Howdy there, future FP&A Administrators!

I’m so glad you’ve determined to hitch me on this thrilling journey. It’s not every single day that somebody decides to take the leap and pursue a profession in Monetary Planning and Evaluation (FP&A). Nonetheless, right here you’re, able to dive into the fascinating world of numbers, forecasts, budgets, and strategic planning. It’s a journey that requires dedication, a pointy thoughts, and a ardour for finance – however let me inform you, it’s price each step.

My ardour for FP&A stems from the distinctive mix of technique, evaluation, and decision-making the function gives. As an FP&A Director, you’re not simply crunching numbers; you’re telling a narrative. You’re portray an image of the corporate’s monetary well being, making sense of advanced information, and offering actionable insights that drive enterprise selections.

So buckle up, as a result of we’re about to embark on an enlightening journey into the world of FP&A. We’ll discover what the function entails, the talents you want, the training and certifications that may give you an edge, and the profession development that may lead you to the coveted director’s chair.

So, are you prepared? Let’s get began!

Understanding the Function of an FP&A Director

Let’s dive proper into the guts of the matter: understanding the function of a Monetary Planning and Evaluation Director.

- The Navigator: Take into account the FP&A Director because the GPS of an organization. They information the enterprise in the direction of its monetary objectives, by way of budgeting, forecasting, and capital planning. All the time plotting the very best path to get there whereas avoiding any potential highway bumps (dangers) alongside the best way.

- The Knowledge Whisperer: If numbers may speak, Administrators of Finance could be their greatest pals. They interpret advanced monetary reporting and remodel it into clear, actionable insights. It’s like they’ve a secret decoder ring for monetary statements!

- The Technique Guru: FP&A Administrators don’t simply reside within the current; they’re additionally time vacationers of kinds. They forecast future monetary traits and assist the corporate put together for them. It’s like having a crystal ball, however with spreadsheets!

- The Staff Chief: As the top of the FP&A staff, they lead a bunch of monetary analysts and managers. It’s very similar to being a coach, the place they information, encourage, and help their staff to attain their greatest efficiency.

- The Communicator: They aren’t simply quantity crunchers but additionally storytellers. FP&A Administrators translate monetary jargon into plain English for different departments and stakeholders. It’s like they’re bilingual in finance and on a regular basis language!

- The Resolution Influencer: Working intently with company growth, their insights and analyses are important within the firm’s strategic selections. They don’t maintain the steering wheel (that’s the Chief Monetary Officer), however they’re the co-pilot advising on the very best route.

Keep in mind, people, being a finance director is like being a superhero within the finance world. It’s a task that calls for ability, technique, and management. However with these powers comes the reward of constructing an actual influence in your firm’s journey.

Now, let’s lighten the temper a bit with a bit of anecdote from my profession. After I first turned a Company Finance Director, I used to be thrilled. However, I have to admit, additionally a bit overwhelmed. Whereas juggling a mountain of studies, my boss walked in sooner or later. Seeing me buried below piles of paper, he quipped, “Did you resolve to take up paper mache as a interest?” We each received a superb chuckle out of it and similar to that, the second’s stress evaporated.

The important thing takeaway? Even in a high-stakes function like an FP&A Director, there’s at all times room for a humorousness.

The Expertise You Want

Alright, my pals, let’s get right down to the nitty-gritty: the abilities you should rock the function of a Director of Finance. These could be divided into technical abilities (the nuts and bolts) and mushy abilities (the key sauce). Let’s break them down.

Technical Expertise:

- Monetary Acumen: That is the bread and butter of your function. You’ll want an in-depth understanding of monetary ideas, accounting requirements, and monetary statements. Brushing up on these subjects will show you how to make knowledgeable selections.

- Analytical Capability: As an FP&A Director, you’ll swim in a sea of information. Having the ability to interpret this information, spot traits, and make projections is essential. So, sharpen these analytical instruments!

- Proficiency with Monetary Software program: Being tech-savvy is a should, from Excel spreadsheets to superior monetary modeling software program. Belief me, these instruments will develop into your greatest pals.

Comfortable Expertise:

- Communication: You have to translate advanced monetary data into clear, comprehensible insights in your staff and stakeholders. Therefore, having robust verbal and written communication abilities is vital.

- Management: Because the captain of the monetary ship, you’ll want to steer your crew successfully. This implies motivating, delegating, and making powerful selections when needed.

- Strategic Considering: You’re not simply crunching numbers however shaping the corporate’s monetary future. So, a forward-thinking mindset and the power to strategize are important.

