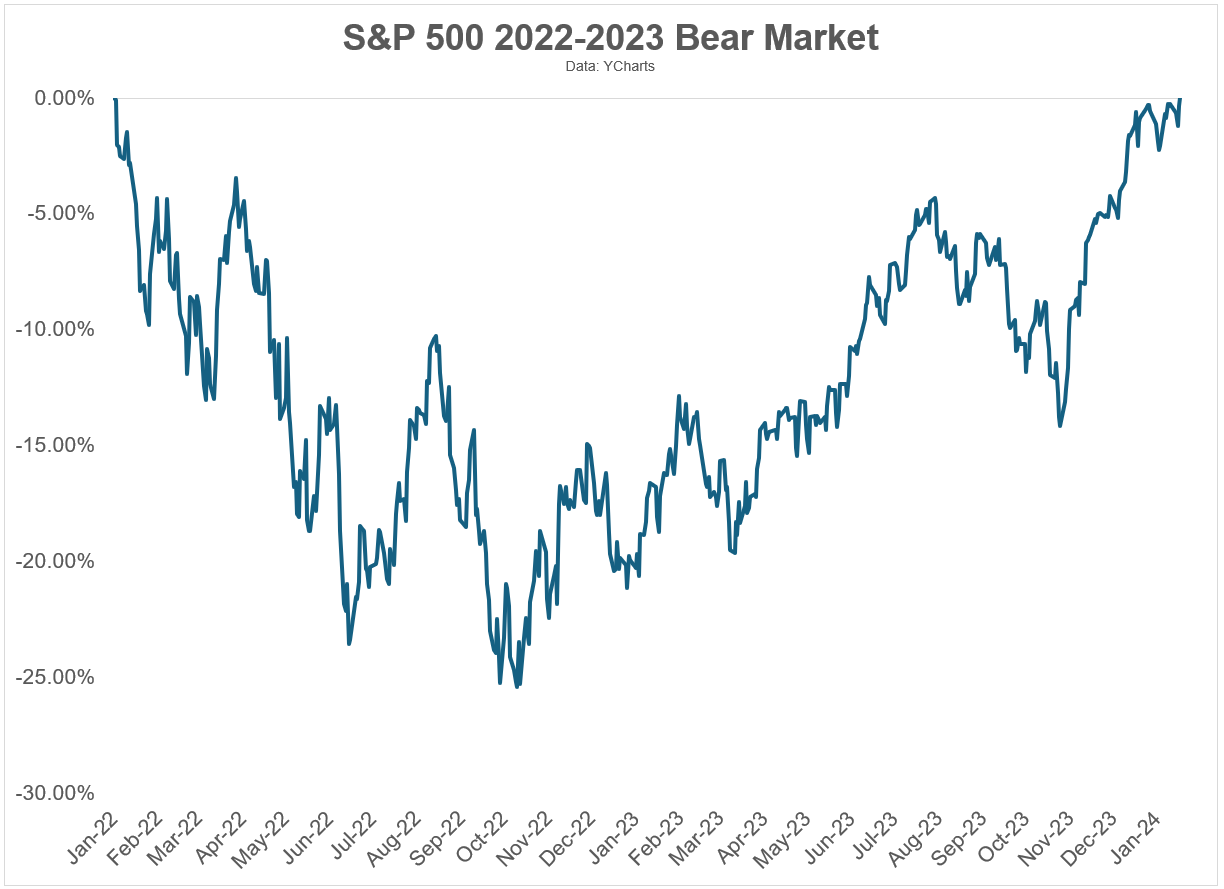

It’s been some time however we’re again:

After slightly greater than two years, the S&P 500 lastly took out the highs from January 2022 on Friday.

New all-time highs!

This bear market felt nasty in 2022 however it was pretty run-of-the-mill when put next with the largest downturns over the previous 70+ years.

