Spotify inventory (NYSE:SPOT) surged after the corporate posted sturdy This fall outcomes. Nonetheless, excessive share value good points over the previous yr have resulted in Spotify’s valuation now elevating eyebrows. On the one hand, the audio streaming firm continues to show strong traction concerning consumer and income progress. Nonetheless, issues emerge when analyzing the inventory’s valuation along side Spotify’s narrow-margin enterprise mannequin. Thus, I’m impartial on the inventory.

This fall Outcomes: Wonderful Consumer Progress, Pricing Energy Shine

Whereas I like utilizing Spotify, I’m not a fan of the inventory for causes I’ll get into later. Nonetheless, I can’t deny I used to be fairly impressed trying on the firm’s consumer progress and pricing energy proven in its most up-to-date This fall outcomes. Spotify’s consumer base progress is selecting up pace once more, and whenever you throw in its sturdy pricing leverage, it’s driving a reacceleration in income progress. Let’s study.

Within the fourth quarter, Spotify skilled a notable surge in month-to-month lively customers (MAUs), reaching a powerful 602 million — a 23% enhance from the earlier yr. Notably, Premium MAUs noticed a strong enhance of 15%, reaching a complete of 236 million, whereas ad-supported MAUs witnessed an much more substantial enhance of 28%, reaching a powerful 379 million.

Evaluating these progress figures to the identical quarter in 2022, the place the numbers stood at 20%, 14%, and 25%, respectively, it’s evident that Spotify’s consumer base is selecting up.

Concurrently, complete revenues grew by 16% year-over-year to €3.67 billion (or 20% Y/Y in fixed foreign money). This progress was led by:

- Premium income progress of 17% to €3.17 billion (or 21% Y/Y in fixed foreign money).

- In flip, this was pushed by subscriber progress of 15% Y/Y, as said earlier, and Premium common income per consumer (ARPU) progress of 1% Y/Y to €4.60 (or up 5% Y/Y in fixed foreign money), and

- Advert-Supported income progress of 12% year-over-year (or 17% Y/Y in fixed foreign money), pushed by progress throughout all areas.

Firstly, let me spotlight the importance of the 16% surge in revenues, because it indicators an uptick in comparison with the earlier three quarters. Particularly, income progress clocked in at 14.3%, 10.9%, and 10.6% from Q1 to Q3, respectively. Therefore, This fall halted a development of declining progress charges whereas probably reinstating progress momentum that may revitalize the inventory’s funding case.

One other necessary word to make is that Spotify demonstrated its pricing energy. Regardless of the unfavorable affect of overseas change transactions on ARPU progress, the metric’s 5% enhance in fixed foreign money speaks volumes. It underscores Spotify’s capacity to spice up costs with out hindering consumer progress, which, as talked about, skilled an acceleration.

Don’t Belief the Margin Enlargement Story Simply But

In addition to sturdy numbers, probably the most essential catalyst that possible contributed to Spotify’s post-earnings surge is the margin enlargement story the corporate is actively pursuing. Nonetheless, that is the place my reservations start to floor. I stay unconvinced by this narrative.

Why? Nicely, let’s begin with its gross margin, which got here in at 26.7% in This fall, marking a 140 foundation factors enlargement in comparison with final yr. Regardless of what seems to be a notable margin enlargement, Spotify’s revenue margins are nonetheless fairly slim, and they’re destined to remain that method. It’s because most of Spotify’s revenues return to labels and artists.

The catch is that as Spotify’s consumer base expands, so do the royalties they should dish out. Scaling up the consumer base gained’t magically pump up their revenue margins. Whereas they managed a lift by increased pricing this time round, there’s a restrict to how a lot they will jack up costs and keep aggressive, particularly with rivals like Apple Music within the combine.

One other spotlight in Spotify’s outcomes, which can initially appear to be proof of its margin enlargement story, is that its free money movement got here in at €396 million. That is the very best free money movement Spotify has ever posted, marking a major enhance from final yr’s adverse determine of €73 million.

That mentioned, the €396 million determine is probably going extremely deceptive. It was artificially boosted by a €419 million enhance in commerce and different liabilities. In less complicated phrases, Spotify primarily deferred funds to its counterparts, making a optimistic money movement state of affairs that may not be as rosy because it seems.

Lastly, it seems that Wall Road was excited with Spotify’s Q1 steering, which tasks an working earnings movement of €180 million. Nonetheless, even when all of this converts into free money movement, the annualized €720 million nonetheless falls quick when in comparison with Spotify’s hefty market valuation of €47 billion.

This suggests a P/FCF ratio of 65, which is, for me, inconceivable to justify, whatever the assumed free money movement progress price over the subsequent few years (be it 15%, 25%, or 35%).

Whereas I can respect why buyers are keen to pay a premium for Spotify’s inventory as a consequence of its sticky enterprise mannequin, resilient money flows, and potential for progress, it’s onerous to examine the corporate rising into such an formidable valuation a number of. Given the numerous gross revenue constraints inherent in its enterprise mannequin, I don’t consider the margin enlargement story is the magic resolution.

Is SPOT Inventory a Purchase, Based on Analysts?

Turning to Wall Road, Spotify Know-how has retained a Average Purchase consensus score based mostly on 16 Buys, seven Holds, and one Promote. up to now three months. At $261.75, the common Spotify inventory forecast suggests 8.7% upside potential.

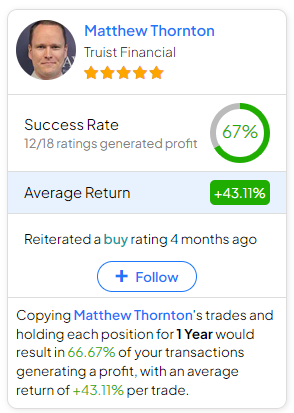

When you’re questioning which analyst it’s best to comply with if you wish to purchase and promote SPOT inventory, probably the most worthwhile analyst masking the inventory (on a one-year timeframe) is Matthew Thornton from Truist Monetary, with a median return of 43.11% per score and a 67% success price.

The Takeaway

In conclusion, whereas Spotify’s This fall outcomes showcase commendable consumer progress and pricing energy, I consider the surge within the inventory’s valuation prompts warning. The notable enhance in revenues and seeming margin enlargement story might excite buyers. Nonetheless, should you take a more in-depth look, it turns into evident that revenue margins nonetheless stay skinny, whereas the This fall free money movement determine is probably going deceptive. Subsequently, I recommend that you just train warning when evaluating Spotify’s prospects at its present value ranges.