Earlier this week, President-Elect Trump introduced on social media that he intends to shut the Division of Training (ED) early in his administration and switch duties of teaching our youngsters to the states.

Closing ED would require Congressional approval. In 2018, President Trump proposed transferring ED below the Division of Labor, however Congress rejected that concept in 2018. Many GOP conservatives have lengthy believed that ED is inefficient and that state-run training departments might higher assist low-income households and handle the wants of youngsters with disabilities.

What stays unclear is the way forward for the Workplace of Federal Scholar Support, which makes up 74% of the Division of Training’s annual price range.

What’s the Position of the Division of Training?

ED’s mission is to “promote pupil achievement and preparation for international competitiveness by fostering academic excellence and making certain equal entry for college kids of all ages.”

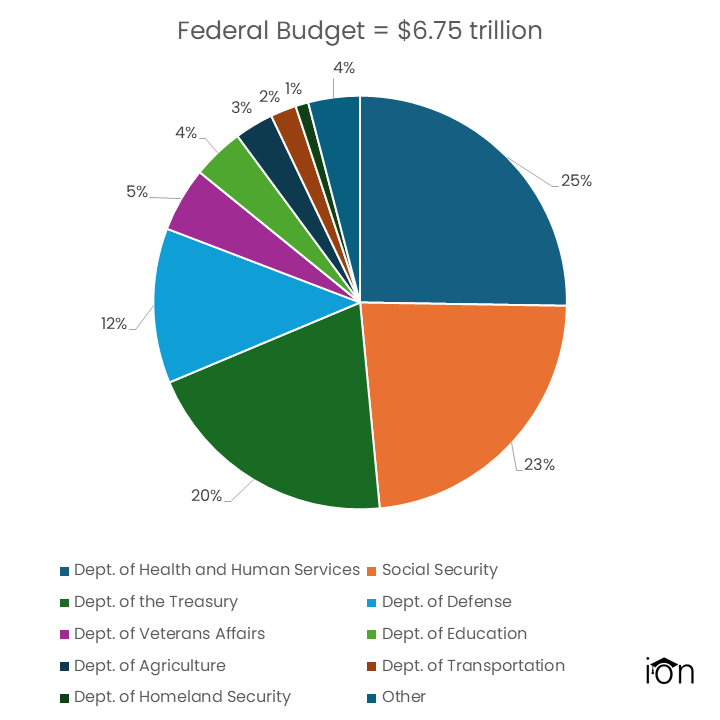

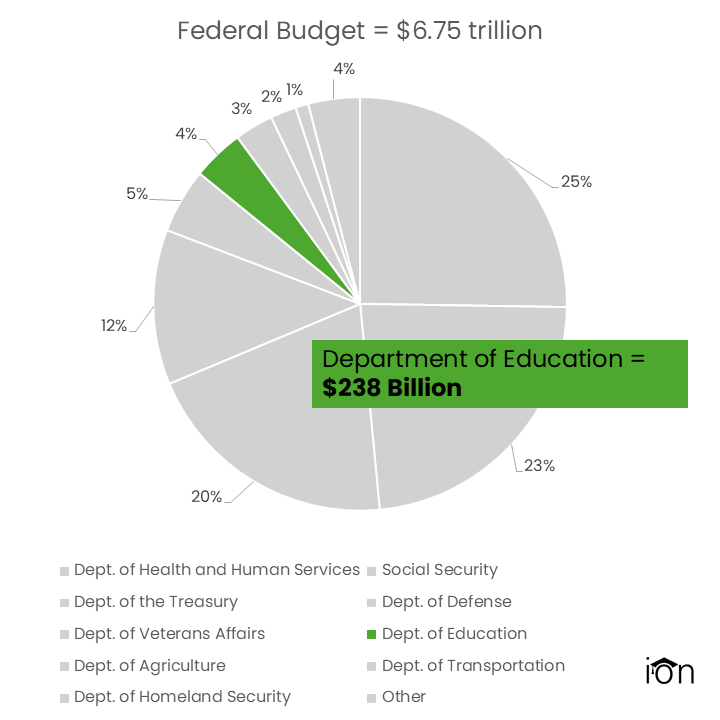

Regardless of this important position, ED represents solely a fraction – between 2% and 4% – of the general Federal price range:

The Division of Training is a minor price in comparison with Social Safety, nationwide protection, and healthcare. Federal grants have lengthy been used to assist low-income households by way of Title I, whereas youngsters with disabilities obtain help by way of the People with Disabilities Training Act (IDEA).

The Position of Federal Scholar Support

Title I and IDEA funding mixed don’t come near the price of federal pupil loans. Greater than $175 billion goes towards working the Workplace of Federal Scholar Support, with the bulk allotted to the Direct Federal Scholar Mortgage Program.

If the Division of Training had been to shut, the Workplace of Federal Scholar Support, its 1,500 staff, and the $1.7 trillion pupil mortgage portfolio, might be transferred to the Treasury Division. Undertaking 2025 means that the Treasury Division “would handle collections and defaults” and FSA and its obligations could be spun off into a brand new authorities company.

Potential Impacts on Scholar Mortgage Debtors

Scholar mortgage debtors face a number of modifications, together with the suspension of a number of pupil mortgage initiatives proposed by the Biden administration, such because the SAVE income-driven compensation plan and new forgiveness proposals.

If ED closes, additional confusion is probably going as insurance policies and duties evolve below the brand new administration. This 12 months has already seen delays in FAFSA processing and court docket injunctions in opposition to the SAVE plan.

Having a default aversion plan in place by way of IonTuition might help debtors navigate these modifications, keep forward of potential confusion, and discover profitable compensation choices within the years forward.