The transient’s key findings are:

- State and native employees historically have had outlined profit (DB) pensions that insulate them from market threat and outliving their financial savings.

- However funding these plans has change into extra burdensome, main sponsors to shift some dangers onto employees by modifying DB plans or adopting new designs.

- Consequently, 42 p.c of plans for state and native employees now have risk-sharing options, although most employees nonetheless retain important protections.

Introduction

State and native authorities employees have historically had outlined profit (DB) pensions that insulate them from the inventory market and be certain that they don’t outlive their financial savings. Funding these plans, nonetheless, has change into burdensome for a lot of governments, with prices rising dramatically within the instant wake of the 2008 monetary disaster and persevering with to develop since then. In response, some governments have launched various plan designs that shift funding and/or longevity threat onto employees.

Given the rise in various designs, this transient solutions two questions: 1) how prevalent had been various designs earlier than the monetary disaster? and a couple of) how have they developed since then? The dialogue proceeds as follows. The primary part introduces the assorted ways in which state and native employers can shift threat onto their employees. The second part describes latest traits in plan design. The third and fourth sections establish the kinds of plans with various designs and discover what elements cause them to undertake these options.

The information present that the share of plans with various designs has grown constantly since 2008, in order that plans with some threat sharing now cowl roughly half of the state and native employees. A decline in funded standing and Republican management typically predict the shift in direction of various designs, whereas native plans and people overlaying public security employees usually tend to keep conventional DBs. The ultimate part concludes that threat sharing within the public sector is probably going right here to remain, however that employees nonetheless have important protections.

How Do States and Localities Shift Danger to Employees?

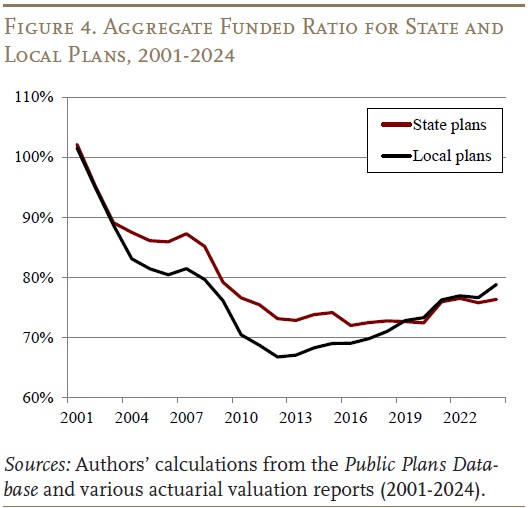

In a standard DB plan, employees earn advantages which can be paid as an annuity all through their retirement. To assist fund these advantages, public sector plans usually require staff to contribute a proportion of their wage to the pension’s belief fund, however employers are liable for any shortfall between the property collected within the fund and promised profit funds. This association imposes two kinds of threat on employers: 1) funding threat, if property within the belief fund underperform goal returns; and a couple of) longevity threat, if retirees dwell longer than anticipated. The 2008 monetary disaster was a stark instance of funding threat: the inventory market crash diminished the combination funded ratio of state and native plans from 86 p.c in 2007 to a low of 72 p.c in 2013.1

To mitigate such dangers, many employers have shifted not less than a few of it onto staff via various plan designs. In apply, these designs typically comply with one of many following fashions:

Stand-alone outlined contribution (DC) plan. Like 401(okay)s within the non-public sector, public sector DCs depend on particular person accounts to which employees and employers every contribute a set proportion of the worker’s wage. Employees determine tips on how to make investments their property and draw down the funds in retirement. Therefore, employees bear all of the funding threat throughout their working years in addition to the danger of outliving their financial savings as soon as they retire.2

Stand-alone money stability (CB) plan. These plans additionally depend on particular person accounts, however the employer determines tips on how to make investments the contributions and ensures a minimal funding return. Account balances are mechanically annuitized at retirement, which protects retirees from outliving their financial savings whereas inserting longevity threat on the employer.

Hybrid plan. Some states and localities pair a smaller conventional DB with a DC or CB plan.3 The notion is that the DB supplies a modest base of core revenue help, whereas the DC or CB element insulates employers from bearing all the danger.

These three plan designs signify a elementary shift away from conventional DBs. But, plan sponsors also can act throughout the DB construction to insulate themselves from rising value within the following methods:

Variable worker contribution fee. Public sector DBs typically set the extent of the employee’s contribution in state statute. Employers are then on the hook for any enhance within the actuarially required contribution (ARC). To scale back this publicity, some employers as a substitute set the worker contribution fee as a proportion of the ARC or explicitly set circumstances underneath which worker contributions will enhance. Successfully, employees’ take-home pay is reduce when the plan does poorly, and elevated when the plan does nicely.

