I bear in mind after I first heard the time period “sensitivity evaluation”. It gave the impression of one thing out of a sci-fi film, or maybe a particular method utilized by psychologists. As somebody who was simply dipping their toes into the huge ocean of enterprise finance, it felt daunting and overwhelming. I’ll admit, there have been nights I lay awake, my thoughts buzzing with questions on this advanced monetary instrument.

However let me inform you, pricey reader, sensitivity evaluation is just not as scary because it sounds. In reality, it’s a bit like making your favourite dish. You understand how you add a pinch of this, a splash of that, after which regulate the seasoning till it tastes excellent? That’s sensitivity evaluation in a nutshell. It’s all about understanding how completely different ‘elements’ (or variables) influence your ‘dish’ (or monetary forecast).

Sensitivity evaluation performs a vital function in monetary forecasting and resolution making. It helps us perceive the potential influence of modifications in enter variables on our output or final result. Consider it as a monetary crystal ball, serving to you peer into numerous doable futures based mostly on completely different eventualities.

Now, for those who’re feeling a little bit nervous, don’t fear! This information is right here to assist. I promise, by the tip of it, sensitivity evaluation will probably be as simple as pie (and simply as satisfying!). So buckle up, seize a cup of espresso, and let’s dive into the fantastic world of sensitivity evaluation collectively.

Fast Overview

To carry out a sensitivity evaluation, you first establish the variables that may have an effect on your final result. Then, you regulate these variables inside a set vary and observe the ensuing modifications in your mannequin’s output or resolution criterion.

To calculate sensitivity evaluation in Excel, you should utilize the Information Desk, State of affairs Supervisor, or Solver capabilities relying on the complexity of your mannequin and the variety of variables you want to check.

To carry out sensitivity evaluation with a knowledge desk in Excel, you arrange a desk with completely different values for one or two enter variables. Then, utilizing the Information Desk instrument beneath the What-If Evaluation choices, you’ll be able to see how these modifications in variables have an effect on your consequence.

Fundamentals of Sensitivity Evaluation

In its easiest type, sensitivity evaluation is a technique to predict the result of a call if a scenario modifications. It’s like a “what if” sport for your small business funds – what if prices improve? What if gross sales lower? What if my espresso machine breaks down and I can’t perform with out my morning caffeine repair? (Okay, perhaps not that final one, however you get the thought!)

Think about you’re planning a street journey. You’ve bought your route mapped out, snacks packed, and your favourite playlist able to go. However what if there’s a site visitors jam on the freeway, or what if the one that you love ’90s boy band’s songs usually are not as sing-along-worthy as you thought? Sensitivity evaluation is like having a backup plan on your journey. It helps you perceive how these modifications may have an effect on your journey and means that you can plan accordingly.

Let’s carry it again to the enterprise world. Suppose you personal a boutique bakery. Your cupcakes are the speak of the city, and enterprise is booming. However you’re nervous in regards to the fluctuating value of vanilla (a key ingredient in your secret recipe). A sensitivity evaluation may make it easier to perceive how a change within the value of vanilla may influence your income.

Or maybe you’re contemplating increasing your small business. Sensitivity evaluation may make it easier to predict how modifications in market circumstances, like a sudden cupcake craze or an unexpected gluten-free motion, may have an effect on your enlargement plans.

Step-by-step Information to Carry out Sensitivity Evaluation in Excel

Alright, let’s roll up our sleeves and dive into the nuts and bolts of performing a one-input variable sensitivity evaluation in Excel. Don’t fear; it’s not as daunting because it sounds! You and I are going to sort out this collectively, step-by-step. Simply bear in mind: each Excel wizard began with a single cell!

Be certain that to obtain our free Excel template to comply with alongside:

Step 1: Open Excel and Set Up Your Financial Fashions

Begin by opening Excel, and take a deep breath. Belief me, Excel is extra afraid of you than you’re of it! Arrange your information with the variables you wish to check. This may very well be something from the worth of vanilla to the variety of cupcakes you promote in a day.

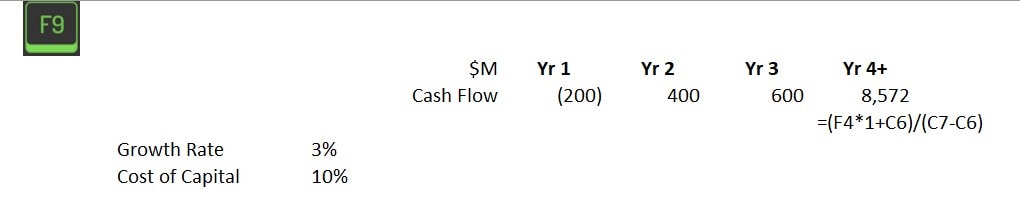

For our instance, we’ll check how the price of capital (WACC) impacts free money flows and the internet current worth of a undertaking.

