The temporary’s key findings are:

- As individuals more and more depend on their 401(okay) belongings for retirement, their publicity to market threat is a key situation.

- A brand new survey reveals that older retirement buyers are usually overly pessimistic about shares, which possible impacts their most well-liked asset allocation.

- However comparable information counsel that they really maintain extra in shares than they would favor, maybe because of the progress of goal date funds as 401(okay) defaults.

- So, whereas buyers could have extra in shares than they appear to need, it in all probability helps them given their overly pessimistic views.

Introduction

As individuals method and enter retirement, they face an array of dangers – together with the chance of outliving their belongings, the chance of a giant healthcare spending shock, inflation threat that erodes their revenue and wealth, and market threat that immediately impacts the worth of their belongings. Market threat has turn into more and more salient as employer-sponsored retirement plans have shifted from outlined profit (DB) to 401(okay)-type preparations, the place households bear the brunt of poor outcomes. The questions are, how do retirement buyers view market threat and the way do these views relate to their desired and precise holdings of dangerous belongings?

This temporary, which is predicated on a brand new paper, first experiences the outcomes of a current survey on how buyers understand market threat.1 The survey covers older households (ages 48-78) who’re depending on their belongings for assist in retirement ($100,000+ in investable belongings and no DB plan). The evaluation then explores the connection between desired holdings in dangerous belongings reported within the new survey to precise holdings reported in two main family surveys – the Well being and Retirement Research and the Survey of Shopper Funds. This method goals to find out the relative significance of investor preferences versus institutional preparations – specifically, the goal date funds which might be usually the default funding choice in 401(okay) plans.

The dialogue proceeds as follows. The primary part offers some background on market threat, and the second part briefly summarizes a portion of the huge literature on the optimum holdings of dangerous belongings and households’ perceptions of the riskiness of shares. The third part briefly describes the findings from the brand new survey, and the fourth part explores the connection between desired and precise holdings of dangerous belongings.

The ultimate part concludes that buyers’ desired allocations to dangerous belongings are usually decrease than their precise allocations. The low degree of desired holdings is in step with households’ overly pessimistic views of inventory returns, and the upper degree of precise holdings possible displays the target-date-fund defaults in 401(okay) plans. In brief, individuals appear to be holding extra equities than they need, however that sample might be good for them.

What Does Market Danger Imply for Wealth Accumulation?

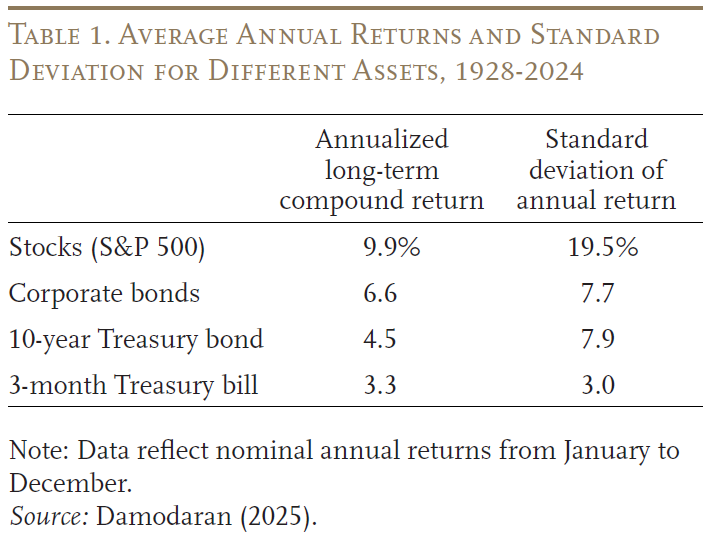

In standard funding portfolios, most monetary market dangers stem from shares. Whereas over the long run, shares have dramatically outperformed fixed-income belongings, their returns are a lot much less sure, as evident by the massive normal deviation of annual returns (see Desk 1). The important thing situation is how the chance related to inventory returns in the end impacts the worth of invested belongings in retirement and the spending degree these belongings can assist.

