Shares of Plug Energy (NASDAQ:PLUG) and Powell Industries (NASDAQ:POWL) closed 19.3% and 45.3% increased on Wednesday, January 31. Additional, each of those shares have been up within the after-hours. The leap in PLUG inventory adopted a ranking improve. On the similar time, stellar Q1 efficiency, margin enlargement, and better dividends pushed POWL inventory increased.

Plug Energy develops hydrogen gas cell programs. In the meantime, Powell Industries gives custom-engineered options designed for the administration, management, and distribution {of electrical} power.

Analyst Expects PLUG Inventory to Double

Roth MKM analyst Craig Irwin upgraded Plug Energy inventory to Purchase from Maintain on January 31. He anticipates that the worth of Plug Energy inventory will double from its present ranges. Because of this, Irwin elevated the value goal to $9 from $4.50.

Referring to the latest tour at PLUG’s Georgia inexperienced hydrogen plant, the analyst sees the power’s clean ramp-up and profitable decision of main technical points as positives, alienating worries in regards to the backlog and margin visibility.

Final month, Plug Energy introduced that it began the manufacturing of liquid inexperienced hydrogen at its Georgia plant, the biggest manufacturing facility within the U.S. market.

Is Plug Energy a Purchase or Promote?

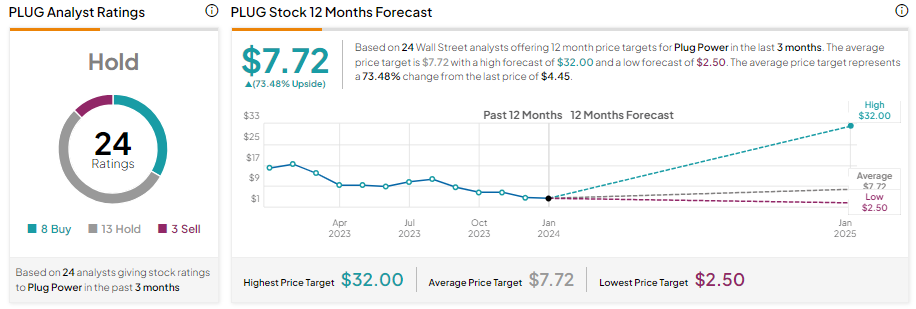

Plug inventory sports activities a Maintain consensus ranking, reflecting eight Purchase, 13 Maintain, and three Promote suggestions. Whereas the beginning of manufacturing at its Georgia facility is a constructive improvement, continued money burn and the necessity for capital stay a drag.

Plug inventory is down about 75% in a single yr. Given the substantial decline, analysts’ common value goal of $7.72 implies 73.5% upside potential from present ranges.

Powell Witnesses Stellar Demand in Q1

Powell Industries is witnessing strong demand throughout its core Industrial finish markets, which drove its Q1 income and earnings. Its prime line elevated 53% year-over-year. Furthermore, the corporate delivered earnings of $1.98 per share, in comparison with $0.10 within the prior yr quarter.

It’s price noting that the corporate’s backlog doubled to $1.3 billion in Q1. Furthermore, new orders and wholesome market exercise will probably assist its top- and bottom-line progress within the coming quarters.

POWL raised its quarterly dividend for the second consecutive yr, due to its strong financials. It now gives an annualized dividend of $1.06 per share, up from $1.05 per share.

What’s the Inventory Value Forecast for Powell Industries?

Powell Industries’ inventory value has gained over 170% in a single yr. Furthermore, POWL inventory has an Outperform Good Rating of 9.