American Specific has rewards bank cards with beneficiant welcome presents and worthwhile advantages. Though Amex does not impose a tough rule like Chase’s 5/24, the issuer is pretty restrictive concerning utility guidelines and lifelong limitations on their playing cards.

Not solely does American Specific restrict the variety of playing cards you’ll be able to have and the way usually you’ll be able to apply, nevertheless it additionally tries to make sure that candidates are solely eligible for one welcome supply per lifetime on every of their card choices. This makes it essential to rigorously select if you apply for a brand new Amex card, as doing so could disqualify you from receiving a fair greater welcome supply sooner or later.

And, because the second half of 2023, Amex has rolled out new restrictions to discourage these holding extra premium playing cards from incomes welcome presents on lower-tier playing cards.

This is what it is advisable find out about Amex’s one-welcome-bonus-per-lifetime coverage.

What’s the Amex once-per-lifetime rule?

Greater than a decade in the past, American Specific would assist you to earn welcome presents on the very same card a number of instances. Nevertheless, since 2014, the issuer has clamped down on purposes and restricted prospects to 1 bonus per card per lifetime, no matter how a lot time had handed since they final utilized for that card.

In different phrases, you’ll be able to apply for The Platinum Card® from American Specific and earn a welcome supply as soon as and solely as soon as. In the event you open the supply particulars hyperlink on the cardboard’s utility web page, you will see the next language:

“Welcome supply not obtainable to candidates who’ve or have had this Card or earlier variations of the Platinum Card.”

The present bonus on the cardboard is a beneficiant 80,000 Membership Rewards Factors after you spend $8,000 on purchases inside the first six months of card membership. Nevertheless, you may be focused for the next welcome supply by way of the CardMatch device (supply topic to alter at any time). Consequently, should you apply for the 80,000-point supply and obtain the next one at a later date, you will nearly definitely be ineligible for it.

New card household restrictions

An growth to the once-per-lifetime rule is being rolled out throughout some households of Amex bank cards. In easy phrases, Amex will most probably disqualify you from receiving the welcome supply on lower-tier playing cards should you’ve beforehand held the higher-tier playing cards inside the similar card household.

Amex appears to be progressively rolling this out to extra merchandise to forestall individuals who maintain higher-tier playing cards from making use of for lower-tier playing cards in the identical household only for the welcome supply.

Each day Publication

Reward your inbox with the TPG Each day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

The newest addition to this record is the American Specific® Inexperienced Card. As of February 2024, the welcome supply eligibility phrases now state:

“You might not be eligible to obtain a welcome supply you probably have or have had this Card, the Platinum Card®, the Platinum Card® from American Specific Completely for Morgan Stanley, the Platinum Card® from American Specific Completely for Charles Schwab, the American Specific® Gold Card or earlier variations of those Playing cards.”

Equally, in October 2023, American Specific launched a restriction on the American Specific® Gold Card. In the event you’ve had the costlier Amex Platinum card, you will not be eligible for the welcome supply on the Gold card.

