How the OBBBA Cuts a Tax that Really Advantages Solely the Mega Wealthy.

Like nearly all of Individuals, I generally discover myself unimpressed with the U.S. Congress. In equity, they’ve a troublesome job balancing the pursuits of a rustic as giant and various because the U.S. But, the lately handed One Huge Lovely Invoice Act (OBBBA) has left me scratching my head only a bit greater than traditional.

As I wrote about final month, the OBBBA enforces work necessities that may seemingly deprive lots of Medicaid advantages but with few employment good points. That’s dangerous, however such cuts might be forgiven if made within the service of decreasing the federal debt. In spite of everything, the debt-to-GDP ratio is close to an all-time excessive regardless of falling barely in the course of the Biden Administration. However the CBO estimates that the OBBBA will enhance the debt by over $3.9 trillion over the subsequent decade. OK, however possibly all these apparently expensive tax cuts will profit primarily middle-income households. Such cuts may offset a few of the rising hole between the middle-class and the ultra-wealthy that has developed during the last 45 years. Besides that the OBBBA does the precise reverse – the largest good points go to the highest of the revenue distribution.

I believe that one provision of the OBBBA illustrates my primary drawback with this invoice and says rather a lot in regards to the priorities of Republicans in Congress. That provision will increase the property tax exemption to $15 million per particular person and makes that enhance everlasting (with changes for inflation). With out the OBBBA, the property tax exemption would have gone all the way down to $5 million subsequent yr as a previous enhance expired. Underneath the OBBBA, any quantity that a person leaves behind to heirs above the $15 million exemption will likely be taxed on the present price of 40 p.c. So, below OBBBA, the heirs to a person who dies with $20 million left behind as a taxable inheritance would owe $2 million in taxes, or 10 p.c of the property. Underneath a $5 million exemption, they’d have owed $6 million.

So, what’s my drawback with rising the property tax exemption? In spite of everything, many individuals argue that the property tax is an unfair type of “double taxation.” Underneath this interpretation, persons are pressured to pay taxes on their wealth having already paid for it when that wealth was first earned as revenue. Others level out that the property tax hurts household companies, generally even requiring their sale to keep away from handing down the enterprise and triggering the tax.

In my view, each of those arguments are weak. The property tax is paid for by heirs not by the deceased who’re, , lifeless. These heirs are decidedly not being double taxed as they didn’t earn the cash within the first place. On the small enterprise facet, there’s maybe a bit extra benefit. However, the everyday small enterprise is nowhere close to giant sufficient to be affected by an property tax, even with the smaller $5 million exemption. In my very own calculations utilizing the Survey of Shopper Funds, the median self-employed individual has a family web value of about $460,000. One has to look above the 88th percentile to search out self-employed individuals with family web worths above the $5 million exemption. Plus, the person exemption is doubled for {couples} to $10 million, shifting the quantity to the 93rd percentilefor affected companies with a married couple concerned, as many are. The OBBBA pushes these numbers to the 96th percentile for a person and the 99th percentile for a pair. Most small companies wouldn’t be affected by the property tax with or with out the OBBBA.

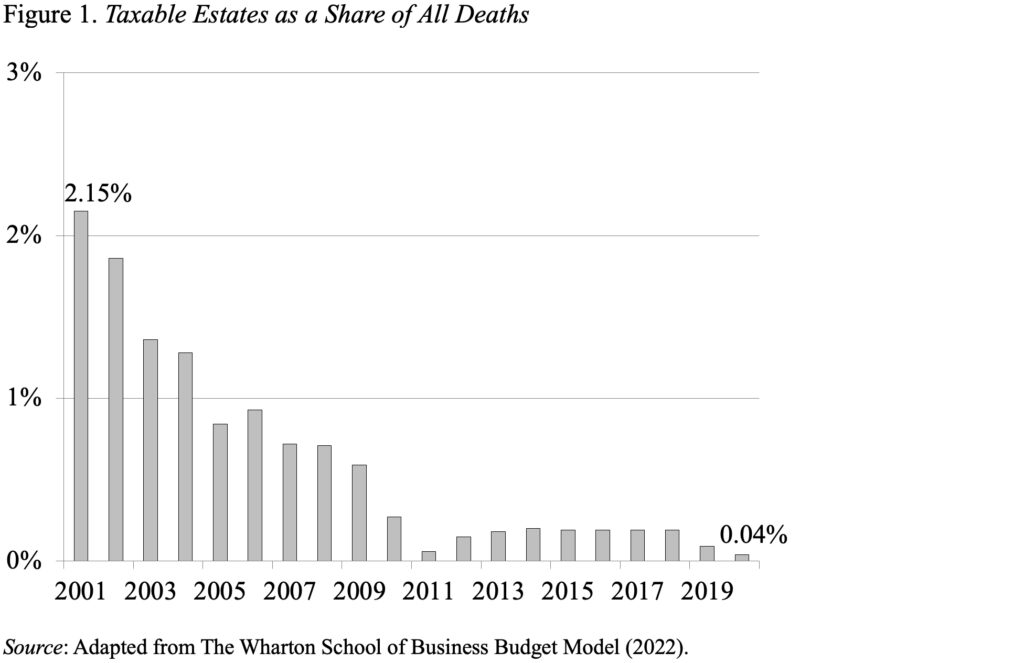

Certainly, the OBBBA is a part of a long-term pattern of weakening the property tax in order that even most very, very wealthy individuals within the U.S. usually are not affected by the tax in any respect. Determine 1 – based mostly on an evaluation from the Wharton College of Enterprise – illustrates this pattern by displaying that over the 20 years previous to the COVID-19 pandemic, the share of households paying any property tax fell precipitously. It was that these within the high 2 p.c of the distribution paid – now it’s all the best way as much as solely the highest 0.1 p.c.

The consequence has been a corresponding decline in income generated from the tax from 0.23 p.c of GDP in 2001 to 0.04 p.c of GDP in 2020, a discount of greater than 80 p.c. Certainly, that very same Wharton College of Enterprise evaluation discovered that had the property tax’s guidelines stayed fixed from 2000-2020, the tax would have generated about $650 billion extra in income than it did. Maybe if this income have been collected from these on the high of the revenue distribution as a substitute of lacking, Republicans in Congress wouldn’t really feel compelled to carry out such draconian cuts to Medicaid affecting these on the backside.

It’s humorous that a part of the argument in implementing these Medicaid work necessities is to encourage individuals to tug themselves up by their bootstraps. I suppose the identical logic doesn’t apply to the youngsters of the very wealthy, most of whom have most likely already had each benefit and below the OBBBA can get one more one – an untaxed property.