Candlestick charts have been used for hundreds of years as a robust instrument in technical evaluation. They supply merchants with precious insights into market sentiment and worth motion. Probably the most well-known candlestick patterns is the Doji candle sample. On this information, we are going to delve into the intricacies of the Doji candle sample and discover varied methods to grasp its artwork in studying and buying and selling.

What’s the Doji Candle Sample?

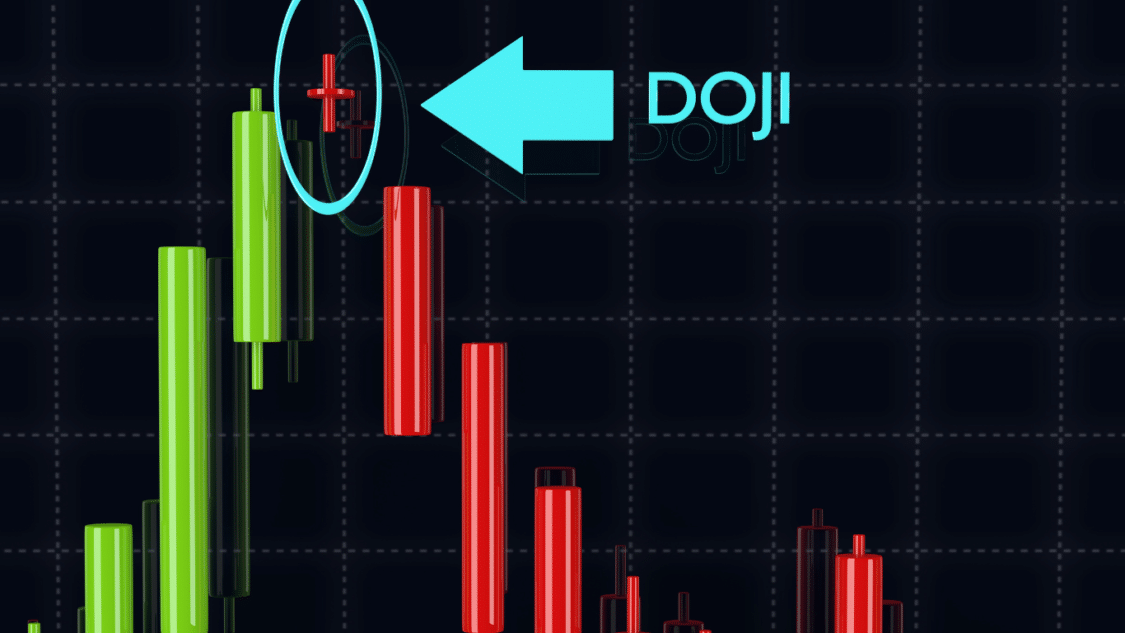

The Doji candle sample is characterised by its distinctive form, the place the opening and shutting costs are nearly the identical or very shut collectively. This leads to a small or nonexistent physique, with the higher and decrease shadows of equal or various lengths. The candle represents market indecision, signalling that consumers and sellers are in equilibrium.

The Doji candle sample holds vital significance on this planet of technical evaluation. It signifies a state of equilibrium between consumers and sellers, suggesting a possible development reversal or continuation. The Doji candle usually acts as a reversal sign when it seems after a protracted uptrend or downtrend. It implies the present development is shedding energy and {that a} reversal is inevitable.

Varieties of Doji Candles:

The Doji candle sample has a number of variations, every with its personal traits and implications. The most typical varieties embody the Customary Doji, the Lengthy-Legged Doji, the Headstone Doji, the 4 Value Doji and the Dragonfly Doji.

Customary Doji Sample

The usual Doji sample is a single candlestick that, by itself, supplies little info. To grasp its significance, merchants want to watch the prior worth motion main as much as it. An ordinary Doji could point out a continuation of the development in an uptrend. Nonetheless, it’s important to verify this via further analysis.

Lengthy-Legged Doji

The long-legged Doji is characterised by a extra vital extension of the vertical strains above and under the horizontal line. This means that the value motion skilled substantial fluctuations in the course of the timeframe however closed at an identical degree to the opening worth. The long-legged Doji represents a state of indecision between consumers and sellers.

An extended-legged Doji usually signifies a retracement after a powerful transfer in the other way. Merchants can interpret this as a possible change in course and look to enter a commerce within the course reverse to the retracement. For instance, if the Doji represents the highest of a retracement in a downtrend, merchants could take into account shorting the asset on the opening of the following candle after the Doji. Inserting the cease loss on the high of the higher wick on the long-legged Doji may also help handle threat.