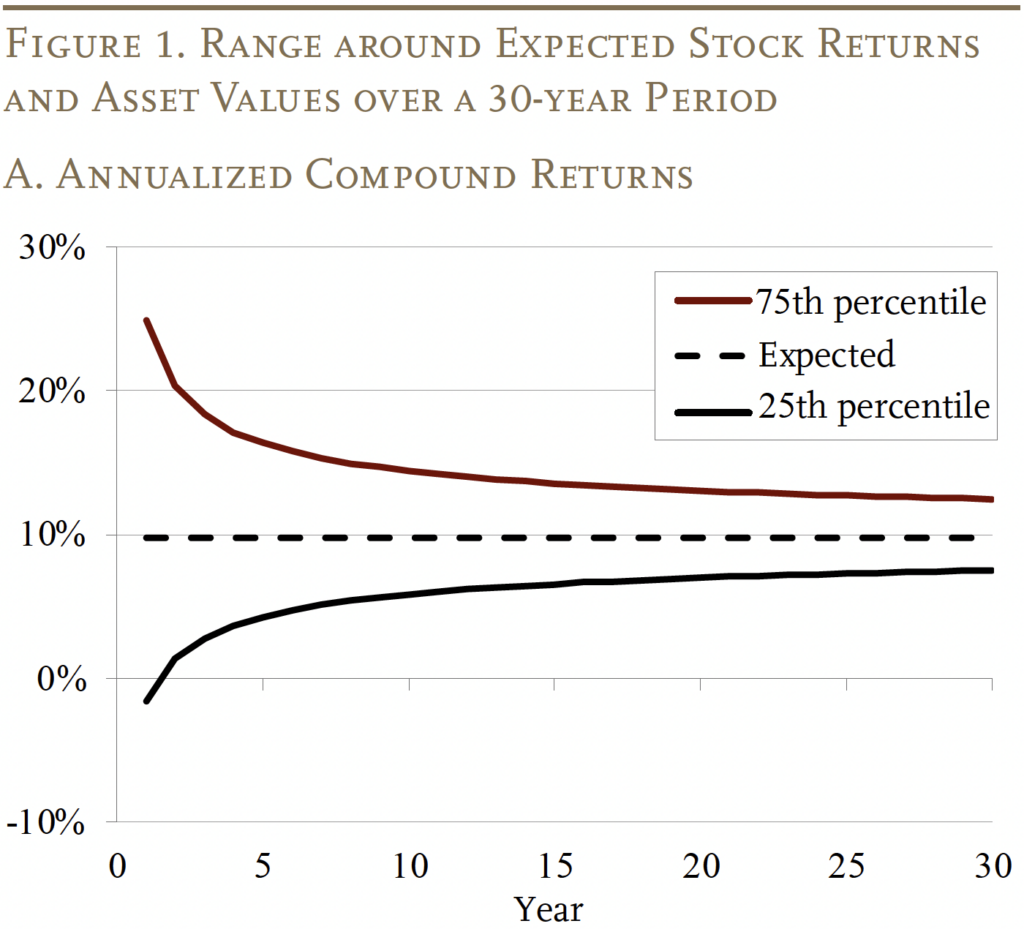

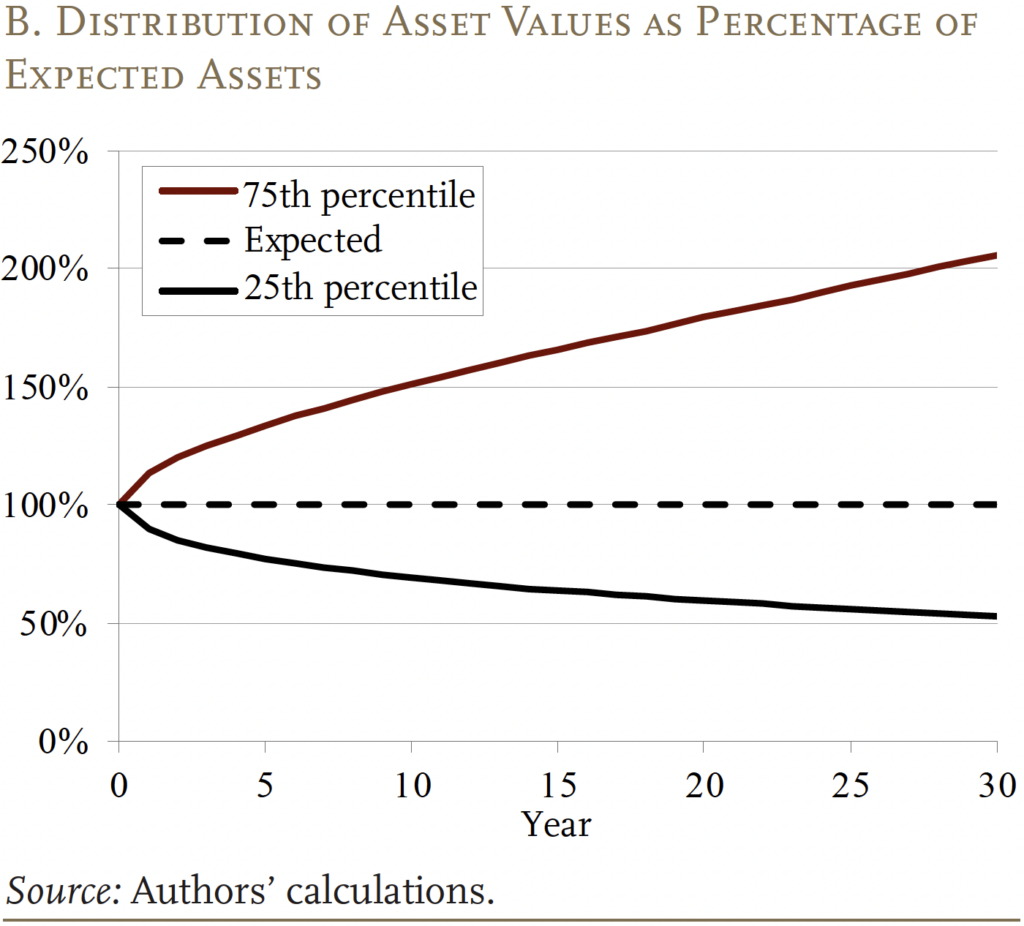

A typical fallacy is that threat declines with longer funding horizons as a result of fluctuations in short-term returns common out in the long term. In reality, even when annualized inventory returns converge to long-term expectations over time (see Determine 1a), the vary of wealth accumulation widens as a proportion of anticipated wealth (see Determine 1b). Extra particularly, over a 15-year interval, the inventory investor faces a 25-percent likelihood that their belongings might be 60 % greater than what they count on, and a 25-percent likelihood that their belongings might be 40 % lower than what they count on. Extending the interval to 30 years, buyers face a 25-percent likelihood that their belongings might be one hundred pc greater than anticipated or 50 % much less.2