Now, let’s speak about honing these abilities. I’d suggest taking related programs or certifications for technical skills- they may give you an edge. For mushy abilities, observe is the secret. Search alternatives that can help you lead, talk, and strategize.

Right here’s a bit of snippet from my journey: After I first began, I used to be a whiz at numbers however struggled with public talking. So, I joined a neighborhood Toastmasters membership to enhance. I gained’t lie; my first few speeches have been extra nervous stutters than eloquent discourses. However with observe, I improved. Now, I can confidently current advanced monetary information to a room stuffed with executives. So keep in mind, each ability could be discovered and improved – all it takes is observe and persistence.

So, buckle up, future FP&A Administrators! It’s time to start out constructing these abilities. Keep in mind, each step you tackle this journey brings you nearer to your aim. You’ve received this!

FP&A Director Salaries, Bonuses, And Advantages

Now that we’ve navigated by the roles, obligations, and abilities of a Director of Finance, let’s speak about one thing that’s in all probability in your thoughts: the wage and advantages. In any case, it’s important to know the monetary rewards of steering the monetary ship!

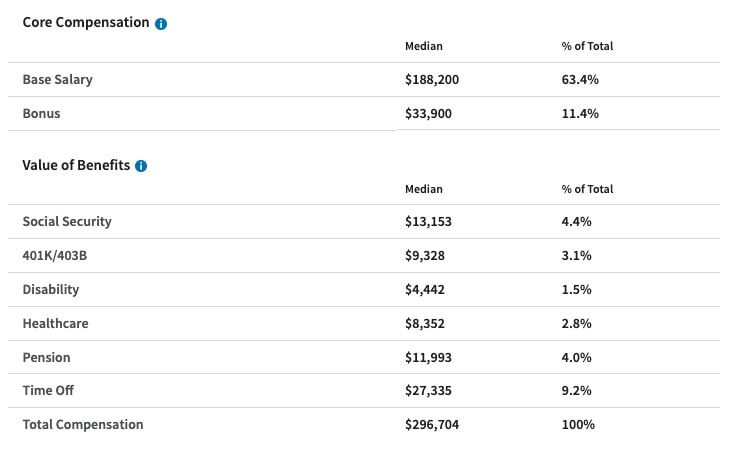

First off, the bottom wage. In accordance with Wage.com, as of October 25, 2023, the common FP&A Director wage in america is $188,200, however this may vary between $165,100 and $217,100 [source]. Not too shabby, proper?

However wait, there’s extra! Let’s not overlook about bonuses and revenue sharing. In accordance with information from Comparably.com, the common bonus for a Director of FP&A could be $38,100, representing about 26% of their wage [source]. Now that’s a pleasant cherry on high of the monetary sundae!

Plus, there are sometimes perks like medical health insurance, retirement plans, paid break day, and typically even inventory choices. I imply, who doesn’t love a superb perk, proper?

The overall compensation, which incorporates base wage, bonus, and advantages, can differ significantly. As an illustration, Wage.com studies that the whole money compensation for a Monetary Planning and Evaluation Director can vary from $183,786 to $241,658 [source].

Whereas the trail to changing into an FP&A Director is difficult, the monetary rewards could be substantial. It gives a aggressive wage, and the extra advantages and bonuses make it a really enticing profession selection. So, preserve that monetary compass regular and sail towards your rewarding FP&A profession!

Training and Certifications

Alright, future monetary wizards, let’s focus on the training and certifications that may set you up for fulfillment as an FP&A Director. It’s like packing the best gear for a mountaineering journey – you wish to be ready for the journey forward!

First, let’s speak about training. To develop into an FP&A Director, you’ll want a bachelor’s diploma in finance, accounting, or a associated area. That is your base camp – the muse from which you begin your ascent.

However don’t cease there! A grasp’s diploma, like an MBA in finance, may give you a major benefit. It’s like having a high-quality mountaineering boot that gives further help and stability.

Now, onto certifications. These are like your mountaineering instruments – they’re not necessary, however boy, do they make the climb simpler. Two key certifications stand out:

Licensed Company FP&A Skilled (FPAC):

The Licensed Company FP&A Skilled (FPAC) is a globally acknowledged certification designed for professionals in search of to advance their careers in company monetary planning and evaluation. The Affiliation for Monetary Professionals (AFP) gives this prestigious certification and is revered by employers worldwide.

Chartered Monetary Analyst (CFA):

This one is all about funding administration and monetary evaluation. Consider it as your multi-tool – it reveals you may deal with varied monetary challenges.

So, my pals, let’s continue to learn and rising. On the planet of finance, the training by no means stops – and that’s a superb factor!

