The temporary’s key findings are:

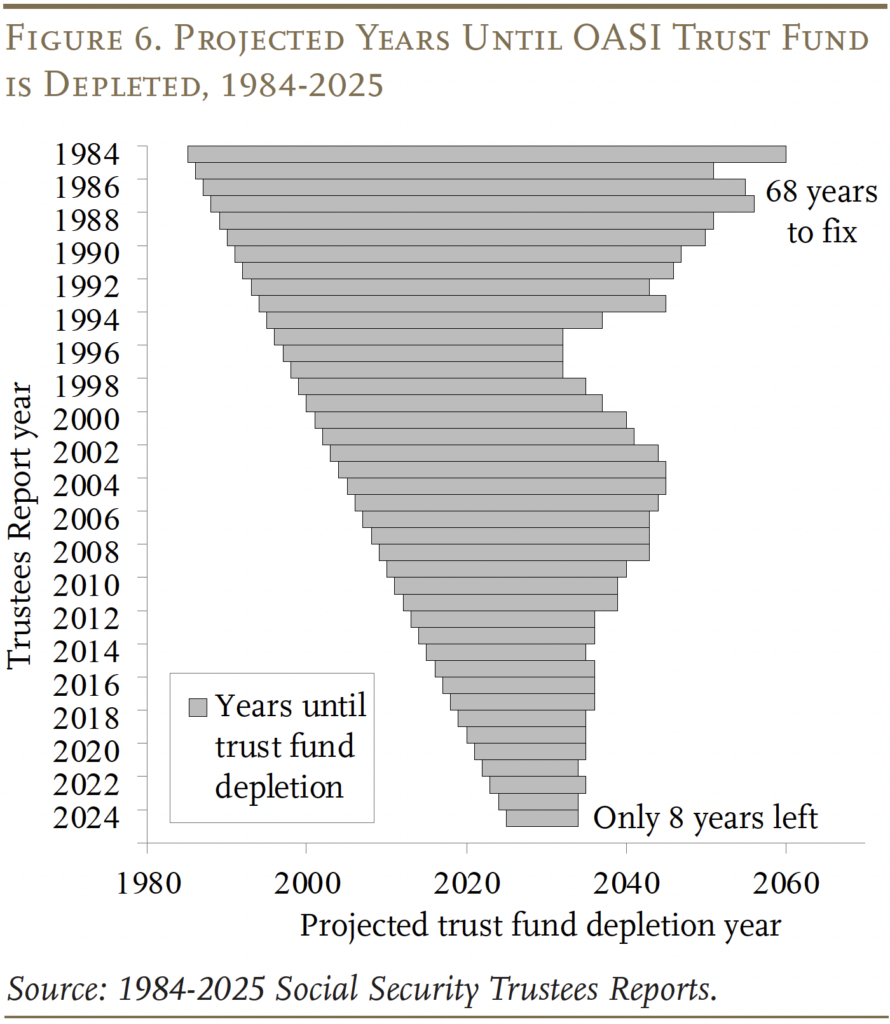

- The 2025 Trustees Report reveals a modest improve in Social Safety’s 75-year deficit, whereas the depletion date for the retirement belief fund stays at 2033.

- The prospect of a 23-percent profit lower solely 8 years away ought to focus our consideration on restoring steadiness to this system.

- It’s essential to notice that these present estimates are based mostly on the Trustees’ intermediate assumptions, which aren’t a certain factor.

- Certainly, the deficit may properly find yourself increased if the fertility fee stays low, hundreds of thousands of immigrants are deported, and other people reside longer than anticipated.

- Even on this case, although, many income and profit choices can be found to shut the hole. All that’s wanted is the political will.

Introduction

Releasing the Social Safety Trustees Report a few months later than common at all times raises the intriguing query that it would embrace some titillating new data. For higher or worse, the 2025 Trustees Report is normal fare. It confirms what has been evident for nearly three a long time – particularly, Social Safety is going through a 75-year financing shortfall that at present equals 1.3 p.c of GDP. And, if no motion is taken earlier than 2033, the depletion of reserves within the retirement belief fund will end in an automated 23-percent lower in advantages.