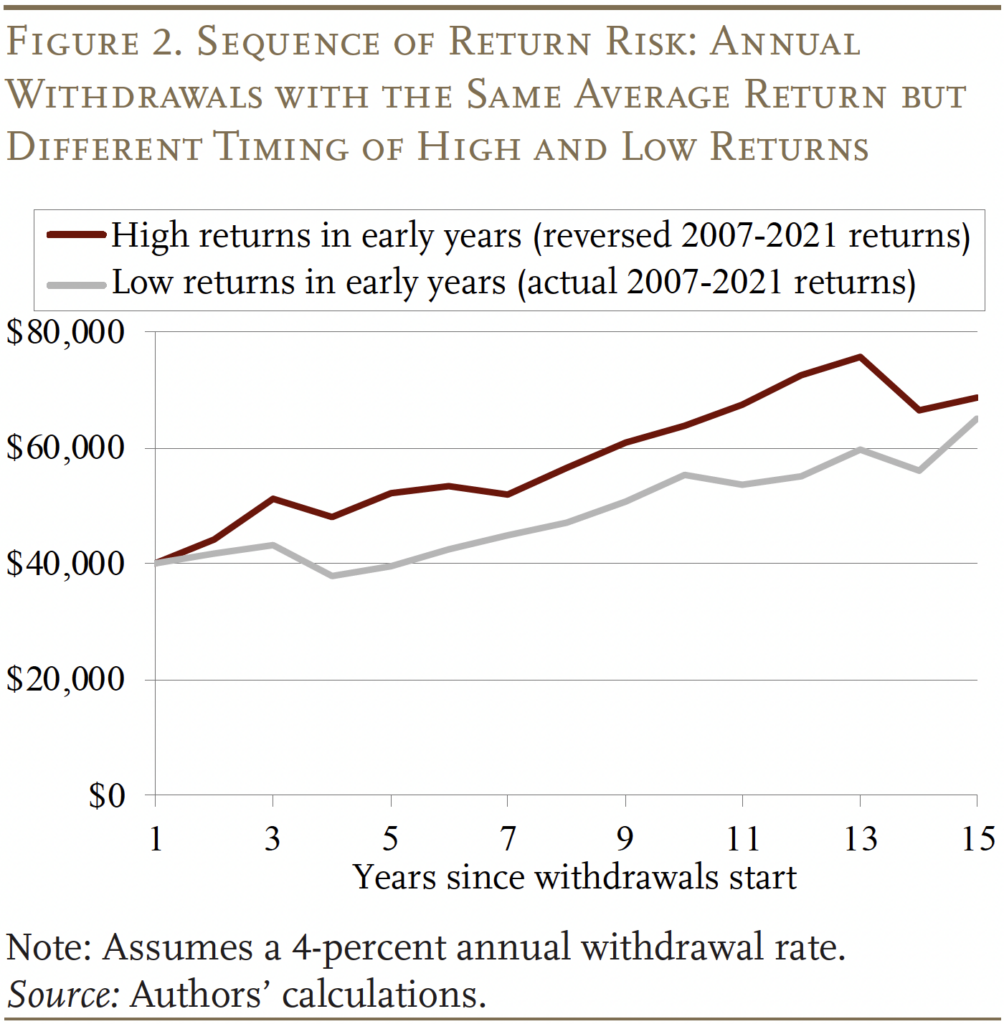

Along with the uncertainty in asset values over the long run, as soon as retirement buyers begin withdrawing their monetary belongings, in addition they face so-called “sequence-of-returns” threat. That’s, within the presence of normal withdrawals from the portfolio, returns early within the interval have better results than later returns on complete retirement revenue. This impact might be seen in Determine 2, which assumes a beginning portfolio of $1 million invested in a 50-50 inventory/bond portfolio and a continuing withdrawal charge of 4 %. The train compares the affect on annual withdrawals beneath two stylized return paths with the identical common annual return: 1) the historic returns from 2007-2021, with decrease returns early because of the Nice Recession and better returns later because of the robust inventory market (grey line); and a couple of) the identical return sequence in reverse order (pink line). The comparability reveals that, within the state of affairs with worse returns within the early years, a retiree sticking with the 4-percent withdrawal technique would have about 10- to 20-percent decrease annual withdrawals.

In brief, monetary threat actually issues for well-being in retirement. The subsequent situation is what the literature says about how people view the chance related to investing in shares and what economists must say about managing this threat.

Optimum Investing and Particular person Perceptions

When it comes to how you can handle the chance related to fairness funding, it’s useful to start out with the seminal work by Samuelson (1969) and Merton (1969), through which the family has no labor revenue and withdrawals from monetary belongings are the one supply of revenue. Such a mannequin ends in a transparent and easy rule for optimum asset allocation: buyers ought to keep a fixed share in dangerous belongings all through their lifetime no matter age and preliminary wealth ranges. That share depends upon three elements: 1) the anticipated return of dangerous belongings relative to that of risk-free belongings (i.e., the inventory threat premium); 2) the volatility of inventory returns; and three) the chance aversion degree of the investor.3

A vital extension to this primary portfolio alternative mannequin is introducing labor revenue.4 Since human capital generates a stream of future labor revenue that’s usually thought-about a better substitute to bonds than to shares, households with better human capital (within the sense of the current worth of complete future labor revenue) ought to maintain a better proportion of their monetary wealth in dangerous belongings. As a result of human capital declines with age, the share of dangerous belongings in complete monetary wealth ought to decline as one approaches retirement. This framework underlies the acquainted suggestion supplied by monetary advisors and the sample of glide paths in goal date funds.5

An enormous array of things can have an effect on households’ tolerance for threat and willingness to spend money on shares – whether or not they personal a house, the state of their well being, concern about outliving their assets, and a need to depart a bequest. Incorporating these elements into the evaluation can alter the asset allocation paths predicted by primary fashions. An in depth literature has tried to estimate the affect of those elements on the willingness to carry shares, and these research are summarized within the full paper.

