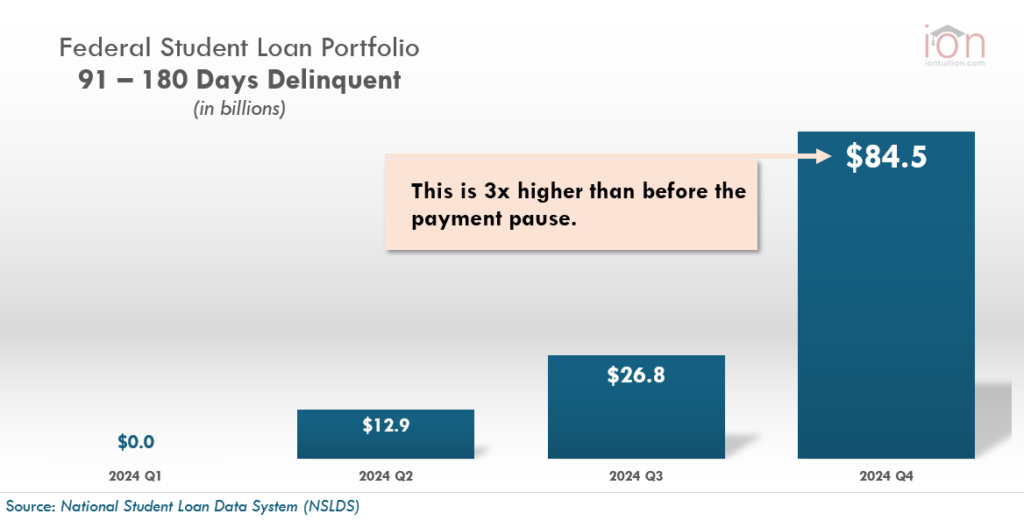

The return to scholar mortgage funds has been rocky, with hundreds of thousands of debtors now delinquent. Roughly three million scholar mortgage debtors are over three months behind on their funds. Based on the Nationwide Scholar Mortgage Knowledge System (NSLDS), the federally managed 91-180 Days Delinquent bucket portfolio is $84.5 billion for This autumn of 2024. This determine is almost thrice increased than earlier than the three-year COVID-19 cost pause. The 91-180 Days Delinquent quantity was $27.5 billion for lower than one million debtors in This autumn of 2019.

Tens of millions of debtors are going through unfavourable credit score reporting and are vulnerable to defaulting on their loans. This alarming determine signifies excessive Cohort Default Charges are coming.

Why is scholar mortgage delinquency so excessive?

A number of interconnected elements contribute to this unprecedented surge in delinquencies. The tip of the federal scholar mortgage cost pause in September 2023 included a 12-month on-ramp with out penalties for late funds to offer debtors time to search out sustainable compensation plans. Nonetheless, the confusion of mortgage forgiveness, rising inflation, the authorized battles over the SAVE plan, and over three years of non-payments have all contributed to an environment the place debtors are unwilling or unable to pay.

Listed below are some key the explanation why delinquencies are excessive:

1. Debtors are Unaccustomed to Paying

The prolonged cost pause considerably impacted borrower habits. Three years of not making funds created a strong conditioning impact, making it tough for a lot of to re-integrate scholar mortgage funds into their budgets. This has resulted in widespread under-budgeting for this now-resumed expense.

Compounding this challenge is a regarding lack of information amongst some debtors relating to their compensation obligations. It’s not unusual for people to be unaware they even have excellent scholar mortgage debt, typically mistakenly believing their monetary assist consisted solely of grants. This lack of information, coupled with the ingrained behavior of non-payment, creates a big hurdle for debtors now going through compensation.

2. Servicer Adjustments and Misplaced Contact Data

A number of scholar mortgage servicers have modified or transferred their portfolios during the last three years. Many debtors are unaware of who their new servicer is or that their servicer has modified. Likewise, many debtors might not have up to date their contact info with their servicer. This makes it tough for debtors and servicers to attach and talk cost obligations.

3. Guarantees of Mortgage Forgiveness

The repeated discussions and guarantees of sweeping scholar mortgage forgiveness in the course of the Biden administration have created a notion amongst debtors that they shouldn’t be paying their loans. Debtors who paid off their loans however would have certified for mortgage forgiveness had they waited don’t obtain a refund. Debtors might have believed that their loans had been already forgiven, or consider their loans will probably be forgiven. These debtors with misplaced contact info might consider their loans have been forgiven since they haven’t obtained any communications.

4. Lack of Fast Penalties

There have been no penalties for missed funds in the course of the cost pause and the 12-month on-ramp interval. This month marks the primary time scholar mortgage debtors will probably be reported to credit score companies for delinquency. Some debtors are possible unaware of the implications of delinquency and default or are snug with these penalties.

5. Unawareness of Compensation Choices

A survey from final September discovered that 2 out of three scholar mortgage debtors are unaware of income-driven compensation choices. These are possible the identical debtors who would qualify and profit essentially the most from an IDR plan. With the SAVE plan caught in authorized jeopardy, the Division of Training has revived two IDR choices: the Earnings Contingent Compensation (ICR) and Pay As Your Earn (PAYE) plans. Aspect Be aware: The Division of Training introduced this week that debtors on the SAVE plan and at present in forbearance might stay in forbearance till September and should not personal any funds till December.

For debtors not enrolled in SAVE, the opposite IDR choices can considerably decrease month-to-month funds in the event that they’re even conscious of them. A CFPB scholar mortgage borrower survey from final November discovered that 42 % of debtors have solely ever been on the Commonplace Compensation plan and a third of these debtors didn’t know they might select a distinct plan.

Faculties Can Keep away from Excessive Cohort Default Charges

Whereas proactive scholar mortgage default aversion plans are designed to stop delinquency by guiding debtors towards sustainable compensation choices from the outset, many establishments now face the problem of re-engaging debtors who’ve already fallen behind.

IonTuition companions with schools to successfully decrease their Cohort Default Charges (CDR) by instantly helping delinquent debtors. We work to establish and implement sustainable cost options, comparable to income-driven compensation (IDR) plans, tailor-made to every borrower’s distinctive monetary scenario.

Debtors can simply enroll in IDR plans by IonTuition’s user-friendly portal, or they will obtain customized steering from our staff of scholar mortgage compensation specialists who can clarify all obtainable choices and navigate the enrollment course of.

By leveraging IonTuition’s experience and assets, schools can successfully handle present delinquencies and mitigate future defaults, in the end defending their institutional standing and supporting scholar success. Contact our gross sales staff at present to implement a complete default aversion technique to your establishment.