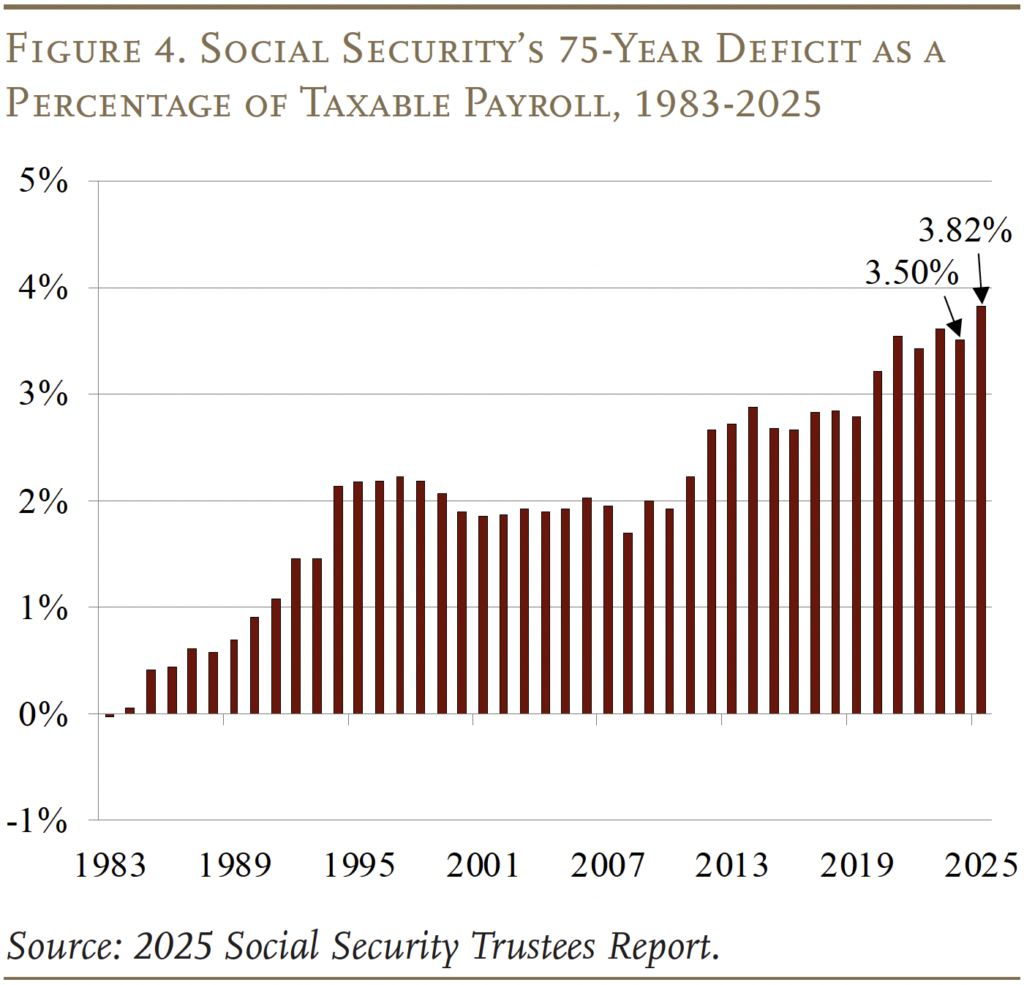

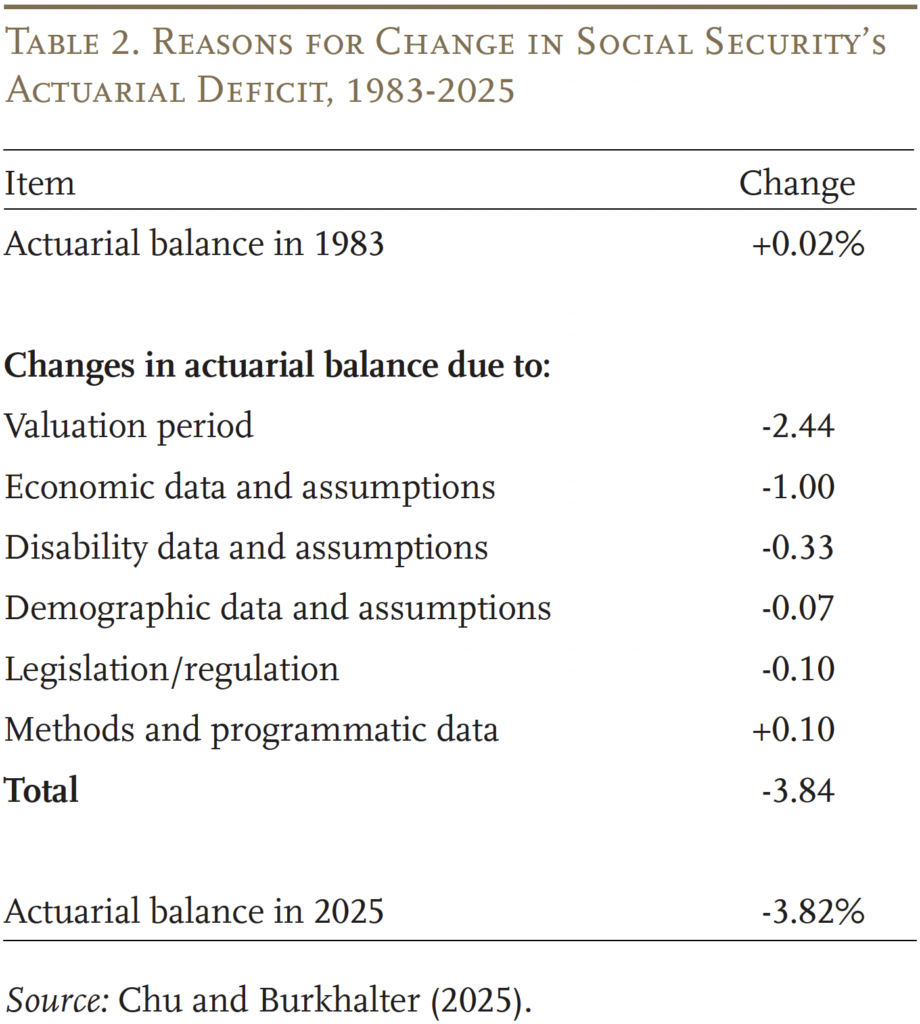

In comparison with final 12 months’s report, the metrics are considerably worse. The projected 75-year deficit rose to three.82 p.c of taxable payroll, in comparison with 3.50 p.c in 2024. The explanations have been predictable: 1) the Social Safety Equity Act, enacted in January, raised advantages for some state and native staff; 2) the interval of restoration from present low fertility charges was prolonged by 10 years to 2050; 3) the projection interval moved ahead, which replaces a low-deficit 12 months with a high-deficit 12 months; and 4) the share of GDP going to staff was revised downward, which reduces payroll tax revenues.

The projected depletion date for the Previous-Age and Survivors Insurance coverage (OASI) belief fund belongings didn’t change; it stays at 2033. Sure, the Incapacity Insurance coverage (DI) belief fund has sufficient to pay advantages for the complete 75-year interval, so the date of depletion for the mixed OASDI belief funds is 2034 – a 12 months sooner than final 12 months’s report. However combining the 2 methods would require a change within the legislation; therefore, below present legislation, the action-forcing date is 2033 – eight years from now.

This temporary offers extra element on the numbers for 2025, utilizing the Trustees’ intermediate assumptions. The intermediate state of affairs, nonetheless, isn’t a certain factor. Certainly, the Trustees current a sensitivity evaluation for each the financial and demographic assumptions. Because the demographic assumptions present a excessive probability of breaking to the high-cost aspect, the dialogue describes the associated fee to this system ought to the fertility fee stay low, ought to policymakers deport hundreds of thousands of immigrants and scale back future immigration ranges, and may individuals reside longer than anticipated.

The underside line stays the identical. Individuals enthusiastically assist the Social Safety program; their representatives ought to repair its funds. Fixing Social Safety sooner moderately than later would preserve extra choices open, distribute the burden extra equitably throughout cohorts, and most significantly, restore confidence within the nation’s main retirement program.

The 2025 Report

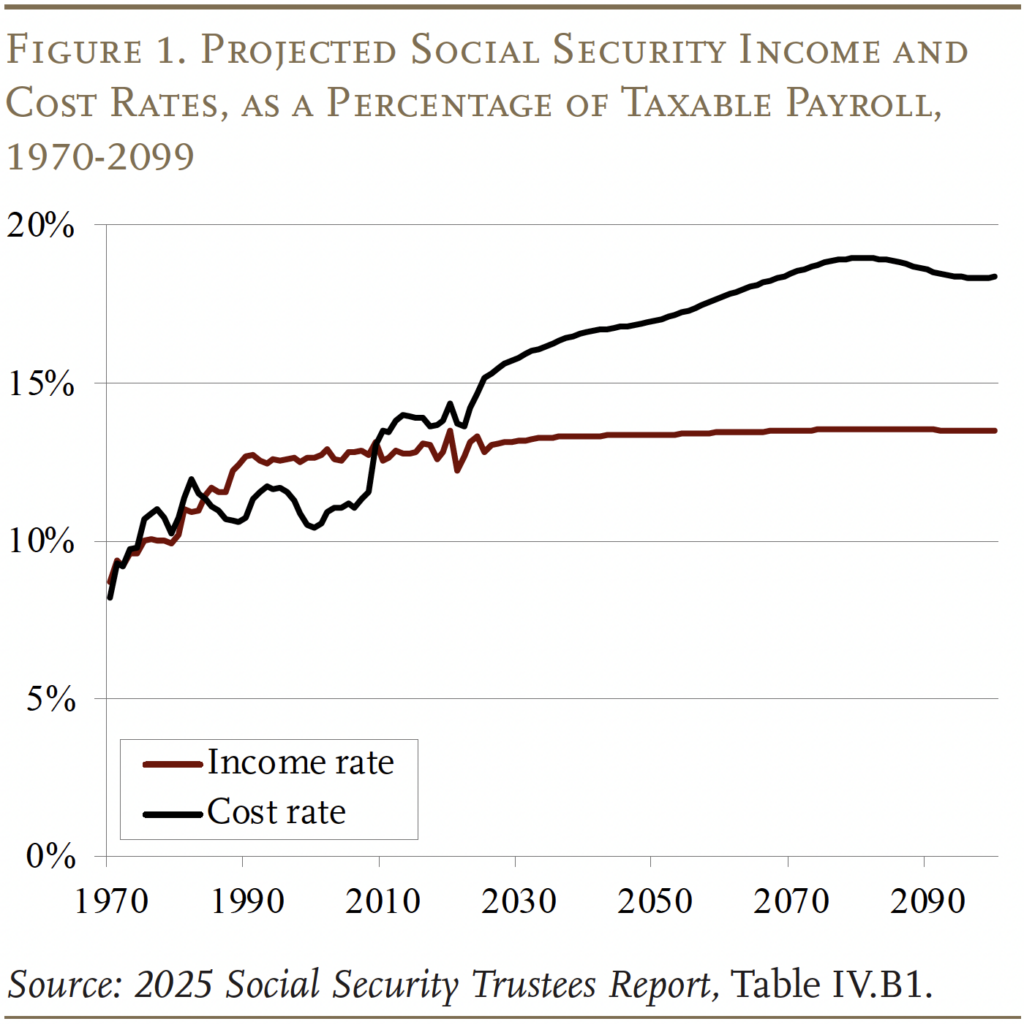

Beneath the Trustees’ intermediate assumptions, the price of the OASDI program rises quickly from 15.2 p.c of taxable payrolls as we speak to 16.6 p.c in 2040, drifts as much as about 19.0 p.c in 2080, after which declines barely (see Determine 1).