A unique sort of consideration – and one vital for this evaluation – may have an effect on individuals’s willingness to spend money on shares – specifically, their expectations about inventory returns and market volatility. As one would count on, the empirical proof confirms that constructive expectations in regards to the inventory market are related to better inventory possession.6 Curiously, one examine finds that beliefs account for twice as a lot variation in noticed portfolio holdings as threat aversion.7

Expectations about returns and volatility, nevertheless, are essentially totally different from the opposite elements mentioned above in that the expectations might be in contrast with goal measures of efficiency to find out their accuracy. Certainly, the literature suggests households are likely to have a lot decrease expectations of inventory market positive factors and better expectations of volatility than historic averages. Extra particularly, analysis utilizing the Well being and Retirement Research (HRS) has persistently discovered that people are likely to underestimate the probability of constructive inventory market efficiency when in comparison with historic information.8 Equally, analysis primarily based on the College of Michigan’s Survey of Shopper Confidence information and the Gallup Investor Survey finds that people commonly underestimate inventory market efficiency.9 Along with underestimating inventory returns, particular person buyers additionally considerably overestimate market volatility and the chance of extreme market downturns.

In brief, the literature offers the theoretical foundation for at present’s goal date funds the place the holdings of dangerous belongings decline as individuals age and in addition means that, if left on their very own, buyers’ unfavorable evaluation of returns and volatility would make them maintain too little in shares. The brand new survey of retirement buyers can function a foundation for exploring the connection between households’ preferences for investing in shares and their precise holdings.

Investor Survey

Within the fall of 2024, Greenwald Analysis interviewed on-line 1,016 people ages 48-78 with $100,000+ in investable belongings and a job within the monetary decision-making of their households. To deal with these most reliant on their investable belongings in retirement, the brand new survey intentionally under-sampled these with a DB plan.

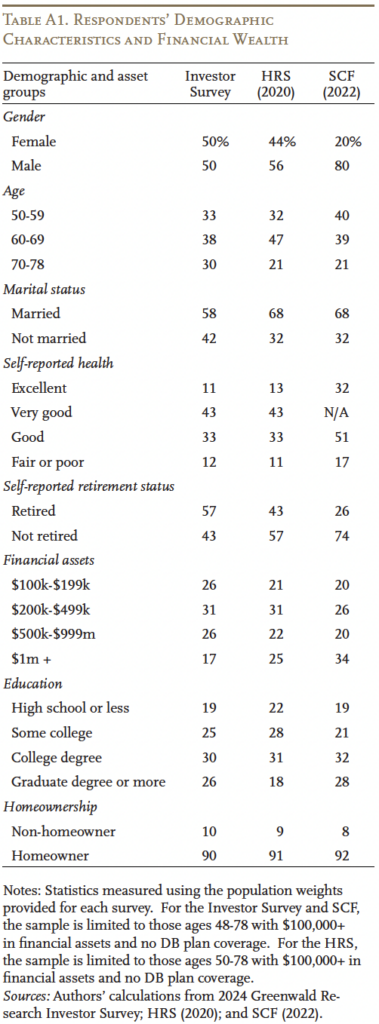

The survey started with questions on the demographic and monetary traits of every respondent – corresponding to age, marital standing, complete monetary belongings, and homeownership. This info is mostly in step with that from different family surveys such because the HRS and the Federal Reserve’s Survey of Shopper Funds (SCF) (see Appendix Desk A1). The survey additionally lined matters of specific relevance for older and wealthier people, corresponding to the quantity that people hope to depart as a bequest and whether or not respondents have put aside any funds for future long-term care bills.

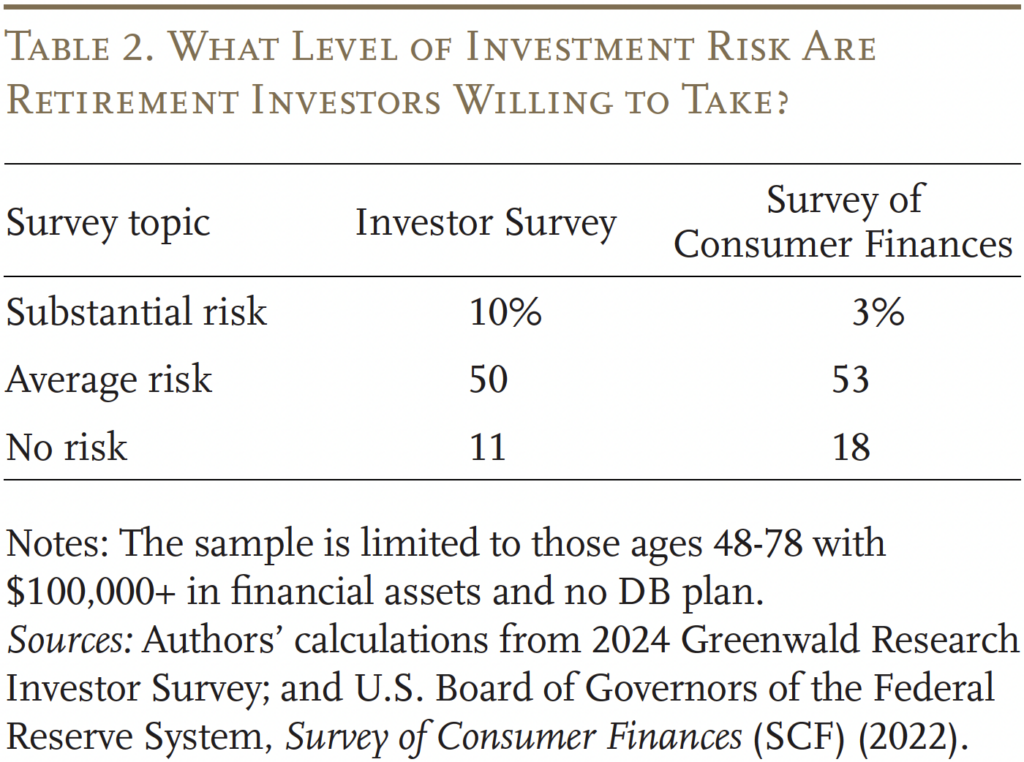

The brand new Investor Survey additionally contained info on respondents’ subjective preferences, beliefs, and issues associated to market threat and, crucially for this evaluation, solicited their desired – reasonably than precise – asset allocation. On the subject of threat desire, the survey requested in regards to the degree of funding threat the respondents are prepared to take. Albeit a easy query, analysis reveals that its result’s fairly correlated with extra complete threat desire measures.10 The outcomes present normal alignment between the Investor Survey and the SCF (see Desk 2 for the midpoint and extremes of the chance desire query in every survey).11