Step 2: Create a Variable Information Desk

Subsequent, we’re going to create a knowledge desk. That is the place the magic occurs. In a single column, listing the completely different eventualities on your enter variable (for instance, numerous costs of vanilla). Within the corresponding row, hyperlink the specified output variable (similar to revenue).

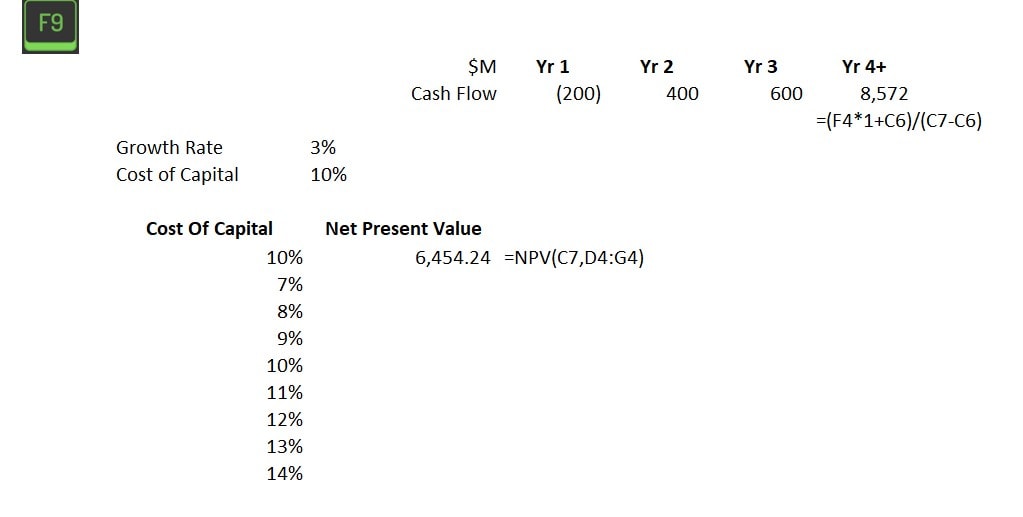

For our instance, the column inputs will probably be price of capital and the corresponding Web Current Worth.

