On September 29, 2023, Mr. Pabrai began the Pabrai Wagons Fund (WAGNX/WGNIX), a ‘40 Act mutual fund, providing retail traders a car to spend money on his inventory concepts.

Mohnish Pabrai, quoting ChatGPT, is a price investor closely impressed by Warren Buffett and Charlie Munger, with a give attention to long-term, concentrated bets on undervalued firms. He based Pabrai Funding Funds, the place he manages non-public partnerships that mirror Buffett’s strategy, usually emphasizing the significance of endurance and low-risk, high-return alternatives.

He has written two notable books:

- The Dhandho Investor: The Low-Threat Worth Technique to Excessive Returns (2007)

This e-book outlines his funding philosophy. The time period “Dhandho” refers back to the idea of enterprise in Gujarati, and Pabrai presents a easy, low-risk technique to attaining excessive returns via worth investing. - Mosaic: Views on Investing (2004, out-of-print)

This e-book is a group of Pabrai’s writings, the place he shares his ideas on investing, together with classes discovered from profitable traders like Warren Buffett and Charlie Munger. It provides insights into his private funding philosophy and techniques.

I had learn considered one of his books, The Dhando Investor, and was conscious of his friendship with Charlie Munger. I had heard him on worth investing podcasts, listened to a few of his inventory investments, and admired his philanthropy work in India.

Mr. Pabrai has fairly a following within the funding neighborhood and his Pabraisms are sometimes quoted. One I heard just lately was “All the time make investments when the market is closed”, adopted by “Take a nap each day”.

I first learnt concerning the Wagon fund via Twitter, the place a focused commercial instructed me:

- The S&P 500 Index of US equities presently trades at a trailing P/E of about 27.5x earnings, equivalent to 2000 and considerably concerning the S&P’s 16x long-term common earnings a number of.

- When the P/E was this excessive in 2000, for the subsequent 11+ years, dividends included, traders made no cash within the S&P 500. The present valuations may very well be an issue going ahead.

- In juxtaposition, the Wagon Fund carries a portfolio of outstanding international companies, which at present commerce at a mean P/E of seven.5x

- Thus, the Wagon Fund is well-suited to outperform the S&P 500 going ahead.

Intrigued by the pitch, I researched the fund’s web site, following which, I reached out to Mr. Pabrai. David Snowball and I met with Mr. Pabrai over Zoom in the course of September 2024 to study extra concerning the Wagon Fund. What follows is a component evaluation, half Q&A, paraphrased for print.

On this article, we’ll first hear from Mr. Pabrai about his causes for beginning a mutual fund, and we’ll dive into the inventory portfolio of the fund. Subsequent, we’ll have a look at the fund construction and among the challenges on this state of affairs. I conclude with my tackle the fund’s benefit for potential traders.

A “Devesh Q and Mohnish A” alternate

Q: Why did you begin the Wagon Fund?

MP: I function a number of non-public funding partnerships, however the most variety of traders that we are able to have in these partnerships is between 100 to 5 hundred. Many particular person retail traders have reached out to spend money on my methods. The non-public funds have a excessive minimal funding within the thousands and thousands of {dollars}. To satisfy the decrease minimums appropriate for small traders, I began the Wagon Fund, a democratic product.

Q: What are the belongings below administration?

The non-public funds have over one billion in belongings managed by me. The Wagon fund is simply getting began and has round 39 million {dollars} in Property (as of Sep ’24, 2024).

Q: Are the returns of the Personal funds out there to traders so we are able to study extra about your investing historical past?

(Mr. Pabrai didn’t provide particular numbers because the funds are non-public however let on that the funds have outperformed the S&P 500 over the long term, albeit with larger volatility).

Q: What comparisons are you able to draw between the Personal funds and the Wagon fund?

MP: The non-public funds are extremely concentrated holding 10 positions. The Wagon Fund holds about 27-28 positions. Mutual Fund rules about diversification require us to run it in a different way than the privates. I’ve a restricted variety of good concepts and thus lots of the shares overlap between the funds.

Q: How have you ever utilized Buffett-Munger learnings to inventory concentrations in your individual investing?

