The temporary’s key findings are:

- Our current analysis means that older retirement buyers are typically overly pessimistic about shares.

- Utilizing new survey knowledge, we discover how monetary advisors may help with inventory allocation selections.

- The outcomes present that, for buyers with common danger tolerance, advisors are inclined to advocate larger allocations than buyers favor.

- However this recommendation is probably going useful because it displays advisors’ extra correct evaluation of market dangers and returns.

Introduction

Market danger is an important consideration for folks counting on monetary property as a significant supply of help in retirement. Retirement buyers typically have misperceptions about asset returns and restricted information about monetary markets, doubtlessly jeopardizing their long-term safety. The position of monetary advisors is to information buyers by their asset allocation selections by serving to them align their portfolios with their danger preferences and danger capacities.

Regardless of the significance of this advisor-client relationship, the literature stays comparatively unsettled concerning how advisors assemble portfolio suggestions and the extent to which they have an effect on their purchasers’ views on market danger. This temporary, which is predicated on a current examine, addresses these information gaps by analyzing knowledge from two new surveys of monetary advisors and retirement buyers.1

The dialogue proceeds as follows. The primary part briefly evaluations prior research on advisors’ position in buyers’ portfolio selections and monetary planning. The second and third sections describe the info from the 2 surveys and the methodology for the evaluation, respectively. The fourth part presents outcomes on advisor suggestions and discusses the implications for purchasers’ retirement safety. The ultimate part concludes that – whereas advisors do tailor their suggestions to purchasers’ danger tolerance (however not the composition of their retirement earnings) – their really useful inventory allocations for purchasers with common danger tolerance are typically larger than desired by buyers. However, this recommendation (even when doubtlessly motivated by an advisor’s want for bigger asset-based charges) is probably going useful for a lot of buyers, because it displays a greater evaluation of market dangers and returns.

Background

Many households with significant monetary property depend on funding professionals. Ideally, an advisor ought to assist people discover the suitable stage of danger publicity by educating them in regards to the dangers and returns of investing; eliciting their danger tolerance preferences; reducing the prices of market participation; and serving to them contemplate doubtlessly related elements reminiscent of bequests, late-life well being prices, and utilizing the home as an asset. Prior analysis has discovered that whereas advisors do affect their purchasers to some extent, the proof is combined on the final word affect of monetary recommendation on portfolio decisions and funding outcomes.

A variety of research have examined how advisors could assist purchasers make higher selections and keep away from errors. Some research discovered that advisors assist purchasers handle dangers by diversifying their portfolios or decreasing dangers throughout downturns.2 One other concluded that skilled steering can particularly assist purchasers with decrease monetary literacy.3

Prior research additionally recognized varied limitations of advisors’ affect on their purchasers. Utilizing a novel Canadian dataset, one examine decided that advisors exert substantial affect over their purchasers’ asset allocation, however present restricted customization.4 And one other concluded that whereas less-skilled buyers typically profit extra from working with advisors, advisors usually tend to work with buyers who’re wealthier, older, and extra skilled.5

Whereas advisors have some constructive impacts on their purchasers, analysis additionally highlights elements which will stop advisors from offering recommendation of their purchasers’ greatest curiosity. On the one hand, advisors could fall prey to the identical pitfalls as particular person buyers. Primarily based on a big pattern of Canadian advisors, researchers discovered that they commerce ceaselessly, chase returns, favor costly and actively managed funds, and under-diversify.6 Alternatively, quite a few research have concluded that advisors could react to the monetary incentive embedded of their compensation construction by recommending high-fee merchandise or investments that don’t essentially end in larger internet returns.7

Briefly, the literature continues to be comparatively unsettled concerning the affect of advisors on households’ portfolio decisions.

Information

To higher perceive the practices of monetary advisors and their affect on purchasers, this evaluation makes use of two new surveys, one on advisors and one on buyers – administered by Greenwald Analysis in mid-2024.

The Advisor Survey questioned 400 monetary advisors with a minimum of three years of expertise, $30 million in property below administration, and 75 purchasers (of whom a minimum of 40 % are ages 50+). The survey first solicits primary details about every advisor’s apply – whether or not they work for a Registered Funding Advisor (RIA); the quantity, age, and wealth of purchasers they serve; the whole property they’ve below administration; and their compensation construction. As well as, the survey asks about every advisor’s beliefs concerning the riskiness of varied asset courses; their strategy to speaking danger and offering monetary recommendation; their view on the extent of risk-taking amongst their purchasers after they initially meet; and asset allocation suggestions for hypothetical purchasers.

