|||

|

Open To Non-Accredited Traders? |

Non-accredited traders should purchase particular person properties on the Roofstock Market, however cannot put money into Roofstock One shares |

Non-accredited traders can put money into REITs however not particular person properties |

|

|

Cell |

How Do Get Began With Roofstock?

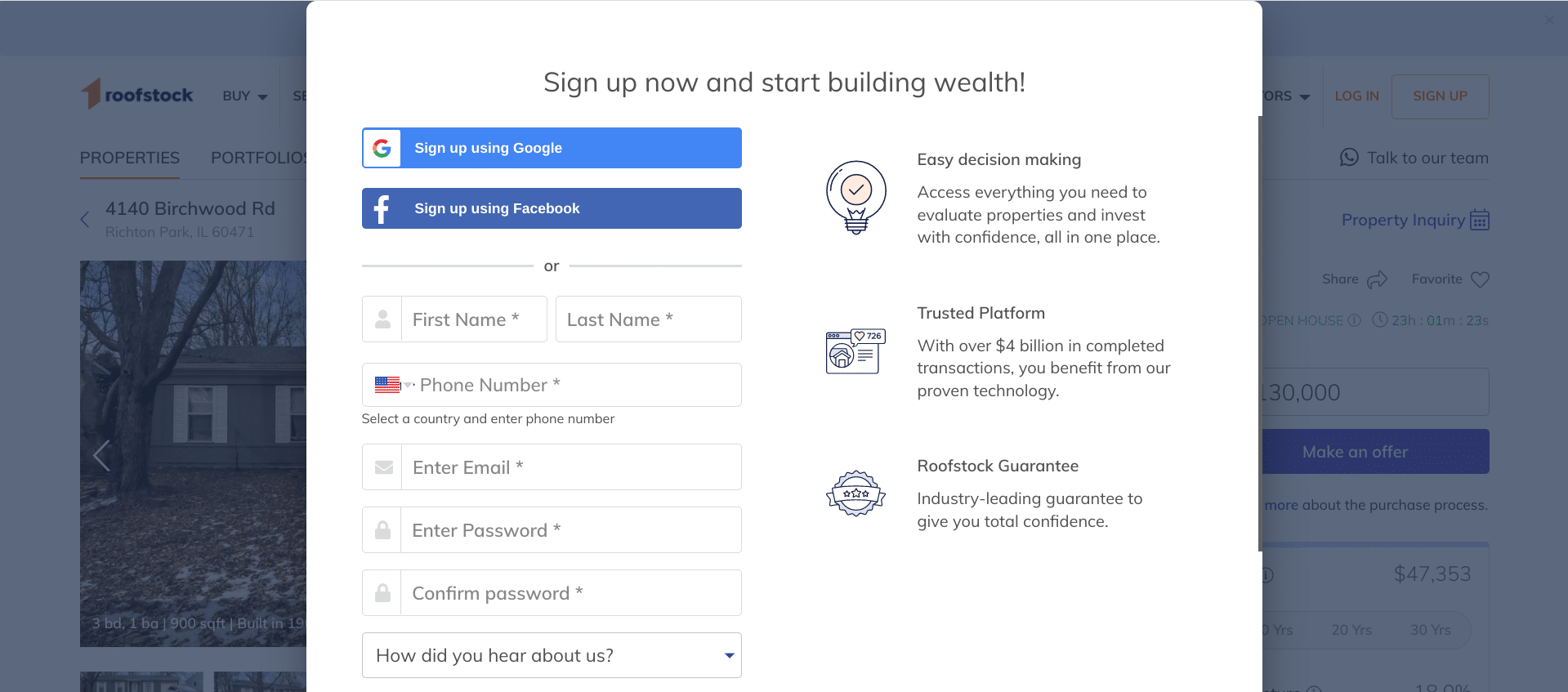

You can begin shopping properties on Roofstock anonymously. However if you happen to attempt to click on on any particular dwelling to see extra footage and monetary particulars, you will be requested to create an account.

Fortunately, that is simple to do. You’ll be able to select to login immediately together with your Fb or Google account. Or you may create a separate account by offering your title, cellphone quantity, electronic mail tackle, and a password.

Is It Protected And Safe?

For an internet home-buying platform, Roofstock is about as protected as it will possibly get. Its web site is encrypted and it offers a great deal of information about every property that can assist you make an knowledgeable choice.

How Do I Contact Roofstock?

In case you have questions in regards to the Roofstock platform or want help, you may name 800-466-4116

or electronic mail help@roofstock.com. You can even ship a message by the corporate’s contact type right here.

Why Ought to You Belief Us?

I’ve been writing about and reviewing funding corporations and overlaying actual property investments for 10 years. I’ve personally owned single household, multi-family, actual property syndications, non-public partnerships, and extra. I am nicely versed in each the funding facet and tax facet of those services and products.

Moreover, we’ve our compliance group that repeatedly checks and updates the information on our critiques.

Who Is This For And Is It Price It?

In my view, Roofstock is the low value brokerage of the real-estate investing world. I anticipate that copycat opponents might quickly hit the market.

If you happen to’re interested by how the market works, try our interview with Roofstock on turnkey actual property investing.

At that time, we must weigh the prices and advantages of varied options. However proper now, Roofstock is in a league of its personal. Take a look at the homes. It’s free to browse.

Roofstock FAQs

Listed here are the solutions to a couple of the commonest questions that folks ask about Roofstock:

Who’s the CEO of Roofstock?

The CEO of Roofstock is Gary Beasley, one of many firm’s co-founders.

Is Roofstock publicly-traded?

No, it is a non-public firm and Roofstock One is a non-public placement REIT.

Can you purchase newly-built properties on Roofstock?

Sure, newly-constructed Lennar properties in choose areas will be bought on the platform.

Does Roofstock have an app?

There isn’t any cellular app for the Roofstock Market. However if you happen to’ve already bought a rental property on the platform, you may monitor its financials utilizing the Roofsavvy iOS app.

Roofstock Options

|

Taxable or self-directed IRA through Roofstock’s partnership with New Path Belief Firm |

|

|

Direct Possession and REITs |

|

|

Roofstock Market Charges |

|

|

Roofstock One Administration Payment |

Begins at 0.50% however might alter with the property’s gross rents |

|

|

|

Excessive — fund financials are filed publicly with the SEC |

|

|

Funding Time period For Roofstock One Shares |

|

|

Roofstock One Share Redemption Program |

|

|

Buyer Service Telephone Quantity |

|

|

Buyer Service E-mail Handle |

|