Ought to I purchase a home now or wait?

There’s one query I wrestle with greater than some other. It’s inconceivable to reply.

On the floor it’s straightforward. Shopping for a home is an efficient long-term transfer.

There are tax advantages.

You get to deduct your mortgage curiosity on the primary $750,000 of mortgage debt. There’s a capital features exclusion.

There are funding advantages.

Your mortgage lets you use leverage. A small down fee buys an enormous home.

Your own home may recognize. The mortgage payoff is mounted so 100% of the appreciation is yours.

Your mortgage turns into a technique to save. The home goes up. Your mortgage goes down. You get extra money once you promote.

Simply purchase a home that’s valued at 3 to 4 occasions your annual revenue. Put 20% down on a 30 yr mounted price mortgage.

Now for the laborious half.

Ought to I purchase a home now or wait in San Francisco?

Let’s see.

3 times your annual revenue of $500,000. You should purchase a home value $1,500,000.

Have you ever thought-about a cardboard field? Possibly purchase a parking spot and dwell out of your Prius?

The numbers don’t work.

It’s an issue.

Justin Fox wrote about What Makes Housing Too Costly in Bloomberg.

The New York Occasions lined the Cries to Construct, Child Construct within the Bay Space.

Kim-Mai Cutler shared her Slidedeck on Medium, The San Francisco Bay Space within the Second Gilded Age.

The issues are two-fold.

First, too many individuals competing to purchase too few housing items. Second, the bay and the ocean. There isn’t any new land.

We are going to get into coping with the excessive price of shopping for in San Francisco. First, allow us to evaluate the fundamentals of investing.

Ought to I Purchase a Home Now or Wait? Your Home is Not Like Your 401(okay)

Your 401(okay) is the place you gained your first expertise investing.

A component of your pay examine goes into your 401(okay). You select mutual funds to speculate your financial savings in. The mutual funds purchase shares and bonds.

However, there are lots of methods shopping for a home is totally different from investing in shares and bonds.

Your Home is an Expense

Lease is a hard and fast expense. It could go up yearly, however it stays the identical month to month. Plus, you probably have an issue, you name your landlord.

A home is a variable expense.

Your mortgage could also be mounted. Property taxes are predictable. The whole lot else varies.

Received an issue? Who you gonna name?

It’s you!

Repairs, upkeep, enhancements will all fluctuate.

You purchase a inventory. Put money into a mutual fund. Your prices are restricted to the value you pay to purchase a share, the fund’s expense payment, and taxes owed sooner or later.

Think about if I instructed you, “I’ve an incredible funding alternative.”

It’ll price rather a lot to start out. You’ll should put cash in each month. There might be occasions the place you’ll have to contribute extra, however I can’t let you know how a lot or when.

Possibly, you may promote in a number of years for a revenue.

Would you purchase now or wait? What I simply described to you is shopping for a home.

What a Makes a Home Value $1.6 Million?

The all-time excessive median house worth in San Francisco is $1.6 million.

The all-time excessive share value for Salesforce (CRM) is $310.

What determines the worth of the common home in San Francisco? What units the value of one share of a San Francisco primarily based tech firm?

What makes a inventory or bond priceless?

A inventory or bond is effective as a result of the corporate who points the inventory or bond makes cash.

The inventory of an organization is effective at the moment. You count on it to extend in worth over time.

Right now and sooner or later the worth of the inventory is tied to the corporate’s present and anticipated future earnings.

Bonds have worth since you consider the corporate borrowing the cash (issuing the bond) pays the cash again with curiosity.

Why?

As a result of the corporate makes cash.

That is the elemental distinction between shares, bonds, and your own home.

Your own home doesn’t make cash.

Provide and demand determines the worth of your own home.

Whether it is value extra sooner or later, it is going to be as a result of extra individuals are competing for fewer homes in your space.

San Francisco is simply an instance of provide and demand on a a lot bigger scale. The demand for housing in San Francisco is a lot larger than the availability.

One Home, One Metropolis, One State, One Nation

You solely purchase one.

You lack diversification once you purchase a home.

The worldwide inventory market is big. There are greater than 10,000 plus shares unfold everywhere in the world you could spend money on.

Once I construct an funding portfolio for you, you may be shopping for hundreds of shares and bonds. You’ll achieve this by shopping for a handful of mutual funds or change traded funds. Every fund will personal tons of or hundreds of shares and bonds.

Your own home might be one home, in a single metropolis, in a single state, in a single nation. There isn’t any diversification to purchasing a home.

Whether or not your own home goes up in worth might be tied to the fortunes of your neighborhood and metropolis.

Ought to I Purchase a Home Now or Wait? Housing Is an Inefficient Market

A home might solely promote a few times a decade.

