A proposed pilot venture might relieve the tax burden on older folks.

Some thrilling information. Adam Scanlon, a consultant within the Massachusetts Home, has submitted a invoice to ascertain “ a senior property tax deferral pilot program.”

I’ve at all times been an excellent fan of desirous about the home as a retirement asset and about methods folks can entry the fairness of their residence to assist themselves in retirement. The standard approaches contain downsizing to a less expensive residence, which requires retirees to maneuver, or taking out a reverse mortgage, which permits folks to remain in place however includes substantial complexity and upfront charges. A much better possibility, in my guide, is property tax deferral.

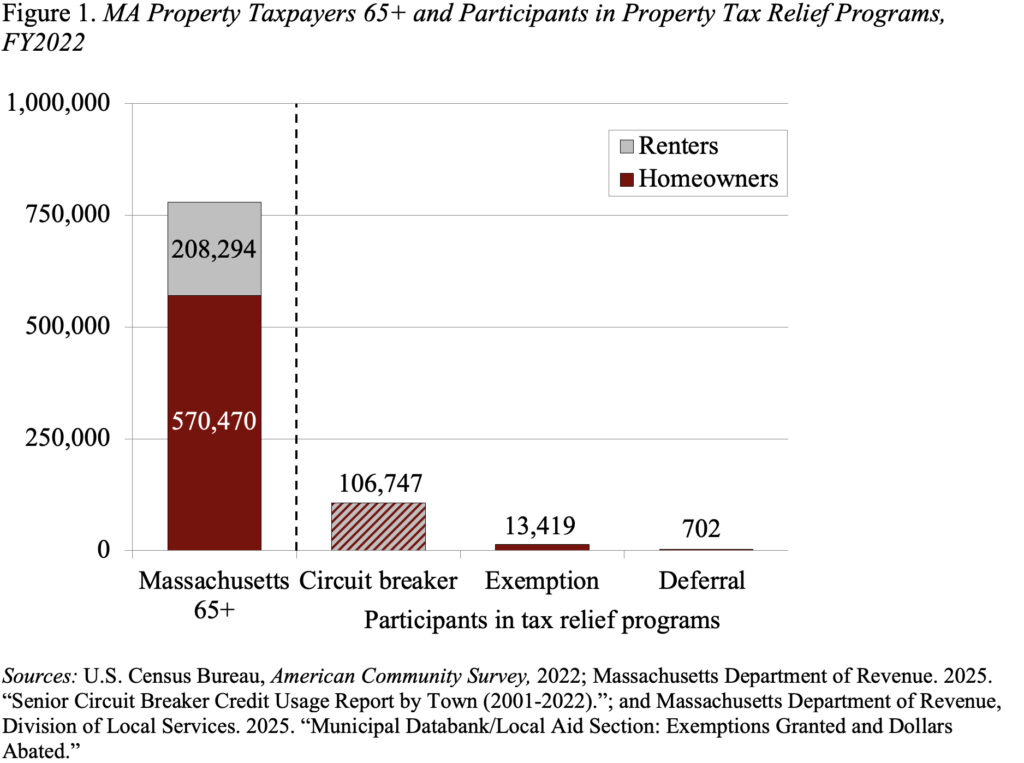

Massachusetts has lengthy acknowledged the burden of property taxes on older folks and has three packages that supply some reduction for low-income taxpayers (see Determine 1). The biggest is the Circuit Breaker Tax Credit score for taxpayers age 65+ who personal or lease residential property. The credit score equals the quantity by which property taxes (plus half of water and sewer bills) or 25 p.c of their lease exceeds 10 p.c of revenue. The subsequent largest is the property tax exemption of $500 for these ages 70+ who meet stringent possession, revenue, and asset necessities. The smallest program is property tax deferral, which permits native governments to allow some seniors to defer the cost of property taxes and to recoup these taxes plus curiosity when the home-owner dies or sells the home.

Take-up for the deferral program is especially low. Three components seem like at play. First, most owners are usually not eligible. Second, eligible householders are usually not conscious of this system (since solely rich communities are likely to publicize their program) and infrequently confuse it with different tax credit score and exemption packages. Third, householders who’re eligible and conscious typically have no idea how one can apply, are involved a few stigma hooked up to an income-tested program, or hesitate to put a lien on their residence.

A number of years in the past, we proposed a brand new statewide property tax deferral program that might tackle many of those shortcomings.

- All people 65+ with a major residence in Massachusetts would be capable of defer their property taxes on the primary $1,000,000 of residence fairness till the sum of deferrals, collected curiosity, and mortgages attain 60 p.c of the assessed worth.

- Participation in this system could be triggered by merely checking a field on town’s or city’s property tax invoice.

- When town or city forwards the tax invoice to the State, the State would ship town or city an quantity equal to the deferred taxes.

- The rate of interest every year could be set on the State’s borrowing value plus a buffer to cowl administrative prices and defaults.

- The State would retain a lien on the home for unpaid property taxes and could be repaid the principal plus curiosity inside a yr of when the home-owner(s) dies or sells the house.

This new program would obtain a number of essential objectives. First, a median older home-owner in Massachusetts would have entry to about $4,755 a yr by deferring property taxes. The home-owner might select to defer for a single yr to assist cowl, say, the price of a brand new roof, or to defer on an annual foundation to complement Social Safety and every other retirement revenue. Second, having this system obtainable to all would eradicate any concern a few stigma related to deferral, which is essential since insufficient retirement revenue just isn’t restricted to the poor. Third, it will alleviate the burden on localities and encourage them to promote its availability.

Consultant Scanlon’s pilot would contain a set of municipalities in order that about 10,000 households could be eligible to take part. The median revenue of the contributors ought to match that for the state as an entire, and the municipalities ought to embrace varied areas throughout the state. The pilot would offer a chance to see what number of households selected to take part, to evaluate the affect on contributors, and consider the potential value of a state-wide program. (Whereas this system could be income impartial on the family degree, it has an affect on money movement when authorities foregoes revenues upfront and recoups the loans with curiosity solely when the house is offered.)

A senior property tax deferral pilot program is a superb thought. Hope the legislature helps it.