The warnings have been sounded. As we highlighted in earlier blogs, the top of the three-year pandemic period cost pause, ongoing borrower confusion, federal servicer limitations, and financial pressures have created an ideal storm for a scholar mortgage default disaster.

Now, the storm is upon us. The variety of scholar mortgage debtors between 30 and 180 days delinquent at the moment stands 3x greater than earlier than the COVID cost pause started.

January 2025 marked the primary time delinquent debtors confronted adverse credit score reporting in 4 years, and the clock is ticking towards widespread defaults later this yr.

Are schools ready for the tsunami-sized wave of defaults about to hit their Cohort Default Charges (CDRs)?

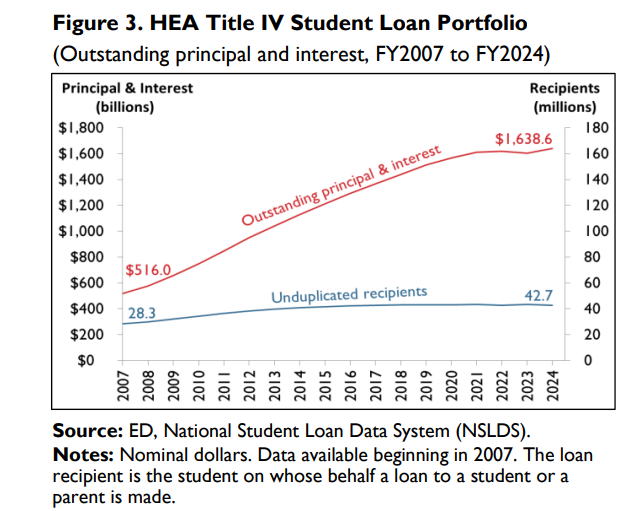

Over the previous 17 years, the federal portfolio of excellent Title IV loans elevated from $516 billion in loans made on

behalf of 28.3 million college students to $1.6 trillion in loans made on behalf of 42.7 million college students.

For the previous few years, schools have loved artificially suppressed CDRs as a result of cost pause and subsequent on-ramp interval. This era of reprieve masked the rising monetary struggles of many debtors.

Now, with the on-ramp over and the results of delinquency kicking in, the true image of borrower misery is rising.

The 2023 and 2024 cohorts face unprecedented challenges, and the ensuing spike in defaults will considerably have an effect on establishments.

Why This Yr is Totally different

A number of elements make this yr notably crucial:

- The Finish of Forbearance: The years of paused funds have created a technology of debtors accustomed to not paying. Re-integrating mortgage funds into already stretched budgets is proving extremely tough, resulting in widespread delinquency.

- Borrower Confusion: The ever-changing panorama of mortgage forgiveness applications, IDR plans (SAVE, ICR, PAYE), and authorized challenges have left debtors bewildered and unsure about their choices. This confusion typically results in inaction, which shortly interprets into delinquency and default.

- Financial Pressures: Inflation continues to erode buying energy, making it even tougher for debtors to afford their month-to-month funds. Many are prioritizing important bills over scholar mortgage reimbursement.

- The Return of Penalties: The grace interval is over. Delinquencies at the moment are being reported to credit score bureaus, impacting debtors’ credit score scores and future monetary alternatives. This can be a stark reminder of the real-world penalties of missed funds, and it’s driving many in the direction of default.

The Looming CDR Disaster for Schools

Excessive CDRs can have severe implications for schools, together with:

- Lack of Federal Funding: Establishments with persistently excessive CDRs threat dropping eligibility for federal scholar support applications, a crucial income.

- Reputational Harm: Excessive default charges can tarnish a university’s popularity, making it tougher to draw potential college students.

- Elevated Scrutiny: Schools with excessive CDRs could face elevated scrutiny from accrediting businesses and regulators.

What Can Schools Do?

The time for proactive intervention was final yr. Schools should implement complete default aversion methods to help their debtors and shield their institutional standing. Listed here are some key steps:

- Proactive Outreach: Attain out to debtors earlier than they develop into delinquent. Present clear and customized steerage on reimbursement choices, together with IDR plans.

- Simplified Sources: Create easy-to-understand sources that designate the complexities of scholar mortgage reimbursement. Minimize via the confusion and supply clear, actionable info.

- Customized Assist: Supply one-on-one counseling with scholar mortgage consultants who may also help debtors navigate their conditions and select one of the best reimbursement plan.

- Early Intervention: Establish at-risk debtors early and supply focused help to stop them from falling behind.

- Leverage Expertise: Make the most of know-how platforms that streamline the reimbursement course of, corresponding to on-line IDR purposes and customized monetary planning instruments.

Don’t wait till your debtors default. Contact IonTuition at the moment to learn the way we may also help you shield your establishment’s future. The tsunami is coming – we’re right here to assist.