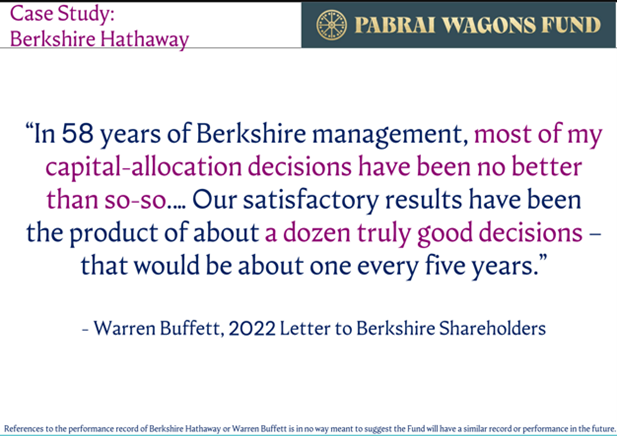

MP: We did a deep dive on each resolution made by Berkshire Hathaway since 1965. If we depend Buffett’s non-public investments, the general public firm shares he purchased, and vital personnel hires, Berkshire Hathaway has made about 300 important choices over six a long time. In his 2022 Annual Letter, Mr. Buffett wrote that solely a couple of dozen choices have been chargeable for virtually all of the returns of Berkshire.

We’re speaking a couple of dozen nice choices out of 300 important investments. That may be a 4% hit price.

And we’re speaking about GOD right here (referring to Mr. Buffett).

What probability will we mortals must outperform the market? It’s robust. The vital lesson is when alternative knocks, we wish to have excessive conviction, guess large, after which maintain the funding ceaselessly.

Q: Trying on the allocation of the inventory portfolio within the Wagon Fund, it seems that the fund holds 35% Turkish shares and 60% US shares. Is your mandate to be (1) a International Fund (like Moerus International MOWIX) (2) an EM fund with US publicity (like Artisan Creating APDYX) or (3) a deep worth fund?

MP: Not one of the above. Our solely mandate within the Wagon Fund is to generate income.

(On the subject of Turkey), the fund has investments in sure shares. They occur to be in Turkey. However I didn’t begin with the thought of shopping for one thing in Turkey.

Q: How would you greatest categorize the Wagon fund?

Consider the Wagon fund (and the non-public partnerships) as an Anomalies Fund – my strongest views on the place Mr. Market is mistaken and created an enormous anomaly, permitting me to speculate.

Broadly talking, the Wagon fund’s investments encompass 6 buckets:

-

- Coal shares (Arch Sources, Alpha Metallurgical Useful resource, CONSOL Power, Warrior Met Coal), symbolize about 20% of the portfolio.

- US Homebuilders (Pulte, Toll Brothers, Tri Level houses) about 10% of the portfolio

- US Automobile Sellers (together with Asbury Automotive, Penske, Lithia) are about 19% of the portfolio. Right here’s the rationale for our funding on this bucket:

- Markets anticipated Electrical Autos (EVs) to turn into a big portion of the automobile fleet, that these EVs can be bought straight, and these automobiles wouldn’t require servicing.

- We aren’t seeing that stage of migration to EVs. The OEMs (the automobile producers) will not be going to bypass the supplier community and lots of of them are locked into these contracts. In any case, sellers don’t make that a lot on automobile gross sales.

- What the market bought mistaken is that the lifetime servicing of an EV is just like Inner Combustion Engine (ICE) automobiles.

- We concluded that Automobile sellers, which have been buying and selling at 5-7x Earnings have been too low-cost. We constructed a place in one of the best names we may discover.

- Automobile dealerships are an instance of a contrarian, deep-value guess.

- Our 4th bucket is TAV Havalimanlari Holding: That is the Turkey Airport Holdings Firm, a 12% holding for the Wagon Fund. Thesis:

- Begin with only one airport.

- Throughout COVID, TAV purchased the Almaty airport in Kazakhstan when the passenger visitors was zero for $400mm. They put in one other $250mm to construct a brand new terminal. The $650mm funding was financed at 4% for 30 years and with a $150mm Fairness funding.

