The transient’s key findings are:

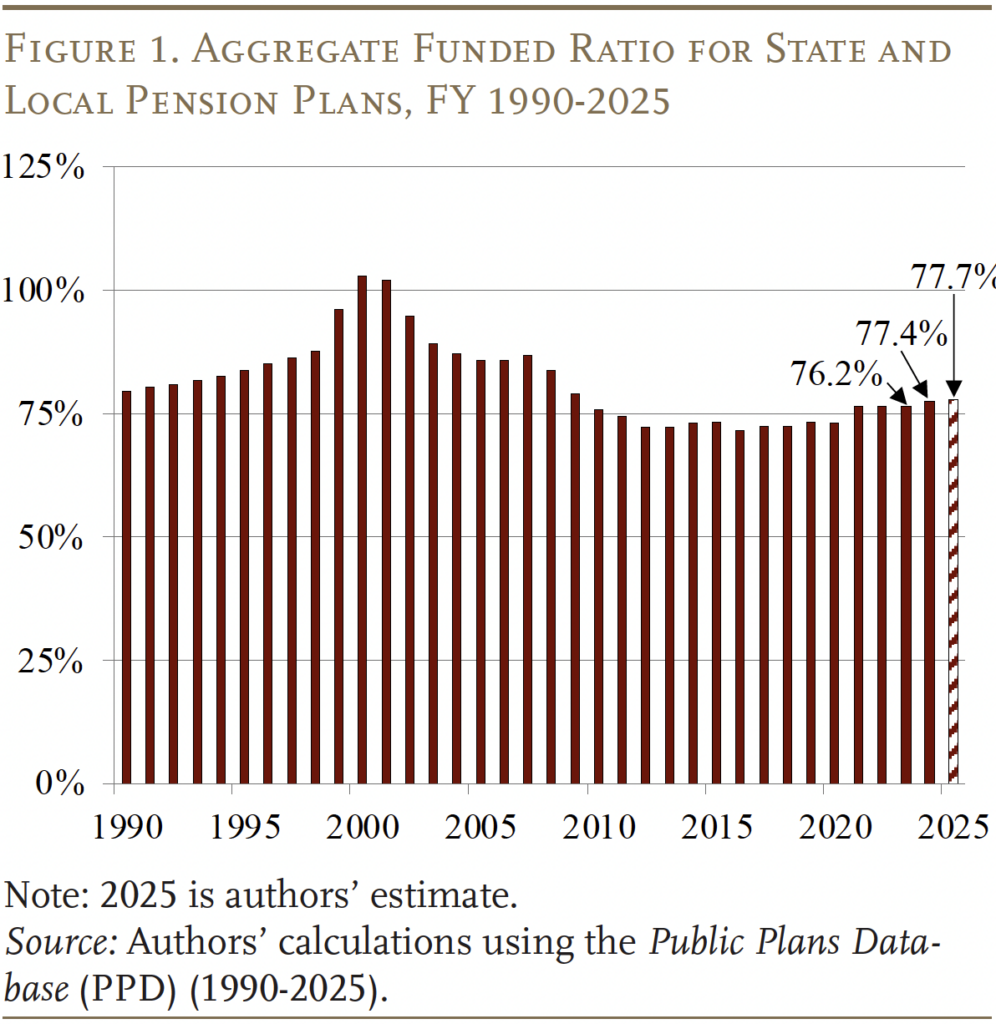

- The estimated ratio of pension property to promised advantages has elevated over the past two years by 1.5 proportion factors to 77.7 p.c.

- This improve displays a lift in property from increased contributions and strong returns, and the belief of profit cuts scheduled for brand new workers.

- The influence of those optimistic fundamentals is partially offset by: 1) unfavorable money flows related to maturing plans; and a pair of) fundamental progress in profit liabilities.

Introduction

The projected funded ratio for state and native pension plans in FY 2025 is 77.7 p.c, 1.5 proportion factors increased than 2023 – the date of our final funding replace. These positive aspects appear fairly modest, on condition that the S&P index elevated greater than 40 p.c between June 2023 and June 2025. Furthermore, as mentioned under, state and native governments have change into extra diligent of their procedures for funding their plans, and have more and more realized profit cuts enacted within the wake of the Nice Recession as “new hires” have changed departing workers.

This transient reviews the newest estimates within the funded standing of state and native pension plans. The dialogue proceeds as follows. The primary part exhibits that over the two-year interval of FY 2024 and FY 2025, the funded ratio elevated from 76.2 p.c to an estimated 77.7 p.c. The second part describes the optimistic development within the funding course of, such because the adoption of extra lifelike estimates of the actuarially required contribution and a continued improve within the chance of creating that contribution. The third part investigates the price facet of the equation, which exhibits how the rising share of latest hires – and the profit cuts related to this group – has checked the expansion in liabilities. The fourth part explores why, regardless of a variety of optimistic developments, the positive aspects within the funded ratio have been so modest.

The ultimate part concludes that the gradual enchancment within the funded standing of state and native pensions displays positive aspects within the fundamentals because of insurance policies to each enhance plan funding and gradual the expansion in liabilities. However, even when governments proceed to contribute the total actuarially decided contribution and funding efficiency stays principally optimistic, enhancements in funded ratios as a consequence of two persistent options of pension funds will probably be modest – the annual progress of liabilities and the influence of unfavorable money flows, related to mature plans, on gathered property.

Funded Standing of Public Plans

As of July 2025, simply over half of the roughly 200 main state and native pension plans within the Public Plans Database (PPD) had reported their 2024 funded ranges. None had reported 2025 ranges. To explain the present standing of public plans, this evaluation makes plan-by-plan projections utilizing knowledge offered in every plan’s most lately launched reviews. Primarily based on the 2024 knowledge and projections for 2025, the combination actuarial funded ratio elevated about 1 proportion level in 2024 and about half a proportion level in 2025 (see Determine 1). Thus, regardless of the current progress within the inventory market, pension funded ratios have elevated solely barely over the past two-year interval.

