House owners of IRAs and certified retirement accounts would possibly identify a belief because the account’s beneficiary for quite a few causes. They may need to have extra management over how the account property are distributed to their beneficiaries. Or they could need to shield any of their beneficiaries who qualify for means-tested public advantages. In some circumstances, it would merely be extra handy to call a single entity – like a belief – because the beneficiary of all their retirement accounts, in order that any future adjustments to be made to the belief itself fairly than needing to be mirrored throughout all of the proprietor’s beneficiary designation kind. Regardless of the motive, naming a belief because the beneficiary of a retirement account topics the account to a posh collection of guidelines relating to how the account have to be distributed after the proprietor’s dying.

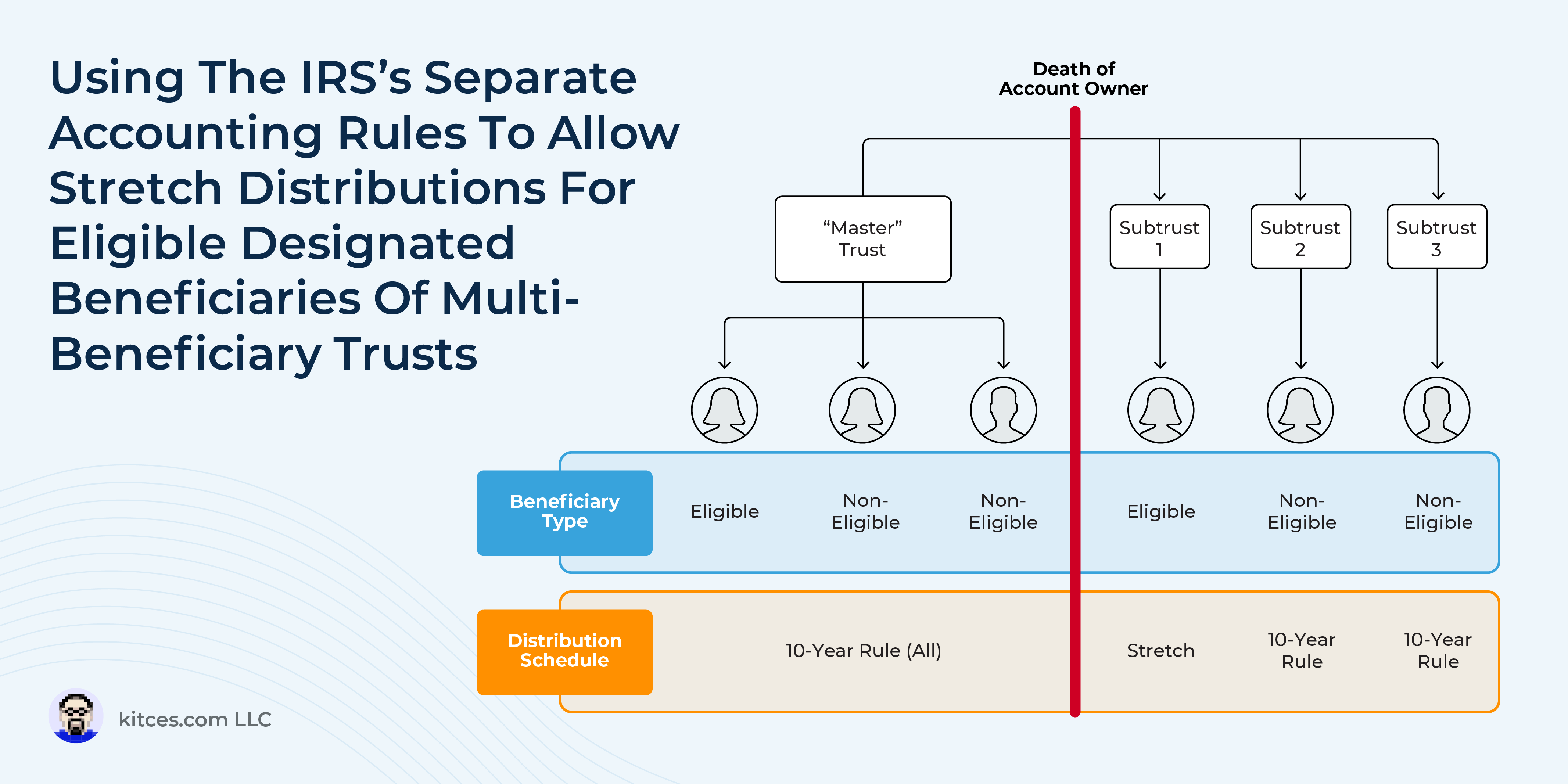

The final rule is that trusts are handled as “Non-Designated Beneficiaries” and due to this fact should totally distribute the retirement account by the tip of the fifth yr after the proprietor’s dying. Nevertheless, some trusts – particularly, ‘see-through’ trusts whose beneficiaries all encompass identifiable people – can qualify for the extra favorable distribution schedules out there to Designated Beneficiaries. The caveat is that irrespective of what number of beneficiaries the belief has, the whole belief will typically be handled as a single beneficiary for distribution functions. Meaning the distribution schedule is often primarily based on the least favorable therapy amongst all of its particular person beneficiaries. If the entire belief’s beneficiaries are thought-about Eligible Designated Beneficiaries, the belief could take ‘stretch’ distributions primarily based on the life expectancy of the oldest beneficiary. But when even one of many belief beneficiaries is a Non-Eligible Designated Beneficiary, then the whole belief is topic to the 10-Yr Rule and have to be totally distributed by the tip of the tenth yr after the account proprietor’s dying.

When the IRS launched its Remaining RMD Rules in July of 2024, it launched a major new carve-out to the ‘single distribution schedule’ rule. Beneath the brand new guidelines, if a see-through belief is break up into separate subtrusts instantly following the account proprietor’s dying, every subtrust can use its personal distribution schedule. In different phrases, beneath the previous guidelines, a belief with a mixture of Eligible and Non-Eligible Designated Beneficiaries would have been robotically topic to the 10-Yr Rule for Non-Eligible Designated Beneficiaries. Beneath the brand new rule, if the belief is split into separate subtrusts for every beneficiary, the Eligible Designated Beneficiaries can every obtain “stretch” distributions over their very own life expectancy – whereas solely the Non-Eligible Designated Beneficiaries will likely be topic to the 10-Yr Rule.

Notably, the IRS rules solely permit this ‘separate accounting’ therapy when the belief doc features a provision to divide the belief into separate subtrusts earlier than the account proprietor’s dying. The belief doc should additionally specify how the retirement account is to be allotted among the many particular person subtrusts– the trustee can’t be granted discretion to make these selections after the very fact. Moreover, the belief should already qualify as a see-through belief; in any other case, any non-individual beneficiaries will trigger the whole belief to be thought-about a Non-Designated Beneficiary, no matter whether or not it is divided into separate subtrusts after the proprietor’s dying.

Finally, the brand new “separate accounting” rule creates extra flexibility for retirement account homeowners who need to identify a belief as their account beneficiary whereas nonetheless optimizing the tax therapy of distributions for every of the belief beneficiaries. Beneath the brand new guidelines, retirement plan homeowners with beneficiaries who’re each Eligible and Non-Eligible Designated Beneficiaries can be sure that their Eligible Designated Beneficiaries can nonetheless obtain stretch distribution therapy. However as a result of the availability to divide the belief have to be written into the belief doc itself, it is necessary for advisors to work with their shoppers (and their property attorneys) to implement any obligatory adjustments prematurely!