The Hong Kong-listed shares of electrical car (EV) maker XPeng (HK:9868) have plunged practically 34% year-to-date amid ongoing macro challenges in China and the extraordinary competitors within the EV market. That mentioned, the common value goal of analysts signifies strong upside potential and a rebound in XPeng inventory, reflecting optimism in regards to the EV firm’s long-term progress potential.

XPeng’s Current Efficiency

Like a lot of its Chinese language friends, XPeng reported a month-over-month decline in its January deliveries primarily on account of seasonal components. The EV maker’s January deliveries declined 59% from the earlier month to eight,250 models. Nonetheless, XPeng’s January deliveries elevated 58% year-over-year.

XPeng delivered 2,478 X9 MPV (Multi-Function Car) models in January, with orders for X9 Max trim contributing about 70% of the general X9 orders. Given the strong demand for the X9 mannequin, deliveries for which started in early January, the corporate is ramping up its manufacturing capability to make sure accelerated deliveries.

XPeng can also be optimistic in regards to the adoption of its ADAS (Superior driver help techniques) know-how. As per the corporate, the month-to-month energetic penetration fee for its XNGP ADAS know-how has surpassed 85%, and the characteristic is now obtainable in 243 cities nationwide. XPeng intends to broaden XNGP’s protection to main city highway networks, personal roads throughout the nation, and parking heaps by 2024.

Whereas macro uncertainty in China and rising rivalry on the earth’s largest EV market proceed to weigh on XPeng, the corporate appears to be like well-positioned to spice up its long-term progress.

What’s the Goal Value of XPeng?

Final month, Financial institution of America analyst Ming Hsun Lee reiterated a Purchase ranking on XPeng inventory following a convention name with the administration. Lee highlighted that the corporate is focusing on greater gross sales quantity progress than the broader trade’s progress estimate for 2024, backed by new mannequin launches, steady gross sales community enlargement, upgrades, penetration into tier 3/4 cities, and better exports.

Likewise, DBS analyst Rachel Miu is bullish on XPeng and reiterated a Purchase ranking with a value goal of HK$66, saying that the inventory’s valuation is but to replicate the corporate’s enhancing prospects. The analyst sees elevated gross sales and higher days forward for the corporate because of the launch of its new mid-market phase model this yr and the strategic funding by Volkswagen (DE:VOW).

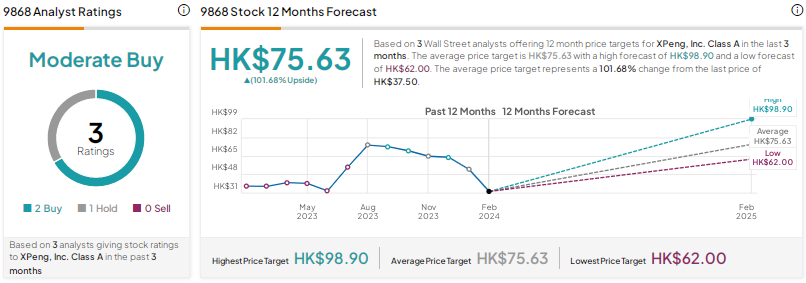

XPeng inventory has a Reasonable Purchase consensus ranking primarily based on two Buys and one Maintain. The common XPeng share value goal of HK$75.63 implies practically 102% upside potential.

Conclusion

Regardless of near-term headwinds, together with macroeconomic uncertainty in China, some analysts stay optimistic about XPeng on account of its long-term progress potential within the EV house and the prospects for its ADAS know-how.