For the primary time in 5 years, pupil mortgage debtors are reaching the 270-day delinquent level, a standing often known as “technical default.” That is basically the “remaining discover” for debtors earlier than they formally default on their loans.

The Significance of the 270-Day Delinquent Standing

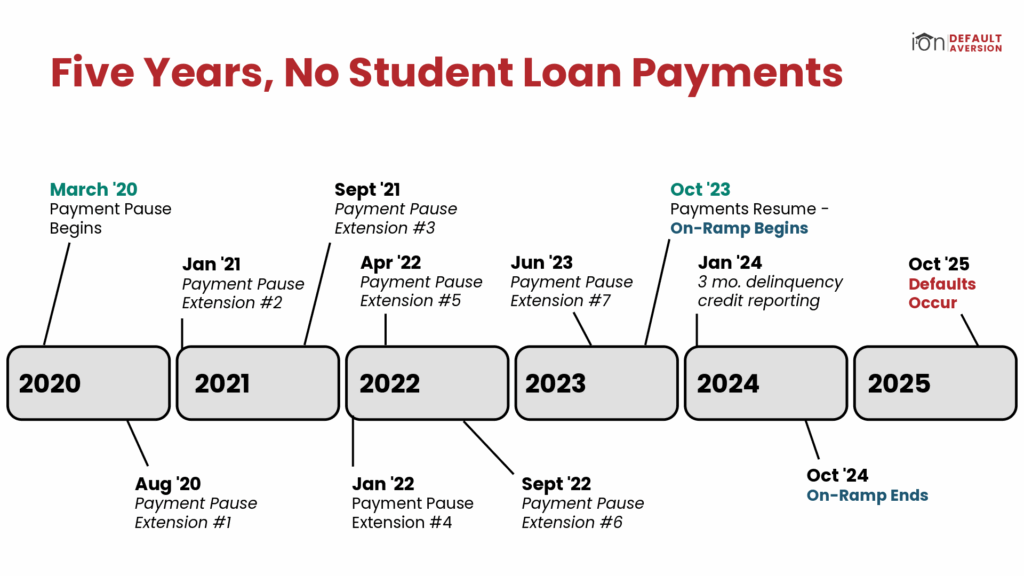

The 270-day mark is a vital threshold on the earth of default aversion. When a borrower hits this level, their mortgage is taken into account in “technical default.” The purpose occurred on June twenty eighth, 270 days after October 1st, the date when the federal pupil mortgage compensation “on-ramp” interval formally ended. This 12-month “on-ramp” was designed to ease debtors again into compensation after practically 4 years of pandemic-era pauses. The on-ramp shielded debtors from the adverse penalties of missed funds.

Technical default triggers the issuance of “remaining demand” letters to debtors. These letters are a precursor to the mortgage formally defaulting, which is able to then instantly contribute to an establishment’s Cohort Default Charge (CDR). A pupil mortgage is taken into account in default sometimes after 360 days of non-payment.

The most recent information from NSLDS confirmed 5.95 million debtors within the 90-180 days delinquent standing for FY2025 Q2. This determine is almost 6.5 occasions increased than the 2019 figures earlier than the pandemic pause started. This surge in delinquencies prompted the Division of Schooling to difficulty Might’s Pricey Colleague Letter, urging schools to contact debtors earlier than June thirtieth in an try to take care of low CDRs and to retain eligibility for federal pupil help.

Why This Issues for Faculties

The rising variety of debtors crossing into technical default is a big warning for a number of causes.

- Influence on Cohort Default Charge (CDR): Each defaulted borrower instantly will increase an establishment’s CDR. CDRs over 40% in a single yr or over 30% for 3 years lead to a lack of vital federal pupil assist packages.

- Reputational Threat: Monetary Support & Debt is a metric used on the Division of Schooling’s School Scorecard, which might negatively influence enrollment.

- Threat Sharing Prospects: The School Value Discount Act and related payments have proposed a “risk-sharing” framework that will maintain schools financially answerable for a portion of their graduates’ unpaid federal pupil loans.

What Can Be Achieved

The upper the delinquency, the extra effort is required to deliver a borrower again into good standing. Default aversion is an “ounce of prevention = a pound of remedy” sort of state of affairs. Nonetheless, late-stage delinquencies aren’t hopeless. Contacting debtors and offering them with the assets and steerage to keep away from default will assist decrease your CDRs, however provided that debtors are contacted earlier than they attain their 360-day delinquent level.

IonTuition will help safeguard your establishment’s future and carry out a CDR Well being Test to let you know the way excessive your CDR could possibly be, however it’s essential to act shortly. Contact ION at this time to get began.