Most likely not – a lot of the drivers have performed themselves out.

Let’s take a deep breath and step again from the day by day information cycle, the place the Social Safety Administration is beneath repeated assault, and check out current tendencies in retirement patterns and what they’re more likely to seem like going ahead.

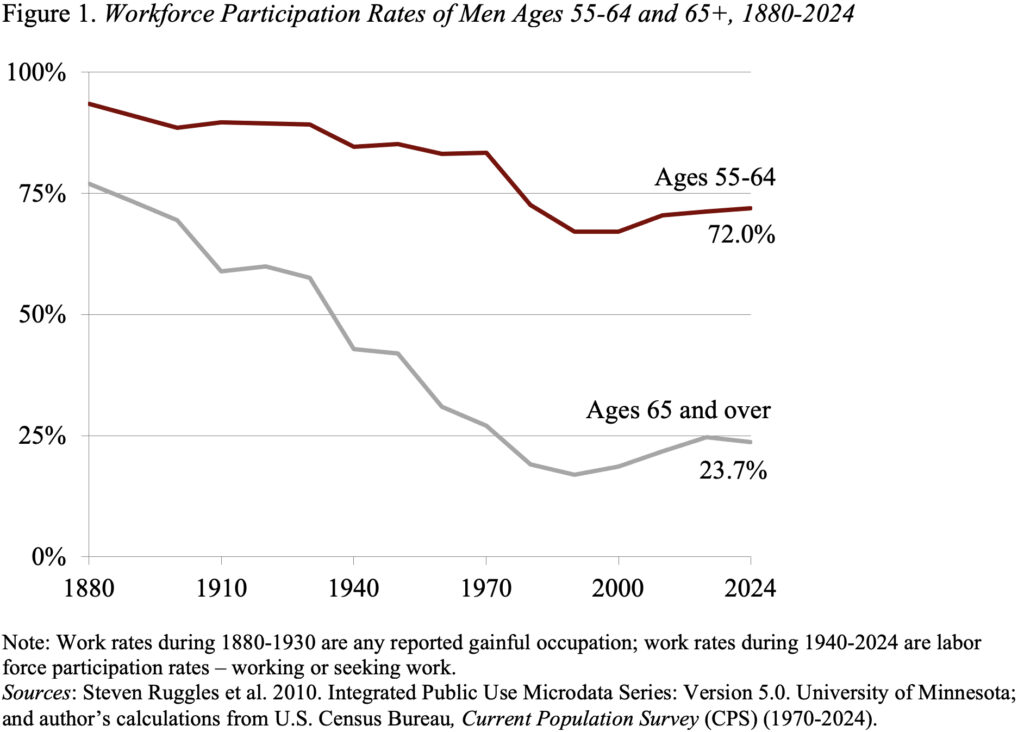

Previous to the Eighties, males typically labored so long as they might, and on the finish of their lives, that they had solely about two years of ‘retirement,’ typically on account of ailing well being. Starting round 1880, nevertheless, the share of the older male inhabitants at work started to say no sharply (see Determine 1). Specialists attribute this decline initially to Civil Battle pensions, then to rising incomes and the shift from agriculture to employment in massive enterprises, and at last to the introduction of Social Safety and Medicare.

The downward trajectory stopped across the mid-Nineteen Eighties and, for the reason that early Nineteen Nineties, the labor power participation of males each 55-64 and 65+ has progressively elevated. This sample has led to a rise within the “common retirement age,” outlined because the age (in years and months) at which the labor power participation charge drops beneath 50 %. Primarily based on this definition, in 2024 the common retirement age for males was 64.6, three years later than in 1994 and nearly again to the Nineteen Sixties (see Determine 2).

Many components most likely contributed to this current enhance within the common retirement age.

- Social Safety: Modifications to Social Safety made work extra engaging relative to retirement. The liberalization, and for these on the Full Retirement Age (FRA) the elimination, of the earnings check eliminated what many considered as an obstacle to continued work. The rise within the FRA from 65 to 67 diminished advantages for these claiming early. And, the improved delayed retirement credit score elevated incentives to maintain working between the FRA and age 70.

- Pension sort: The shift from outlined profit to 401(okay) plans eradicated built-in incentives to retire. Furthermore, since 401(okay) contributors bear funding threat, they should work longer to build up a buffer in opposition to prematurely exhausting their sources.

- Training: Higher-educated employees have much less bodily demanding jobs, extra employment alternatives, are paid extra, and work longer.

- Improved well being and longevity: Common life expectancy for males at 65 has elevated about 3.2 years since 1990, and till 2010 the proof recommended that individuals have been more healthy as properly. The correlation between well being and labor power exercise may be very robust.

- Decline of retiree medical insurance: The speedy rise in well being care prices has been accompanied by a major decline in employer provision of retiree medical insurance. Therefore, employees have a powerful incentive to remain working till they qualify for Medicare at 65

- Much less bodily demanding jobs: As manufacturing has declined, the service sector has exploded with knowledge-based alternatives, which put much less pressure on older our bodies.

Will the early drivers of delayed retirement proceed to have an effect? I’d argue ‘no.” All of the modifications within the Social Safety program at the moment are full. The shift from outlined profit to 401(okay) plans within the non-public sector is now full. Academic attainment for males has leveled off and can seemingly stage off for ladies by 2030. Since 2010, estimates for wholesome life expectancy at 50 – which mixes the incapacity charge with modifications in life expectancy – present precise declines for some teams. Lastly, the shift by companies away from providing retiree well being advantages is just about full.

The underside line is that the components contributing to the reversal within the labor power participation of older employees seem to have run their course. Their influence will stay, so it’s unlikely the common retirement age will decline. Then again, they may present little impetus for will increase within the common retirement age.