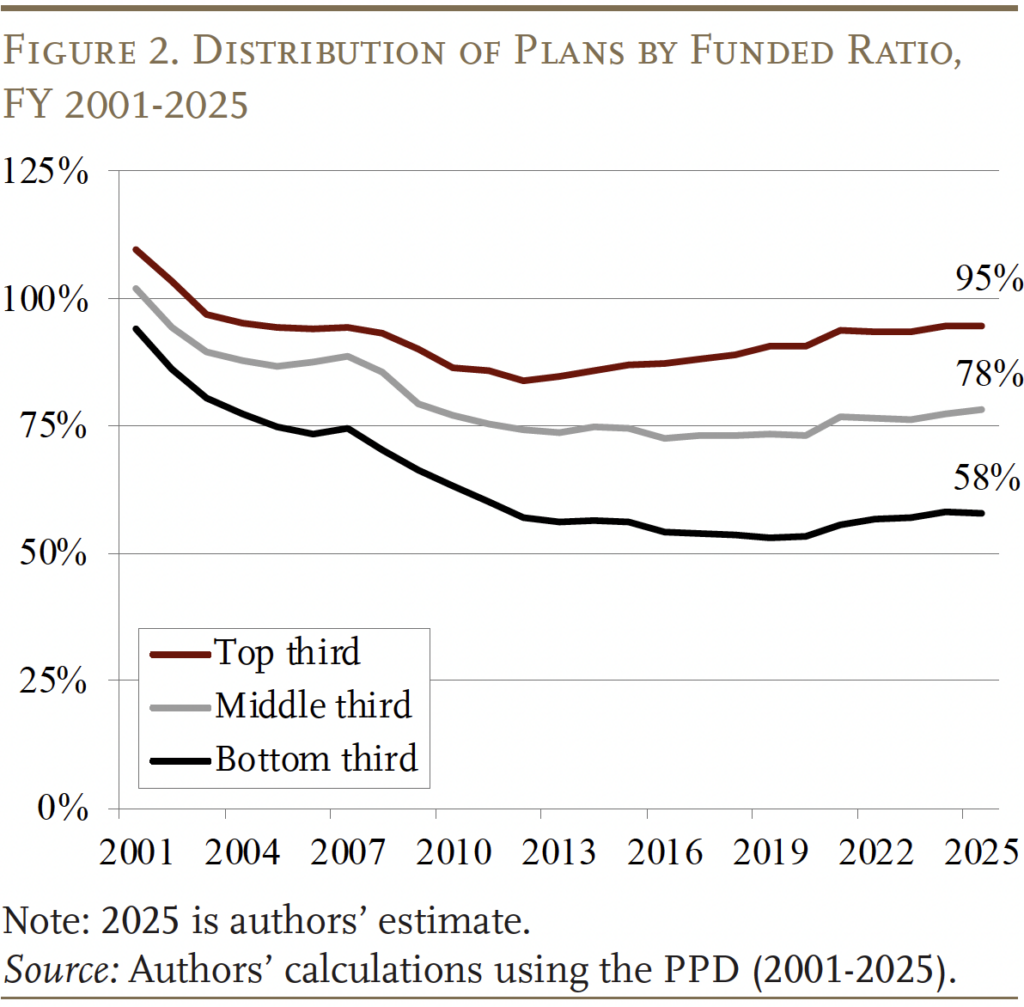

Whereas the combination funded ratio offers a helpful measure of the general public pension panorama at giant, it might probably additionally obscure variations in funding on the plan degree. Determine 2 separates the plans within the PPD into thirds based mostly on their present actuarial funded standing and tracks the combination funded standing for every group from 2001 to 2025. Importantly, every group has skilled a gradual improve in funded ratio since 2020, with the combination 2025 funded ratio being 58 p.c for the underside third, 78 p.c for the center third, and 95 p.c for the highest third.

The overall enchancment in funded standing might be ascribed to 2 optimistic developments: 1) plans are change into extra lifelike about defining how a lot they should contribute and extra constant in paying that quantity; and a pair of) prices have been held in examine by reforms adopted within the wake of the Nice Recession, in addition to the gradual progress in employment.