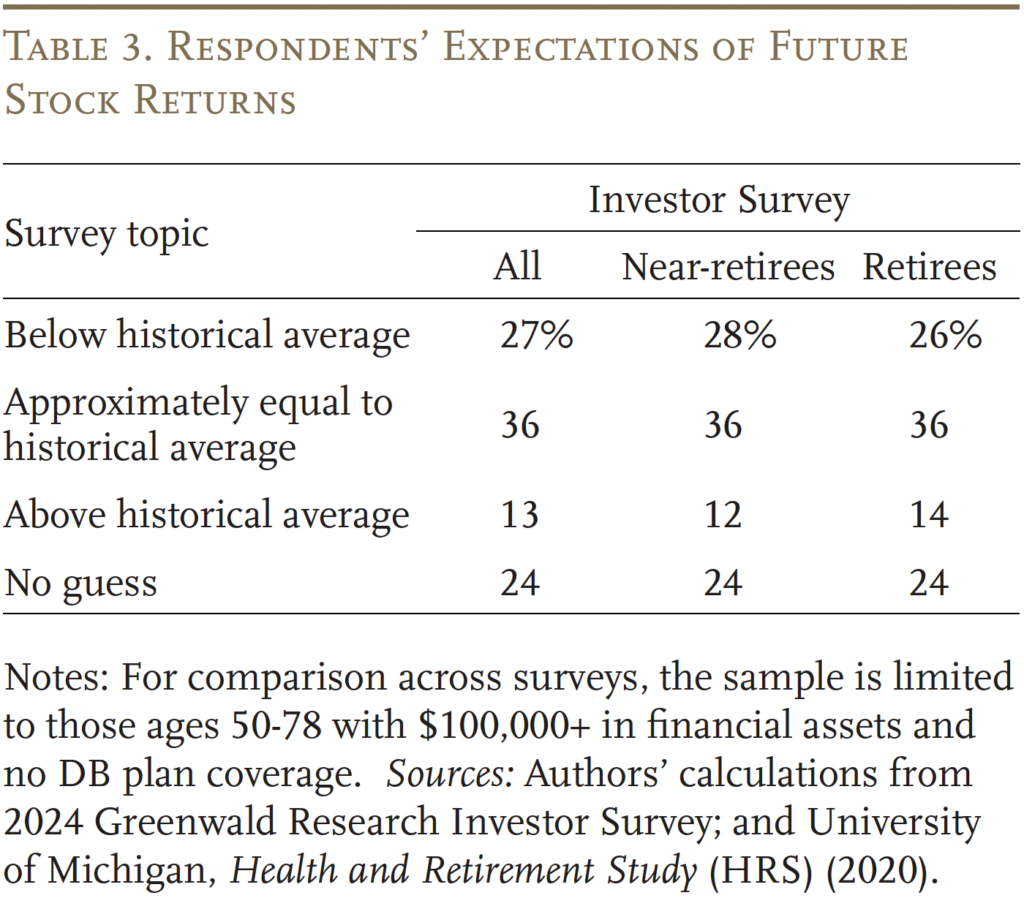

To evaluate respondents’ expectations concerning future inventory returns, the survey asks whether or not they suppose common annual returns shall be under, equal to, or above the long-term historic common. Roughly one-third of the respondents suppose future returns shall be near the historic common; and respondents with a pessimistic view about future returns outnumber these with an optimistic view by about two to 1 (see Desk 3). Curiously, a few quarter of respondents report that they have no idea sufficient to make a judgement. As some extent of comparability, the HRS asks people to offer their greatest guess on whether or not the inventory market will go up within the subsequent yr. The common response is reliably round 60 %. However traditionally, the inventory market has gone up about 75 % of the time – suggesting a considerably pessimistic view of future inventory returns relative to historical past within the HRS as nicely. The subsequent part explores how people’ anticipated inventory returns match into the query of desired versus precise allocation to shares.