The Investor Survey questioned 1,016 retirement buyers ages 48-78 with a minimum of $100,000 in complete investable property. To concentrate on these most reliant on these property for retirement, the survey intentionally under-sampled these with an outlined profit (DB) plan.8 The survey begins with primary demographic and monetary data – such because the investor’s age, marital standing, complete monetary property, and homeownership – after which asks in regards to the respondent’s danger preferences, beliefs, and portfolio decisions.9 Two key kinds of questions for this evaluation are: 1) the respondents’ desired asset allocation, which will be in contrast with the really useful allocation from the Advisor Survey; and a couple of) whether or not they have ever labored with an advisor and, if that’s the case, whether or not it altered their urge for food for danger.10

Whereas the 2 surveys aren’t explicitly linked – that’s, advisors can’t be matched with buyers – weighting the responses to the Advisor Survey by the variety of purchasers ages 50+ helps make the Investor Survey outcomes extra related for comparability functions.

Methodology

Information from each surveys are used to analyze advisors’ really useful asset allocations and to discover the affect of those suggestions on buyers.

What Drives Advisors’ Suggestions?

To know what drives advisor suggestions, the evaluation examines their really useful fairness allocations for 3 hypothetical purchasers. Particularly, the Advisor Survey asks them about: 1) a baseline consumer who’s a 65-year-old retired couple with reasonable danger tolerance; 2) a consumer that matches the baseline apart from having low danger tolerance; and three) a consumer that matches the baseline apart from having a bigger share of monetary wealth within the type of assured lifetime earnings.

To research how suggestions is perhaps influenced by varied elements of the advisors’ apply, the examine makes use of regression evaluation to find out the affect of the next advisor-related elements:

- Inventory danger premium, calculated because the distinction between the assumed long-term returns of shares and bonds reported by the advisor. The next assumed inventory danger premium is predicted to extend the really useful allocation to shares.

- Perceived riskiness of shares, measured by whether or not the advisor charges shares larger than 4 on a 1-7 danger scale. The advisor’s perceived riskiness of shares is predicted to be negatively related to the really useful allocation to shares.

- Advisor’s compensation construction, measured by the share of complete compensation derived from percentage-of-asset charges. Prior analysis means that having a bigger share of such compensation will probably be related to the next really useful inventory allocation.

- Kind of advisor. Each RIAs and dealer sellers are required to behave of their purchasers’ greatest curiosity, however the RIA customary is extra complete and, thus, is predicted to weaken the affiliation, if any, between advisors’ compensation construction and their recommendation. Therefore, the equation consists of an RIA variable and interacts RIA with the compensation construction variable.

- Earnings methods. The survey asks advisors to report the proportion of their retired purchasers with whom they use particular methods to handle their investments. Methods with a higher emphasis on securing primary spending could result in extra conservative portfolio suggestions.11 These methods embrace:

- “Whole return”: makes use of one fundamental asset allocation throughout all of the consumer’s accounts and depends on all aspects of funding return (dividends, curiosity, capital beneficial properties, and principal) to finance a pre-determined month-to-month withdrawal quantity.

- “Bucket” or “time segmentation”: divides the consumer’s investable property into classes, based mostly on when – and for what objective – the cash is to be spent.

- “Ground”: seeks to fund important bills by autos that present earnings that’s assured for all times, reminiscent of Social Safety, pensions, and annuities.

How Do Advisors’ Suggestions Influence Purchasers?

This portion of the evaluation begins by evaluating really useful inventory allocations to buyers’ desired and precise allocations. A perfect dataset would come with data on the really useful allocation to every investor, in addition to knowledge on every investor’s desired and precise asset allocation. However no survey – together with the current Greenwald Analysis surveys – comprises all three measures collectively. So, the evaluation as a substitute compares really useful inventory allocations from the Advisor Survey to buyers’ desired inventory allocation within the Investor Survey, and precise allocations reported within the Well being and Retirement Examine (HRS), a big family survey. Then, utilizing knowledge from the Investor Survey, the evaluation paperwork the share of retirement buyers that imagine working with an advisor has influenced their desired danger stage.