Variable cost-of-living adjustment (COLA). Public DB plans also can share threat by making COLAs contingent on the plan’s monetary situation in two methods. First, it has been long-standing apply for some plans to fund their COLAs solely from “extra return” accounts the place funds are deposited at any time when a plan’s funding efficiency exceeds actuarial targets (or another threshold).4 This strategy implicitly hyperlinks the supply and measurement of COLA funds to the plan’s funding efficiency. Extra lately, some plans have explicitly linked annual COLA funds to both the plan’s funded ratio, latest funding returns, or each.

Clearly, these incremental risk-sharing options inside conventional DBs have a lot much less affect on staff than shifting away from the DB construction. Nevertheless, all these designs switch some extent of threat to the employee in comparison with the essential DB mannequin. The query is, to what extent have these various designs gained traction lately?

Traits in Different Plan Design

Though the 2008 monetary disaster was a watershed second for various plan designs, a handful of public retirement techniques – 34 of the 250 plans within the Public Plans Database (PPD) – had beforehand adopted some kind of threat sharing. Previous to 2001, most of those preparations concerned threat sharing inside conventional DBs – variable worker contributions or investment-linked COLAs (see Determine 1). However 9 plans already had DC, CB, or hybrid buildings.5

Between 2001 and 2007, one other handful of plans switched to DC, CB, and hybrid designs.6 Not like the reforms to comply with, these transitions weren’t essentially perceived as detrimental to employees as they took benefit of a robust inventory market throughout the interval.

The 2008 monetary disaster modified the image fully. The variety of state and native plans shifting funding threat onto employees greater than doubled within the seven years following the crash, from 34 plans in 2007 to 79 in 2014. Importantly, legislators on this interval had little urge for food for transferring employees right into a stand-alone DC plan, the place the worker bears all the danger. As an alternative, many reforms concerned shifting new staff into much less dangerous (for the employee) CB and hybrid plans, in addition to introducing some risk-sharing inside present conventional DB plans.

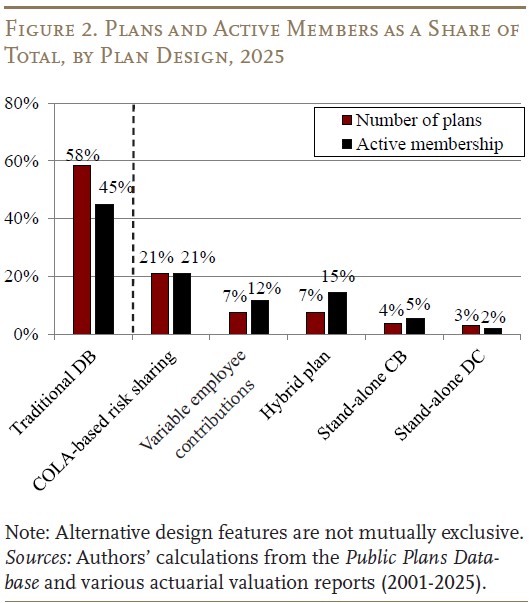

Within the decade since, various plan designs have continued to proliferate, with 107 state and native plans presently having some type of threat sharing (see Appendix Desk A1).7 To place these numbers into perspective, Determine 2 exhibits the share of all state and native plans with various plan designs together with the overall lively members in these techniques. The primary cluster bar exhibits the share with a standard DB, whereas the shorter bars to the correct break the rest down into the 5 several types of threat sharing. Amongst plans with DC components, the hybrid mannequin has clearly gained probably the most traction – affecting plans that cowl 15 p.c of all lively retirement system members. For threat sharing throughout the DB, COLA-based threat sharing is probably the most prevalent.8

You will need to consider, nonetheless, that this determine might overstate the share of lively members presently impacted by various designs as many plans solely utilized the brand new options to staff employed after the reform. That mentioned, it offers a way of the widespread nature of threat sharing and highlights that the strategy to various plan designs has remained protecting of employees – only a few plans have launched stand-alone DC plans.

Are States or Localities Extra More likely to Undertake Different Designs?

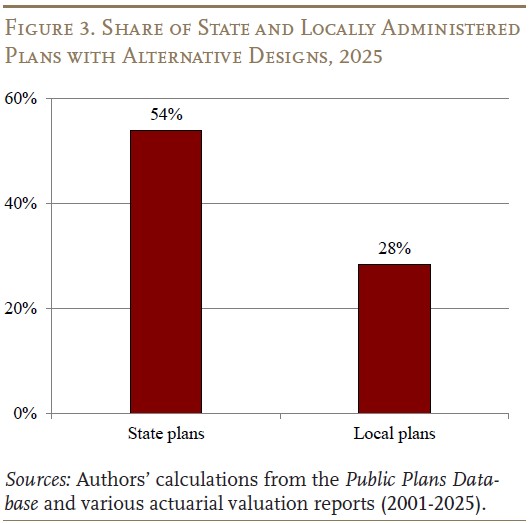

Whereas the development signifies a shift away from conventional DBs, considerably lower than half of plans have finished so. Which plans are making these adjustments? Step one right here is to contemplate whether or not the adjustments are affecting massive state-administered techniques or smaller native plans. Determine 3 exhibits the share of state and domestically administered plans within the PPD that presently have various designs. Clearly, most exercise has been concentrated amongst state plans – greater than half of which now have some alternativ design. In distinction, lower than a 3rd of native plans have adopted various designs.