Actuarial Contributions Have Develop into Extra Dependable

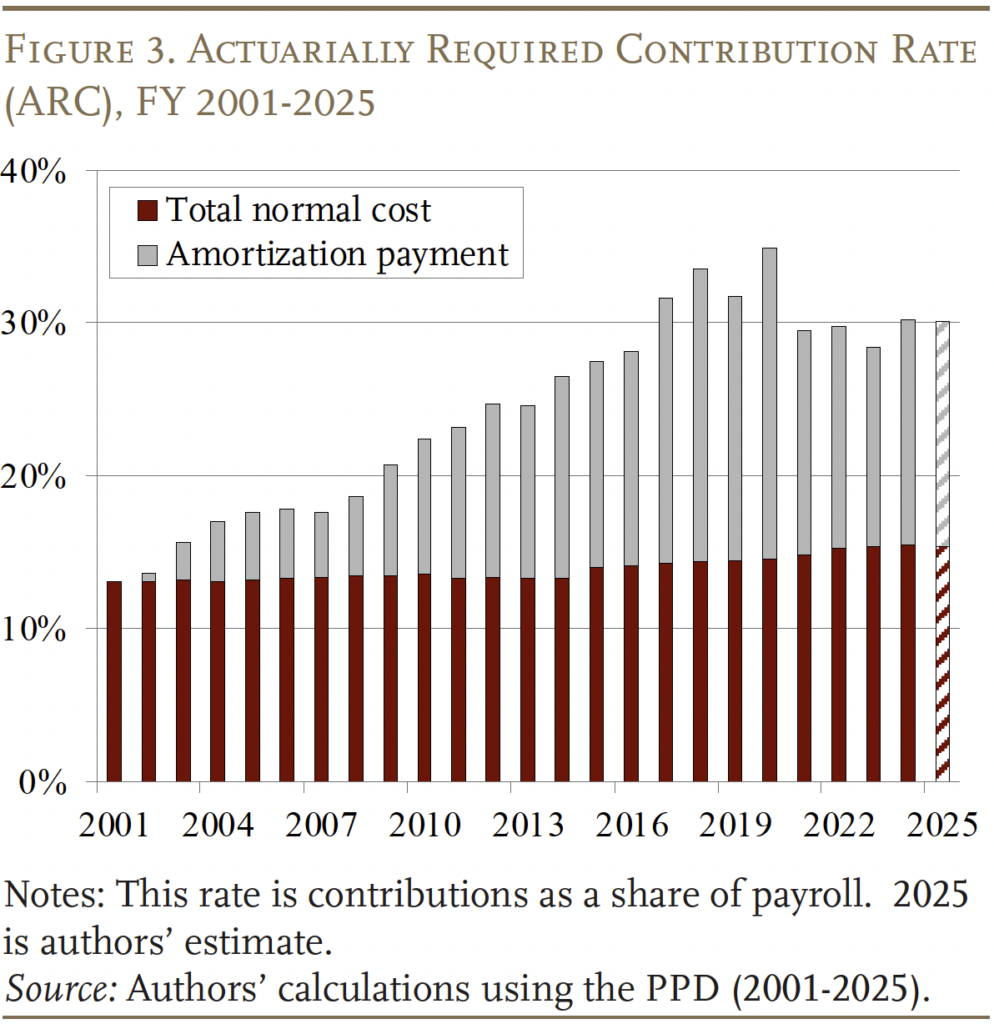

The actuarially required employer contribution charge – the speed required to maintain the plan on a gradual path towards full funding – seems to have stabilized round 30 p.c of payrolls (see Determine 3). Roughly half of those funds cowl the continued or “regular” value of this system and the opposite half goes to paying down the unfunded legal responsibility.

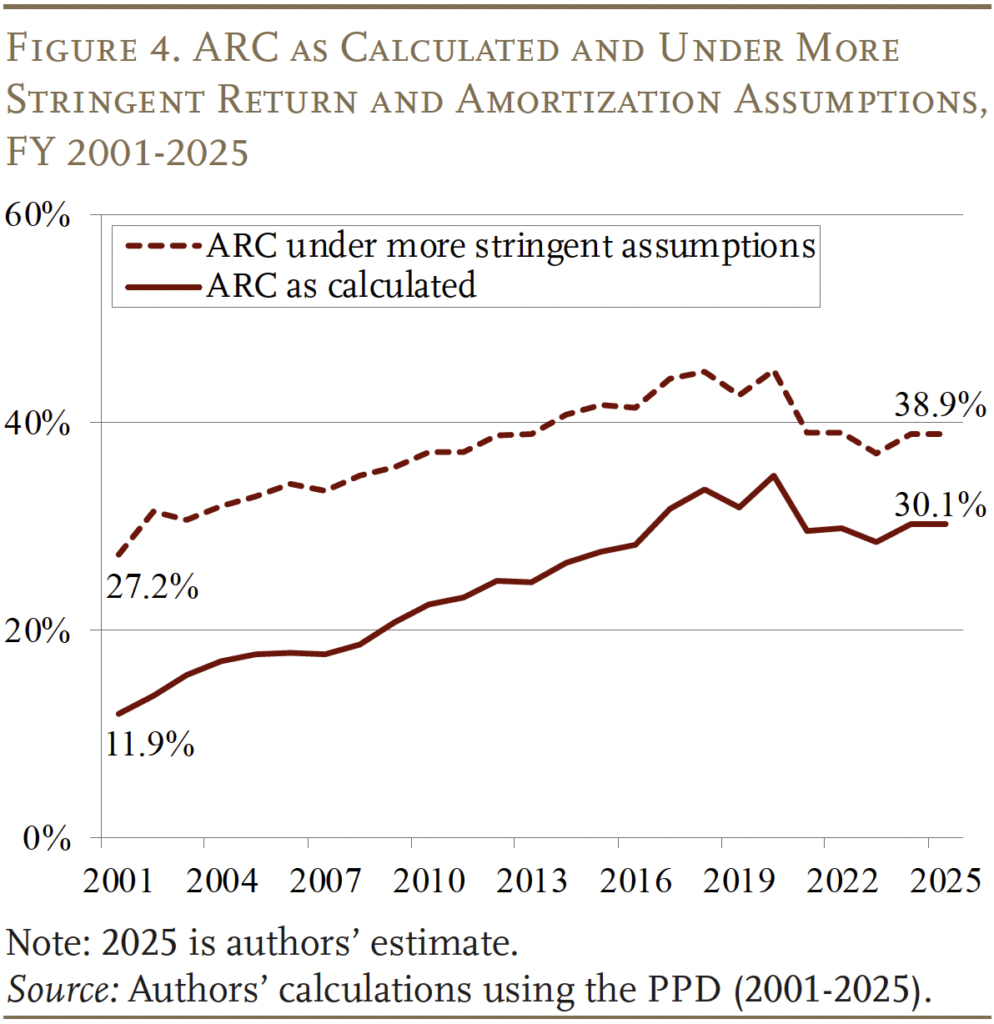

Many pension researchers (and a few practitioners) have questioned the adequacy of actuarially required contributions as they’re generally calculated. Critics spotlight the usage of overly optimistic funding return assumptions and comparatively lax strategies for amortizing the unfunded legal responsibility. If funding return assumptions extra carefully mirrored precise efficiency since 2001, and plans adopted extra stringent approaches to amortizing their unfunded liabilities, the common required contribution in 2025 would have been 39 p.c of payroll as an alternative of 30 p.c. You will need to be aware, nonetheless, the distinction between the precise required contribution and that underneath extra stringent assumptions has narrowed over time (see Determine 4). Two elements have contributed to the convergence of those measures – a gradual reducing of the assumed charge of return from 8.0 p.c in 2001 to six.9 p.c in 2024 and a extra speedy amortization of the plans’ unfunded liabilities.