The rise in prices is pushed by demographics, particularly the drop within the whole fertility fee after the Child Increase. Girls of childbearing age in 1964 had a mean of three.2 youngsters; by 1974 that quantity had dropped to 1.8. The mixed results of the retirement of Child Boomers and a slow-growing labor power because of the decline in fertility scale back the ratio of staff to retirees, which raises prices. The hole between the earnings and value charges signifies that the system is going through a 75-year deficit.

The 75-year money stream deficit is mitigated within the brief time period by the belongings within the belief fund, which at present equal about two years of advantages. These belongings are the results of annual surpluses attributable to reforms enacted in 1983. Since 2010, nonetheless, when Social Safety’s value fee began to exceed the earnings fee, the federal government has been tapping the curiosity on belief fund belongings to cowl advantages. And, in 2021, as taxes and curiosity fell in need of annual advantages, the federal government began to attract down belief fund belongings. As famous within the introduction, these drawdowns will come to an finish for OASI in 2033 when the belief fund is depleted.

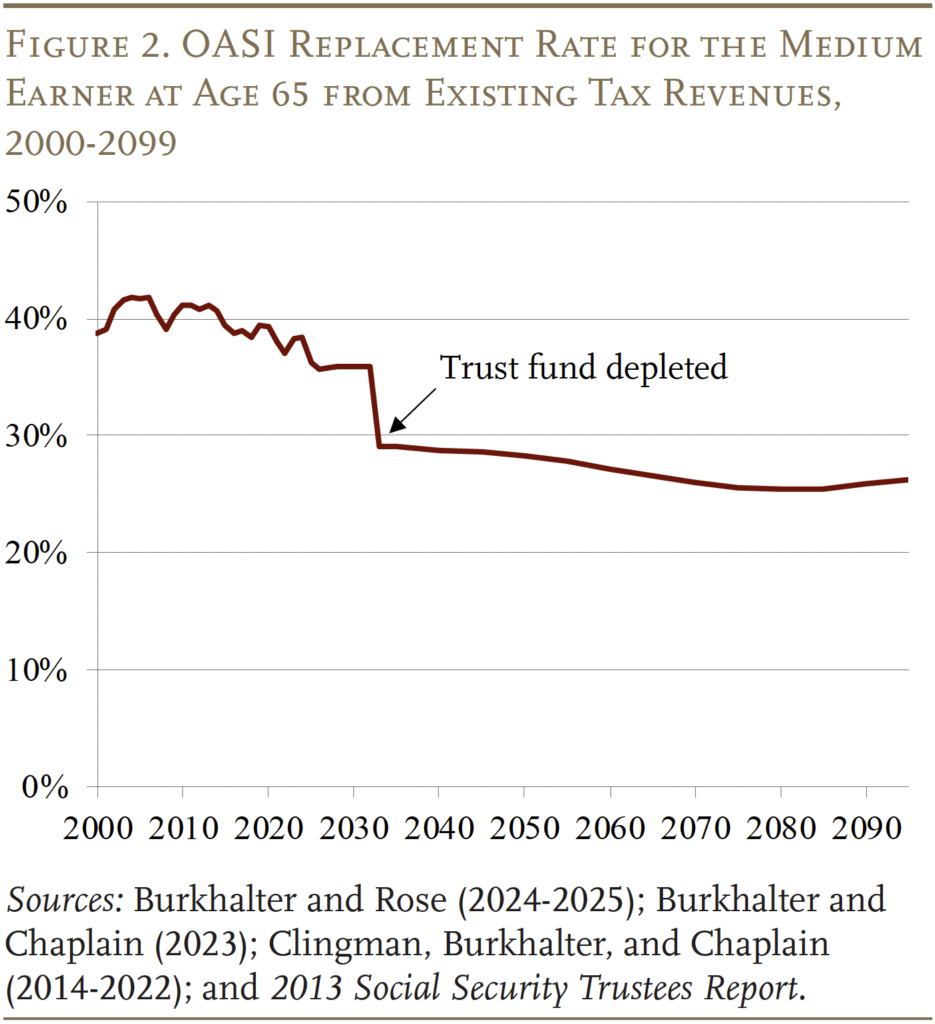

It’s essential to emphasise that the depletion of the belief fund doesn’t imply that OASI has run out of cash. On the time of the depletion, payroll tax revenues preserve rolling in and may cowl 77 p.c of at present legislated advantages, declining to 69 p.c by the tip of the projection interval. (If the OASI and DI belief funds have been merged, the protection numbers can be 81 p.c, declining to 72 p.c.) Relying solely on present tax revenues, nonetheless, signifies that the alternative fee – retirement advantages relative to pre-retirement earnings – for the standard age-65 employee would drop instantly from about 36 p.c to about 29 p.c (see Determine 2). (Notice that the alternative fee for these claiming at 65 has already declined because of the rise within the Full Retirement Age from 65 to 67.)

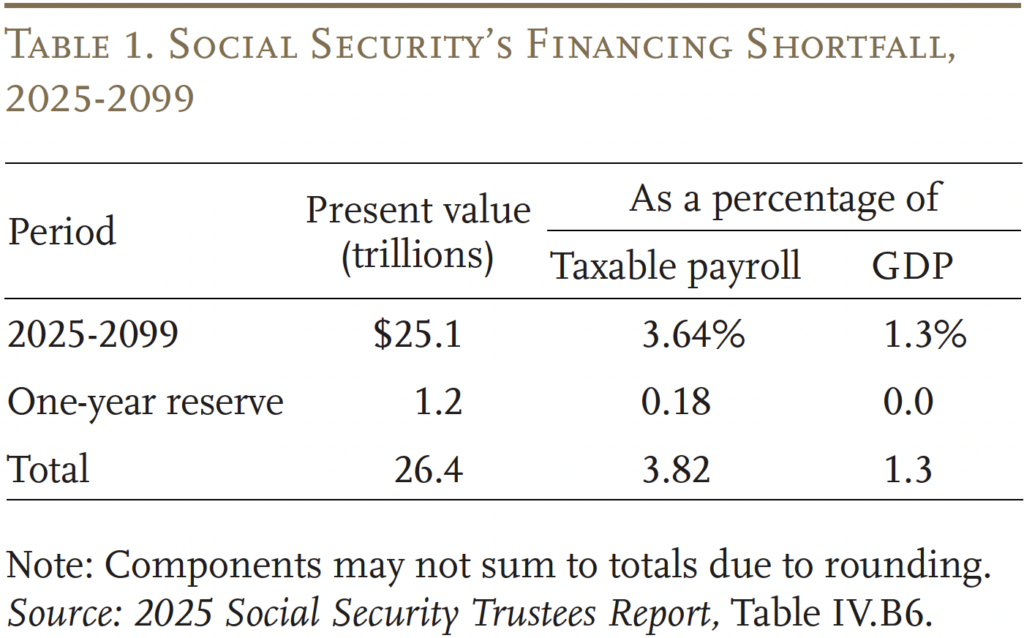

Shifting from money flows to the 75-year deficit requires calculating the distinction between the current discounted worth of scheduled advantages and the current discounted worth of future revenues plus the belongings within the belief fund. This calculation for the OASDI program reveals that Social Safety’s long-run deficit is projected to equal 3.82 p.c of coated payroll earnings. That determine signifies that if payroll taxes have been raised instantly by 3.82 share factors – 1.91 share factors every for the worker and the employer – the federal government may pay scheduled advantages by way of 2099, with a one-year reserve on the finish.

