Fed Pauses Charges Once more

On the Fed’s final Federal Open Market Committee (FOMC) assembly of the 12 months, the Fed determined to keep up the goal for the fed funds price at 5.25-5.50%. This determination was largely consistent with market expectations forward of the discharge, which assigned a close to certainty the Fed would pause rate of interest will increase at its December assembly. Fed Powell indicated the final price hike is probably going now behind us, and the market is now setting its eyes on the probably first price lower, which per the Fed’s estimates ought to happen someday subsequent 12 months.

Funding Implications

- We consider our portfolios proceed to be nicely positioned to navigate the altering macroeconomic surroundings.

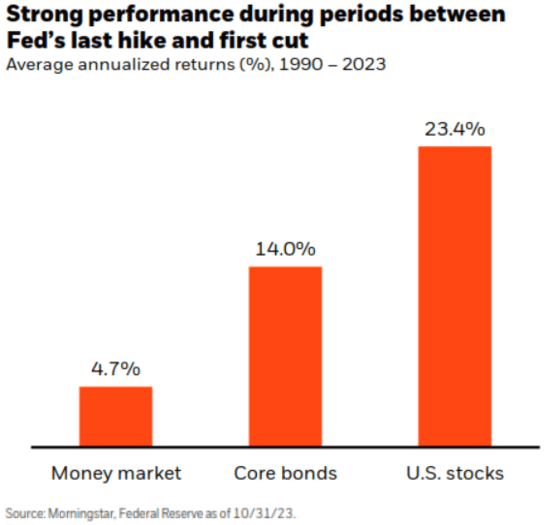

- Traditionally, the time interval between the final Fed rate of interest hike and the primary rate of interest lower has been optimistic for each inventory and bond returns.

- Long run, we consider we now have entered a structural shift in the direction of tighter financial coverage relative to the years post-2008. This shift could act to reasonable inventory market returns over the lengthy haul.

Stronger Progress in 2023, Curiosity Charges to Decline in 2024

The Fed’s accompanying assertion famous that latest information signifies financial exercise could have slowed from the power skilled within the third quarter of 2023. Job good points have additionally moderated from earlier within the 12 months, although the labor market stays sturdy. The assertion additionally famous that inflation has subsided however stays elevated and above the Fed’s long-term goal of two%.

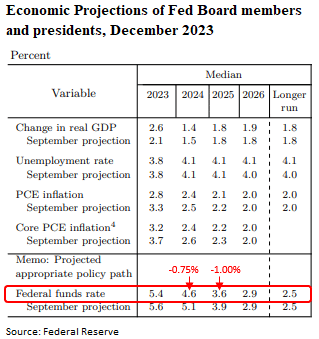

All eyes have been on the Fed’s financial projection supplies, aka the “dot plot” forecast. The Fed elevated its outlook for financial development this 12 months, and marginally revised decrease its financial development outlook for 2024 to +1.4%, down from the earlier estimate of +1.5%. On the subsequent press convention, Fed Chair Powell indicated that, because it stands, the Fed’s base case is for no extra rate of interest will increase, though emphasised any future determination will stay information dependent. The “dot plot” confirmed the Fed believes rates of interest will drop in 2024. The Fed’s present expectations for the fed funds price on the finish of 2024 are between 4.50% and 4.75%, or -0.75% beneath the present vary of 5.25%-5.50%, representing three 25 foundation level rate of interest cuts. Thereafter, the Fed anticipates one other 1.00% of rate of interest cuts will likely be applicable in 2025.

The Fed indicated inflation is ready to reasonable additional, revising its estimate for 2023 inflation -0.5% decrease for each PCE Inflation and Core PCE Inflation. Forecasts for inflation in 2024 and 2025 are marginally beneath the Fed’s prior estimates in September and anticipated to development decrease over time. The labor market is prone to stay comparatively strong, with the Fed incrementally rising unemployment price expectations for 2024, bringing the unemployment price consistent with the Fed’s long-term objective of 4.1%.