The distinction in adoption charges is probably shocking provided that native plans for a protracted whereas had persistently decrease funded ratios (see Determine 4) and better prices than state plans. Compounding these monetary challenges, native authorities income is much less diversified than state income attributable to reliance on property taxes – a weak point that hit localities arduous throughout the 2008 monetary disaster.9 As well as, relative to a typical DC plan, self-administering a DB plan requires important workers sources and funding experience. Bigger state governments arguably have extra capability to handle these plans, making the persistence of conventional DBs run by native governments much more shocking.

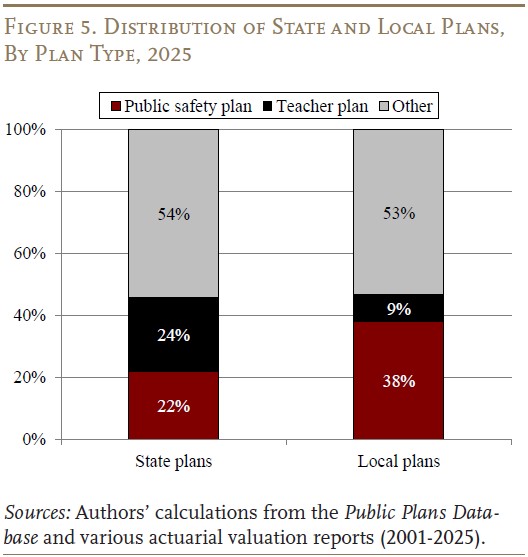

One cause for this considerably counterintuitive development could possibly be the political surroundings wherein state and native plans function. State plans are ruled by legislators who typically signify a broader swath of stakeholders. Native politicians, however, typically cope with a narrower constituency and may be extra simply affected by the views of worker teams. Another excuse could possibly be the kind of employees coated by state and native plans. Whereas roughly half of each state and native plans are both instructor or public security plans, native plans are more likely to cowl police and firefighters – two teams who notably worth conventional DB advantages, are closely unionized, and are sometimes lively in native politics (see Determine 5).10

To additional look at the potential causes behind the adoption of different plan designs, the subsequent part turns to a regression evaluation.

Why Did Some Plans Undertake Different Designs?

The sharp rise in various plan designs after the monetary disaster suggests a defensive motivation: to keep away from the prices related to massive unfunded liabilities and to unload a number of the funding and longevity threat related to conventional DB plans. However the distinction in uptake amongst states and localities additionally suggests political forces at play. To examine whether or not this story is supported by the information, we used regression evaluation to seek out the elements related to the likelihood {that a} plan sponsor would swap to an alternate design. The evaluation contains information on every plan within the PPD from 2001-2024.11 The dependent variable is about equal to zero if no motion was taken within the yr and 1 if the federal government launched a compulsory (or default) various design. The impartial variables embody:

- Change within the plan’s funded ratio since 2001: plans experiencing a gentle deterioration in funding could also be extra more likely to swap to an alternate design.

- Republican management: jurisdictions with Republican management could also be extra ideologically motivated to undertake various designs. For state plans, we establish Republican management when the governor is Republican and all legislative our bodies are majority Republican. For native plans, we classify Republican management as when the mayor is Republican and the town council (or different main governing physique) is majority Republican.

- Social Safety protection: round one-quarter of state and native employees will not be coated by Social Safety as a result of their employer has agreed to offer comparable advantages.12 These non-covered plans could also be much less more likely to undertake various designs to make sure that their members obtain the annuity that they in any other case would have from Social Safety.

- State plan: usually, states have better fiscal and managerial capability to handle a DB plan. On the identical time, state legislators might take into account the preferences of a broader constituency than native governing our bodies.13

- Instructor plan: academics usually tend to spend their entire profession within the public sector and so could also be extra more likely to worth conventional DB advantages.14 They’re additionally higher represented in state and native politics, suggesting that plans catering to those employees usually tend to stay conventional DBs.

- Public security plan: equally, police and firefighters are additionally extra more likely to worth conventional DB advantages and are sometimes strongly represented in native politics via their unions, suggesting that plans for these employees usually tend to stay conventional DBs.

