Impulsive initiatives are placing Social Safety, the inventory market, and the economic system itself in danger.

By attacking Social Safety, crashing the inventory market, and imposing unconscionable tariffs that can improve each unemployment and costs, Trump has taken purpose on the retirement safety of tens of millions of American households.

The assault on Social Safety is shameful. The preliminary foray was justified by the extensively debunked declare that 20 million useless individuals have been receiving advantages. Regardless of no proof of widespread “waste, fraud, or abuse” and already-existing customer-service challenges, the company has introduced plans to chop 7,000 workers and shut six regional places of work; and extra cuts could also be on the way in which. Because of this, tens of millions of People will discover it actually onerous to entry advantages that they’ve earned over a lifetime of labor.

Much more regarding, DOGE plans to rebuild Social Safety pc’s code in months, the place specialists agree that rewriting that code safely would take years. It’s true that Social Safety’s system, like these of many authorities businesses, accommodates code written in COBOL, a programming language created within the Fifties. It must be up to date, nevertheless it’s onerous to repair a bicycle whilst you’re using it. The company might by no means get the entire assets it wanted to assemble an entire new system after which migrate the information. Now is likely to be the time to start such an initiative, however take the time to do it correctly. A rushed job will produce cascading failures, with individuals getting incorrect advantages, ready ages to get their advantages, or getting no advantages in any respect.

Crashing Social Safety’s pc techniques can be catastrophic, with greater than 13 million People virtually completely reliant on Social Safety for retirement earnings. The truth that they may in the end obtain their promised quantities can not compensate for the devastation that may be brought about within the brief run.

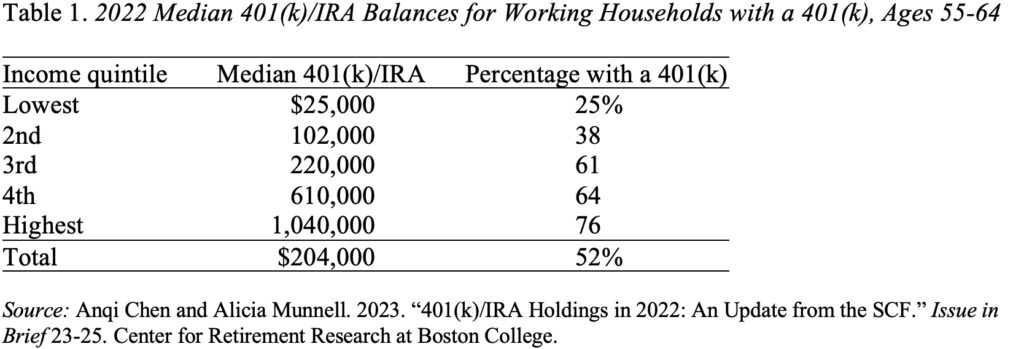

The harm to retirement safety goes past the assault on the Social Safety Administration. Many non-public sector employees and most new retirees now depend on the property of their 401(okay) plans (and rollovers to Particular person Retirement Accounts) to complement their Social Safety advantages. The Federal Reserve’s Survey of Client Funds gives a complete image of the holdings in these accounts amongst households approaching retirement in 2022 – the latest information accessible. These balances are modest for all however the prime earnings quintile. Importantly, they’re principally invested in equities, and due to this fact very depending on the efficiency of the inventory market. Within the wake of Trump’s tariff announcement, the indices declined by greater than 10 %. If the markets proceed to tank, retirements will likely be in danger.

Lastly, Trump’s tariff insurance policies have the potential to harm the broader economic system each by growing layoffs and costs. To the extent that employees lose their jobs, they will be unable to contribute to their 401(okay) and could also be pressured to withdraw property to help themselves. And to the extent that tariffs result in larger costs, even those that keep employed will discover they should spend extra to keep up their way of life, making them much less capable of save. As well as, inflation will erode the worth of present property.

The subsequent replace to the Heart’s Nationwide Retirement Danger Index, which measures the proportion of at the moment’s working households unable to keep up their way of life in retirement, will likely be primarily based on the Federal Reserve’s Survey of Client Funds for 2025. In 2022, primarily as a result of appreciation in home costs, the information was good (see Determine 1). Solely 39 % of working households have been projected to be in danger. Based mostly on the economic system’s present trajectory, the outcomes for 2025 could nicely present a rise that approaches ranges seen throughout the Nice Recession – with greater than half of households in danger in retirement.