At this level, fixing the 75-year funding hole isn’t the tip of the story by way of required tax will increase. Sooner or later, as soon as the ratio of retirees to staff stabilizes and prices stay comparatively fixed as a share of payroll, any answer that solves the issue for 75 years will roughly remedy the issue completely. However, throughout this era of transition, any bundle of coverage adjustments that restores steadiness just for the subsequent 75 years will present a 75-year deficit within the following 12 months because the projection interval picks up a 12 months with a big unfavorable steadiness. Thus, eliminating as we speak’s 75-year shortfall ought to be seen as step one towards “sustainable solvency.”

Some commentators cite Social Safety’s monetary shortfall over the subsequent 75 years by way of {dollars} – $25.1 trillion (see Desk 1). Though this quantity seems very giant, the financial system – and, subsequently, taxable payrolls – may also be rising. Thus, the scary $25.1 trillion will be eradicated – and a one-year reserve created – just by elevating the payroll tax by 3.82 share factors.

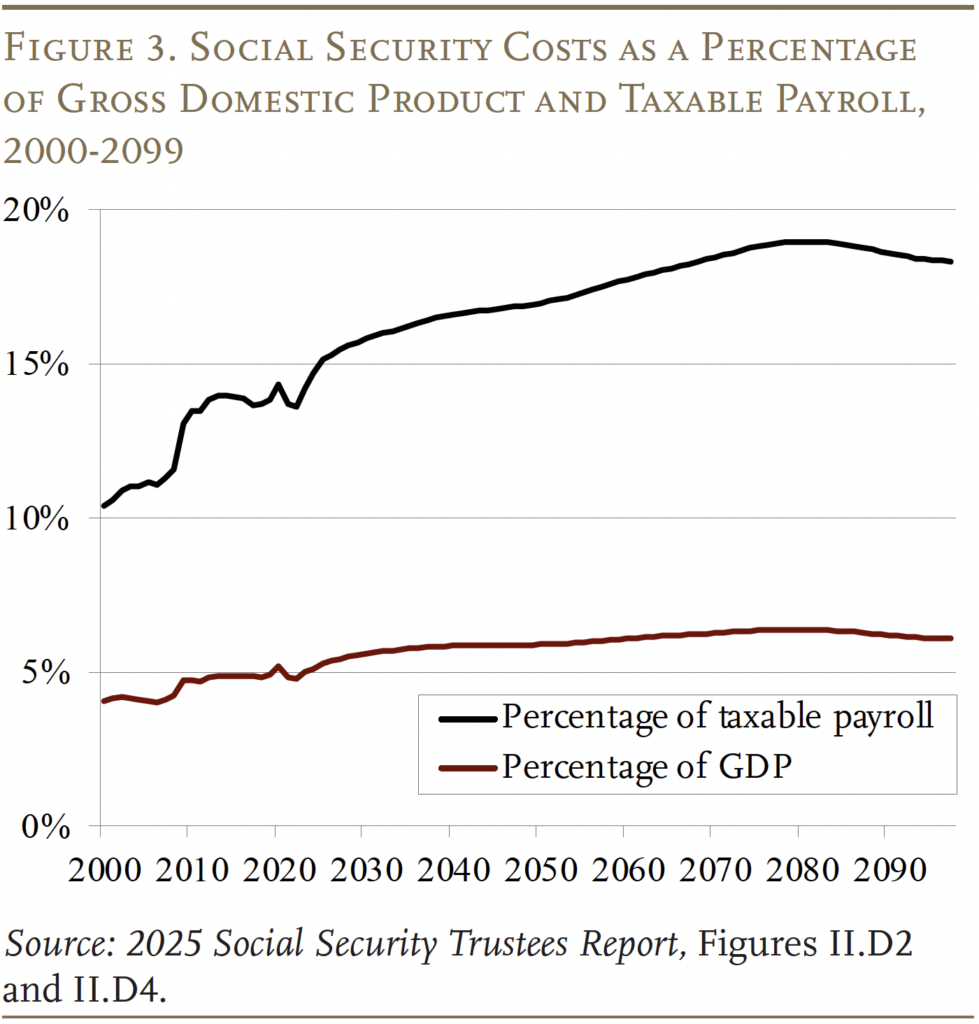

The Trustees additionally report Social Safety’s shortfall as a share of GDP. The price of this system is projected to rise from about 5 p.c of GDP as we speak to about 6 p.c of GDP because the Child Boomers retire (see Determine 3). The rationale why prices as a share of taxable payroll preserve rising – whereas prices as a share of GDP roughly stabilize – is that taxable payroll is projected to say no as a share of whole compensation attributable to continued progress in well being advantages.

2025 Report in Perspective

The 75-year deficits within the final 5 Trustees Reviews are the biggest since 1983 when Congress enacted main laws to revive steadiness (see Determine 4). The principle query is why did the deficit develop over the interval 1983-2025, and a secondary query is why did it improve since final 12 months’s Report.