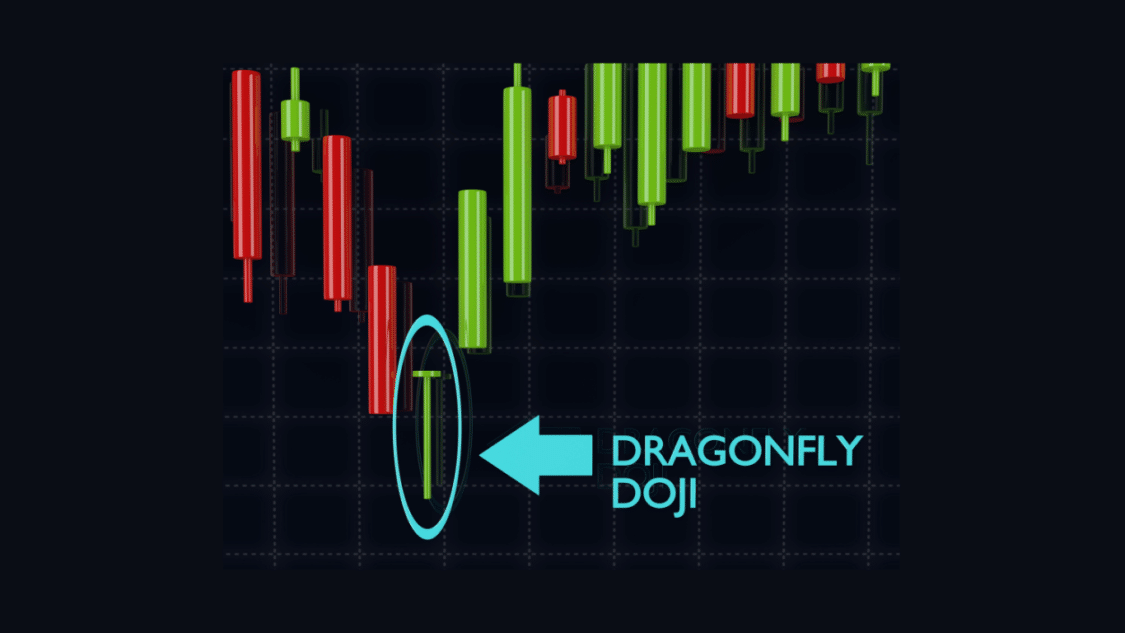

Dragonfly Doji

The Dragonfly Doji seems on the high or backside of a development. It’s characterised by a ‘T’ form, with no line above the horizontal bar. This means that costs didn’t transfer above the opening worth. When the Dragonfly Doji seems on the backside of a bearish transfer, with an prolonged decrease wick, it indicators a possible bullish reversal.

Merchants ought to pay shut consideration to the Dragonfly Doji because it suggests a shift in market sentiment. It signifies that consumers are stepping in and probably reversing the downtrend. Affirmation is a crucial step earlier than getting into a commerce via this sample.

Headstone Doji

The Headstone Doji kinds when opening and shutting costs are on the decrease finish of the buying and selling vary, which is the alternative of the Dragonfly Doji. It signifies a bearish sign, indicating that consumers couldn’t maintain the bullish momentum. The Headstone Doji usually seems on the high of an uptrend, suggesting a probable reversal.

When merchants encounter a Headstone Doji, they need to be cautious in regards to the potential of a development reversal. It signifies that sellers may be gaining management and pushing the value down. To substantiate the reversal, merchants can analyze further indicators and worth motion.

4 Value Doji

The 4 Value Doji is the distinctive sample on this listing. It represents the final word market indecision, characterised by a horizontal line with no vertical strains above or under it. The excessive, low, open, and shut costs are an identical, signifying excessive uncertainty or a extremely quiet market.

Merchants ought to be cautious when encountering a 4 Value Doji, because it means that neither consumers nor sellers management the market. It signifies a state of equilibrium and sometimes precedes vital worth actions. Extra evaluation and affirmation are important earlier than buying and selling primarily based on this sample.

Components to Contemplate:

When buying and selling the Doji candle sample, take into account the next elements that may affect its significance.

- Firstly, the context by which the Doji candle seems is essential. If it happens after a powerful uptrend or downtrend, it carries extra weight and is prone to be a big reversal sign.