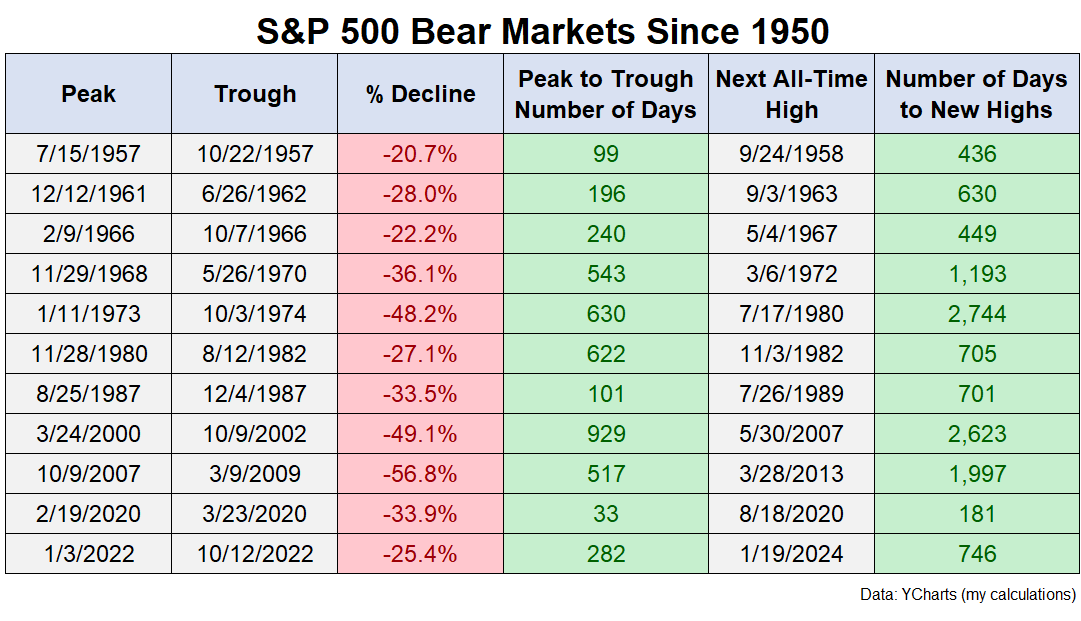

Right here’s an up to date desk of S&P 500 bear markets since 1950 together with the variety of days it has taken to go peak-to-trough together with the prior peak-to-new highs:

The typical bear market since 1950 has seen a drawdown of 35%, taking 381 days to backside out and greater than 1,100 days to go from the prior peak to new all-time highs.1

That is the type of factor it’s best to anticipate to occur each 5 – 6 years.2

In fact, we’ve now skilled two bear markets in 4 years however that’s how market averages work. You possibly can’t set your watch to those issues.

So what occurs subsequent?

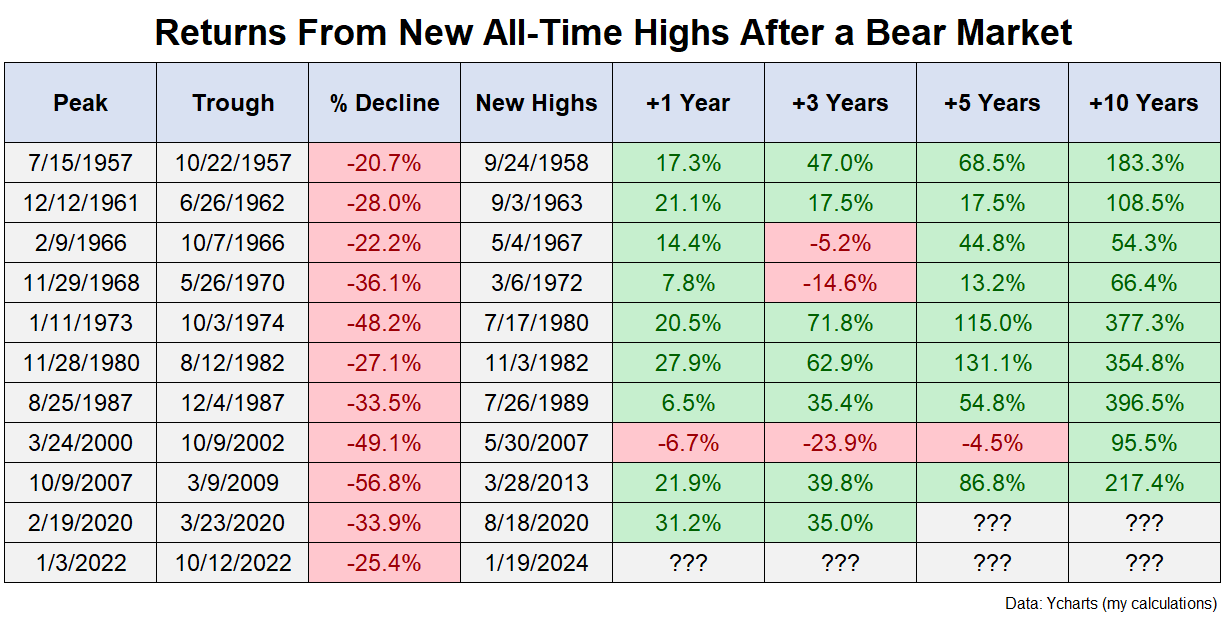

I don’t know, after all, however it’s fascinating to take a look at what’s occurred after the inventory market hit new highs following bear markets prior to now.

Right here’s a have a look at the one, three, 5 and ten yr returns3 from new highs following a bear market:

More often than not new highs are adopted by extra new highs. The typical one, three, 5 and ten yr complete returns following new highs had been +16%, +27%, +59% and +206%, respectively.

That’s fairly good.

Actually the one time new highs had been hit and one other bear market rapidly adopted was in 2007. New highs got here in Could 2007 whereas the height for the Nice Monetary Disaster got here in October of the identical yr.

The early Seventies skilled two dreadful bear markets in brief order as properly.

As at all times, there are exceptions to the principles in relation to the markets.

I don’t know what occurs from right here. It’s anybody’s guess.

What I do know is that pondering and appearing for the long run is often rewarded in relation to the inventory market.

Staying the course nonetheless works.

Additional Studying:

Staying the Course is Tougher Than it Sounds

1If you happen to had been to take out the three largest crashes (1973.1974, 2000-2002, and 2007-2009), the typical outdated peak to new peak was a median of 614 days.

2Together with the latest one, there have been 11 bear markets since 1950 or one each six-and-a-half years.

3I needed complete returns right here since they’re longer-term, however I didn’t really feel like calculating the worth returns to the precise day (it takes a whole lot of time). So these are complete returns from the primary full month after new highs (that means the returns are most likely even a tad understated). Shut sufficient.

This content material, which incorporates security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here will likely be relevant for any explicit info or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or provide to supply funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

Wealthcast Media, an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the chance of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.