Getting a mortgage might be one of many largest monetary commitments you’ll ever make. There’s at all times a priority about within the occasion of your dying or turning into severely sick, your loved ones may need problem assembly this massive legal responsibility.

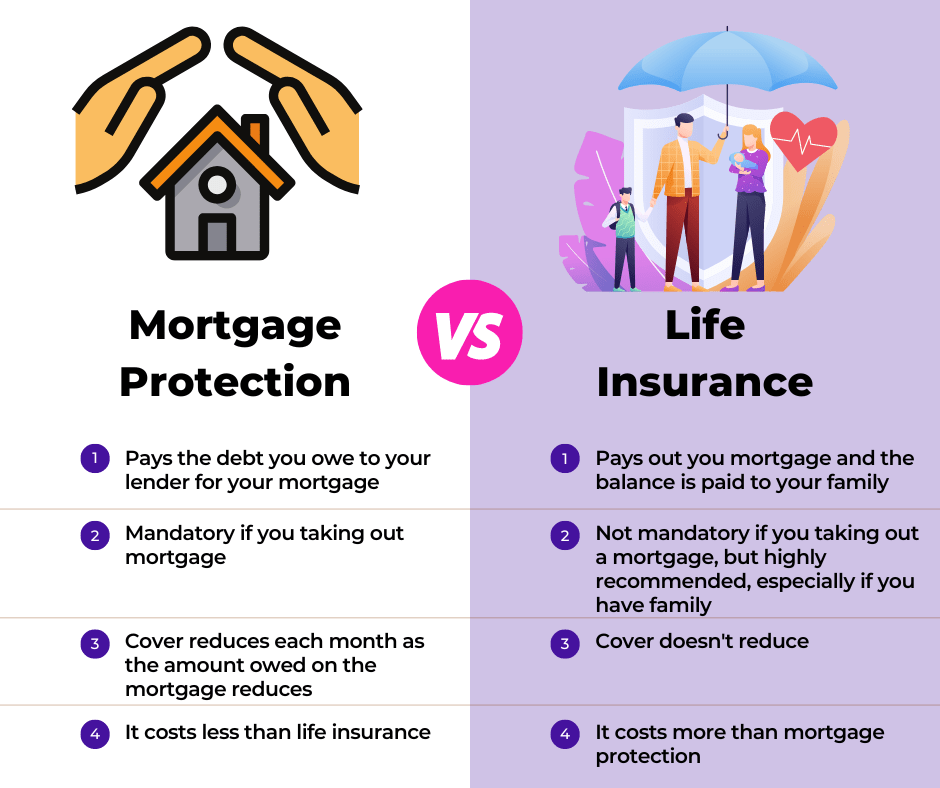

When you’re making an attempt to take out a mortgage your lender will inform you that you will want both life insurance coverage or mortgage safety. Mortgage safety and life insurance coverage appear to be the identical product as each will be assigned to your lender to repay your mortgage in case of the dying of the policyholder.

Nonetheless, one of many important variations between them is that Mortgage Safety insurance coverage is designed to cowl simply your mortgage repayments when you die. Life insurance coverage insurance policies, however, are primarily to guard you and your loved ones.

What’s Mortgage Safety and the way does it work?

Mortgage safety is a life assurance safety coverage that ensures that your mortgage might be paid off when you die throughout the time period of your plan. It’s obligatory and should be taken out once you get a mortgage.