There’s a lack of accessible info. Folks shopping for homes fluctuate of their talent and data degree.

The vary of particular person outcomes is big.

There have been 5,700 houses bought in San Francisco throughout 2022.

On a median day 5,628,855 shares of Salesforce (CRM) commerce fingers.

A good value is simpler to find out with a inventory than it’s with a home. The value on a inventory will get adjusted tens of millions of occasions per day.

Shopping for one home in a single metropolis means the end result is tough to foretell.

There’s a median return. However, particular person outcomes will fluctuate.

Shopping for a home is rather a lot like investing within the inventory of 1 firm.

How A lot Will My Home Go Up in Worth?

With hundreds of shares and bonds, there may be numerous historic information to assist us know what we are able to count on. Some will go up, some will go down, however we all know what to anticipate.

There’s a median.

There’s a median anticipated return in housing too. The common is for the nation as a complete, and it’s round 3 to 4% per yr.

Even within the Bay Space, the winners and losers may be solely 80 miles aside.

It’s inconceivable to foretell with any certainty the longer term worth of 1 home.

However, utilizing the common charges of return for housing and the inventory market, we are able to make some comparisons.

Ought to I Purchase a Home Now or Wait? Inventory Market vs a Home

Let’s assume your life is easy (Ha!).

You could have $1.5 million money. You should purchase a home in San Francisco or spend money on the inventory market.

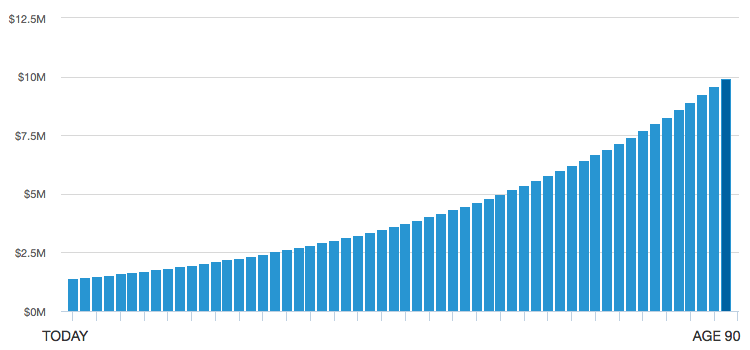

A home bought at the moment for $1.5 million rising in worth at 3.69% per years provides as much as $9,890,271 on the finish of 55 years.

Not unhealthy.

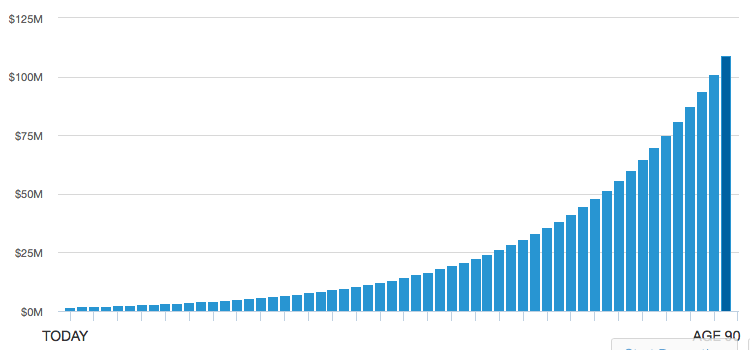

What if you happen to invested the $1.5 million within the inventory market as a substitute?

We are going to use the Dimensional US Fairness ETF (ticker DFUS) to characterize an funding in your complete US inventory market. Since 1926, your complete US Inventory Market index has grown at 9.9% per yr.

Your $1.5 million rising at 9.6% per yr over 55 years provides as much as $108,620,554.

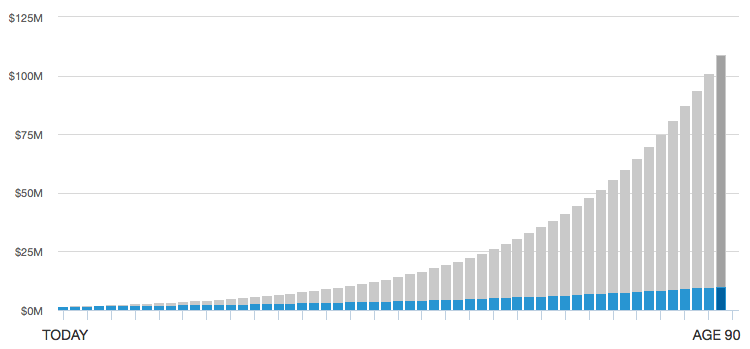

Right here is one other approach of taking a look at it.

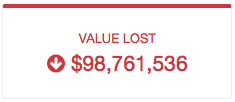

The blue represents the elevated worth of your own home. The gray what you’d have gained with an funding within the inventory market.

