The inventory chart doesn’t look good for Alibaba (NYSE:BABA), whichever method you have a look at it. Yr-to-date, shares are down by 10% already, zoom again 12 months, the inventory has shed 39%. The three-year chart? Down by a depressing 72%.

However does that replicate a enterprise in perpetual decline? Not essentially, says Barclays analyst Jiong Shao. In reality, contemplating that within the final 12 months, BABA generated $27 billion in FCF, a couple of fast calculations, says Shao, present that its valuation is now “among the many most compelling.”

“Our math assumes that every one BABA’s subsidiaries are given zero worth plus FCF already together with all of the losses from the subsidiaries,” the analyst defined. “If assigning some worth for these subs and excluding sub losses, valuation could be less expensive. We imagine BABA screens as the most affordable main tech inventory globally.”

The Chinese language e-commerce large has additionally been prioritizing its shareholders and has been shopping for again ~$1 billion in shares a month in current occasions and can in all probability carry on doing so for some time. Moreover, in November, the corporate introduced its first annual dividends of $1 per share.

“There isn’t any different firm in our protection universe that’s doing extra and even shut in contrast to what BABA has been doing by way of returning worth to shareholders, moreover maybe Tencent,” notes Shao.

That mentioned, it’s not all bliss within the BABA universe. Lower than a 12 months after asserting its intention to spin off its cloud division, the corporate made a U-turn on the plan, drastically disappointing traders. Nevertheless, Shao says his newest checks counsel that an IPO of its sensible logistics enterprise and its Hema (higher-end offline grocery) enterprise stays heading in the right direction for the primary half of this 12 months. Traders are additionally involved about frequent adjustments in administration, with former group CEO and cloud CEO Daniel Zhang, and former Taobao Tmall CEO Trudy Dai (appointed solely two years in the past), departing. These departures add main worries relating to the shortage of administration in what might be thought of two of the corporate’s most vital segments.

All in all, Shao has reaffirmed an Chubby (i.e. Purchase) score for Alibaba shares, albeit with a lower cost goal of $109, down from $138. This suggests a 57% development projection for the approaching 12 months. (To look at Shao’s monitor document, click on right here)

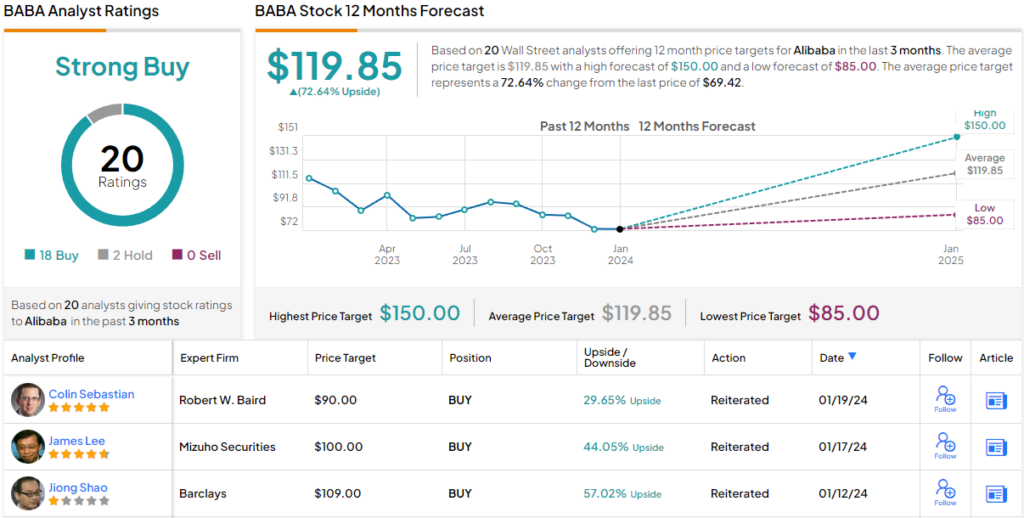

Amongst Shao’s colleagues, whereas two choose to presently sit this one out, all 17 different critiques are optimistic, making the consensus view right here a Sturdy Purchase. Going by the $119.85 common value goal, a 12 months from now, shares can be altering arms for ~73% premium. (See Alibaba inventory forecast)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally vital to do your personal evaluation earlier than making any funding.