The ultimate query addressed is whether or not advisor suggestions are useful. Step one is to see whether or not advisors are higher knowledgeable than buyers about market dangers and returns. The second step includes evaluating advisor suggestions to the inventory allocations prescribed in Morningstar’s goal date glide paths to see whether or not the suggestions align with the portfolio alternative of well-informed rational buyers throughout the framework of lifecycle portfolio alternative fashions.12

Outcomes

This part presents the outcomes of the analyses of monetary advisors’ suggestions and their affect on retirement buyers.

What Do Advisors Usually Advocate?

Desk 1 reveals, for every of the three hypothetical purchasers, the typical and customary deviation of the inventory allocation really useful by advisors. The common suggestions for the baseline consumer and the consumer with decrease danger tolerance are 48 % and 30 %, respectively, suggesting that purchasers’ danger tolerance ranges are a important consideration for advisors.13 The common suggestion for the consumer with extra assured earnings is a stunning 44 %, despite the fact that assured earnings is predicted to crowd out an investor’s bond allocation and thus enhance the allocation to shares of their remaining liquid wealth.

What Explains the Variation in Advisable Inventory Allocations Throughout Advisors?

A more in-depth take a look at advisors’ suggestions reveals important variation – the really useful inventory allocation for the baseline consumer has an ordinary deviation of 18 proportion factors. A shift in fairness allocation of this magnitude would have a considerable affect on retirement planning; thus, it is very important perceive what elements would possibly clarify the big selection of suggestions throughout advisors for a similar consumer.