Your worth misplaced is big.

Now, our mannequin is filled with assumptions.

What is going to enhance in worth sooner? Your own home? The US inventory market?

Who is aware of?

The hot button is to recollect:

Your own home just isn’t an funding. Your own home is a spot to dwell.

Shopping for a home solely since you consider it’s worth will go up is a unhealthy concept.

Bonus – Find out how to Make the Inconceivable Achievable for You

A home just isn’t an funding.

However shopping for a home can nonetheless be a good suggestion for you.

When You Completely, Positively Ought to Purchase a Home Now

When do you have to purchase a home in San Francisco? When is it sensible to pay greater than $1 million for your own home?

It’s the hardest query I assist purchasers reply.

Listed below are 4 methods I assist purchasers reply the query: Ought to I purchase a home now or wait?

1. Life

Are you getting married? Planning to have a child? Bored with renting?

Your life is crucial issue.

I normally inform purchasers,

“Look, I consider shopping for a home is a good suggestion. Shopping for a home in San Francisco is dear. The foundations I take advantage of to find out what home is best for you (2 to 2.5 occasions annual revenue) don’t apply. Your own home just isn’t an funding. Let your life decide when the time is best for you.”

Don’t get in a rush.

Get monetary savings. Prepare for a down fee. Resolve when the time is best for you

2. Down Cost

Do you’ve a down fee?

Our goal down fee is twenty % of your buy value.

That’s $300,000 on a median, $1.5 million home in San Francisco.

You don’t wish to be home poor.

Sitting in an empty home with an empty checking account is a really lonely feeling.

The down fee is extra of a crimson gentle/inexperienced gentle.

Don’t purchase if you happen to don’t have it. Don’t purchase if the down fee is all you’ve.

3. Plan to Keep

The longer you propose to remain in a single place, the larger the possibilities that purchasing is healthier than renting.

Your own home just isn’t an funding. It’s a spot to dwell.

By shopping for, you’ll change hire with the expense of proudly owning.

However, there’s a tipping level, when proudly owning begins to look higher than renting.

The technical time period for this tipping level is the breakeven horizon.

Zillow does some work on calculating the breakeven horizon.

Like our earlier instance evaluating shopping for a home to investing within the inventory market, calculations of a breakeven horizon are primarily based on assumptions which will or might not be true.

The one factor I consider is that the longer you’ll personal a home the larger the possibility that purchasing is the precise transfer to make.

4. Want a Place to Put Cash

I like Johnny Depp within the film Blow.

There’s a scene the place the drug commerce goes properly for Johnny’s character.

They’re operating operations from a home. Money is flowing in. There’s only one drawback.

They’ve run out of locations to place the money. Johnny cries out, “We’re going to want an even bigger boat.”

There comes a time the place shopping for a home is your subsequent finest transfer.

I begin to suggest shopping for a home when the down fee could be a 3rd of your funding portfolio.

The concept right here is to stability your investments amongst shares, bonds, and actual property.

“I believed a home just isn’t an funding.”

You might be proper. It’s a spot to dwell. However, shopping for a home ought to play a job in your monetary plan.

Absent a powerful need to personal a home. The purpose when shopping for a home is your subsequent finest transfer is when a 1/3 of your portfolio covers the down fee.

A median home in San Francisco is $1.5 million so we’re speaking an funding portfolio of $1,000,000.

A 3rd of $1,000,000 is $300,000, which is twenty % of the $1.5 million buy value.

Wait. Did You See What Did Not Make the Record?

There’s one merchandise that didn’t make the checklist.

Did you catch it?

Value

Value is the least vital think about figuring out whether or not you can purchase or promote a home.

Value might decide whether or not you CAN afford to purchase. It doesn’t decide whether or not you SHOULD.

Housing costs are like a tide.

Value floats all ships.

You could be fortunate. Possibly you discover a deal. However, don’t get caught ready for 2009 to occur once more. It is perhaps awhile.

Everybody who purchased a home in 2014, 15, or 16 might be fast to let you know they simply knew the time was proper. You’ll examine Zillow. See how a lot homes have went up since then, and suppose perhaps I ought to wait.

The value goes up. The value goes down.

What Ought to I Do? Ought to I Purchase a Home Now or Wait?

Solely you may determine, however don’t fear about lacking out.

A few of my purchasers will proceed to hire and others want to purchase. Their “proper transfer” has extra to do with life than it does with {dollars}.

Perceive what shopping for means to you.

Verify the 4 methods to consider whether or not you must.

Resolve what’s finest for you.

Proceed to discover this matter with the assistance of a monetary advisor by scheduling a name at the moment.

Proceed studying: Three Methods to Purchase a Home in San Francisco