Modifications in 75-12 months Deficit Since 1983

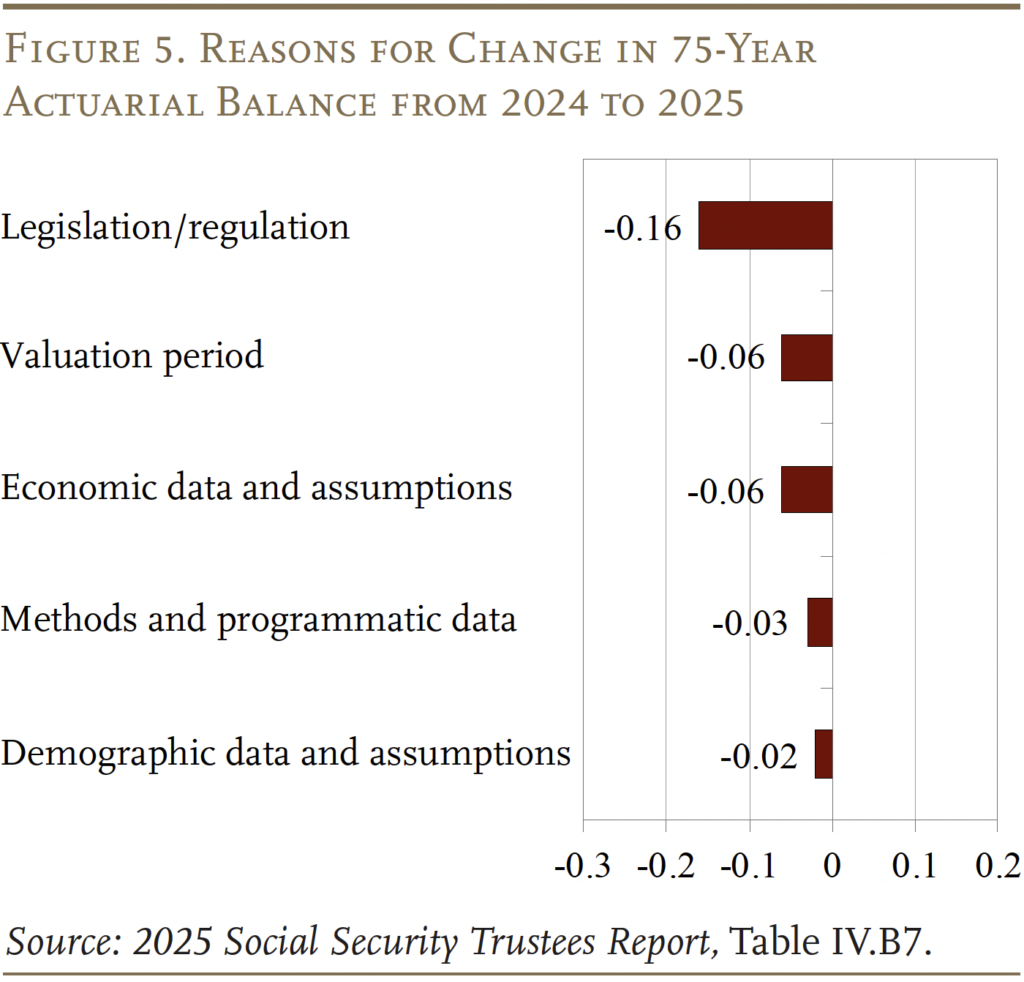

Social Safety moved from a projected 75-year actuarial surplus of 0.02 p.c of taxable payroll within the 1983 Trustees Report back to a projected deficit of three.82 p.c in 2025. As proven in Desk 2, main the listing of causes is advancing the valuation interval. Every time it strikes out one 12 months, it picks up a 12 months with a big unfavorable steadiness. The cumulative impact over the past 42 years has been to extend the 75-year deficit by 2.44 p.c of taxable payrolls. That’s, virtually two-thirds of the 42-year change within the OASDI deficit is attributable to easily transferring the valuation interval ahead.

A worsening of financial assumptions – primarily a decline in assumed productiveness progress and the influence of the Nice Recession – have additionally contributed to the rising deficit. One other contributor over the previous 42 years has been will increase in incapacity rolls, though that image has modified dramatically lately. Lastly, altering demographic assumptions – most notably, the discount within the assumed fertility fee final 12 months – has additionally added to the 42-year change. Partially offsetting the unfavorable elements has been a discount within the actuarial deficit attributable to methodological enhancements and up to date information. The online impact in 2025 of all these adjustments is a 75-year deficit equal to three.82 p.c of taxable payrolls.

Modifications from Final 12 months’s Report

As famous earlier, the deficit of three.82 p.c of taxable payrolls within the 2025 Report is considerably increased than the three.50 p.c in final 12 months’s Report. This shift is primarily a results of 4 adjustments: the Social Safety Equity Act was enacted in January 2025; the valuation interval moved ahead one 12 months; the projected ratio of labor compensation to GDP was decreased; and, buried within the demographic assumptions, the interval of low fertility was prolonged (see Determine 5).

Laws. The Social Safety Equity Act repealed provisions that have been designed to make sure that state and native staff, who weren’t coated of their authorities job however gained minimal protection by way of a second job, didn’t profit unfairly from the progressivity of Social Safety’s profit formulation or from advantages designed for non-working spouses. Sure, the changes may have been higher designed – and so they certainly infuriated state and native staff – however they addressed an actual fairness difficulty. Eliminating the changes not solely made the system much less honest, however the increased advantages for these state and native staff value the system cash – worsening its monetary state of affairs in 2025 by 0.16 p.c of taxable payroll.

Valuation interval. The projection interval for the 2025 Report is 2025-2099, in comparison with 2024-2098 for the earlier 12 months. The distinction between the associated fee fee and the earnings fee in 2024 was -1.34 p.c in comparison with -4.86 p.c projected for 2099. Changing the low-deficit 12 months with a high-deficit 12 months will increase the 75-year shortfall by 0.06 p.c.

Decrease labor compensation/GDP. The ratio of whole labor compensation to GDP over the past six full financial cycles from 1969 to 2019 has averaged 0.62. The common ratio over the interval 2020-2024 has been decrease, nonetheless, and the Trustees barely lowered their projection in 2025, lowering revenues barely.

Demographics. This class can also be of observe as a result of one part – extending the interval of restoration from present low fertility charges by 10 years (from 2040 to 2050) – worsened the 75-year deficit by 0.11 between 2024 and 2025. This massive unfavorable impact, nonetheless, was largely offset by different optimistic adjustments, akin to increased ranges of immigration within the interval 2022-2025, leading to a modest web improve within the deficit of 0.02 p.c of taxable payrolls.

The place Do We Go from Right here?

The 2025 Trustees Report reveals that Congress has solely eight years to behave to keep away from a 23-percent lower in retirement advantages (see Determine 6). If the legislation is modified in order that Social Safety’s OASI and DI belief funds are mixed, reserves shall be enough to pay full advantages till 2034. As famous, to stay solvent with a one-year reserve, the payroll tax fee must be elevated instantly by 3.82 share factors. Alternatively, scheduled advantages must be decreased by 22.4 p.c or by 26.8 p.c if the discount have been utilized solely to those that grow to be eligible in 2025 or later. A politically acceptable answer would probably contain some mixture of income will increase and profit cuts.

All these estimates, nonetheless, are based mostly on the Trustees’ intermediate assumptions. The issue is that the demographic assumptions – what number of youngsters we could have, what number of immigrants we let in, and the way lengthy we are going to reside – look fairly optimistic given current traits and political initiatives. Subsequently, it’s helpful to try the sensitivity evaluation integrated within the 2025 Report.

Sensitivity of 75-year Deficit to Various Demographic Assumptions

Demographic elements – fertility charges, immigration patterns, and mortality charges – are the most important drivers of the price of Social Safety as a result of they decide the variety of staff paying into the system relative to beneficiaries accumulating from this system. Though the Trustees current each high-cost and low-cost options to their baseline assumptions, the dangers look like totally on the pessimistic aspect – that’s, the prices reported in future years are prone to be increased than envisioned within the 2025 Report.

