A more in-depth take a look at the Boeing negotiations solely makes the query extra puzzling.

Boeing employees just lately accepted the corporate’s third provide. The settlement doesn’t embrace reopening the Boeing outlined profit pension plan, which was cited as the most important purpose that the union rejected the second provide. Although the strike is over, I discover the truth that reopening the pension plan performed such a outstanding position within the negotiations actually fascinating.

After many years of enthusiastic about retirement plans, my conclusion is that protection is the most important problem. A lifetime of participation in any kind of employer-sponsored plan just about ensures a safe retirement. In my opinion, the 401(okay)/DB debate is a diversion.

But, the reopening of the pension plan was clearly vital to Boeing employees. I can consider two causes that may be the case: 1) the belief that the employer pays for advantages below an outlined profit plan whereas the employee pays for 401(okay) advantages; or 2) the advantages provided below the Boeing outlined profit plan had been increased than these ensuing from mixed worker/employer 401(okay) contributions.

No economist can settle for the notion that the employer contribution to an outlined profit plan is an “add-on” that prices the worker nothing. Slightly, the employer decides on a bucket of cash that it may possibly pay in whole compensation – wages, medical health insurance, retirement and many others. – after which allocates it among the many numerous elements to create essentially the most fascinating package deal. If staff clarify they need extra employer contributions to an outlined profit plan, they are going to over time obtain much less in wages, well being care, or different advantages. In different phrases, the worker pays no matter whether or not retirement advantages are offered by way of 401(okay)s or outlined profit plans.

The second problem requires evaluating the advantages payable below Boeing’s outlined profit plan and its 401(okay) association. The agreed-upon contract included provisions for every:

- Outlined profit plan: In 2015, Boeing ended all profit accruals for present and future hires, however some energetic employees nonetheless have credit within the plan. Boeing will improve the greenback per credited service (i.e., service earned earlier than 2015) for all energetic employees from $95 to $105.

- 401(okay) plan: Boeing will improve the employer matching contribution from 50% of the primary 8% of an worker’s contributions to 100%. As well as, the corporate will make a supplementary 4-percent employer contribution program accessible to all staff (at the moment, it’s only for these employed after 2015).

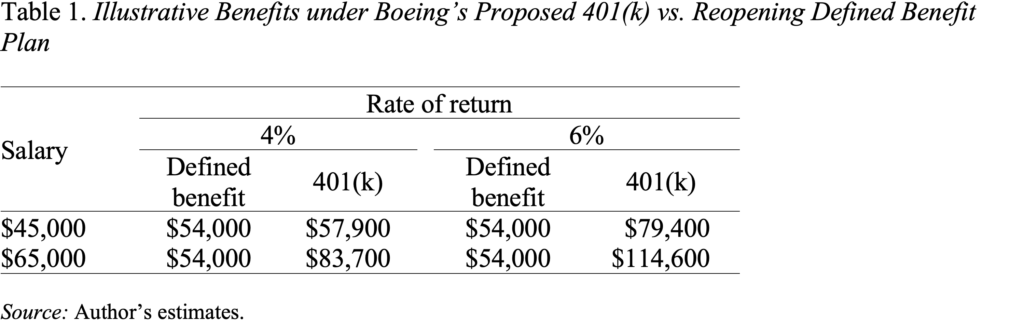

My colleagues JP Aubry and Yimeng Yin constructed a spreadsheet for employees at two wage ranges based mostly on the next assumptions:

- Wage: Development 3% per 12 months.

- Age: Beginning at 35 and ending at 65.

- 401(okay): Whole contribution 20% (8% worker, 8% employer match, and 4% employer complement).

- Outlined profit: Greenback per credited service $150 (reflecting a continuation of the expansion within the credited quantity between 2009 and the brand new contract).

- Price of return: 6% and 4%.

- Annuitization of 401(okay) balances (for comparability to outlined profit fee) based mostly on immediateannuities.com.

You’ll be able to see the outcomes of this train in Desk 1. The profit quantities look actually excessive as a result of all of the calculations are in nominal, not inflation-adjusted, {dollars}. What we’re fascinated about is the distinction between the outlined profit and 401(okay) quantities. The underside line is that the 401(okay) constantly outperforms the outlined profit plan. And the discrepancy is larger at increased salaries, which isn’t stunning on condition that the outlined profit is a flat quantity per 12 months of service (albeit with a ground associated to a employee’s ultimate wage) whereas the 401(okay) contributions are based mostly on earnings.

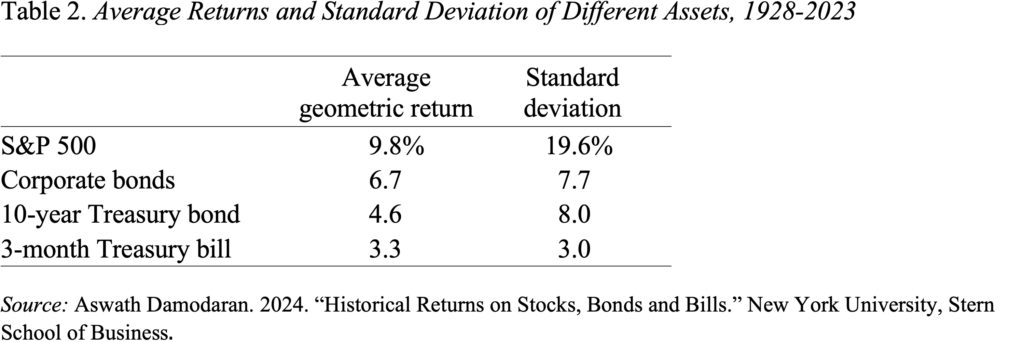

However what’s extra fascinating to me is even at a 4-percent return – lower than the historic common return on 10-year Treasuries (see Desk 2) – the 401(okay) plan does barely higher on the decrease wage stage. That signifies that a really risk-averse particular person might make investments their 401(okay) property solely in Treasuries and are available out forward of the Boeing outlined profit plan.

In fact, this easy train includes quite a lot of caveats – staff might not select to contribute the complete 8% to the 401(okay), salaries might develop extra slowly, and many others. However the outcomes do make it exhausting to grasp employees’ unwavering devotion to outlined profit plans.