Desired vs. Precise Inventory Allocation

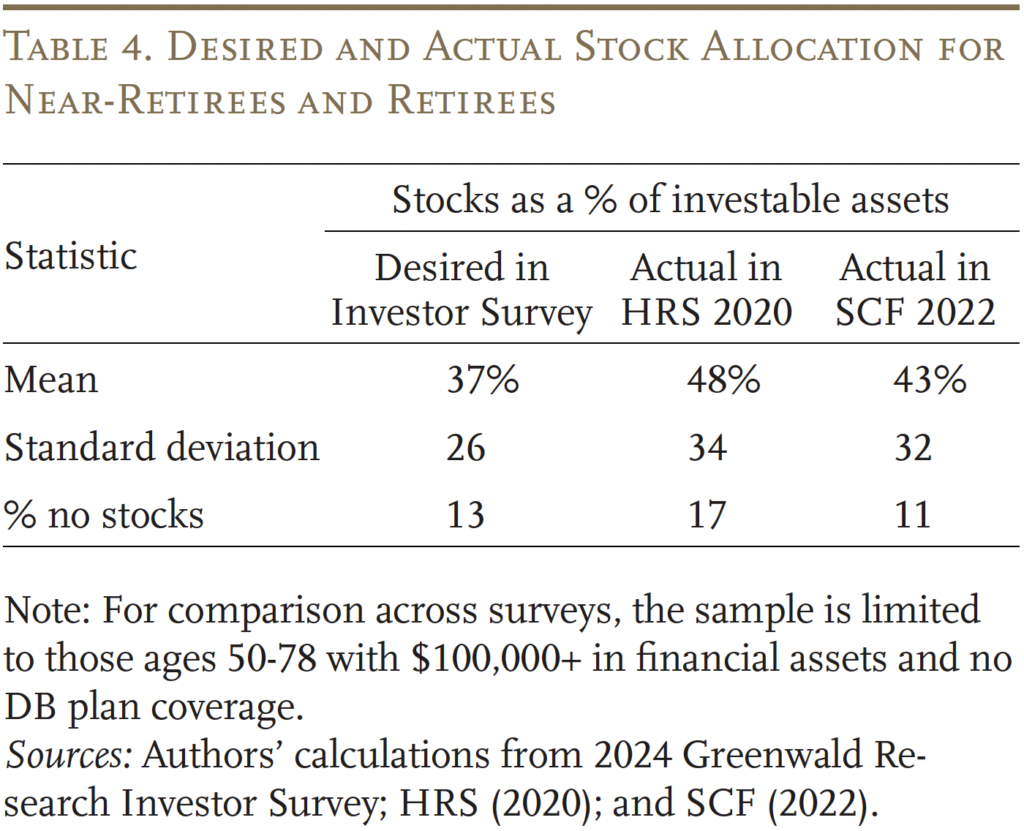

Desk 4 compares the common desired allocation throughout each near-retirees and retirees to the precise allocation for the same pattern in each the HRS and the SCF. The Investor Survey reveals that the common desired allocation is decrease than the precise allocation reported in each the HRS and SCF.12 The variation in desired allocation can also be smaller than for precise allocation. Curiously, a significant fraction of retirement buyers need to keep away from shares completely – and really accomplish that in apply.

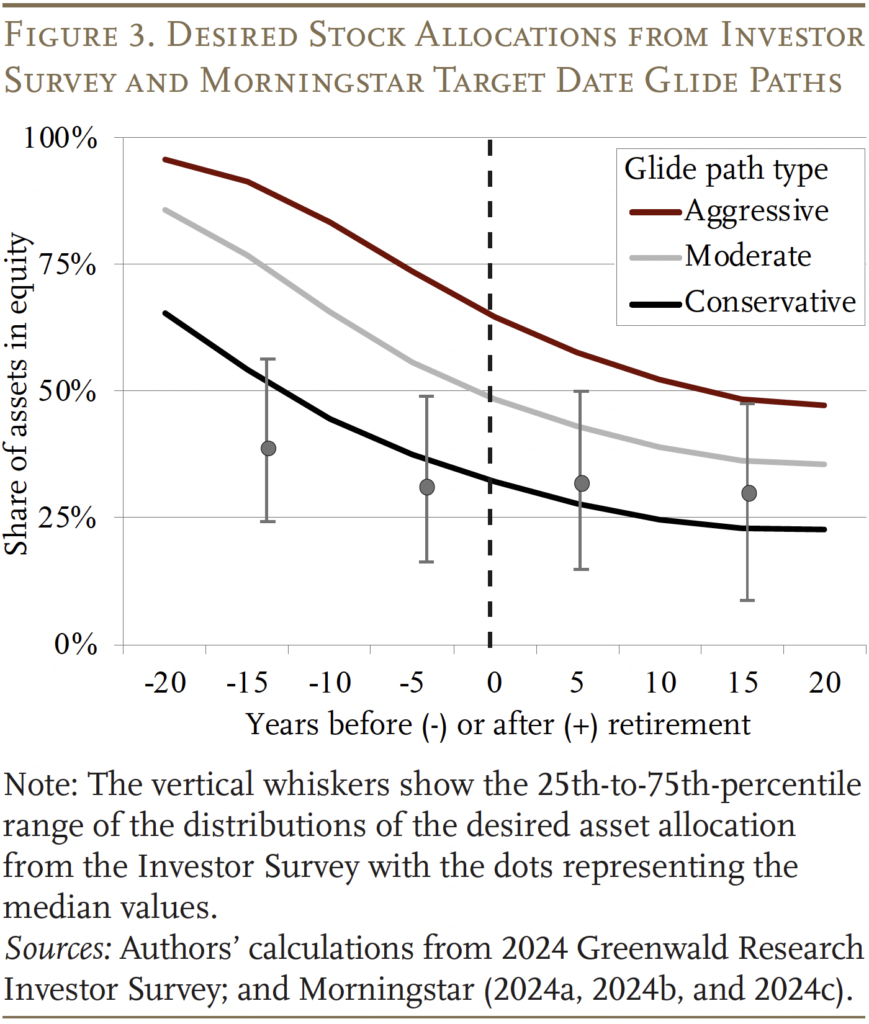

One possible purpose for the distinction between desired and precise allocations are the defaults embedded within the retirement system – specifically, goal date funds. Determine 3 reveals three glide paths comparable to the aggressive, average, and conservative variants of Morningstar Lifetime Allocation Indexes, that are constructed presuming rational buyers who’ve totally different threat preferences and labor revenue threat.13 The determine additionally contains the distribution of the specified inventory allocation (vertical traces) from the Investor Survey for every 10-year interval. The underside of every vertical line represents the twenty fifth percentile, the mid-point represents the median, and the highest represents the seventy fifth percentile.14 Whereas the specified allocation displays substantial variation, the median hews closest to the conservative path, with the median for youthful near-retirees (greater than 10 years away from their anticipated retirement age) falling about 15 proportion factors under the conservative allocation. If the average glide path is the widespread default, it could assist clarify the higher-than-desired allocation. Curiously, the common precise allocation within the HRS – 48 % – is sort of much like the allocation for these close to retirement beneath the average glide path.