Influence of Whole Fertility Price

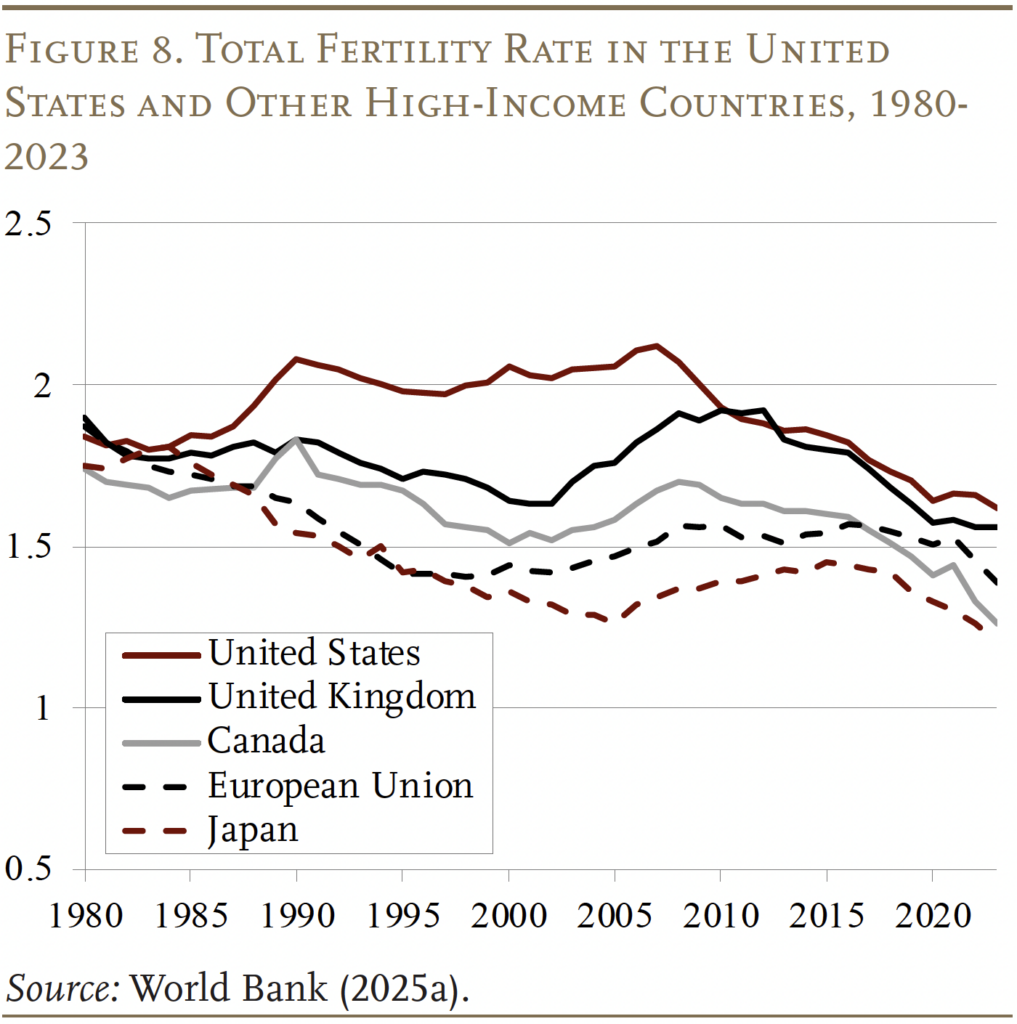

U.S. fertility charges have typically been falling for the reason that finish of the Child Increase within the mid-Sixties, and that decline accelerated after the Nice Recession. Many observers thought that, as soon as the financial system recovered, the fertility fee would rebound. It has not (see Determine 7). At present, the hypothetical lifetime variety of births for a lady over her childbearing years is 1.63, properly beneath the extent required to carry the inhabitants regular.

The U.S. present fertility fee isn’t an anomaly; it’s now roughly consistent with the charges in different high-income nations (see Determine 8). A part of the belated convergence between america and different nations displays a dramatic decline in births amongst Hispanic ladies, a few of which will be attributed to a rise within the native-born share of Hispanics and a few of which can mirror the declining beginning fee in originating nations, akin to Mexico.

The Social Safety Trustees are properly conscious of those numbers, however venture an final fertility fee of 1.9 youngsters. The sample integrated within the 2025 projections is a gradual improve from as we speak’s worth to its final worth of 1.9 in 2050 (up from 2040 in final 12 months’s report). The Trustees base their case on two elements. The primary is that repeated surveys of ladies of childbearing age present beginning expectations above 2.0, suggesting that the present low ranges won’t be everlasting.1 Second, they consider that rising fertility charges for girls of their 30s assist the notion that girls are merely suspending their childbearing.

This Trustees’ projected fertility fee, nonetheless, is considerably increased than different authorities companies. The Congressional Finances Workplace, of their 2025 projections, attain an final whole fertility fee of 1.60 by 2035.2 Within the Census Bureau’s 2023 projections, the fertility fee decreases linearly from 2023 by way of 2100 and past.3 Extra particularly, the Census whole fertility fee is 1.60 in 2050 and 1.55 in 2100.

Moreover, the latest expectations information – which got here out after the Trustees set their assumptions for this 12 months’s report – present that girls below 35 all anticipate to have fewer than 2.0 youngsters.4 The truth is, as we speak’s 20-24-year-olds solely anticipate to have 1.5 youngsters, whereas 25-29-year-olds anticipate to have 1.9 youngsters.

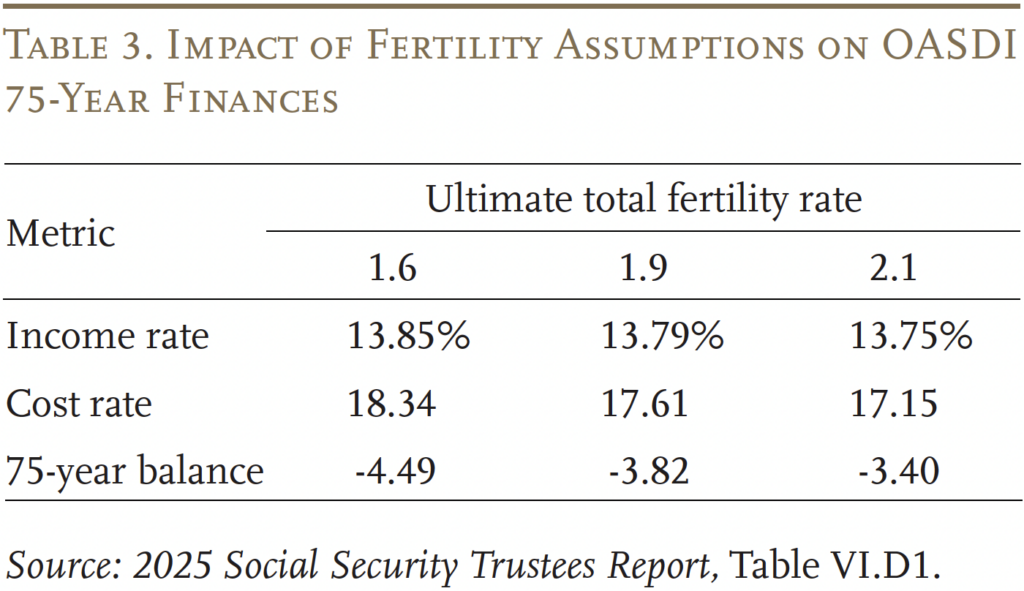

If low fertility persists, the price of the Social Safety program shall be increased over the subsequent 75 years than reported within the 2025 report. In response to the Trustees’ sensitivity evaluation, an final fertility fee of 1.6 moderately than 1.9 would improve the 75-year deficit from 3.82 to 4.49 p.c of taxable payroll (see Desk 3). Since a rise within the fertility fee wouldn’t have an effect on the labor power for about 20 years, decrease fertility charges would haven’t any influence on the depletion of OASDI belongings.

Might pro-natalist insurance policies improve the fertility fee? President Trump has referred to as for a brand new “child increase,” suggesting steps akin to a $5,000 money “child bonus” to each American mom.5 The problem is that, over the past 30 years, many nations have instituted pro-natalist insurance policies – basing advantages on variety of youngsters, offering allowances for newborns, or providing baby tax credit. The proof means that these efforts haven’t labored.6 Sweden is an excellent instance as a result of, even with soup-to-nuts assist, its fertility fee is 1.45 – considerably decrease than the U.S. fee.7

The essential factor to recollect is that producing our personal infants isn’t the one different; rising immigration is a direct option to increase the worker-to-retiree ratio and enhance the funds of Social Safety. The issue is that we appear to be transferring within the improper route.

Influence of Immigration

Future patterns of immigration are notoriously troublesome to foretell; flows rely on financial and political situations in each the emigrant nation and america. The duty right here, nonetheless, is way less complicated – assessing how the projected patterns may very well be affected by each present and future Administrations’ perspective in the direction of immigrants and immigration.

Social Safety’s immigration projections contain estimating web flows for 2 sorts of immigrants – lawful everlasting residents and people current briefly or unlawfully. Momentary/illegal immigrants embrace those that entered legally however have been solely granted momentary authorization (akin to college students and overseas staff on visas) and people who overstayed their visas, in addition to those that entered illegally.