Step 3: Insert the Information Desk Operate

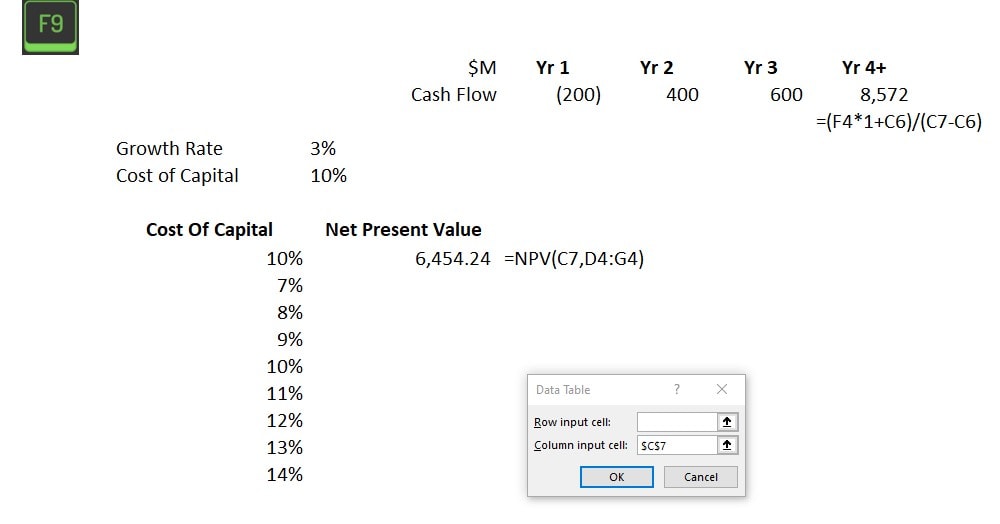

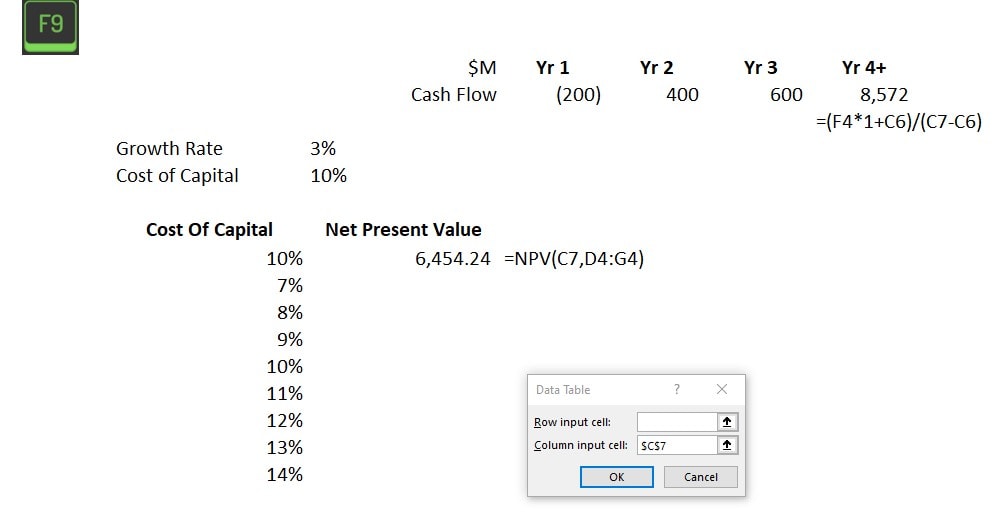

Now, go to the ‘Information’ tab, click on on ‘What-If Evaluation’, and choose ‘Information Desk’. A dialog field will pop up (don’t panic, it’s pleasant!). Within the row and column inputs cell, enter the reference to the unique variable cell within the spreadsheet.

For our instance, our information is in columns, so we will probably be utilizing the column enter cell. A row enter cell is used in case your information is about up horizontally. Hyperlink column enter cells to cell C7, the place we now have the enter variable: Price of Capital.

Step 4: Watch Excel Do Its Factor

When you hit OK, Excel will work its magic. It’s going to refill your information desk with outcomes for every situation. It’s like watching your favourite baking present, however as an alternative of cupcakes, you’re getting scrumptious monetary modeling!

For our instance, Excel populates the information desk with our desired output and exhibits the web current worth at every price of capital holding all different variables fixed. This offers precious insights for administration to think about when financing an funding.

Step 5: Analyze the Outcomes

Lastly, pour your self a cup of espresso, sit again, and analyze the sensitivity evaluation outcomes. Search for patterns, see which variables have the largest influence, and use this data to make knowledgeable enterprise selections.

Bear in mind, conducting sensitivity evaluation in Excel is like baking. It may appear intimidating at first, however when you get the hold of it, it’s a chunk of cake! And identical to with baking, don’t be afraid to experiment and check out various things. Who is aware of, you may find yourself creating the subsequent huge factor in monetary forecasting… or no less than, get a extremely good deal with on your small business funds!

Widespread Errors and Tips on how to Keep away from Them

We’ve all been there. You’re midway via an Excel spreadsheet, and instantly, the whole lot goes haywire. The cells begin spitting out numbers that seem like they belong in a sci-fi novel, and also you’re left questioning the place you went unsuitable. Belief me, I’ve been there too. In reality, let’s make a journey down reminiscence lane and revisit a few of my very own sensitivity evaluation blunders.

Mistake 1: Ignoring Correlated Variables

Early in my profession, I used to be analyzing the profitability of a espresso store. I used to be so centered on the worth of espresso beans that I utterly ignored the way it was tied to the worth of milk. The consequence? A forecast that regarded like I’d be sipping margaritas on a personal island inside a 12 months. If solely!

Takeaway: All the time think about correlated variables. They’re like a bundle deal – you’ll be able to’t have one with out the opposite.

Mistake 2: Overcomplicating the Evaluation

As soon as, in a match of over-enthusiasm, I made a decision to incorporate each doable variable in my evaluation. The climate, the phases of the moon, the variety of cats within the neighborhood – you title it, I included it. For sure, my evaluation ended up as complicated as a maze.

Takeaway: Preserve it easy. Concentrate on the important thing variables which have a major influence in your final result.

Mistake 3: Neglecting to Double-Verify

This one nonetheless makes me cringe. I had painstakingly carried out a whole sensitivity evaluation, solely to appreciate I had inputted the unsuitable preliminary information. It was like baking a cake with salt as an alternative of sugar – not a tasty final result!

Takeaway: All the time double-check your inputs. An additional couple of minutes can prevent numerous complications afterward.

Superior Suggestions for Sensitivity Evaluation

Alright, my monetary wizards in coaching, it’s time to degree up! You’ve mastered the fundamentals of conducting sensitivity evaluation and are actually able to sort out some superior methods. However bear in mind, with nice energy comes nice accountability. Don’t go all mad scientist on me!