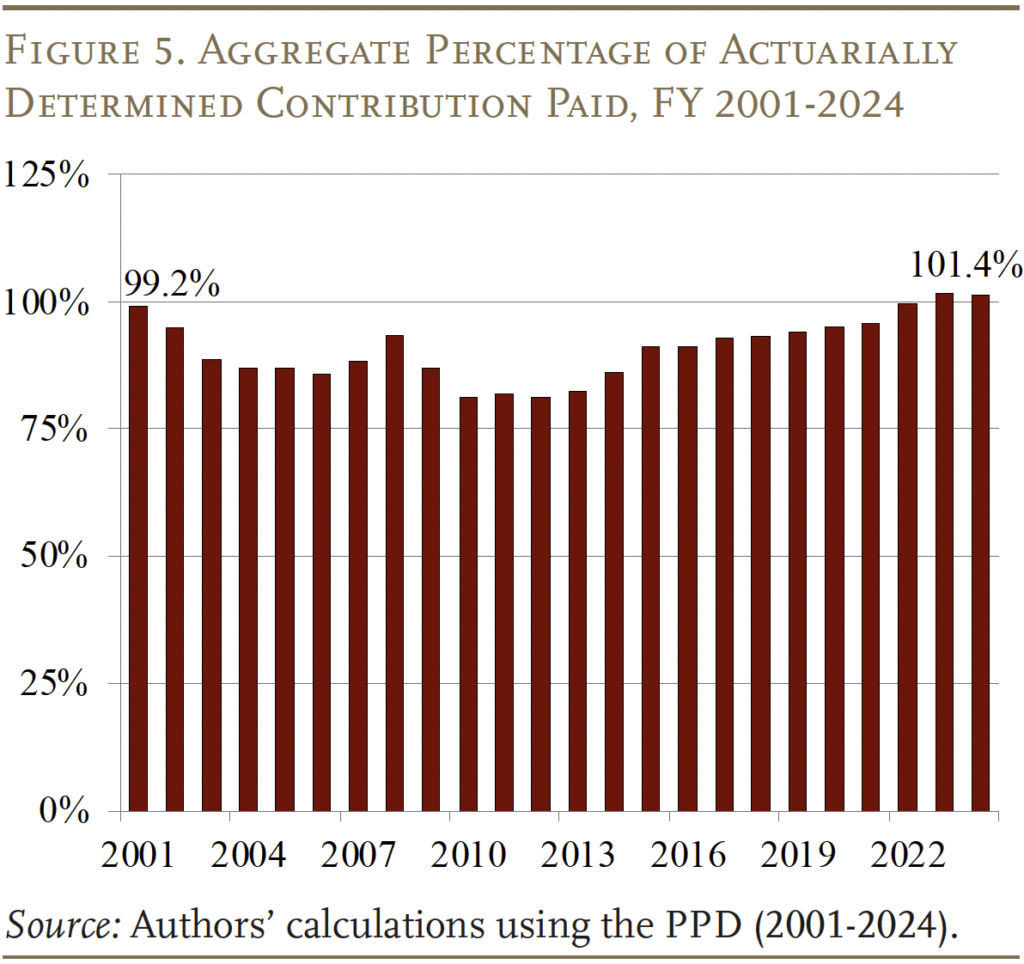

Along with the required contribution turning into extra lifelike, the combination proportion paid now exceeds 100% – above the extent earlier than the bursting of the dotcom bubble on the flip of the century (see Determine 5). And, at this level, greater than 80 p.c of plans are receiving the total actuarially decided contribution.

Profit Cuts Have More and more Taken Maintain

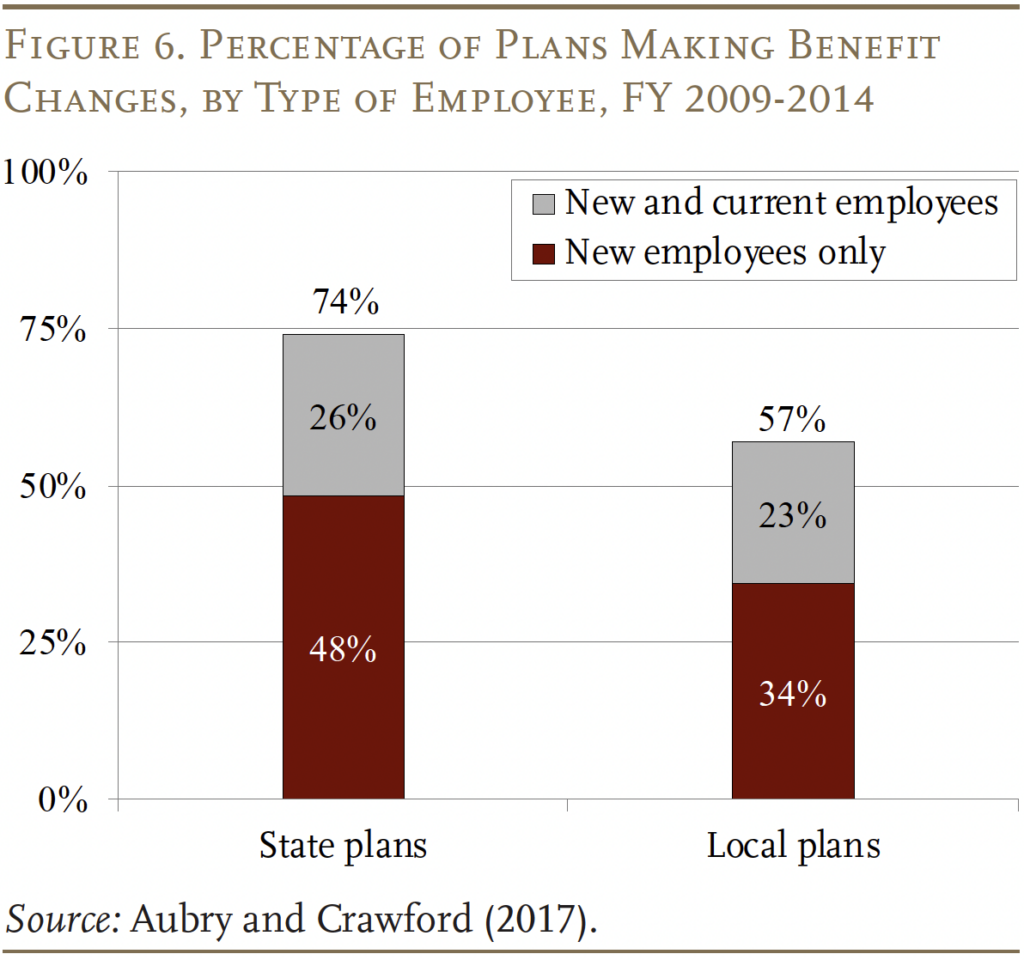

On the identical time that plans have change into extra accountable on the contribution facet, most of the profit cuts enacted within the wake of the Nice Recession have taken maintain as new hires substitute departing workers. Between 2009-2014, 74 p.c of state plans and 57 p.c of native plans made some sort of discount to their pension advantages. Provided that many states have authorized protections that constrain their skill to change advantages, nearly all of plans lowered advantages just for new workers, though about one-quarter additionally reduce advantages for present workers (see Determine 6).