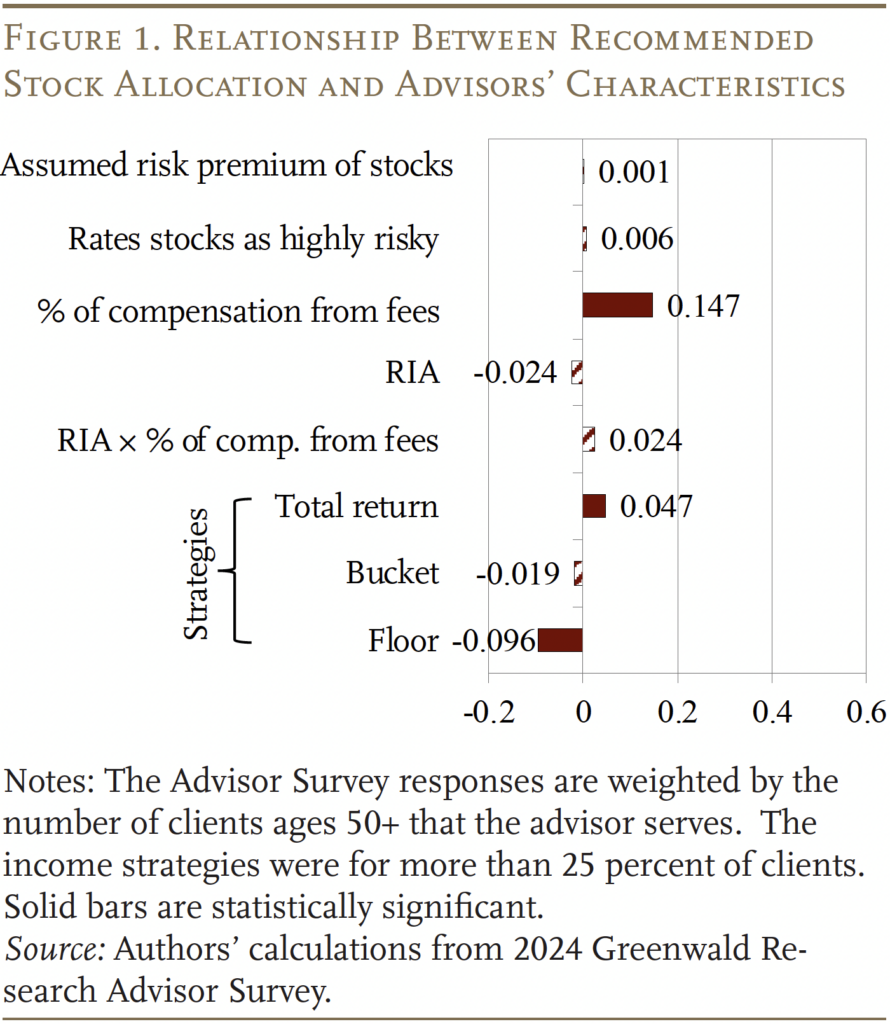

Determine 1 presents the outcomes of the regression that relates advisors’ really useful inventory allocation for the baseline consumer to numerous elements of the advisors’ apply, together with assumptions and perceptions on inventory returns, compensation construction, whether or not training as an RIA, and ceaselessly used earnings methods. The important thing discovering is that the upper the share of the advisor’s compensation derived from percentage-of-asset charges, the upper the really useful allocation to shares below the baseline state of affairs. The kind of generally used earnings technique additionally issues – specifically, advisors who ceaselessly use the whole return technique advocate larger inventory allocations, whereas those that ceaselessly use the ground technique advocate decrease inventory allocations, doubtless reflecting the next precedence given to securing important spending.14 Curiously, nevertheless, neither the danger premium for shares of their monetary fashions, nor their beliefs in regards to the riskiness of shares, seem to matter. Additionally, whether or not the advisor works for an RIA doesn’t appear to have any direct affect on their suggestions or have an effect on the affect of their compensation construction on suggestions.15

How Do Monetary Advisors’ Suggestions Influence Their Purchasers?

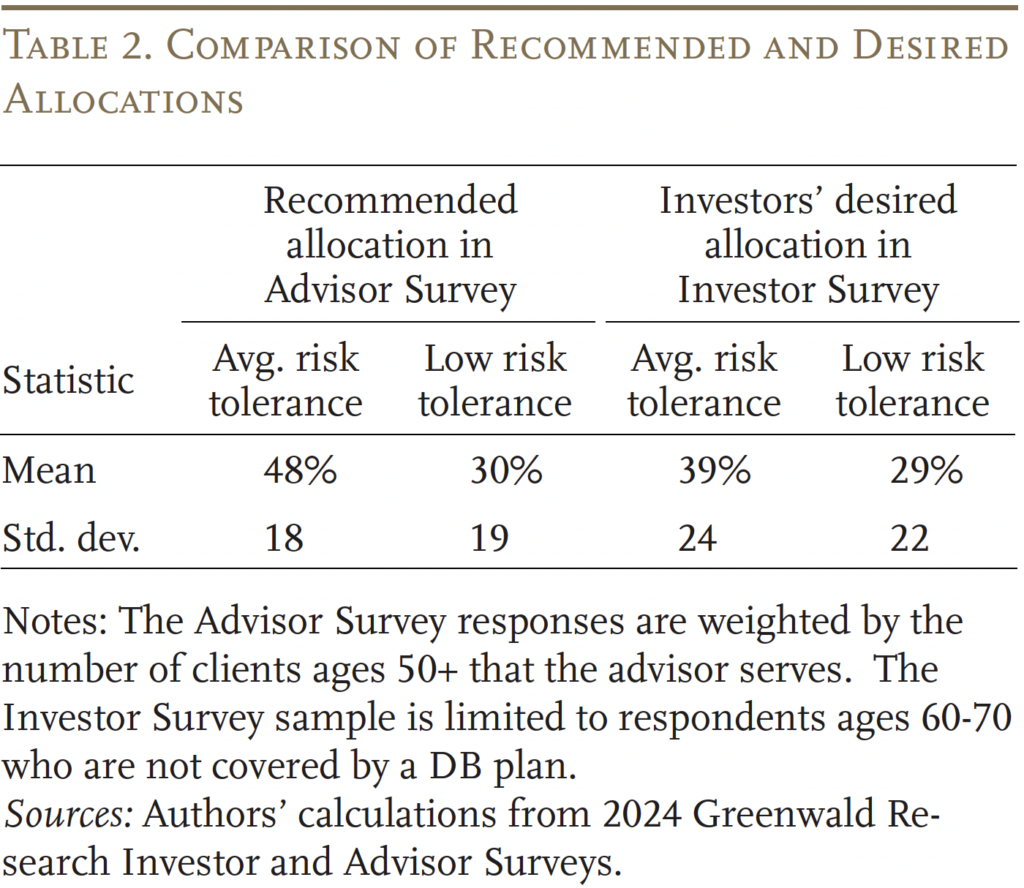

The evaluation begins by evaluating advisors’ really useful inventory allocations within the Advisor Survey to the buyers’ desired allocations within the Investor Survey. Desk 2 reveals that – on common – the really useful allocations are larger than the specified allocations for buyers with common danger tolerance, however aligned for these with low danger tolerance.