- 95% of the airports world wide are owned and operated by Governments.

- Even when airports are non-public, they function on BOT (Construct, Function, Switch), that’s, the airport goes again to the Authorities after 20-30 years.

- In distinction, the Almaty airport license is everlasting (he mentioned, 10,000 years).

- Quick ahead to 2024: Money Stream from Almaty might be $150-200 mm rising at 15-20% per 12 months.

- TAV operates 15 airports throughout 8 international locations. It gives a variety of providers along with airport administration, together with duty-free operations, floor dealing with, and different aviation-related providers.

- The inventory’s Fairness Market Cap was $800mm once we invested and is $2.8Bn at present.

- Why would I ever wish to promote TAV Holdings when it pays for itself many occasions over? I can’t discover companies like these on the NYSE.

- Bucket quantity 5 is the Turkish Coca Cola Bottling Firm, Coca Cola Icecek. We personal inventory in Icecek (the bottling firm), in Anadolu Grubu Holding (the father or mother firm), and Anadolu Efes Biracilik ve Malt Sanayii AS ORD (the holding firm) for a complete allocation of 25%. Via the father or mother and holding firm, the fund additionally has publicity to numerous companies in that area. The publicity offers us possession of the biggest beverage and beer distributor in Ukraine and Russia. The enterprise trades at a really cheap valuation.

- Mongolian Mining (which Pabrai talked about in depth) represents a excessive money move enterprise buying and selling at low Free Money Stream multiples. Together with Occidental Petroleum, and a smidgen of Amazon and Microsoft, the portfolio is generally spoken for.

These are my nice concepts for now. My two analysts and I’ll spend months diving deep into every firm earlier than investing.

Q: Do you anticipate the Wagon Fund to beat the S&P 500? What about Berkshire Hathaway?

MP: First, let’s discuss why the S&P 500 Index is unbeatable.

The index is a factor of magnificence as a result of it’s so DUMB.

Take, for instance, NVIDIA. The Index has been lengthy NVIDIA since 2001 and fortuitously by design is just too dumb to have bought the inventory. In the meantime, energetic managers have purchased and bought NVIDIA from their portfolio quite a few occasions.

Bear in mind the lesson from Berkshire is just not the shopping for of nice firms which creates funding greatness. It’s the half one stays invested in that enables for compounding.

Each Buffett and Munger have publicly disclosed they don’t anticipate Berkshire to outperform the S&P 500. The dimensions of the steadiness sheet is just too giant to speculate and acquire an edge versus the S&P.

For the Wagon fund, I prefer to underpromise and overdeliver. I hope the fund will beat the S&P by 1% to three% over the long term. And since I don’t assume Berkshire can outperform the S&P anymore, it follows I anticipate the fund to outperform Berkshire too.

On the finish of the decision …

Within the ninety-minute Zoom name, Mr. Pabrai delved deep into his evaluation of Mongolian Mining and a few of his Canadian Metal investments round 2005. He was making the purpose that he has a historical past of discovering shares that Mr. Market has mispriced. He finds them, invests large, and sits on these firms.

I consider Mr. Pabrai is a high-quality investor, has a knack for locating areas the place Mr. Market provides anomalies, and may determine stable companies. The Wagon fund seems to be promising.

However this fund is just not for everyone.

There are a number of challenges on the Enterprise facet.

Points/Challenges for Wagon Fund traders:

-

-

-

Key man threat. That is the Pabrai Wagon Fund.

If Mr. Pabrai will get hit by the proverbial bus, the fund has no future. There are two analysts, however this isn’t a staff, the place one other Portfolio Supervisor with Mr. Pabrai’s gravitas can take over.

-

Buying and selling precedence between privates and Wagon Fund.

Q. Since Mr. Pabrai operates non-public funds and this mutual fund, which funds get precedence to commerce? Is there a battle of curiosity?

MP:

- We’ve got labored on an answer whereby every fund will get a precedence someday per week. Monday can be Personal Fund 1, Tuesday Personal Fund 2, Wednesday Wagon Fund, and so forth and so forth. The thought is that every day one fund will get first dibs to speculate out there.