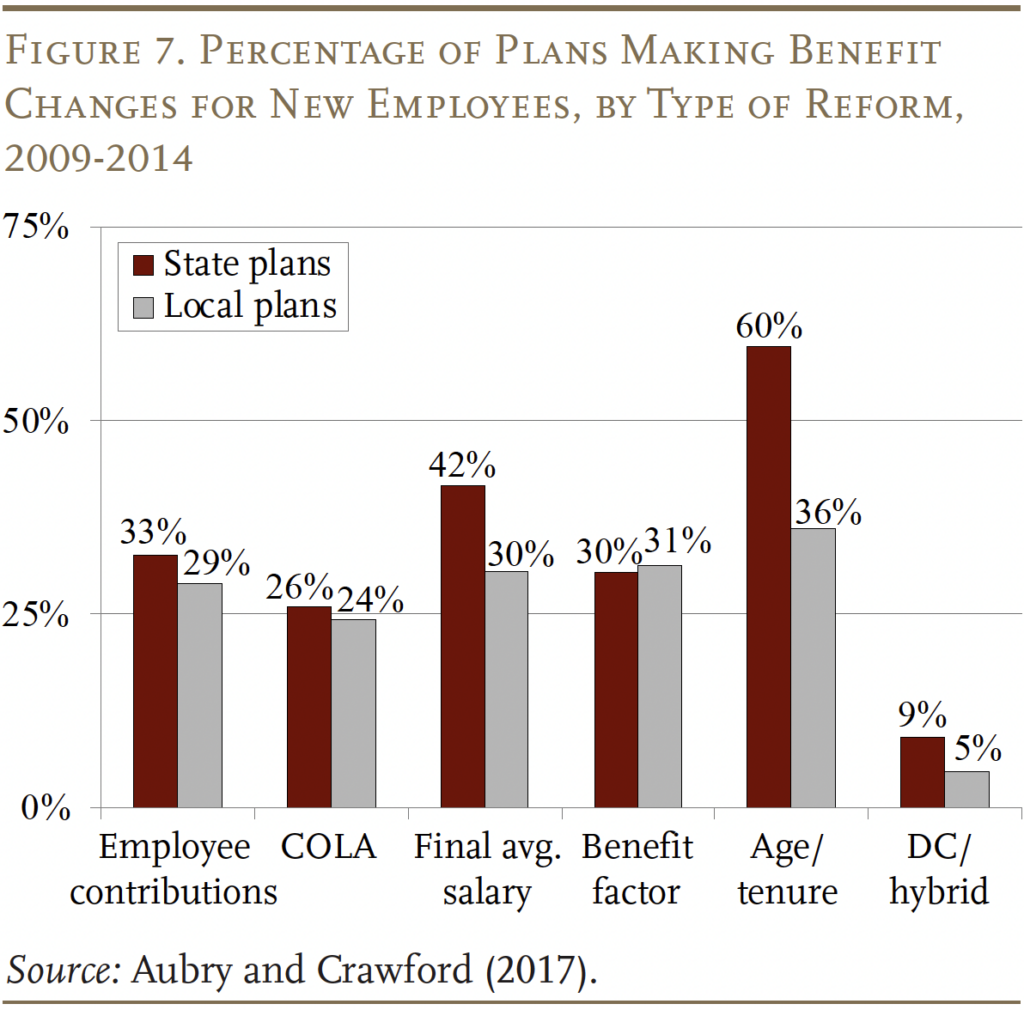

The commonest profit reductions for present workers had been will increase of their pension contributions and reductions to the cost-of-living adjustment (COLA). Whereas the rise in worker contributions does cut back an worker’s web pension profit, the prevalence of the reform prompt that it’s considered otherwise than direct reductions to advantages. When it comes to the COLA, our prior analysis revealed that, in lots of states, COLAs weren’t considered as “core” advantages and have much less safety underneath the legislation. Because of this, they seem simpler to chop than the profit issue, the ultimate common wage interval, or retirement age and tenure provisions.1

For brand spanking new workers, reductions to core advantages had been way more widespread (see Determine 7). The commonest change was to extend the age and tenure required to assert advantages. The following most prevalent modifications had been to elongate the interval used to calculate last common wage, improve worker contributions, and cut back the profit issue. Apparently, native plans are a lot much less more likely to improve age and tenure necessities than state plans. A doable clarification is that the majority police and fireplace plans are administered on the native degree, and their worker unions are significantly delicate to altering retirement ages.