Profession Development

Strap in, people! It’s time to speak in regards to the journey to changing into an FP&A Director. Very similar to climbing a mountain, it entails a number of steps, some steeper than others, however with willpower and the best gear (abilities and {qualifications}), you’ll attain the highest.

Step 1: Earn Your Diploma

Your first step is to earn a bachelor’s diploma in finance, accounting, or an analogous area. Consider this as packing your backpack with the important gear – primary information of finance and enterprise ideas. This was the place my journey started, and let me inform you, investing time in understanding the basics pays dividends down the road!

Step 2: Achieve Entry-Degree Expertise

Subsequent, you’ll wish to safe an entry-level place like a Monetary Analyst. That is your first style of the climb, the place you’ll apply what you’ve discovered and acquire sensible expertise.

Step 3: Pursue Additional Training and Certifications

As mentioned earlier, getting a complicated diploma or related certifications may give you a leg up. It’s like upgrading your mountaineering gear to one thing extra skilled. It was powerful after I determined to pursue my CPA, nevertheless it considerably boosted my profession development.

Step 4: Transfer right into a Managerial Function

After gaining some expertise and extra {qualifications}, purpose for a managerial function like a Finance Supervisor. Right here, you’ll begin main a staff and making strategic selections. As a new supervisor, I confronted challenges in delegation and management of senior analysts, however over time, I discovered to belief my staff and information them successfully.

Step 5: Purpose Larger

Lastly, with sufficient expertise and confirmed management, you may purpose for the FP&A Director function. It’s a difficult climb, however the view from the highest is price it!

Getting ready for the Interview

It’s showtime, people! The interview – the large stage the place you get to strut your stuff as a possible FP&A Director. However earlier than you enter the highlight, let’s speak about some ideas and tips that will help you shine.

- Analysis, Analysis, Analysis: Know your potential employer inside out. Dig into their monetary studies, perceive their trade, and get below the pores and skin of their enterprise mannequin. It’s like finding out the script earlier than the large efficiency.

- Know Your Numbers: You’re a finance professional, in any case. Be ready to debate monetary metrics, traits, and analyses. It’s your time to indicate off these analytical chops!

- Showcase Your Comfortable Expertise: Communication, management, strategic pondering – these are your co-stars on this efficiency. Use examples out of your expertise to spotlight these abilities.

- Ask Insightful Questions: Keep in mind, an interview is a two-way avenue. Asking considerate questions reveals your curiosity and engagement. It’s like improv in the midst of a scripted scene – it retains issues fascinating!

Now, for a bit of anecdote from my very own expertise. I as soon as went for a job interview the place, in an try and exhibit my analytical abilities, I began discussing the corporate’s latest monetary report in depth. I used to be so engrossed in my evaluation that I didn’t discover the interviewer’s rising amusement. After I lastly paused for breath, he chuckled and mentioned, “Nicely, that’s extra thorough than our personal inner evaluation!” We each laughed, and it broke the ice for the remainder of the interview.

The ethical of the story? Be ready, however don’t overlook to be your self. Interviews could be nerve-wracking, however they’re additionally a chance to indicate your ardour and character. Keep in mind, you’re not only a assortment of abilities and experiences – you’re a singular particular person with your personal method to finance. So go on the market and steal the present! You’ve received this, my pals!

Fast Recap

Nicely, people, we’ve reached the top of our monetary path. We’ve lined so much, so let’s pause for a second and catch our breath as we recap the important thing factors:

- Training and Certifications: Your journey begins with a strong instructional basis in finance or accounting, and is additional strengthened by certifications like CPA or CFA.

- Profession Development: From entry-level roles to managerial positions, every step on this path brings new challenges and alternatives for development.

- Getting ready for the Interview: Analysis, number-crunching, showcasing your mushy abilities, and asking insightful questions are the keys to acing that interview.

Phew! That’s fairly a climb we’ve made collectively. However keep in mind, each nice journey begins with a single step. And every step you tackle this path not solely brings you nearer to changing into an FP&A Director but additionally helps you develop as an expert and as an individual.

So, my fellow finance adventurers, lace up these mountaineering boots and set your sights on the height. You’re embarking on a exceptional journey, one which’s as rewarding as it’s difficult. And I’ve little doubt that you simply’ve received what it takes to succeed in the highest. So, go forth, conquer, and keep in mind – the world of finance is your mountain to climb. Blissful mountaineering, and see you on the high!

Have any questions? Are there different subjects you prefer to us to cowl? Depart a remark under and tell us! Additionally, keep in mind to subscribe to our Publication to obtain unique monetary information in your inbox. Thanks for studying, and comfortable studying!