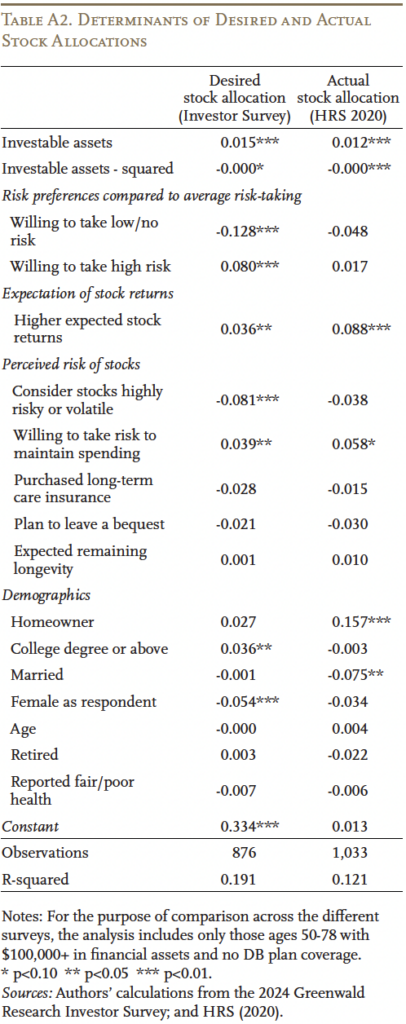

One other option to assist the case that concentrate on date funds are controlling the motion is to take a look at the explanatory energy of variables associated to portfolio alternative. If the goal date plans had been the important thing lever, one would count on the person preferences and traits which might be associated to portfolio alternative within the literature to higher clarify the variation in desired allocation than in precise allocation. Sadly, no current survey – together with the brand new Investor Survey – asks people about each their desired and precise allocation, so the train requires information from each the Investor Survey to elucidate desired allocation and the HRS to elucidate precise allocation.15 Whereas the 2 regressions embrace the identical set of conceptual determinants of allocation recognized within the literature, they depend on totally different uncooked variables to replicate every determinant.16

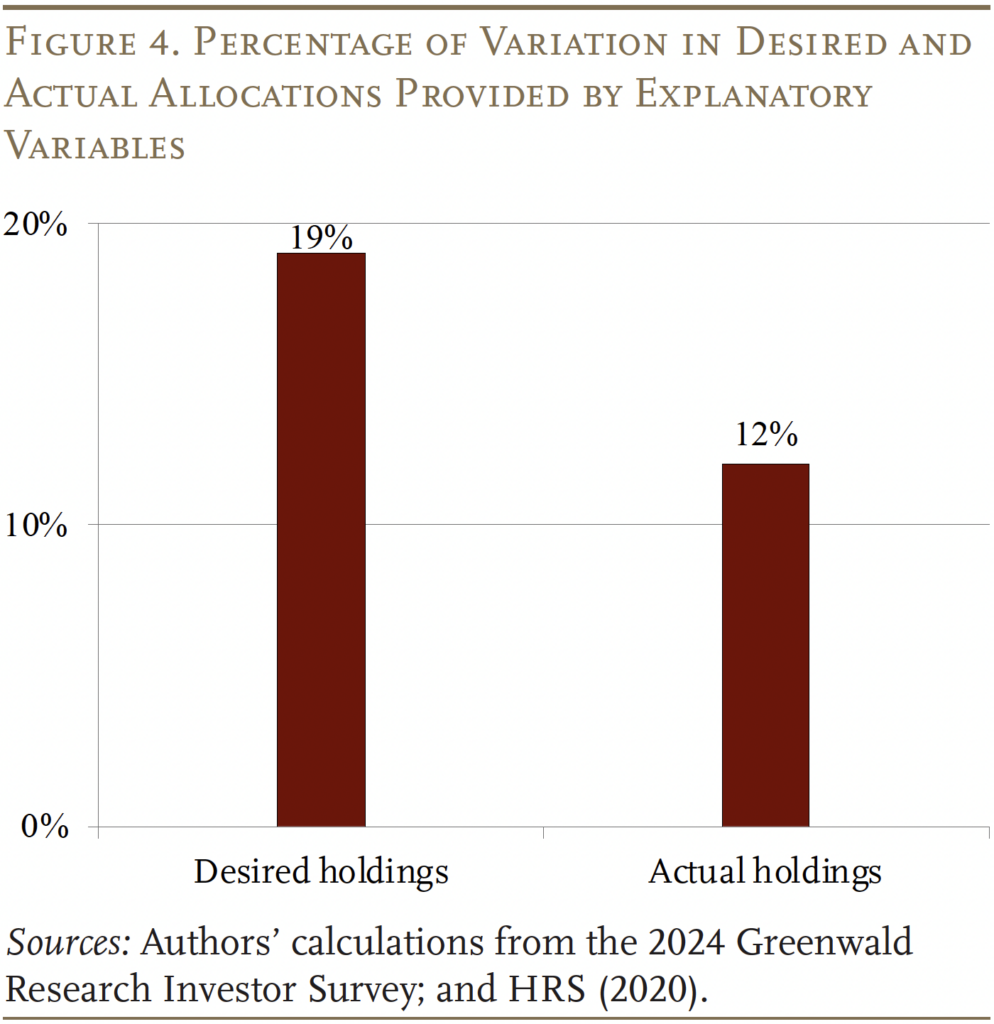

The regression outcomes are introduced in Appendix Desk A2. Monetary wealth and subjective elements, corresponding to threat preferences, return expectations, and perceived threat of shares play a serious function in explaining each desired and precise allocations – however the relationships are typically a lot stronger for desired allocation.17 Total, the regression utilizing the Investor Survey explains 19 % of the variation in desired allocation, whereas the regression utilizing the HRS explains 12 % of the variation in precise allocation (see Determine 4). These outcomes counsel that the specified allocation is a more true reflection of particular person preferences.