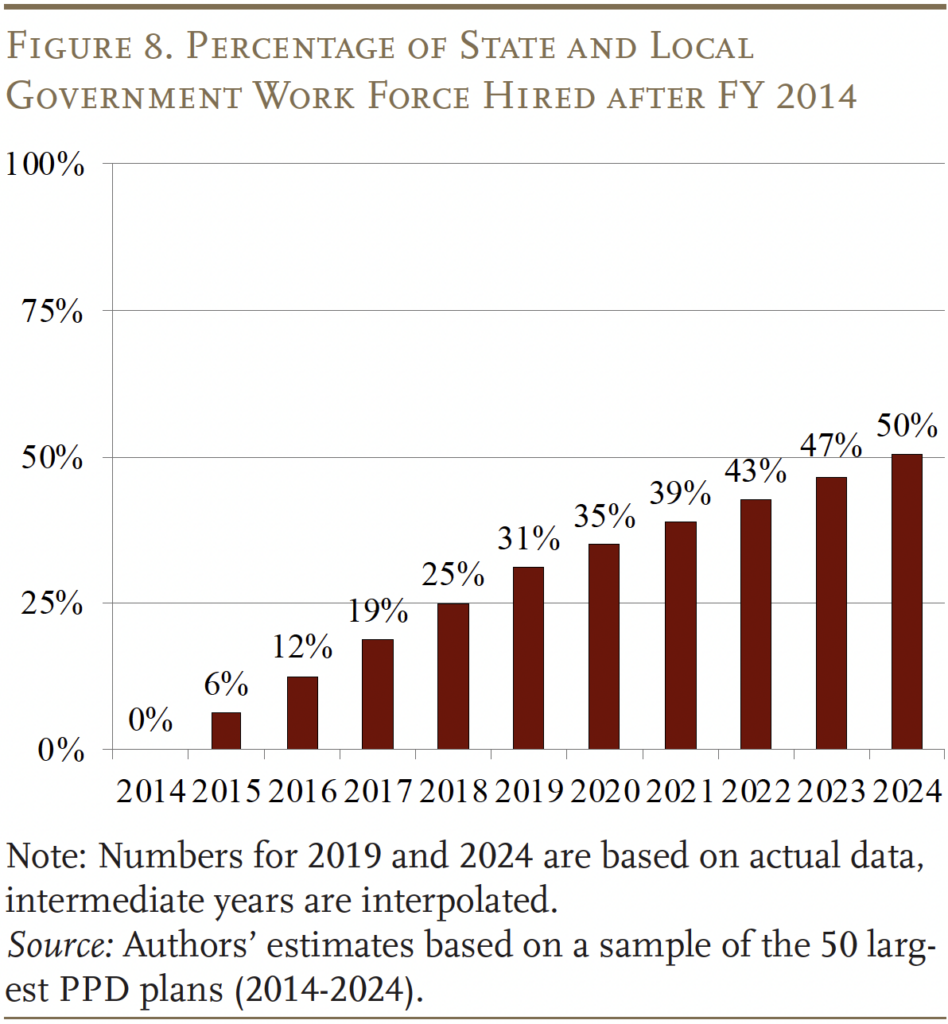

The influence of cuts for brand new hires relies upon crucially on the turnover in public plans. Since 2014, new hires – outlined as workers employed after 2014 – as a share of the workforce have gone from zero to 50 p.c (see Determine 8). Because the cuts made within the wake of the Nice Recession take maintain, the price per worker declines.

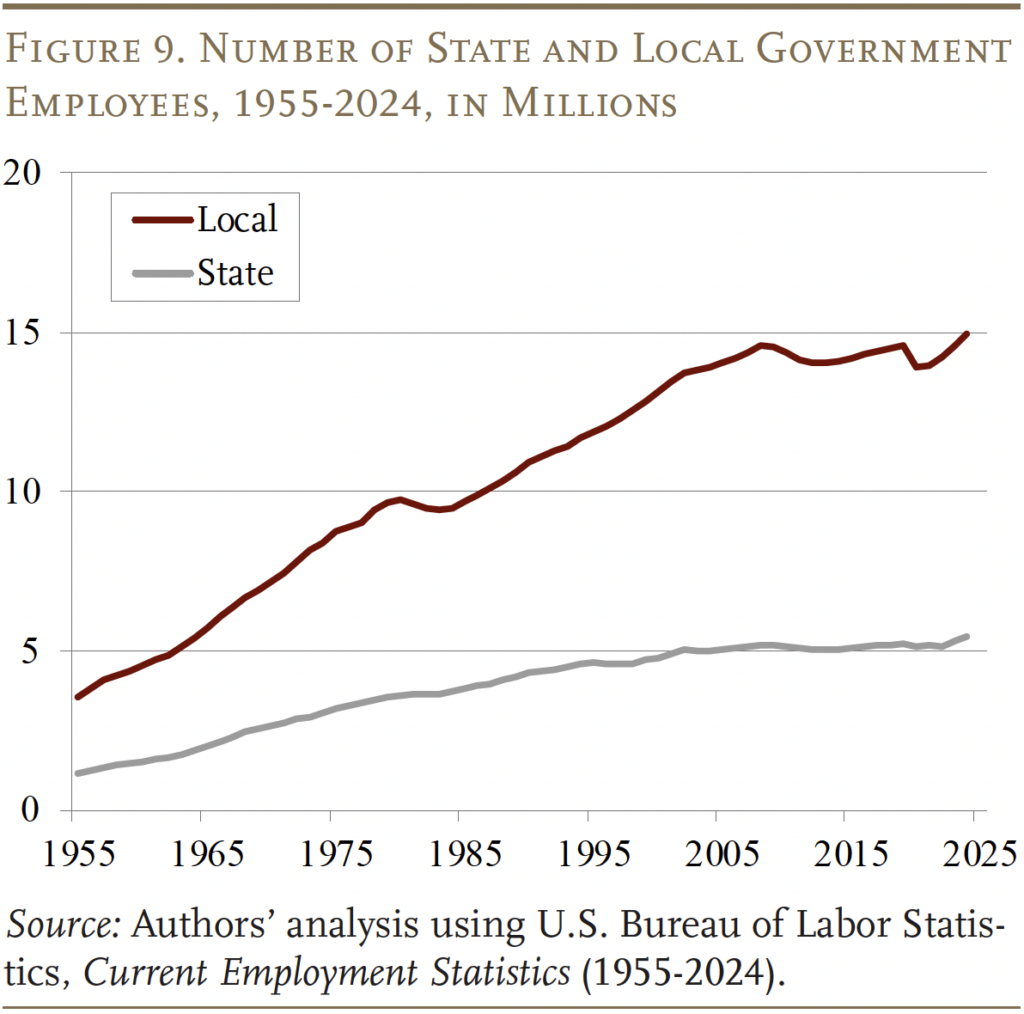

On the identical time, employment within the public sector has stabilized (see Determine 9).