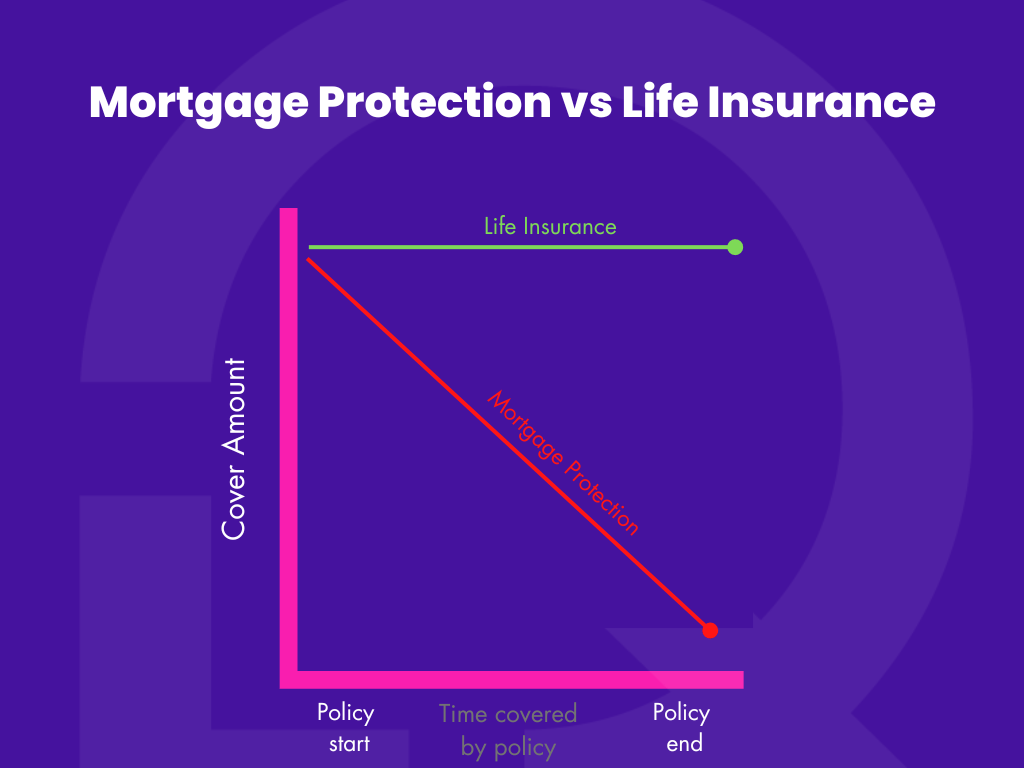

The duvet quantity of this plan reduces every month as the quantity owed on the mortgage reduces. Your premium doesn’t change, regardless that the extent of protection reduces. This makes mortgage safety the cheaper possibility. However is cheaper at all times the perfect? Not essentially.

What’s Life insurance coverage and the way does it work?

Life insurance coverage gives a lump sum money fee to your loved ones within the occasion of your dying. The duvet of this plan doesn’t scale back like with mortgage safety and it’ll stay the identical for your complete time period of your coverage.

No one needs to speak about their dying, however failing to plan can have a critical affect on your loved ones since they would be the ones to pay this large debt and even pay for funeral bills. So placing the appropriate cowl in place to guard your loved ones ought to be a high precedence.

After all, you can too get Life Insurance coverage and assign it to your Mortgage lender. If you do that, your mortgage will lower yearly however your cowl quantity gained’t. When you have been to go away, the mortgage can be paid off and any remaining cowl might be paid out to your loved ones. This feature solely prices a bit bit extra, but when it was ever wanted, it’s undoubtedly the higher possibility.

Based on the Irish Instances, the typical value of a funeral in Eire is round €6,000. And in comparison with different nations within the survey; Eire was positioned fourth within the rating as the most costly funeral value.

Having life insurance coverage will assure peace of thoughts figuring out your family members can be taken care of financially. The cash from a life cowl plan might allow them to:

– Preserve their present life-style and assist with their month-to-month outgoings.

– Repay loans and money owed.

– Make investments the cash for the long run or to generate a brand new month-to-month revenue.

– Pay for youngsters’s schooling.

– Create a “wet day fund” or handle every other dwelling bills comparable to upkeep or hospital bills.

Mortgage Safety vs Life Insurance coverage in Eire – The Breakdown

Each insurances will present a lump sum in case of dying throughout the time period of the coverage. One of many variations is that mortgage safety will cowl solely your mortgage repayments when you die prematurely and life insurance coverage, however, is especially to guard you and your loved ones financially within the occasion of dying.

One other distinction is that the quilt on mortgage safety reduces every month as the quantity owed on the mortgage reduces. This doesn’t occur with life insurance coverage, the quilt stays the identical.

See the opposite variations beneath.