However they need solely excessive earners to pay for the repair.

With all of the DOGE-driven turbulence on the Social Safety Administration, it might have gotten misplaced that 2025 is the 90th anniversary of this system. In celebration, numerous organizations have put out studies that assess the present standing of this system and recommendations for reform. In an effort to make amends for my studying, I simply completed “Social Safety at 90,” which was launched in January by the Nationwide Academy of Social Insurance coverage (NASI).

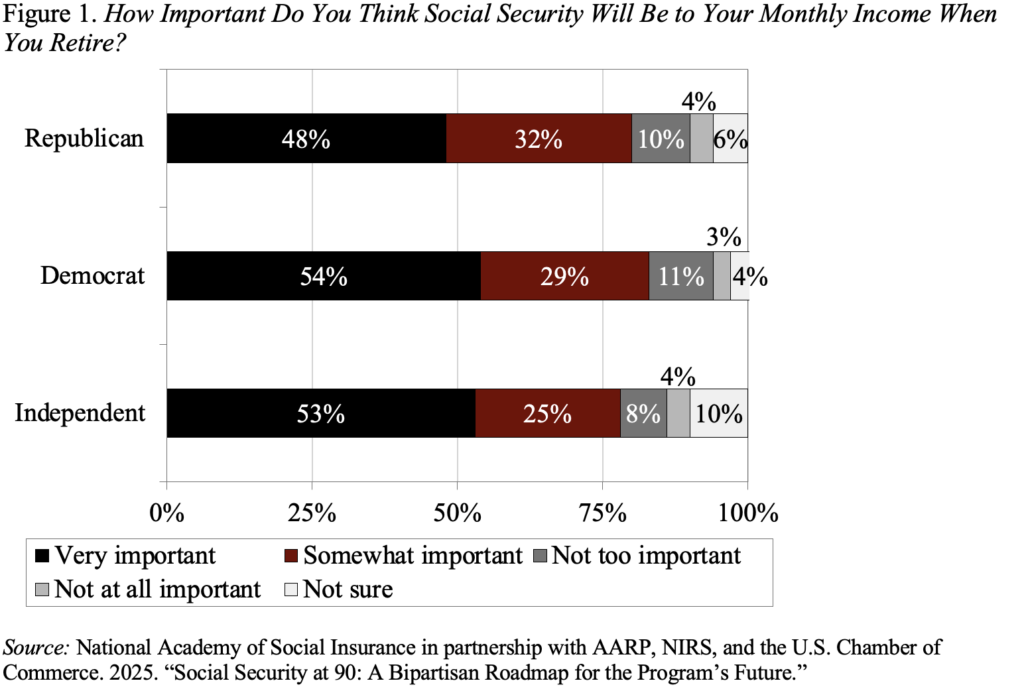

This report highlighted the outcomes of a survey of about 2,000 respondents on their views of Social Safety and attainable methods to get rid of this system’s 75-year deficit. When respondents had been requested how vital they thought Social Safety advantages could be to their month-to-month earnings as soon as they retired, between 65 and 90 % replied “essential” or “considerably vital.” This sample held throughout political affiliation (see Determine 1), age group, instructional attainment, and earnings degree.

This broad-based help of this system was encouraging in a interval when the press studies that this system will go bankrupt within the early 2030s and lots of younger folks suppose they could by no means get any Social Safety advantages. Neither declare is true. Social Safety isn’t going bankrupt within the early 2030s. Slightly, the belief fund reserves that bridge the hole between this system’s revenues and outlays shall be depleted within the 2030s. Nonetheless, the payroll taxes that proceed to roll in can cowl about 80 % of promised advantages. Therefore, even when nothing is finished, folks will proceed to obtain the majority of their advantages.

Nobody, nonetheless, desires to see a direct 20-percent across-the-board profit reduce in Social Safety retirement advantages. So, a lot of the NASI report focuses on how the respondents would repair the issue. Right here the findings are much less satisfying. The respondents would primarily increase extra money by taking the cap off the utmost taxable earnings – subjecting everyone’s full earnings to the payroll tax – and elevating the payroll tax charge from 6.2 % to 7.2 % for each workers and employers.

Whereas I believe {that a} modest improve within the payroll tax charge must be a part of any package deal to shut Social Safety’s 75-year shortfall, I actually don’t just like the notion of taking the cap off most taxable earnings. My first concern is that it dissolves any hyperlink between payroll tax contributions and advantages, which in the long term may nicely undermine help for this system.

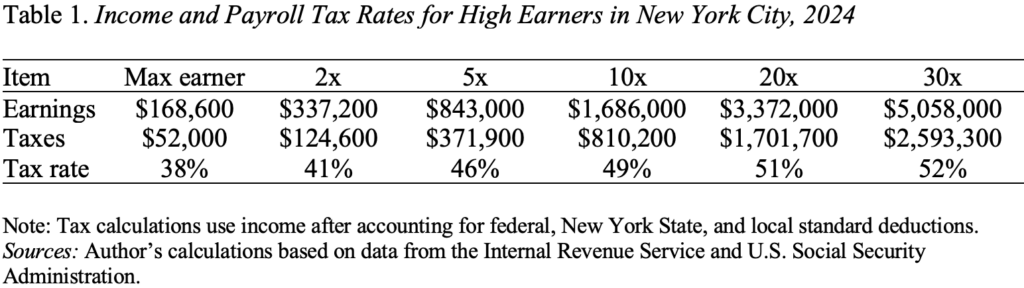

Extra broadly, I’m involved about elevating taxes additional on individuals who get all their earnings within the type of wages and salaries. Certainly, a fast calculation for these residing in New York Metropolis suggests that actually excessive earners pay greater than half their compensation in earnings (federal, state, and metropolis) and payroll taxes (no taxable most on the Medicare tax plus a 0.9-percent tax on earnings above $200,000 for singles and $250,000 for married {couples}) (see Desk 1). Efforts to extend tax revenues ought to purpose at traders who put penny shares in Roth IRAs, individuals who benefit from the step-up in foundation on their belongings at dying, and the non-public fairness guys who take pleasure in capital good points charges on carried curiosity.

Briefly, surveys could also be useful for gauging the general public’s views in regards to the worth of a serious program like Social Safety, however I don’t suppose they’re significantly helpful in designing reform proposals. In my view, I’m sticking with Wendell Primus’s package deal of profit cuts and tax will increase.