Because the nation was rising from the pandemic, rents exploded. Two years later, the strain on rents is beginning to ease in response to a rise in multifamily development, together with residence buildings.

However the COVID-era surge continues to hang-out renters, who’re paying about 20 % greater than they did in 2019, although wholesome wage will increase in recent times offset a few of that.

The nation is within the grips of “an unprecedented affordability disaster,” Harvard’s Joint Heart for Housing Research concludes in its new report. The middle estimates that about half of U.S. renters – some 22 million households – spent at the least 30 % of their revenue on rental housing in 2022. That’s the best share in over a decade. About 12 million of them spent greater than half their revenue on housing.

A associated pattern detected by Harvard’s housing middle final yr is regarding for future retirees: declining homeownership amongst older staff that can expose rising numbers of them to rising rents after they retire.

Any home-owner will inform you a giant benefit they’ve over renters is that the funds on a fixed-rate mortgage don’t improve. Rents do and, as we’ve seen lately, generally by loads. Rising rents are notably a pressure on retirees since they’ve much less revenue than after they had been working.

One other bonus of homeownership is that it’s a type of pressured retirement saving. Each mortgage fee provides a little bit bit to dwelling fairness, which is cash retirees can use to complement their revenue. They’ve to this point been reluctant to faucet that cash. However it’s, however, a supply of wealth that’s obtainable to them.

To the extent that homeownership is a type of retirement wealth, issues appear to be heading within the improper route.

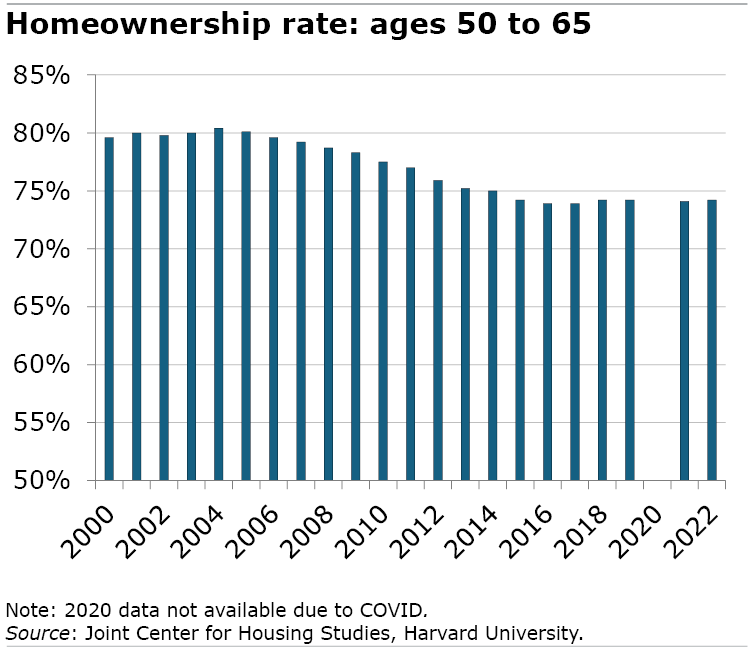

Twenty years in the past, homeownership amongst 50- to 65-year-olds – principally boomers – hit an all-time excessive of 80 %, the housing middle stories. After which the Nice Recession occurred, and homeownership began dropping. In the present day, 74 % of older staff personal their properties.

That downward pattern “probably foreshadows decrease homeownership charges for older adults sooner or later,” the middle predicted.

If that prediction is true, the absence of this main supply of wealth can solely imply the necessity for inexpensive rental housing for retirees that the middle has warned about for years will proceed to develop.

Squared Away author Kim Blanton invitations you to comply with us @SquaredAwayBC on X, previously often known as Twitter. To remain present on our weblog, be part of our free e mail checklist. You’ll obtain only one e mail every week – with hyperlinks to the 2 new posts for that week – whenever you enroll right here. This weblog is supported by the Heart for Retirement Analysis at Boston School.