The discrepancy between advisors’ suggestions and buyers’ desired inventory allocations means that advisors are inclined to counsel their purchasers – a minimum of these with reasonable danger tolerance – to extend their inventory allocations. This implication is per the truth that precise inventory allocations for buyers are a lot nearer to advisors’ really useful allocations than to buyers’ desired allocations (see Desk 3).16

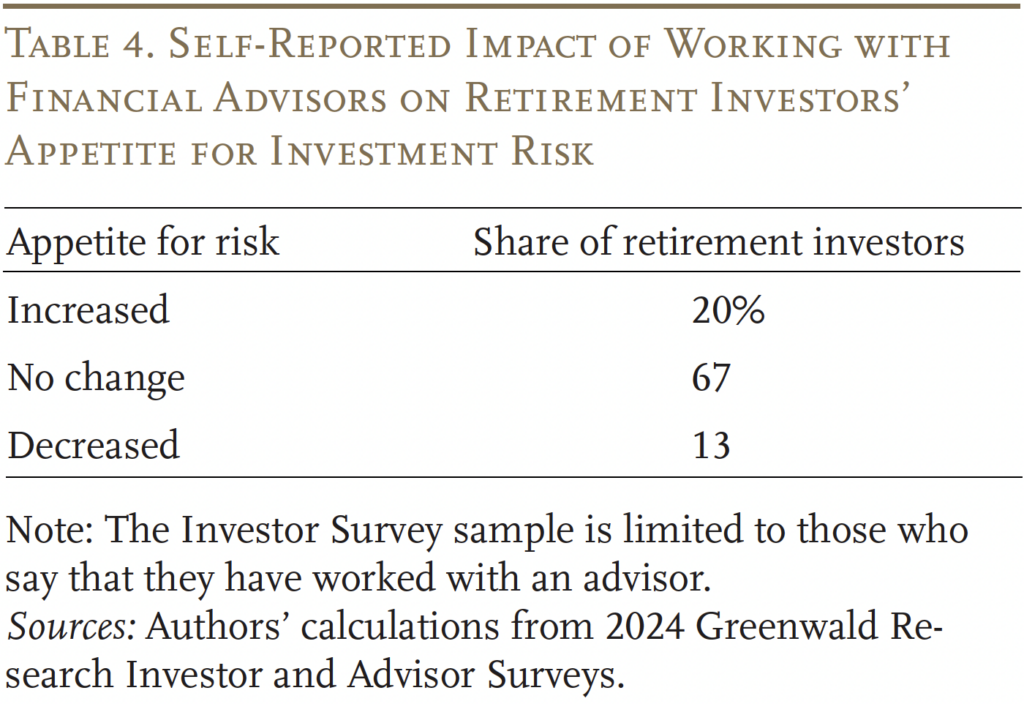

This interpretation can also be supported by what buyers say straight about working with an advisor. Desk 4 reveals that 33 % of retirement buyers who work with an advisor suppose doing so has modified their danger urge for food; amongst this group, about three-fifths say it has elevated their danger urge for food moderately than decreased it (20 % vs. 13 %).

Provided that advisors do affect a few of their purchasers’ urge for food for danger, the pure follow-on query is whether or not that affect improves their purchasers’ retirement safety. Two items of proof help the concept advisor suggestions do, broadly, assist. First, evaluating knowledge from the Investor and Advisor Surveys means that advisors – on common – have a extra rational view of the dangers and returns of shares versus bonds, so one would anticipate retirement buyers to profit from advisors’ higher information and experience.17