Tip 1: Use State of affairs Supervisor

State of affairs Supervisor is just like the Swiss military knife of Excel. It’s a instrument that may create and save completely different teams of values or eventualities and swap between them simply. This may be tremendous useful if you’re coping with a number of variables and wish to see how completely different mixtures have an effect on your final result.

Tip 2: Harnessing the Energy of Solver

Solver is one other highly effective instrument in Excel that may optimize decision-making by adjusting your inputs to realize a desired final result. Wish to maximize revenue whereas maintaining prices beneath management? Solver is your new finest pal.

Tip 3: Monte Carlo Simulations

This methodology entails producing random inputs on your variables to simulate completely different outcomes. It’s like rolling cube, however as an alternative of hoping for a six, you’re predicting future enterprise efficiency. Simply watch out to not get misplaced within the thrill of the gamble!

Now, let me inform you a story of a time after I bought a little bit too excited with these superior methods. I used to be analyzing a small lemonade stand (sure, you learn that proper). I had Solver working, eventualities multiplying like rabbits, and a Monte Carlo simulation that might make a Vegas on line casino jealous. I used to be misplaced in a sea of information, forgetting one essential factor – the enterprise was a easy lemonade stand! Let’s simply say, it was an overkill.

So, bear in mind this cautionary story. Whereas these superior methods could be extremely helpful, they’re instruments, not toys. Use them correctly, preserve your evaluation related to your small business, and don’t overlook to step again and take a look at the massive image.

Fast Recap

Effectively, my monetary comrades, we’ve journeyed collectively via the land of sensitivity evaluation, and what a journey it’s been! We’ve delved into the nitty-gritty particulars, laughed at my previous blunders, and found some fairly nifty instruments alongside the way in which. However what does all this imply for you?

Sensitivity evaluation, in all its Excel glory, is greater than only a fancy time period or a box-ticking train. It’s your crystal ball, your roadmap, your secret weapon in making knowledgeable, data-driven selections for your small business. It’s about understanding how completely different variables can have an effect on your backside line and utilizing that information to plan, strategize, and finally, succeed.

I do know, it may appear daunting at first. You could be pondering, “Can I actually do that?” And to that, I say, “Completely, you’ll be able to!” Bear in mind my tales of confusion and errors? Effectively, take a look at me now, passing on the knowledge to you fantastic of us. If I can do it, so are you able to.

Steadily Requested Questions

How do I do a sensitivity evaluation on Excel?

To carry out an Excel sensitivity evaluation, you first establish the important thing variables affecting your mannequin’s output. Then, you regulate these variables inside an affordable vary and observe the ensuing modifications within the output.

How do I add a sensitivity desk in Excel?

A sensitivity desk in Excel could be added utilizing the “Information Desk” perform beneath the “What-If Evaluation” instruments. You may then outline the row or column enter cell based mostly in your mannequin’s setup.

What’s a sensitivity desk?

A sensitivity desk, sometimes called a “what-if” desk, is a desk that exhibits how the outcomes of a mathematical mannequin change with completely different enter values. It’s a useful gizmo for understanding the influence of adjusting variables in a mannequin.

How do you present sensitivity in Excel?

Sensitivity in Excel is usually proven via information tables, charts, or graphs that clearly illustrate the influence of adjusting variables on the result of a mannequin.

What’s the sensitivity perform in Excel?

The sensitivity perform in Excel isn’t a particular instrument or formulation however refers to a spread of methods for performing sensitivity evaluation. These methods contain altering inputs to your mannequin and observing the influence on the output.

What Excel instrument is used for sensitivity evaluation?

Excel’s Information Desk, State of affairs Supervisor, and Aim Search capabilities are sometimes used for sensitivity evaluation. Nevertheless, extra advanced or detailed evaluation might require using Solver.

What’s the characteristic of sensitivity evaluation in Excel?

The important thing characteristic of sensitivity evaluation in Excel is the power to vary a number of enter variables to see how these modifications influence the output of your mannequin. This may also help you perceive which variables have essentially the most impact in your outcomes and the place your information could be most weak to vary.

What’s an instance of a sensitivity evaluation?

An instance of a sensitivity evaluation may very well be testing how modifications in rates of interest would have an effect on an organization’s internet current worth (NPV), or how modifications in value or amount bought would have an effect on an organization’s revenue.

What’s a sensitivity evaluation in projected monetary statements?

A sensitivity evaluation in projected monetary statements entails adjusting key variables similar to income development charge, price of products bought (COGS), and working bills to see how these modifications have an effect on the corporate’s future profitability.

Have any questions? Are there different subjects you prefer to us to cowl? Depart a remark beneath and tell us! Additionally, bear in mind to subscribe to our Publication to obtain unique monetary information in your inbox. Thanks for studying, and pleased studying!