It could be good fiscal coverage and, I guess, good politics.

Right here’s the plan. The President has linked two funds objects, and which may be a good suggestion. He desires to increase his 2017 Tax Cuts and Jobs Act and supply some different tax breaks, and we have to repair Social Safety. The hyperlink between tax cuts and Social Safety exists as a result of certainly one of President Trump’s new tax-cutting proposals would exempt Social Safety advantages from taxation below the federal earnings tax. Since profit taxation now accounts for 4 % of Social Safety revenues, exempting advantages from taxation worsens this system’s funds and will increase strain for fixing the issue rapidly.

My plan is to mix the President’s tax discount proposals with a bundle to eradicate Social Safety’s 75-year deficit. This plan wouldn’t remedy all of the world’s issues, however it could keep away from making our fiscal state of affairs extra dire than it’s already.

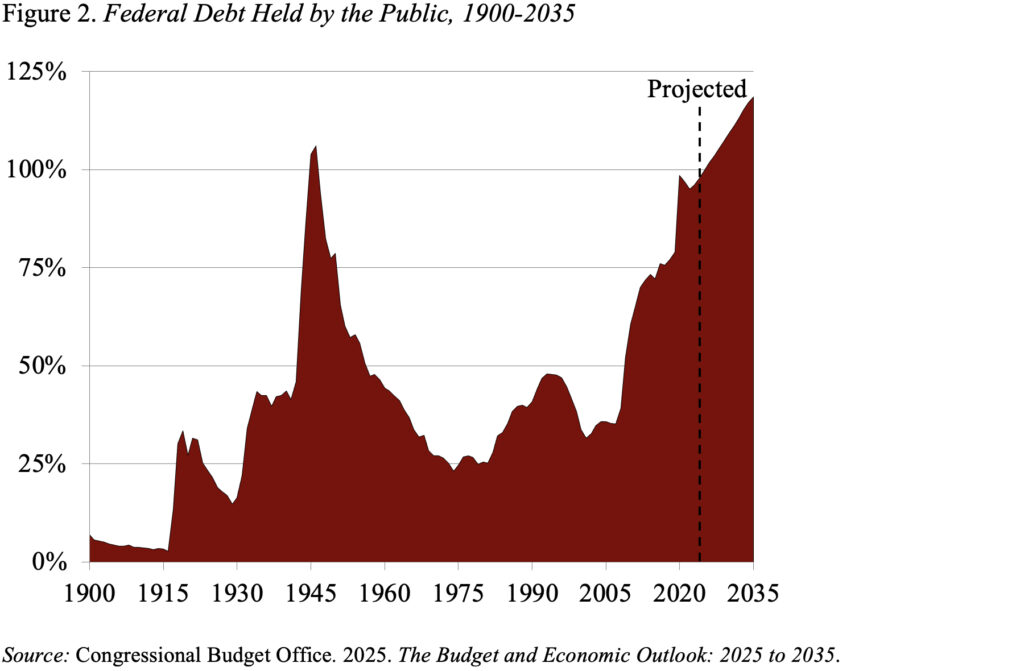

Based on the Congressional Price range Workplace, the federal government is presently slated to run a deficit equal to six.2 % of GDP in 2025. With out corrective motion, deficits of roughly that dimension are projected to proceed all through CBO’s projection interval (see Determine 1).

On account of these persistent deficits, debt swells. Federal debt within the fingers of the general public rises from one hundred pc of GDP this yr to 118 % of GDP in 2035, larger than at any level in our nation’s historical past (see Determine 2).

Now right here’s the vital level. These CBO projections assume that the legal guidelines “governing taxes and spending usually stay unchanged.” That assumption signifies that many of the tax cuts within the Tax Cuts and Jobs Act of 2017 expire as deliberate on the finish of 2025. If they don’t, the deficits as a proportion of GDP can be about 1.2 % increased and the debt would balloon much more. The CBO projections additionally assume that nothing is finished to repair Social Safety. If Congress did enact a bundle to eradicate Social Safety’s 75-year deficit, the funds deficit would be 1.2 % of GDP decrease.

Simply to be clear – extending the 2017 tax cuts alone would make the fiscal state of affairs a lot worse than present projections; extending these tax cuts and fixing Social Safety would do no hurt. In different phrases, a bundle to repair Social Safety might be seen as a “pay for” for extending the tax cuts – yielding no improve within the projected deficits.

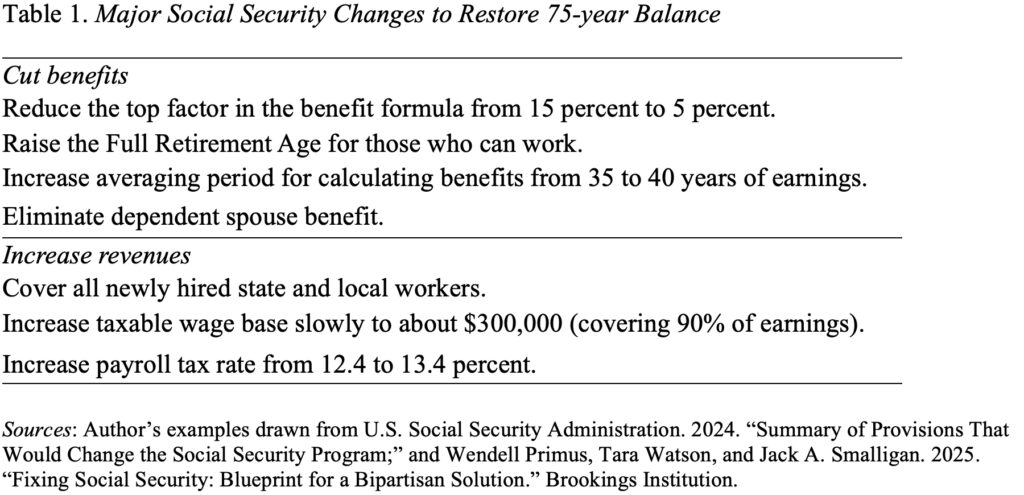

Because the President appears in a rush to get his tax modifications by way of Congress, listed below are a number of pretty easy, and well-vetted, modifications that would restore steadiness to Social Safety – cut up roughly equally between profit cuts and income will increase (see Desk 1). The one new merchandise on the listing is decreasing the highest issue within the profit components, which might decrease advantages barely for increased earners, now that they’d now not should pay earnings taxes on their advantages. In any other case, this listing is fairly customary fare.

On the subject of the federal funds, I’m actually old-fashioned. I truly assume we should always pay for any proposal with an offsetting change in revenues or expenditures, and preserve deficits at a minimal. Clearly each events have moved away from that easy framework. The proposal supplied right here doesn’t tackle that basic failing. All it does is keep away from making the state of affairs a lot worse. It additionally has a pleasant ring to it – whereas the tax cuts primarily profit the rich, fixing Social Safety helps everybody.