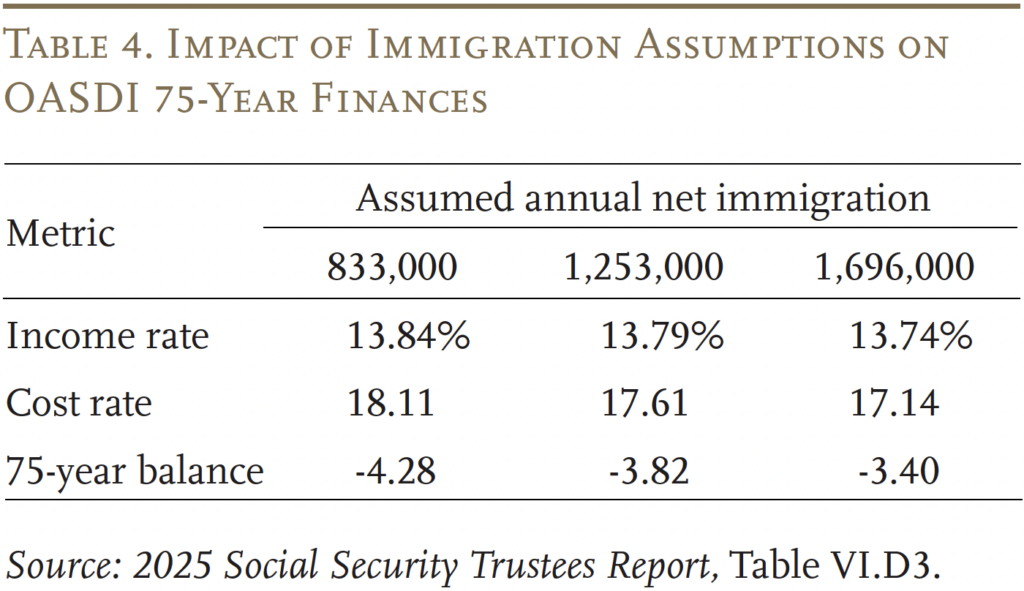

Within the 2025 Report, whole annual immigration for the 2 teams – below the intermediate assumptions – averages 1,253,000 for the interval 2035 by way of 2099. Of the overall, 788,000 are lawful everlasting residents and 465,000 are momentary/illegal immigrants. The final word stage of immigration assumptions remained unchanged from final 12 months’s Report. The Social Safety projections are pretty per these from different federal companies.8

As with different assumptions, the Trustees current each a extra optimistic (decrease value) and extra pessimistic (increased value) projection for immigration (see Desk 4). Further immigration helps Social Safety funds in a number of methods. First, the associated fee fee decreases as a result of immigration happens at comparatively younger ages, thereby – not less than within the brief run – decreasing the ratio of retirees to staff. Second, momentary/unlawful immigrants usually contribute to Social Safety, however by no means qualify for advantages. Third, immigrants are likely to have extra infants than native-born Individuals, thereby elevating the home fertility fee, which additional improves the outlook.

The Administration’s coverage is to get rid of all unlawful immigration, and its actions – akin to, barring overseas college students – will probably result in much less authorized immigration. If future immigration flows find yourself nearer to the pessimistic assumptions, the 75-year actuarial deficit would look nearer to 4.28 p.c of taxable payrolls than 3.82 p.c.

Along with lowering the flows of future immigrants, President Trump campaigned on deporting 15 to twenty million unlawful immigrants at present in america.9 Latest analysis from the Pew Analysis Heart and different students places the variety of immigrants right here illegally at nearer to 11 million.10 Nonetheless, ought to such an effort succeed, it will improve the variety of beneficiaries per employee. The upper value fee would additional increase the 75-year deficit, and the immediacy of the influence would speed up the depletion of the belief fund by a couple of 12 months.11

Influence of Mortality

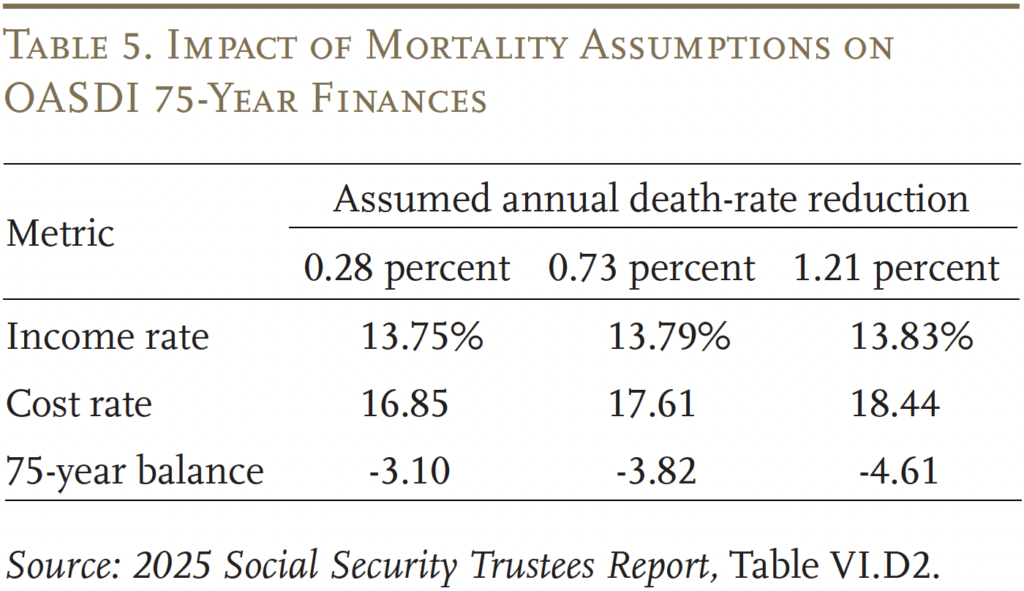

That mortality assumptions can be essential is intuitive, for the reason that longer individuals reside – given the present Full Retirement Age – the costlier this system. Mortality, nonetheless, differs from the earlier two elements alongside two dimensions. First, whereas the variety of anticipated births is an easy-to-understand metric for fertility and web flows of individuals into the nation for immigration, the metric for mortality is extra convoluted. Loss of life charges are typically declining, and the idea facilities on the speed at which the loss of life fee is projected to say no. If the speed of decline is quicker than the intermediate assumption, individuals will reside longer; if it slows down, individuals will die sooner. The Trustees estimate {that a} increased fee of decline may increase the 75-year deficit from 3.82 to 4.61 p.c of taxable payrolls; slower mortality enchancment would decrease the 75-year deficit to three.10 (see Desk 5). The attainable vary of outcomes for mortality is bigger than that for fertility or immigration.

The second dimension during which the dialogue of mortality differs from fertility and immigration is the desirability of a low-cost consequence. One will be comfortable if ladies determine to have extra infants or if america attracts extra gifted immigrants, however it’s laborious to argue for individuals dying earlier. That mentioned, it’s nonetheless helpful to invest about whether or not the long run path of mortality will break to the high-cost or low-cost aspect. Two items of proof counsel that the precise consequence may end in a better fee of mortality enchancment than recommended by the Trustees’ intermediate assumptions.

First, comparisons present that the Social Safety mortality assumptions end in a barely decrease life expectancy than different authorities entities. The Congressional Finances Workplace’s mortality assumptions end in life expectancy at beginning of 82.3 years in 2055 – the tip of their projection interval. Within the Census 2023 projections, the assumed mortality charges end in a life expectancy at beginning of 83.7 years in 2055. In distinction, the Trustees assumptions’ end in a life expectancy at beginning of 82.0 years in 2055.