- There isn’t a lot buying and selling happening everyday. We make investments and sit on shares for a very long time.

- The Personal fund traders can solely redeem every year on the finish of the 12 months. Whereas Public funds present each day liquidity by regulation. By design, the general public funds win in liquidity on the exit.

- It takes 6-9 months to speculate slowly in some enterprise. Bear in mind it took Berkshire eighteen months to spend money on the Japanese buying and selling homes.

Evaluation: The thought of rotating liquidity first dibs is pragmatic, however I don’t know the way snug many traders might be with such a mechanism.

-

Dimension limits to investments?

-

Suppose the Wagon fund would turn into a Billion-dollar fund. Do Turkish shares have that sort of each day buying and selling quantity and liquidity? Suppose there’s a market crash and there are redemptions within the Wagon Fund, will you be capable of promote these identical shares to match outflows (if it took 6-9 months to get into these shares).

MP: Firstly, it is a theoretical, not an actual drawback. The Wagon Fund solely has $39 million in belongings. Second, can set up Strains of Credit score with Banks, so we may use that liquidity to fulfill Outflows if wanted. Third, we personal different shares within the US. We will promote these first to lift the cash to fulfill outflows.

Evaluation: Neither Berkshire Hathaway nor the non-public funds are compelled to promote shares in a crash. Their capital is everlasting and locked respectively.

However, the Wagon Fund is a each day liquidity product. concentrated investing is a dual-edged sword. When the market goes in your favor, the fund will mint cash and compound at extraordinary charges. When the market goes in opposition to you, the underside falls out. The Wagon Fund will undergo from illiquidity as a nature of its bets.

As a living proof, Mr. Pabrai talked about that Personal funds have been down as a lot as 60-70% within the Nice Monetary Disaster of 2008-2009. They did bounce again and have been up roughly 20% by the tip of 2009. Ergo, traders ought to be buckled up when investing on this fund when the market is in tough waters.

-

Potential threat of sharper drawdowns than the market

Stated Mr. Pabrai, “While you maintain 10 shares within the Personal funds’ portfolio, it’s sure to be extra risky than the S&P 500, which has 500 shares. Certainly one of our funds in 2008 was a sub-prime funding, which went to zero. When that’s 10% of the portfolio, you get hit.”

Mr. Pabrai added, “Ted Weschler (one of many two Berkshire Teds) was additionally down 70% within the GFC and Buffett nonetheless employed him.”

-

For retail traders contemplating the Wagon fund, it’s vital to needless to say even the nice traders have giant drawdowns and have shares that go to zero. Their greatness is just not as a result of they’re good at controlling drawdowns. Reasonably, it’s as a result of they discover companies that may survive the financial cycles, they usually purchase such companies at nice valuations (and maintain them ceaselessly).

Placing the Steadiness between Causes to Purchase and Causes to Keep away from

Buyers are being offered with entry to a high-quality, deep-value, storied investor, within the type of Mr. Pabrai. The fund’s portfolio is completely different than the Magazine 7, not ridiculously diversified like some index funds, and never invested for the sake of filling buckets. It’s constructed meticulously.

However this entry comes with caveats on the enterprise facet.

Pabrai hasn’t run a mutual fund earlier than. He’s the Keyman for the fund. Conflicts between non-public and public funds, liquidity in worldwide markets, and the correlation between concentrated portfolios and drawdown measures are all on the desk.

Mr. Pabrai would argue my considerations are theoretical. I agree. But it surely’s my obligation to level out considerations for potential traders.

I’m going to spend money on the Wagon fund as a result of I like a differentiated portfolio, and I believe Mr. Pabrai has super funding acumen.

But it surely can’t be an enormous place.

I would love the fund to season and fine-tune on the enterprise facet – construct an even bigger staff with a seasoned quantity two. I wish to see how the fund performs in a market correction – the way it handles outflows and manages liquidity in Turkish shares. And I’d prefer to see if the general public vs non-public funds create conflicts.

It’s not a fund for everybody, however for these with additional funding capability, and a want to miss the teething issues of the mutual fund, it may be a good suggestion to circle the wagons.

-