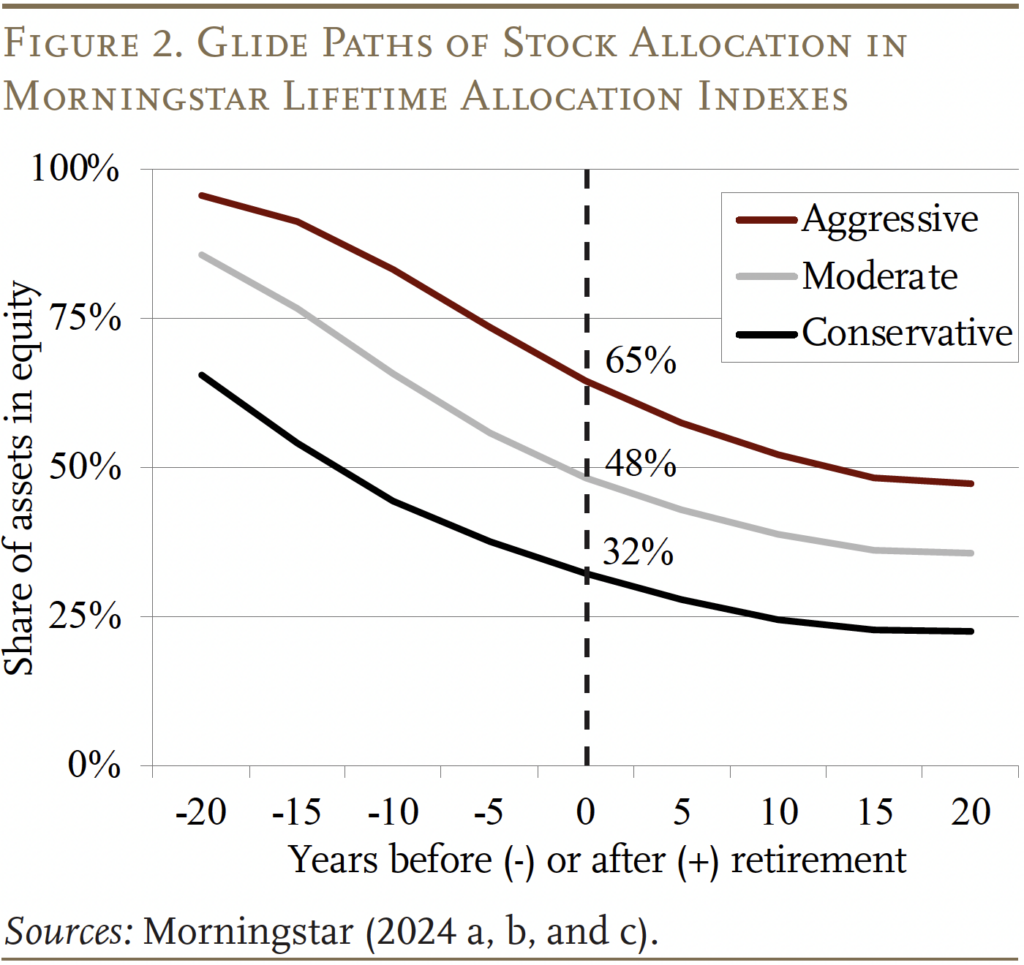

Second, advisors’ common suggestions look fairly just like the inventory allocations prescribed by goal date funds (TDFs). For instance, advisors’ really useful allocations for hypothetical purchasers with reasonable and decrease danger tolerance (48 and 30 %) match the inventory allocations of the reasonable and conservative variants of the Morningstar Lifetime Allocation Index (48 % and 32 %, respectively) (see Determine 2).18 TDFs are designed to replicate the optimum asset allocation that financial and finance idea would predict for a rational investor throughout the lifecycle-model framework. One would anticipate retirement buyers to profit from advisor suggestions that align broadly with optimum allocations based mostly on long-standing ideas of financial and finance idea.

Conclusion

Regardless of the prevalence of monetary advisors, the educational literature stays comparatively unsettled concerning advisors’ affect on households’ portfolio decisions. Extra particularly, a big information hole stays concerning advisors’ strategy to portfolio suggestions and the extent to which they have an effect on their purchasers’ views on market danger.

This evaluation used two new surveys of monetary advisors and retirement buyers to evaluate advisors’ portfolio suggestions and discover their affect on purchasers’ danger urge for food in ways in which help retirement safety. The outcomes present that – whereas advisors do tailor their suggestions to purchasers’ danger tolerance (however not the composition of their retirement earnings) – their really useful inventory allocations for these with common danger tolerance are typically larger than what buyers with common danger tolerance want. However, this consequence is probably going useful for a lot of buyers as a result of extra reasonable evaluation of dangers and returns of advisors (even when doubtlessly motivated by advisors’ want for bigger asset-based charges).

References

Aubry, Jean-Pierre and Yimeng Yin. 2025a. “What Inventory Allocations Do Advisors Advocate and How Does It Influence Their Purchasers?” Working Paper 2025-10. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Aubry, Jean-Pierre and Yimeng Yin. 2025b. “Do Desired Inventory Allocations Differ From Precise Holdings?” Working Paper 2025-9. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Bannier, Christina E. and Milena Neubert. 2016. “Gender Variations in Monetary Threat Taking: The Position of Monetary Literacy and Threat Tolerance.” Economics Letters 145: 130-135.