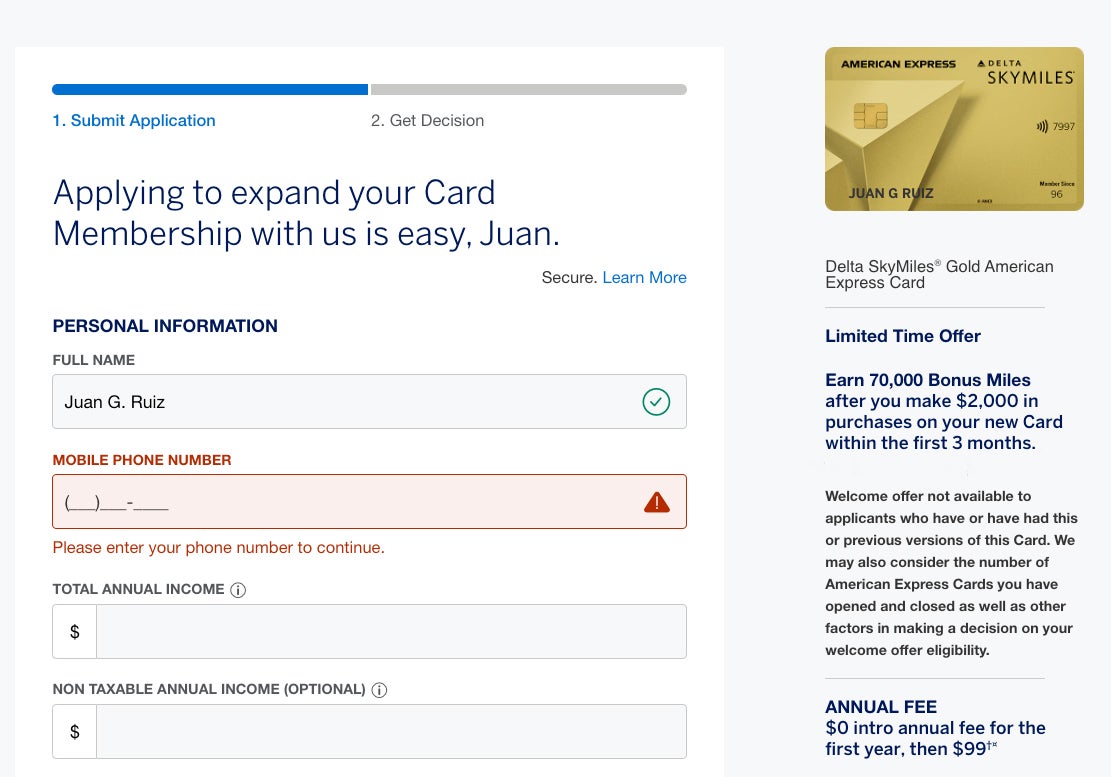

And in September 2023, American Specific launched a household rule on private Delta bank cards. For instance, one of many strictest household guidelines will be discovered on the no-annual-fee (see charges and costs) Delta SkyMiles® Blue American Specific Card: You might not be eligible to obtain a welcome supply you probably have or have had the Delta SkyMiles® Gold American Specific Card, the Delta SkyMiles® Platinum American Specific Card, the Delta SkyMiles® Reserve American Specific Card or earlier variations of those playing cards.

The knowledge for the Amex Inexperienced, Amex Platinum Completely for Morgan Stanley and Amex Platinum Completely for Charles Schwab playing cards has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Caveats

There have been stories of individuals getting accepted and incomes the welcome supply once more a number of years later. Moreover, you could be accepted for the bonus if the supply phrases do not embody the above language about beforehand having the cardboard.

Lastly, American Specific provides you a warning as a part of its on-line card utility course of. If Amex deems you aren’t certified for the cardboard’s welcome supply, you’ll possible see a pop-up field stating so.

Basically, although, the issuer’s one-bonus-per-lifetime rule was carried out to discourage candidates from making use of for Amex playing cards solely for the welcome bonuses.

Associated: Selecting the perfect American Specific bank card for you

What playing cards are affected by this rule?

This rule covers all of Amex’s playing cards. American Specific maintains a strict rule of 1 bonus per card for all times whatever the household of playing cards (cobranded lodge and airline, enterprise, cash-back and rewards playing cards).

Though this rule covers all Amex playing cards, you’ll be able to earn a welcome supply on private and enterprise playing cards of the identical sort.

For instance, the American Specific® Gold Card and American Specific® Enterprise Gold Card are from the identical card household, however one is a private card and the opposite a enterprise card. Amex lets you earn the welcome supply for every card — so long as you have got by no means been a cardholder of that card prior to now.

Be aware that this additionally applies to rebranded or up to date playing cards. For a few years, the Amex Gold was referred to as the Premier Rewards Gold Card, and the present supply — 60,000 factors after you spend $6,000 on purchases in your new card in your first six months of card membership — explicitly references that older product:

“Welcome supply not obtainable to candidates who’ve or have had this Card or the Premier Rewards Gold Card.”