Financial system Resilient, However Set to Slowdown

Regardless of many headwinds thrown its method – regional banking issues, increased rates of interest, sticky inflation, tighter credit score circumstances, geopolitics, debt ceiling issues – the economic system constantly exceeded development forecasts all through 2023. Client spending, underpinned by a strong labor market, helped propel the economic system ahead and keep away from an financial slowdown. In consequence, the possibilities of a “mushy” or “no touchdown” financial final result have elevated. With that being stated, we’re seeing softening in labor market fundamentals, whereas tighter credit score circumstances could weigh on financial development transferring ahead, a view that was reiterated within the Fed’s December FOMC assertion. In actuality, it might take as much as 12 months for the complete impact of financial coverage to work its method via the economic system. The final Fed rate of interest enhance was on the finish of July 2023, so the complete impact of the Fed’s tightening coverage is probably going to not be felt till at the very least July 2024. In consequence, anticipate slowing development subsequent 12 months, as predicted within the Fed’s financial forecasts above.

Don’t Anticipate Imminent Fee Cuts

With that backdrop, the Fed will probably lower rates of interest, however is unlikely to take action earlier than the vast majority of prior rate of interest will increase work via the economic system. Furthermore, whereas inflation is transferring in the precise path, it stays nicely above the Fed’s 2% goal and nonetheless has some option to go. The Fed has emphasised its laser-focus on bringing inflation again in the direction of its long-term objective, so could also be hesitant to chop charges earlier than it sees ongoing and significant inflationary developments in the direction of its goal. This view has been supported by Fed rhetoric, which has constantly indicated that after the Fed is completed climbing, rates of interest are unlikely to come back down in a rush. Present market-implied estimates for the primary Fed rate of interest lower are for about Could of subsequent 12 months, although we wouldn’t be stunned if that date will get pushed again over time. In fact, ought to we see a major deterioration in financial fundamentals slipping in the direction of a recession, the Fed could lower rates of interest sooner or additional than what the Fed’s present forecasts point out.

Fed Pause Could Assist Shares & Bonds

Traditionally, this has been an excellent interval for each inventory and bond investments. The interval between the final Fed price hike (finish of July 2023) and the primary Fed price lower (TBD) has traditionally been supportive of inventory and bond returns.

Structural Shift to Tighter Coverage

Lengthy-term, we consider we now have already entered a structural shift with respect to financial coverage. Even when the Fed brings rates of interest again in the direction of it’s longer run equilibrium price of two.5% (we don’t anticipate that occurs over the close to time period, nor do the Fed’s financial forecasts), the fed funds price will nonetheless symbolize tighter financial coverage relative to the years post-2008 via the top of 2021. Moreover, by the use of quantitative tightening (QT), the Fed is dedicated to shrinking its stability sheet. This dynamic alone represents tighter financial coverage, so even underneath a “Fed price pause” surroundings, to the extent QT stays in impact, the Fed is, by implication, erring in the direction of tighter financial coverage.

Asset Class Implications

In consequence, we consider the tailwind of simple financial insurance policies that helped propel shares increased within the post-2008 years has been eliminated. We’re not bearish on the outlook for shares, we simply suppose expectations must be reset for annualized inventory market returns extra aligned with historic averages of mid- to high-single digits.

We consider the outlook for bonds has improved. Bond yields are far more enticing at present relative to the yields out there simply 12-24 months in the past. A lot of our most well-liked core bond holdings are yielding mid- to high-single digits, and the present yield on a bond portfolio tends to be the biggest figuring out issue for future bond returns.

Given the financial outlook, various investments could play an vital function in funding portfolios, offering upside return potential and decrease correlations to the broad inventory market. In the end, we consider our portfolios are nicely positioned to navigate adjustments in financial coverage and the macroeconomic surroundings, and proceed to fulfill the long-term monetary objectives of our purchasers.