- Secondly, the quantity in the course of the formation of the Doji candle is essential. Increased quantity strengthens the validity of the sample.

- Lastly, analysing the general market circumstances and different technical indicators is essential to verify the Doji candle’s implications.

How you can Commerce the Doji Candlestick?

Buying and selling this requires a scientific method and a eager understanding of market dynamics. One standard technique is to attend for affirmation after the looks of a Doji candle. This could be a subsequent candle closing in the other way or a breakout above or under the Doji’s excessive or low. One other technique is to make use of the Doji candle as a sign to exit an current place or tighten stop-loss orders. This ensures that merchants shield their earnings or restrict potential losses.

Doji Star Sample:

The Doji star sample is a variation of the Doji candle sample that’s significantly vital in figuring out potential development reversals. It consists of a Doji candle adopted by a bigger candle that gaps in the other way. This sample signifies a sudden shift in market sentiment and sometimes precedes a considerable worth transfer. Merchants can use the Doji star sample to enter new positions or shut current ones.

Dragonfly Doji in Pattern Buying and selling:

The Dragonfly Doji is a bullish variation of the Doji candle sample. It’s characterised by a protracted decrease shadow and a nonexistent or very small higher shadow. This sample normally happens on the backside of a downtrend and suggests a possible development reversal. Merchants can use the Dragonfly Doji as a sign to enter lengthy positions or as affirmation to carry onto current lengthy positions.

Double Doji Technique:

The Double Doji technique is a robust approach that mixes two consecutive candles to establish potential development reversals. This technique requires endurance and cautious statement. When two Doji candles seem consecutively, it signifies a chronic interval of indecision out there. Merchants can use this sample to anticipate a big worth transfer and place themselves accordingly.

Errors to Keep away from:

Whereas buying and selling the Doji candle sample, keep away from these frequent errors that may result in potential losses. One frequent mistake is to rely solely on the Doji candle with out contemplating different technical indicators or market circumstances. Utilizing this candle as a part of an intricate buying and selling technique is important. One other mistake is getting into trades instantly after a Doji candle’s look with out awaiting affirmation. Persistence and affirmation are key to profitable buying and selling utilizing the Doji candle sample.

How do you learn a doji sample?

To grasp the artwork of studying and buying and selling the Doji sample, it’s important to develop sure strategies. Firstly, follow observing and figuring out totally different variations of the Doji candle sample on historic charts. It will assist prepare your eyes to identify these patterns in real-time buying and selling. Secondly, research the connection between the Doji candle sample and different technical indicators, reminiscent of transferring averages or help and resistance ranges. It will present a extra complete understanding of market dynamics and improve the accuracy of your trades.

Is a doji and spinning high candle the identical factor?

A doji and a spinning high candle should not the identical. Though they share the similarity of being an indecision candle, additionally they present a stability between consumers and sellers. They’ve some variations of their form and significance.

The open and shutting costs are the identical or very shut when a candle is doji, which has a small physique or none. The truth that the higher and decrease shadows are lengthy or equal signifies that the value moved broadly in each instructions earlier than settling near the open. Relying on the context and affirmation, a doji can recommend a development reversal or continuation and denotes a state of equilibrium or neutrality out there.

A spinning high candle has a broader physique than a doji, indicating that the open and shutting costs differ considerably. Moreover, it accommodates in depth higher and decrease shadows, indicating that the session noticed a number of worth volatility. Relying on the context and affirmation, a spinning high candle may signify a state of market uncertainty or a development reversal or continuance.

The first distinction between a doji and a spinning high is {that a} doji exhibits that the market is totally balanced, whereas a spinning high signifies some imbalance or uncertainty. A doji, versus a spinning high, signifies that the market is prepared for a shift and that the prior development has misplaced tempo. A spinning high signifies that the prior development nonetheless has some energy and that the market is just not but prepared to show and is extra prone to sign a continuation than a doji.

Conclusion:

The Doji sample is a robust technical evaluation instrument that gives important insights into market sentiment and potential development reversals. By understanding the various kinds of Doji candles and their implications, merchants could make knowledgeable choices and enhance their buying and selling outcomes. Nonetheless, it’s important to think about varied elements, keep away from frequent errors, and develop efficient strategies to commerce the Doji sample efficiently. With follow and expertise, mastering the artwork of studying and buying and selling the Doji candle sample can develop into a precious talent for any dealer.