Associated: Bank card showdown: Amex Gold vs. Amex Enterprise Gold

What number of Amex playing cards can I’ve?

Formally, American Specific doesn’t have a cap on the variety of playing cards you’ll be able to have. Nevertheless, the unofficial coverage from Amex says that almost all cardmembers will probably be restricted to at most 5 Amex shopper and enterprise bank cards. They will even be restricted to 10 Amex playing cards with no preset spending restrict (previously often known as cost playing cards). This latter class consists of the Amex Gold and Amex Platinum.

For instance, TPG director of content material Nick Ewen has the next American Specific playing cards presently open:

The knowledge for the Hilton Honors Aspire has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Since 5 of the seven are bank cards, he has reached his cap on bank cards with Amex.

Associated: Chase’s 5/24 rule: All the pieces it is advisable know

How do I do know if I qualify for an Amex welcome supply?

Monitoring which Amex playing cards you have got utilized for prior to now offers you a greater concept if you’re eligible for a sure card’s welcome bonus or not. In case your organizational expertise aren’t as much as par, do not fret — American Specific has a welcome bonus qualification device to warn candidates if they’re ineligible for one. This is the way it works:

If you apply for an American Specific card that you have already had prior to now, you will obtain the next message earlier than your credit score is pulled:

As a result of you have got or have had The Platinum Card, you aren’t eligible to obtain the welcome supply.

We now have not but carried out a credit score examine. Would you continue to prefer to proceed?

In essence, should you suppose you had a card earlier than and thus usually are not certain should you’re eligible for the welcome supply, Amex ought to provide you with a warning with a pop-up message if you apply.

There’s a attainable exception to the rule for Amex welcome presents. Sometimes, you will see the verbiage famous above on the touchdown web page of an utility:

Welcome supply not obtainable to candidates who’ve or have had this Card.

In case your card utility doesn’t embody this restrictive language, however you have got had the cardboard prior to now, this might imply that you have been focused for the cardboard by American Specific and are eligible for the supply. Verify your e-mail for focused presents or log into your American Specific account and search for pre-approved presents with no lifetime language.

Simply double-check earlier than submitting your utility for the pop-up message by Amex alerting you if you’re ineligible for the welcome bonus. Taking a screenshot simply earlier than clicking apply can be a good suggestion. That would assist should you run into points receiving the bonus after you meet relevant spending necessities.

Different Amex welcome supply restrictions

Though American Specific has restricted welcome presents to 1 bonus per lifetime per card, cardholders can nonetheless apply and get accepted for a card with out the welcome supply. The language within the supply phrases highlights the ineligibility of the welcome supply, nevertheless it usually does not prohibit approval.

Nevertheless, it is also price declaring the extra verbiage from the above screenshot:

“We might also contemplate the variety of American Specific Playing cards you have got opened and closed in addition to different elements in making a choice in your welcome supply eligibility.”

This overly broad assertion retains Amex’s skill to make use of extra elements out of your credit score report and historical past with the issuer to find out should you qualify for a proposal. This should not affect most candidates — however should you’ve proven a sample of opening playing cards, incomes welcome bonuses after which canceling these playing cards after only one 12 months, that might be a purple flag.

Given the big selection of American Specific card choices and once-per-lifetime restrictions, you need to time your purposes strategically to make sure you get the very best attainable welcome bonus. Remember to examine the CardMatch device to know should you qualify for a attainable focused as much as 150,000 Membership Reward factors on the private model of the Amex Platinum and a 75,000-point focused supply on the Amex Gold (presents topic to alter at any time).

Associated: The final word information to bank card utility restrictions

Backside line

American Specific has a powerful portfolio of playing cards with beneficiant welcome presents for first-time candidates. Their once-per-lifetime rule, though restrictive, has sure exceptions which will enable prospects to earn a welcome supply once more after a while. Together with the welcome bonus qualification device, Amex makes it simple for candidates to trace and perceive their eligibility for welcome bonuses on American Specific playing cards.

Associated: Which is the perfect American Specific bank card for you?

For charges and costs of the Delta SkyMiles Amex Blue Card, click on right here.