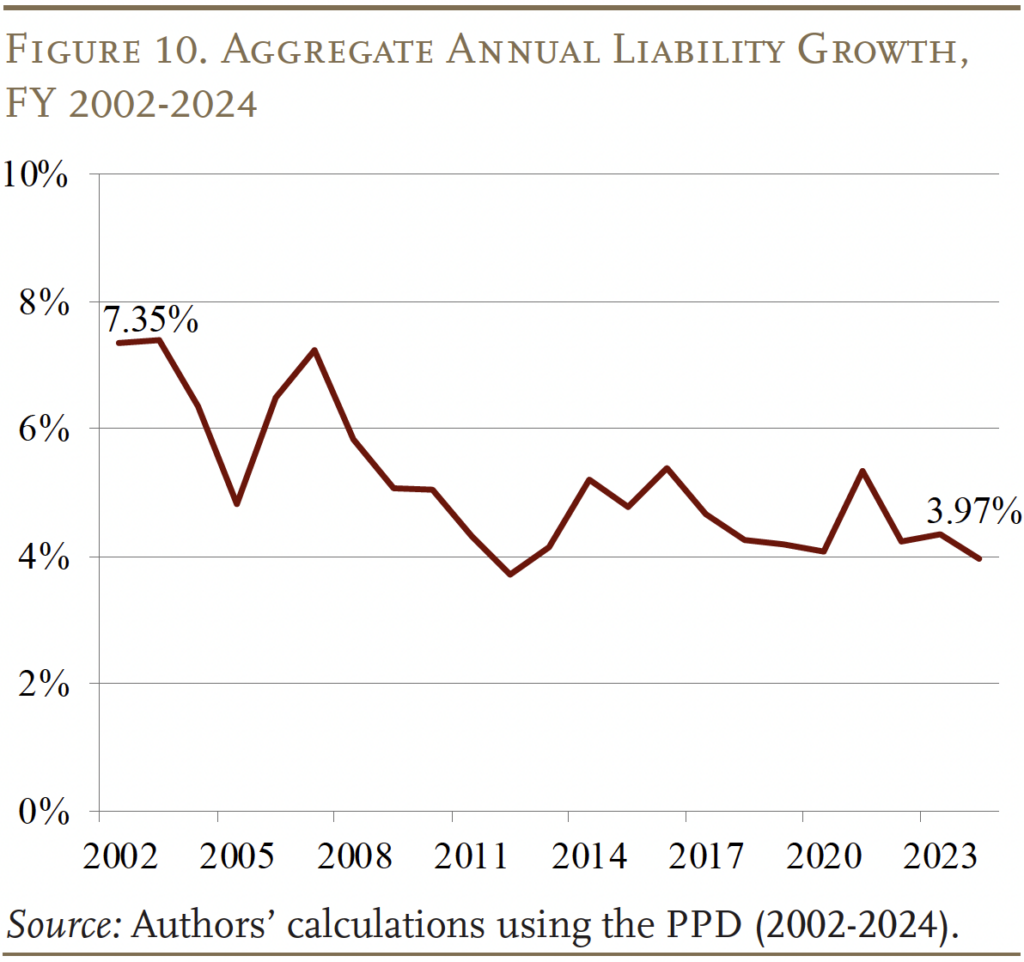

The mixture of profit reductions and stabilizing employment has considerably slowed the annual progress of liabilities. At present, liabilities are rising at about 4 p.c annually – roughly half the speed seen on the flip of the century (see Determine 10).

Why Was Enchancment in Funding So Modest?

So, the query is why has the funded ratio grown so modestly since FY 2023 when the inventory market has risen over 40 p.c, plans have been making their full contributions, and legal responsibility progress has stabilized at a comparatively low clip? The reply is that modifications within the funded ratio are decided by the expansion in property relative to the expansion in liabilities. As proven above, liabilities have been rising at their comparatively low stabilized charge of about 4 p.c since 2023 – leading to 8-percent progress in liabilities over the past two years. So, for the funded ratio to enhance over that interval, property should develop by greater than 8 p.c.

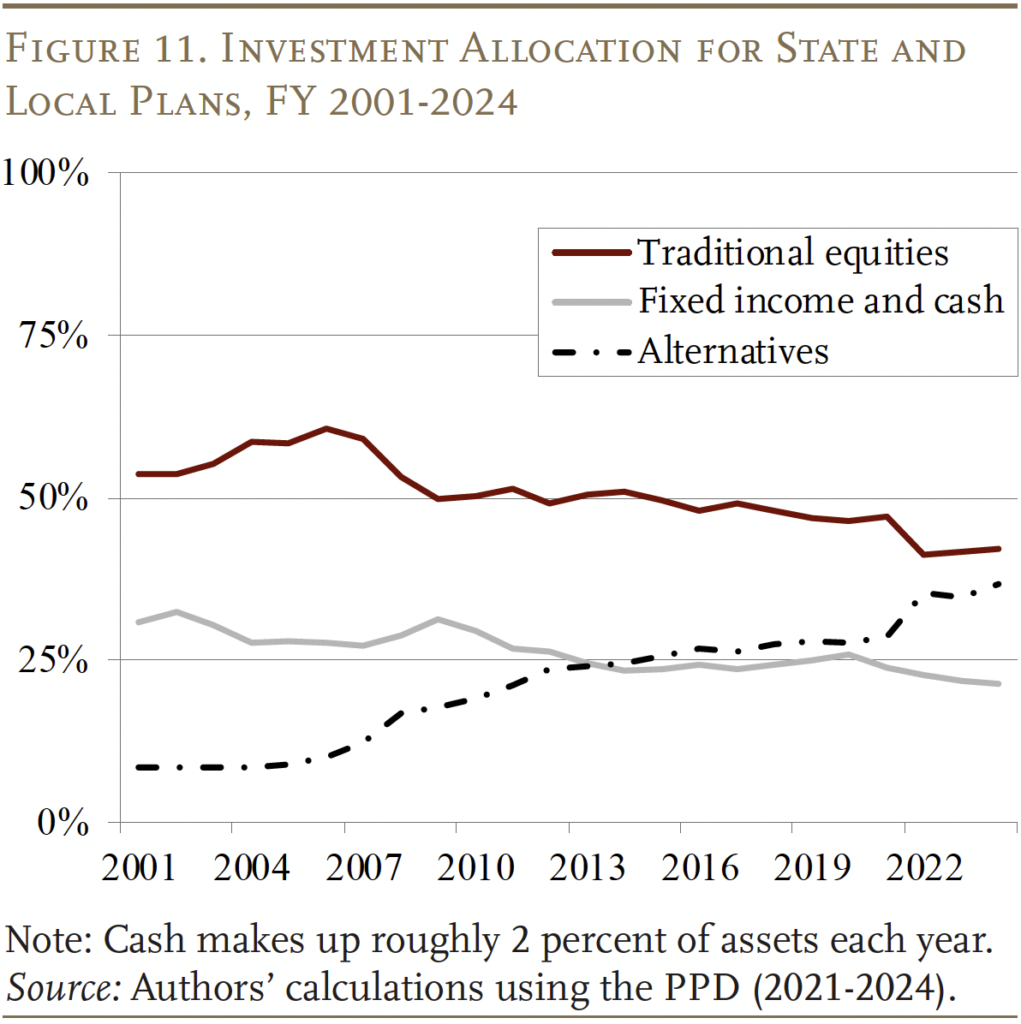

The change in property is attributable to 2 parts: funding returns and money flows (contributions minus advantages). Though the inventory market grew by greater than 40 p.c from 2023 to 2025, pension funds solely earned a 15-percent return on their property over that interval, as a result of: 1) about one-quarter of property are invested in fastened revenue securities; and a pair of) a sizeable share is in various property similar to actual property which have struggled within the increased interest-rate surroundings (see Determine 11). Whereas issues stay relating to the long-term utility of the pension fund’s complicated funding strategy, their funding efficiency over the past two years has each exceeded their anticipated return and been roughly akin to the efficiency of a easy 60/40 inventory and bond index.2