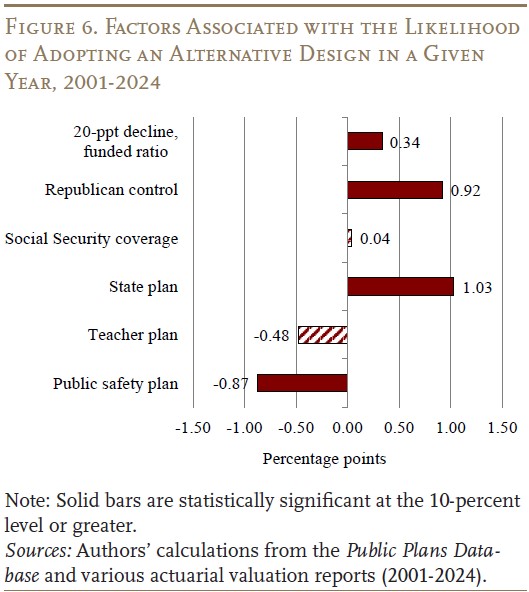

The outcomes are proven in Determine 5 (with extra particulars in Appendix Desk A2).15 The bars present the correlation between every issue and the likelihood of introducing an alternate plan design in any given yr. As anticipated, a plan’s deteriorating funded standing is predictive of the swap. For ease of interpretation, the determine scales this outcome to replicate a 20-percentage-point drop within the funded ratio, as skilled by public plans on common between 2001 and 2009. It exhibits that this drop is related to a 0.34-percentage-point enhance every year within the likelihood of adopting some type of threat sharing.

Equally, Republican management is related to a 0.92-percentage-point enhance within the annual likelihood of switching plan design, whereas being state-administered is related to a 1.03-percentage-point enhance. Conversely, as anticipated, plans overlaying cops and/or firefighters are 0.87-percentage-points much less more likely to swap in any given yr. Whereas the coefficient on instructor plan can also be unfavourable, as anticipated, it’s not statistically important. And curiously, we discover no affect of Social Safety protection.16

Whereas a 1-percentage-point change in annual probability may appear small, it turns into significant when compounded over our 25-year evaluation interval. For instance, though 42 p.c of plans presently have various designs, the typical probability of adopting one in any given yr was lower than 2 p.c. So, a 1-percentage-point enhance in that baseline probability is definitely substantial.

Conclusion

Different plan designs – the place funding and longevity threat are shared between staff and employers – at the moment are nicely established within the public sector. Certainly, plans that cowl roughly half of state and native employees presently have some type of threat sharing. The shift away from conventional pensions has been pushed by sharply declining funded ratios after the monetary disaster, with state and native politics additionally enjoying a task. However, most reforms up to now have remained protecting of employees, eschewing stand-alone 401(okay)-style plans in favor of different designs that alleviate some employer burden whereas nonetheless offering core annuity advantages to retirees.

References

Aubry, Jean-Pierre, Siyan Liu, Alicia H. Munnell, Laura D. Quinby, and Glenn R. Springstead. 2022. “State and Native Authorities Workers With out Social Safety Protection: What Proportion Will Earn Pension Advantages That Fall In need of Social Safety Equivalence?” Social Safety Bulletin 82(3): 1-20.

Brainard, Keith and Alex Brown. 2018. “In-depth: Danger Sharing Retirement Plans.” Lexington, KY: Nationwide Affiliation of State Retirement Directors.

Nationwide Affiliation of State Retirement Directors. 2025. State Hybrid Retirement Plans: A Complete Overview of State Hybrid Plans. Situation Temporary. Lexington, KY.

Pew Charitable Trusts. 2017. Price-Sharing Options of State Outlined Profit Pension Plans. Report. Washington, DC.

Public Plans Database. 2001-2024. Middle for Retirement Analysis at Boston School, Middle for State and Native Authorities Excellence, and Nationwide Affiliation of State Retirement Directors.

Quinby, Laura D., Jean-Pierre Aubry, and Alicia H. Munnell. 2020. “Pensions for State and Native Authorities Employees Not Lined by Social Safety: Do Advantages Meet Federal Requirements?” Social Safety Bulletin 80(3): 1-29.

Quinby, Laura D. and Geoffrey T. Sanzenbacher. 2020. “Do State and Native Authorities Workers Save Exterior of Their Outlined Profit Plans When They Want To?” Working Paper 2020-17. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Quinby, Laura D. and Gal Wettstein. 2021. “Do Deferred Profit Cuts for Present Workers Improve Separation?” Labour Economics 73(102081): 1-14.

U.S. Census Bureau. 2001-2023. State and Native Authorities Funds. Washington, DC. https://www.census.gov/programs-surveys/gov-finances/information/datasets.html.

Appendix

Click on right here to view appendix tables.