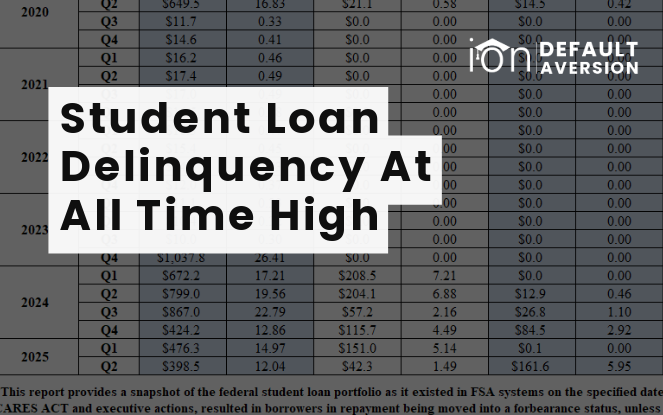

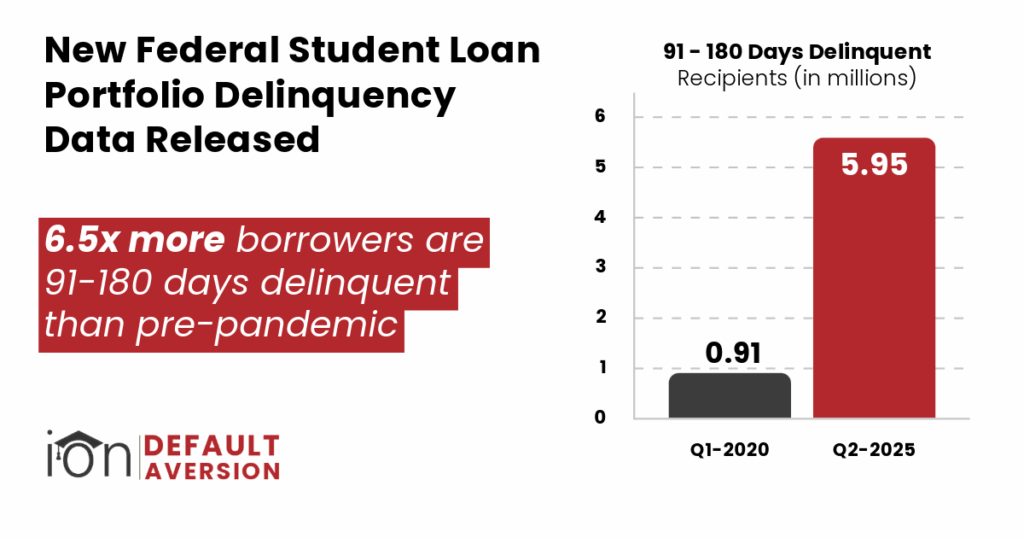

New knowledge launched by Federal Scholar Help paints a stark image of the post-pandemic pupil mortgage compensation panorama. The numbers reveal a 6.5-fold improve in debtors 91-180 days delinquent in comparison with the pre-COVID fee pause. As of FYQ2 of 2025, a staggering 5.95 million debtors owe $161.6 billion on this essential delinquency window. It is a dramatic surge from the 0.91 million debtors owing $27.7 billion in FYQ1 of 2020.

This explosive development in severe delinquency indicators a looming disaster for establishments. The sheer quantity of debtors struggling to make funds signifies a possible tidal wave of defaults on the horizon.

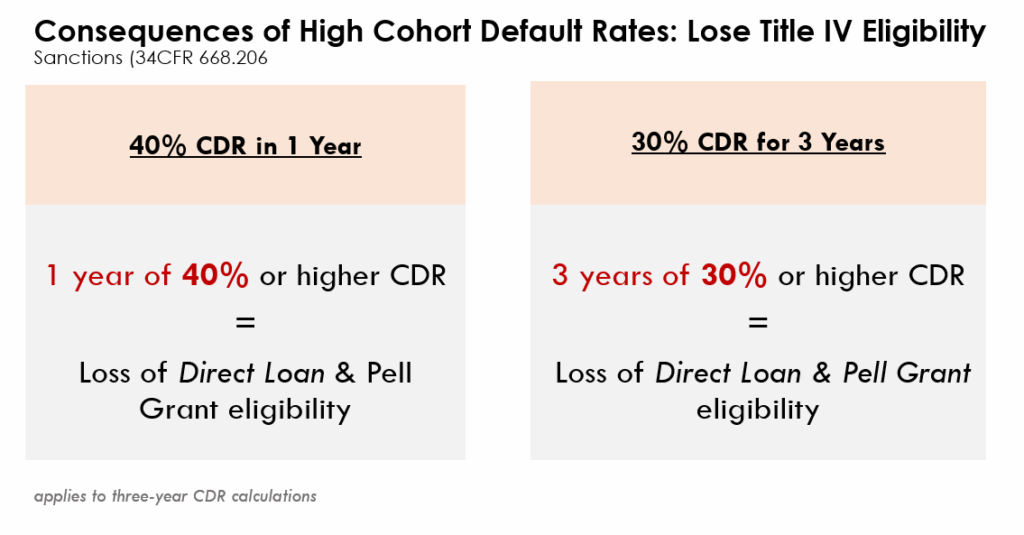

The 40% Threshold: A Actual and Current Hazard for Title IV Eligibility

For faculties and universities, these delinquency figures ought to function an pressing wake-up name. The trajectory of those numbers strongly means that Cohort Default Charges (CDRs) might simply surpass the essential 40% threshold. Crossing this line carries extreme penalties, most notably the threat of shedding Title IV federal pupil support eligibility. The lack of Title IV funding could be catastrophic for many establishments, severely impacting enrollment and monetary stability.

The Time for Proactive Default Aversion is NOW (truly, extra like 12 months in the past)

Ready to deal with this situation is not an choice. The knowledge show that debtors are already deep into delinquency, making them extremely prone to default. Schools and universities should take instant motion to implement sturdy and efficient default aversion methods.

Right here’s what your establishment must do NOW:

- Acknowledge the Urgency: Acknowledge the gravity of this new knowledge and the very actual risk it poses to your establishment’s Title IV eligibility.

- Implement Proactive Outreach: Don’t watch for debtors to default. Make the most of knowledge analytics to establish college students and alumni within the early phases of delinquency and implement focused outreach campaigns.

- Improve Monetary Literacy Sources: Present complete and accessible sources to assist debtors perceive their compensation choices, handle their funds, and keep away from delinquency.

- Provide Personalised Counseling: Make pupil mortgage compensation counseling available. Equip your workers to supply individualized help and steering to struggling debtors.

- Leverage Expertise Options: Discover and implement technology-driven options that may automate outreach, monitor borrower engagement, and supply personalised help at scale.

- Associate with Consultants: Contemplate partnering with organizations specializing in default aversion, like IonTuition, to leverage their experience and confirmed methods.

ION is a Price-Impartial Possibility as a result of the Price of Inaction is Too Excessive

The results of inaction are dire. Permitting CDRs to climb unchecked dangers the very basis of your establishment’s means to serve college students by federal monetary support. The time for passive commentary is over.

Take management of your establishment’s future. Prioritize default aversion TODAY. The alarming delinquency knowledge is a transparent indicator of the challenges forward. By appearing decisively now, you may assist your alumni navigate compensation and safeguard your establishment’s Title IV eligibility. Don’t wait till it’s too late.

Contact ION at present to learn the way our complete default aversion options will help your establishment proactively handle this disaster and shield your future.