The discovering that the precise allocation to shares exceeds the specified allocation is just not essentially dangerous information. As famous, buyers underestimate the return and overestimate the volatility of shares, so their wishes are primarily based on a defective evaluation. A extra correct evaluation would have led to increased desired holdings – a lot nearer to that supplied by goal date funds.

Conclusion

When contemplating the problem of managing market threat for retirement buyers, current information and literature can be utilized for example the affect of variable returns on their wealth accumulation and withdrawals and establish the important thing elements affecting family selections on risk-taking. Current analysis, although, focuses on precise holdings of dangerous belongings, versus desired holdings. However precise inventory holdings could also be extra reflective of institutional preparations, corresponding to goal date funds in 401(okay) plans, than of particular person preferences.

To assist that competition, this examine relied on information from a brand new survey overlaying retirement buyers ages 48-78 with complete investable belongings of $100,000+. The findings present that desired allocation to dangerous belongings tends to be decrease than precise holdings. The low degree of desired holdings is in step with households’ overly pessimistic views of inventory returns, and the upper degree of precise holdings possible displays the default allocations in 401(okay) plans – specifically goal date funds. In brief, individuals appear to be holding extra equities than they need, however that sample might be good for them.

References

Amromin, Gene and Steven A. Sharpe. 2012. “From the Horse’s Mouth: How Do Investor Expectations of Danger and Return Range with Financial Circumstances?” Working Paper 2012-08. Chicago, IL: Federal Reserve Financial institution of Chicago.

Aubry, Jean-Pierre and Yimeng Yin. 2025. “Do Desired Inventory Allocations Differ from Precise Holdings?” Working Paper 2025-9. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Beutel, Johannes and Michael Weber. 2022. “Beliefs and Portfolios: Causal Proof.” Analysis Paper 22-08. Chicago, IL: The College of Chicago, Sales space College of Enterprise.

Bodie, Zvi. 1995. “On the Danger of Shares within the Lengthy Run.” Monetary Analysts Journal 51(3): 18-22.

Bodie, Zvi, Robert C. Merton, and William F. Samuelson. 1992. “Labor Provide Flexibility and Portfolio Alternative in a Life Cycle Mannequin.” Journal of Financial Dynamics and Management 16(3-4): 427-449.

Boyd, Donald J. and Yimeng Yin. 2017. “Appropriateness of Danger-Taking by Public Pension Plans.” Albany, NY: Nelson A. Rockefeller Institute of Authorities.

Damodaran, Aswath. 2025. Historic Returns on Shares, Bonds and Payments: 1928-2024. New York, NY: New York College, Stern College of Enterprise.

Dominitz, Jeff and Charles F. Manski. 2007. “Anticipated Fairness Returns and Portfolio Alternative: Proof from the Well being and Retirement Research.” Journal of the European Financial Affiliation 5(23): 369-379.

———. 2005. “Measuring and Deciphering Expectations of Fairness Returns.” Working Paper. Cambridge, MA: Nationwide Bureau of Financial Analysis.

Egan, Mark L., Alexander MacKay, and Hanbin Yang. 2022. “Recovering Investor Expectations from Demand for Index Funds.” The Evaluation of Financial Research 89(5): 2559-2599.

Grable, John and Ruth H. Lytton. 1999. “Monetary Danger Tolerance Revisited: The Improvement of a Danger Evaluation Instrument.” Monetary Providers Evaluation 8(3).

Greenwood, Robin and Andrei Shleifer. 2014. “Expectations of Returns and Anticipated Returns.” Evaluation of Monetary Research 27(3): 714-746.

Hou, Wenliang. 2020. “How Correct Are Retirees’ Assessments of Their Retirement Danger?” Working Paper 2020-14. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Jagannathan, Ravi and Narayana R Kocherlakota. 1996. “Why Ought to Older Individuals Make investments Much less in Shares Than Youthful Individuals?” Minneapolis, MN: Federal Reserve Financial institution of Minneapolis.

Kézdi, Gábor and Robert J. Willis. 2008. “Inventory Market Expectations and Portfolio Alternative of American Households. Preliminary and Incomplete.” Cambridge, MA: Nationwide Bureau of Financial Analysis.

Merton, Robert C. 1971.“Optimum Consumption and Portfolio Guidelines in a Steady-Time Mannequin.” Journal of Financial Concept 3(4): 373-413.

———. 1969. “Lifetime Portfolio Choice beneath Uncertainty: The Steady-Time Case.” The Evaluation of Economics and Statistics 51(3): 247-257.

Morningstar. 2024a. Morningstar Lifetime Allocation Indexes Aggressive. Chicago, IL.

———. 2024b. Morningstar Lifetime Allocation Indexes Conservative. Chicago, IL.

———. 2024c. Morningstar Lifetime Allocation Indexes Average. Chicago, IL.

———. 2015. “Development Guidelines for Morningstar Asset Allocation Index Household.” Morningstar Methodology Paper. Chicago, IL.

Pástor, Ľuboš and Robert F. Stambaugh. 2012. “Are Shares Actually Much less Unstable within the Lengthy Run?” The Journal of Finance 67(2): 431-478.

Samuelson, Paul A. 1969. “Lifetime Portfolio Choice By Dynamic Stochastic Programming.” The Evaluation of Economics and Statistics 51(3): 239-246.

College of Michigan. Well being and Retirement Research, 2020. Ann Arbor, MI.

U.S. Board of Governors of the Federal Reserve System. Survey of Shopper Funds, 2022. Washington, DC.

Appendix