The scholar mortgage compensation panorama has undergone a elementary shift. For a full 12 months, the Division of Schooling’s “on-ramp” interval shielded debtors from the harshest penalties of non-payment.

Nonetheless, now we have now crossed a essential threshold: the primary wave of debtors who missed their first fee in October 2023 has handed 360 days of delinquency.

This date marks a pivotal second for establishments. Whereas the executive course of takes time, these debtors are actually crossing into default standing, launching the disaster that instantly impacts your Cohort Default Fee (CDR). With an unprecedented 6 million debtors delinquent throughout the FSA portfolio, it is a dwell disaster that calls for rapid consideration to mitigate the fallout.

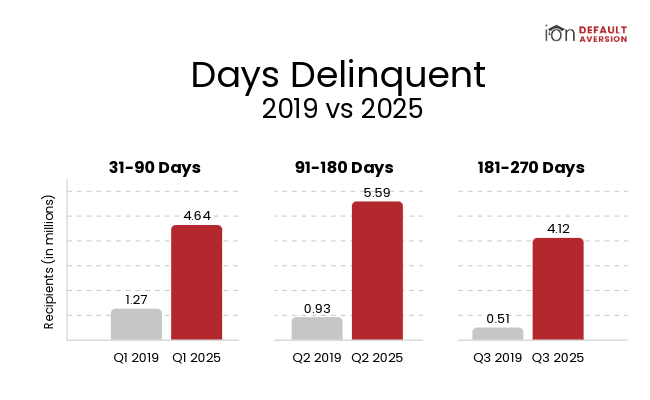

Monitoring the present fee of delinquencies by quarter, there are 6 to eight instances extra debtors delinquent than earlier than the COVID fee pause.

What the 360-Day Mark Means for Schools

For institutional leaders, the top of the on-ramp and the passage of the 360-day is a wake-up name following the 0% Cohort Default Charges for the final couple of years.

The CDR Timer is Working

The FY 2024 Cohort consists of debtors who entered compensation between October 1, 2023, and September 30, 2024.

- June 28, 2025: Debtors who missed their October 2023 fee reached 270 days delinquent, reaching the standing of “Technical Default”.

- September 26, 2025: The primary cohort of debtors hit 360 days delinquent, which is the purpose the place this default standing begins to be counted for CDR calculation.

- The monitoring interval for this FY 2024 CDR calculation continues by means of September 30, 2026.

CDRs are a measure of danger over three years. Excessive delinquency right this moment interprets instantly into excessive default tomorrow. The institutional aim needs to be a CDR beneath 15% to make sure no maintain is positioned on disbursement. For those who’re not sure the place your delinquency charges are, request a CDR HealthCheck.

The Menace of Sanctions is Actual

The sheer quantity of non-payment locations many establishments in danger. our CDR HealthChecks are exhibiting many establishments are at present reporting over 35% delinquency for the 2024 cohort.

A CDR over 40% in a single 12 months or three years over 30% ends in a lack of Federal Title IV eligibility.

The Division of Schooling reported in July 2025 that 1,110 schools have been already prone to dropping taxpayer-funded scholar help resulting from excessive CDR.

Servicer and Systemic Limitations are Compounding the Disaster

The disaster is just not solely blamed by debtors alone, however has been closely amplified by systemic points:

- IDR Backlogs: An enormous backlog exists, with hundreds of thousands of IDR purposes at present at a standstill.

- Software Confusion: Debtors who utilized for an IDR plan previous to April 27, 2025, have been advised to reapply if their utility had not been processed, including to borrower confusion and potential missed deadlines.

- Servicer Pressure: Federal servicers are struggling to deal with the quantity, with compensation fashions that incentivize decrease service ranges when borrower quantity will increase.

Your Resolution: A Complete Default Aversion Technique

Your establishment can not depend on exterior elements to save lots of your CDR. The scholars now within the 360+ day delinquency class are the clearest sign {that a} strong default aversion plan is critical.

IonTuition gives the important instruments to intervene successfully and defend your establishment. Contact IonTuition right this moment to implement a default aversion plan and safe your establishment’s future.