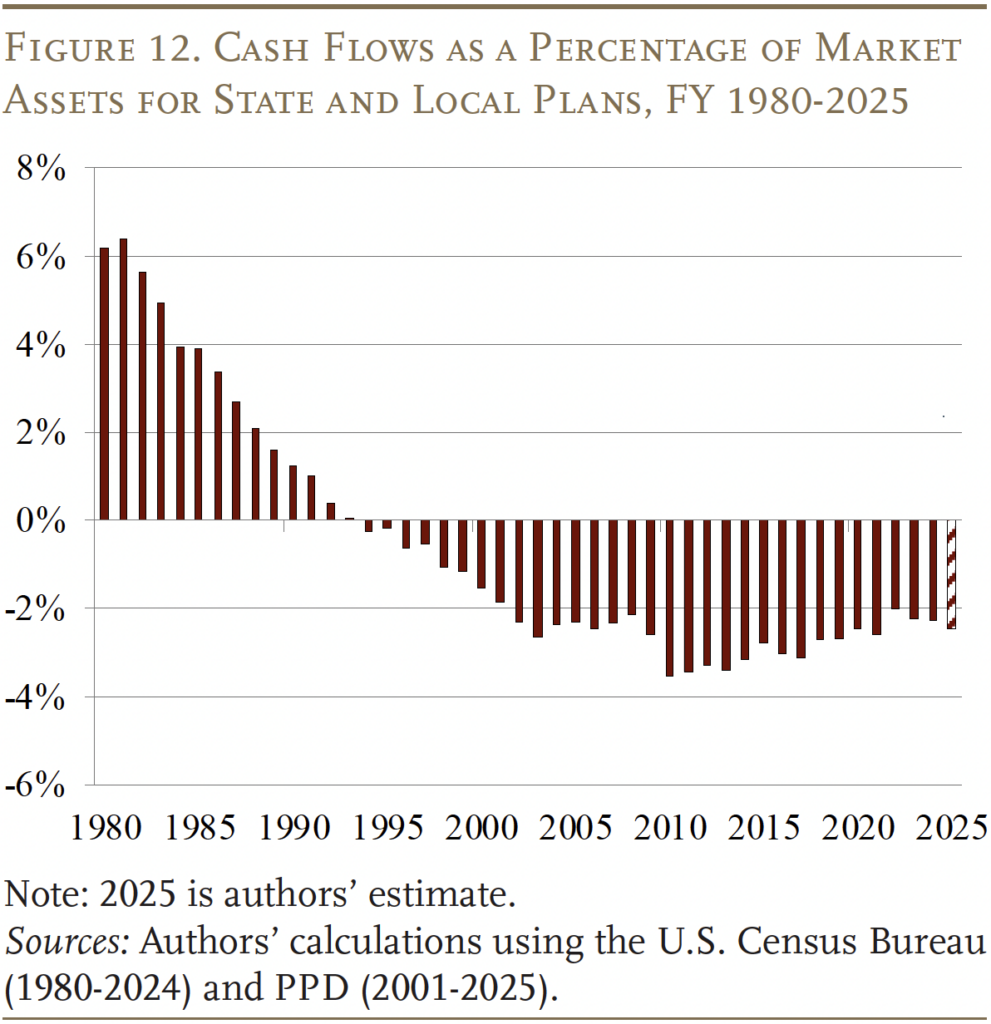

Though pension funds’ current funding efficiency has been satisfactory, most public sector retirement programs are extraordinarily mature, which suggests they face important profit funds to retirees annually. So, although pension funds obtain the total actuarially required contribution, they nonetheless expertise unfavorable web money flows of about 2 p.c of property annually (see Determine 12). Over the two-year interval since FY 2023, these unfavorable money flows cut back the expansion of property from 15 p.c to 11 p.c.

Ultimately, the roughly 11-percent progress in property since 2023 was increased than the roughly 8-percent progress in liabilities over that very same interval, and ample to extend the funded ratio by 1.5 proportion factors – from 76.2 to 77.7 p.c.

Conclusion

The gradual enchancment within the funded standing of state and native pensions displays positive aspects within the fundamentals. These positive aspects embrace extra stringent calculations of actuarially required contributions and the elevated chance of really making the fee, in addition to the continued impact of profit cuts launched after the Nice Recession and the implementation of additional cuts as new hires substitute outdated workers. However, even when governments proceed to contribute the total actuarially required contribution and funding efficiency stays principally optimistic, we must always solely anticipate incremental enhancements in funded ratios as a consequence of two persistent options of pension funds – the annual progress of liabilities and the influence of unfavorable money flows, related to mature plans, on gathered property.

References

Aubry, Jean-Pierre and Caroline V. Crawford. 2017. “State and Native Pension Reform For the reason that Monetary Disaster.” State and Native Plans Concern in Temporary 54. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Aubry, Jean-Pierre and Yimeng Yin. 2024. “How Do Public Pension Plan Returns Examine to Easy Index Investing?” Concern in Temporary 24-13. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Munnell, Alicia H., Jean-Pierre Aubry, and Mark Cafarelli. 2015. “How Will Longer Lifespans Have an effect on State and Native Pension Funding?” State and Native Plans Concern in Temporary 43. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Public Plans Database. 1990-2025. Middle for Retirement Analysis at Boston School, MissionSquare Analysis Institute, the Nationwide Affiliation of State Retirement Directors, and the Authorities Finance Officers Affiliation.

U.S. Bureau of Labor Statistics. Present Employment Statistics, 1955-2024. Washington, DC.

U.S. Census Bureau. Annual Survey of Public Pensions, 1980-2024. Washington, DC.