Beutel, Johannes and Michael Weber. 2022. “Beliefs and Portfolios: Causal Proof.” Analysis Paper 22-08. Chicago, IL: The College of Chicago, Sales space Faculty of Enterprise.

Chalmers, John and Jonathan Reuter. 2020. “Is Conflicted Funding Recommendation Higher than No Recommendation?” Journal of Monetary Economics 138(2): 366-387.

Dimmock, Stephen G., Roy Kouwenberg, Olivia S. Mitchell, and Kim Peijnenburg. 2016. “Ambiguity Aversion and Family Portfolio Alternative Puzzles: Empirical Proof.” Journal of Monetary Economics 119(3): 559-577.

Dominitz, Jeff and Charles F. Manski. 2007. “Anticipated Fairness Returns and Portfolio Alternative: Proof from the Well being and Retirement Examine.” Journal of the European Financial Affiliation 5(23): 369-379.

French, Kenneth and James Poterba. 1991. “Investor Diversification and Worldwide Fairness Markets.” The American Financial Evaluate 81(2): 222-226.

Foerster, Stephen, Juhani T. Linnainmaa, Brian T. Melzer, and Alessandro Previtero. 2017. “Retail Monetary Recommendation: Does One Measurement Match All?” The Journal of Finance 72(4): 1441-1482.

Goetzmann, William N. and Alok Kumar. 2008. “Fairness Portfolio Diversification.” Evaluate of Finance 12(3): 433-463.

Gomes, Francisco. 2020. “Portfolio Alternative Over the Life Cycle: A Survey.” Annual Evaluate of Monetary Economics 12(12): 277-304.

Gomes, Francisco, Michael Haliassos, and Tarun Ramadorai. 2021. “Family Finance.” Journal of Financial Literature 59(3): 919-1000.

Grinblatt, Mark and Matti Keloharju. 2001. “How Distance, Language, and Tradition Affect Stockholdings and Trades.” The Journal of Finance 56(3): 1053-1073.

Hackethal, Andreas, Michael Haliassos, and Tullio Jappelli. 2012. “Monetary Advisors: A Case of Babysitters?” Journal of Banking & Finance 36(2): 509-524.

Hermansson, Cecilia and Sara Jonsson. 2021. “The Influence of Monetary Literacy and Monetary Curiosity on Threat Tolerance.” Journal of Behavioral and Experimental Finance 29: 100450.

Kramer, Marc M. 2012. “Monetary Recommendation and Particular person Investor Portfolio Efficiency.” Monetary Administration 41(2): 395-428.

Linnainmaa, Juhani T., Brian T. Melzer, and Alessandro Previtero. 2021. “The Misguided Beliefs of Monetary Advisors.” The Journal of Finance 76(2): 587-621.

Linnainmaa, Juhani, Brian Melzer, Alessandro Previtero, and Stephen Foerster. 2019. “Monetary Advisors and Threat-Taking.” Working Paper. Out there at: https://www.aleprevitero.com/wp-content/uploads/2021/05/FinancialAdviceRiskTaking_20191115.pdf

Liu, Zhikun, Michael Finke, and David Blanchett. 2024. “Skilled Monetary Recommendation and Investor Conduct throughout the COVID-19 Pandemic.” Monetary Planning Evaluate 7(1): e1172.

Morningstar. 2024a. Morningstar Lifetime Allocation Indexes Aggressive. Chicago, IL.

———. 2024b. Morningstar Lifetime Allocation Indexes Conservative. Chicago, IL.

———. 2024c. Morningstar Lifetime Allocation Indexes Average. Chicago, IL.

———. 2015. “Development Guidelines for Morningstar Asset Allocation Index Household.” Morningstar Methodology Paper. Chicago, IL.

Mullainathan, Sendhil, Markus Noeth, and Antoinette Schoar. 2012. “The Marketplace for Monetary Recommendation: An Audit Examine.” Working Paper 17929. Cambridge, MA: Nationwide Bureau of Financial Analysis.

Shapira, Zur and Itzhak Venezia. 2001. “Patterns of Conduct of Professionally Managed and Impartial Buyers.” Journal of Banking & Finance 25(8): 1573-1587.

Von Gaudecker, Hans-Martin. 2015. “How Does Family Portfolio Diversification Range with Monetary Literacy and Monetary Recommendation?” The Journal of Finance 70(2): 489-507.

College of Michigan. Well being and Retirement Examine, 2020. Ann Arbor, MI.