Second, comparisons with different developed nations additionally counsel substantial room for a significant enchancment in U.S. life expectancy (see Determine 9). Life expectancy at beginning in america and different high-income nations has elevated dramatically over the past 40 years. However progress in america has been slower than its friends, and the U.S. rating has dropped from the center of the group to absolutely the backside. Traditionally, two contributors to this poor efficiency have been deaths linked to smoking and weight problems.12 Smoking has pale as a problem, however weight problems stays essential. To the extent that the brand new weight reduction medication grow to be extensively accessible, america would possibly regain its place amongst different developed nations.13 Briefly, projections of future life expectancy could break to the excessive aspect – elevating the price of the Social Safety program.

Abstract

The earlier dialogue isn’t a critique of the Trustees’ assumptions however moderately an effort to focus on the uncertainty that surrounds any projections made for the subsequent 75 years and to determine elements which will make the high-cost options extra probably than the intermediate estimates. These developments – mixed with the annual improve within the deficit because the analysis interval shifts ahead – signifies that Trustees Reviews within the subsequent few years could properly present 75-year deficits within the vary of 4.0 to 4.5 p.c. Even with increased projected deficits, the levers can be found on each the income and profit aspect to revive steadiness. Congress simply must act.

Conclusion

The 2025 Trustees Report confirms what has been evident for nearly three a long time – particularly, Social Safety is going through a long-term financing shortfall that equals about 1 p.c of GDP. The adjustments required to repair the system are properly inside the bounds of fluctuations in spending on different applications prior to now. Furthermore, motion must be taken earlier than the OASI belief fund is depleted in 2033 to keep away from a precipitous lower in advantages.

This temporary additionally attracts consideration to the truth that all the general public dialogue about Social Safety focuses on numbers based mostly on the Trustees’ intermediate assumptions. The intermediate state of affairs, nonetheless, isn’t a certain factor. Certainly, the Trustees current a sensitivity evaluation for each the financial and demographic assumptions. Because the demographic assumptions present a excessive probability of breaking to the high-cost aspect, the dialogue describes the associated fee to this system ought to the fertility fee stay low, ought to policymakers deport hundreds of thousands of immigrants and scale back future immigration ranges, and may individuals reside longer than anticipated. Even when the outlet seems to be considerably bigger than at present estimated, quite a few choices can be found on each the income and profit sides to shut the hole. All that’s wanted is the political will.

References

Brainerd, Elizabeth. 2014. “Can Authorities Insurance policies Reverse Undesirable Declines in Fertility?” IZA World of Labor 2014: 23.

Burkhalter, Kyle and Karen Rose. 2024-2025. “Alternative Charges for Hypothetical Retired Staff.” Actuarial Notice Quantity 9. Baltimore, MD: U.S. Social Safety Administration.

Burkhalter, Kyle and Chris Chaplain. 2023. “Alternative Charges for Hypothetical Retired Staff.” Actuarial Notice Quantity 9. Baltimore, MD: U.S. Social Safety Administration.

Facilities for Illness Management and Prevention, Nationwide Very important Statistics System. 2025. “Beginning: Provisional Knowledge for 2024.” Report No. 38. Atlanta, GA.

Chen, Anqi, Alicia H. Munnell, Geoffrey T. Sanzenbacher, and Alice Zulkarnain. 2017. “Why Has U.S. Life Expectancy Fallen Beneath Different Nations?” Difficulty in Transient 17-22. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Chu, Sharon and Kyle Burkhalter. 2025. “Disaggregation of Modifications within the Lengthy-Vary Actuarial Stability for the Previous Age, Survivors, and Incapacity Insurance coverage (OASDI) Program Since 1983.” Actuarial Notice Quantity 8. Baltimore, MD: U.S. Social Safety Administration.

Clingman, Michael, Kyle Burkhalter, and Chris Chaplain. 2014-2022. “Alternative Charges for Hypothetical Retired Staff.” Actuarial Notice Quantity 9. Baltimore, MD: U.S. Social Safety Administration.

Congressional Finances Workplace. 2025. The Demographic Outlook: 2025 to 2055. Washington, DC.

Demissie, Hannah and Katherine Faulders. 2025. “Trump Administration Taking a look at $5,000 ‘Child Bonus’ to Incentivize Public to Have Extra Kids.” (April 23). New York, NY: ABC Information.

Desilver, Drew. 2024. “As Weight problems Charges Rise within the U.S. and Worldwide, New Weight-Loss Medication Surge in Reputation.” Quick Reads. Washington, DC: Pew Analysis Heart.

Duleep, Harriet Orcutt, Dave Shoffner, Robert Gesumaria, and Christopher R. Tamborini. 2025. “Measuring the Variety of Unauthorized Immigrants in america: A Evaluate of the Residual Estimation Technique.” Social Safety Bulletin 85(2): 1-8.

Gesumaria, Robert, Harriet Orcutt Duleep, Christopher R. Tamborini, and Dave Shoffner. 2025. “A New Strategy to Estimate the Variety of Unauthorized Immigrants in america.” Social Safety Bulletin 85(2): 17-23.

Hays, Jake. 2025. “U.S. Adults in Their 20s and 30s Plan to Have Fewer Kids than within the Previous.” Quick Reads. Washington, DC: Pew Analysis Heart.

Kearney, Melissa S. and Phillip B. Levine. 2022. “The Causes and Penalties of Declining US Fertility.” In Financial Coverage in a Extra Unsure World, edited by Melissa S. Kearney and Amy Ganz. Washington, DC: Aspen Institute.

Passel, Jeffrey S. and Jens Manuel Krogstad. 2024. “What Do We Know About Unauthorized Immigrants Dwelling within the U.S.?” Quick Reads. Washington, DC: Pew Analysis Heart.

Shin, Sophie. 2025. “The Influence of President Trump’s Deportation Insurance policies: The Social Safety Program.” Penn Wharton Finances Mannequin Transient. Philadelphia, PA: The College of Pennsylvania, Wharton College.

Sobotka, Tomáš, Anna Matysiak, and Zuzanna Brzozowska. 2019. “Coverage Responses to Low Fertility: How Efficient Are They?” Working Paper 1. New York, NY: United Nations Inhabitants Fund.

Tamborini, Christopher R., Harriet Orcutt Duleep, Robert Gesumaria, and Dave Shoffner. 2025. “Measuring the Financial and Sociodemographic Traits of Unauthorized Immigrants in america with Survey Knowledge.” Social Safety Bulletin 85(2): 9-15.

Time. 2024. “Learn the Full Transcripts of Donald Trump’s Interviews With TIME.” (April 30). New York, NY.

U.S. Census Bureau. 2025. 2023 Nationwide Inhabitants Projections Datasets. Washington, DC.

U.S. Social Safety Administration. 1983-2025. The Annual Reviews of the Board of Trustees of the Federal Previous-Age and Survivors Insurance coverage and Federal Incapacity Insurance coverage Belief Funds. Washington, DC: U.S. Authorities Printing Workplace.

U.S. Social Safety Administration. 2025b. The Lengthy-Vary Demographic Assumptions for the 2025 Trustees Report. Washington, DC: U.S. Authorities Printing Workplace.

U.S. Social Safety Administration. 2004. “A Stochastic Mannequin of the Lengthy-Vary Monetary Standing of the OASDI Program.” Actuarial Research No. 117. Baltimore, MD: Workplace of the Chief Actuary.

World Financial institution. 2025a. “World Improvement Indicators: Fertility Price, Whole (Births per Lady).” Washington, DC.

World Financial institution. 2025b. “World Improvement Indicators: Life Expectancy at Beginning, Whole (Years).” Washington, DC.